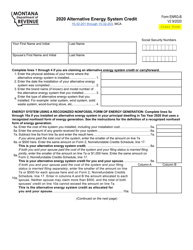

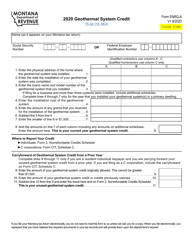

This version of the form is not currently in use and is provided for reference only. Download this version of

Form ENRG-C

for the current year.

Form ENRG-C Energy Conservation Installation Credit - Montana

What Is Form ENRG-C?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

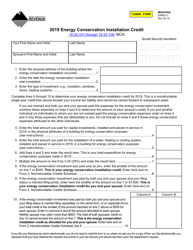

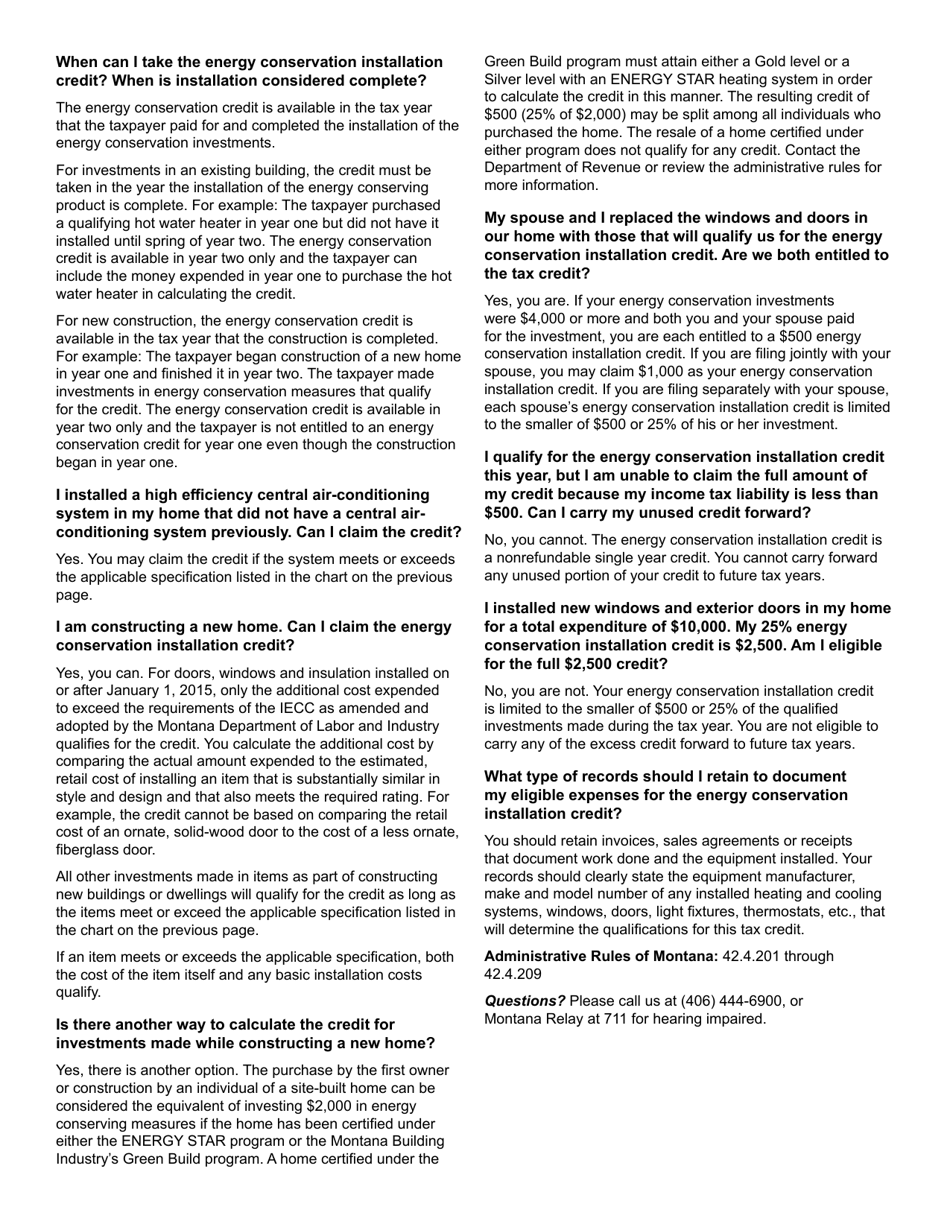

Q: What is the Form ENRG-C Energy Conservation Installation Credit?

A: The Form ENRG-C Energy Conservation Installation Credit is a tax credit available in the state of Montana for energy conservation installations.

Q: Who is eligible for the Form ENRG-C Energy Conservation Installation Credit?

A: Montana residents who have installed energy conservation measures in their homes or businesses may be eligible for this tax credit.

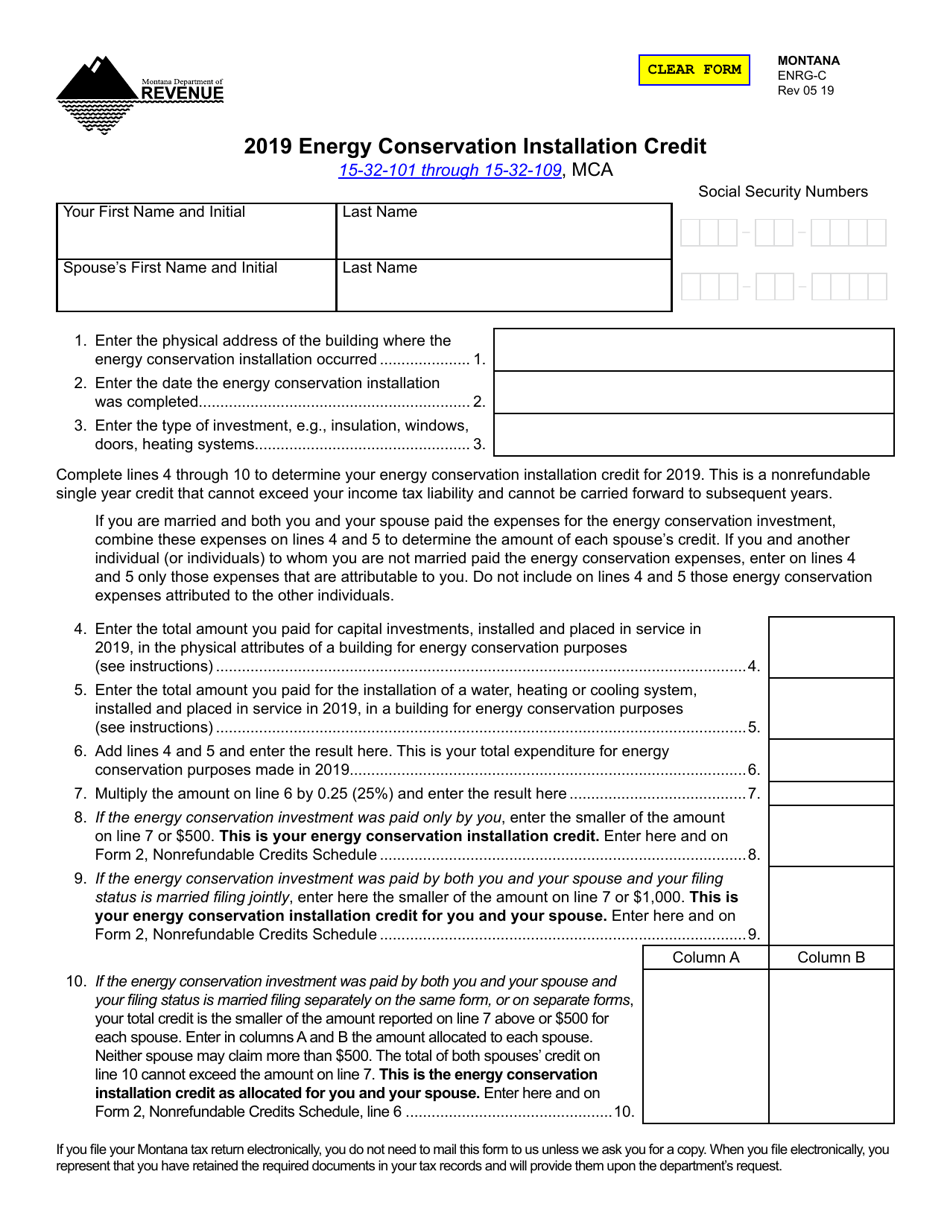

Q: What are energy conservation installations?

A: Energy conservation installations include measures such as solar panels, wind turbines, geothermal systems, insulation, and energy-efficient appliances.

Q: How much is the Form ENRG-C Energy Conservation Installation Credit?

A: The credit amount varies depending on the type of installation, but it can be up to 25% of the eligible costs.

Q: How can I claim the Form ENRG-C Energy Conservation Installation Credit?

A: To claim the credit, you need to complete and submit the Form ENRG-C along with your Montana state tax return.

Q: Is the Form ENRG-C Energy Conservation Installation Credit refundable?

A: No, the credit is non-refundable, but any unused credit can be carried over for up to three years.

Q: Are there any limitations or restrictions for the Form ENRG-C Energy Conservation Installation Credit?

A: Yes, there are certain limitations and restrictions, such as maximum credit amounts and eligible expenses. It is recommended to review the instructions and guidelines provided with the form.

Form Details:

- Released on May 1, 2019;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ENRG-C by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.