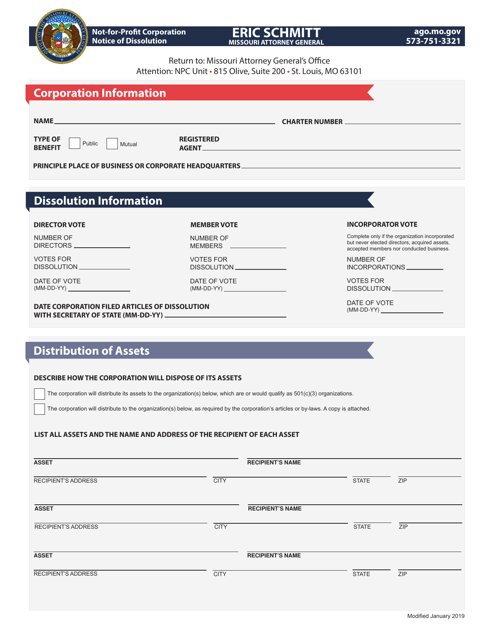

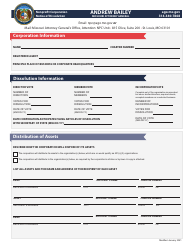

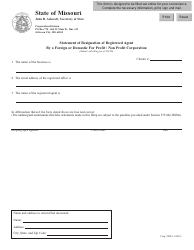

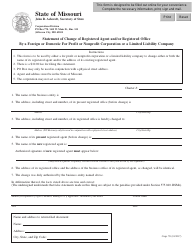

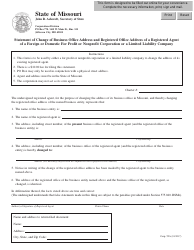

Not-For-Profit Corporation Notice of Dissolution - Missouri

Not-For-Profit Corporation Notice of Dissolution is a legal document that was released by the Missouri Attorney General - a government authority operating within Missouri.

FAQ

Q: What is a Not-For-Profit Corporation?

A: A Not-For-Profit Corporation is a type of organization that is established for charitable, religious, educational, scientific, or other similar purposes, and operates without the intention of generating profit.

Q: What is a Notice of Dissolution?

A: A Notice of Dissolution is a legal document that is filed by a Not-For-Profit Corporation to officially terminate its existence and cease its operations.

Q: Why would a Not-For-Profit Corporation dissolve?

A: There could be various reasons for a Not-For-Profit Corporation to dissolve, such as the completion of its mission, financial difficulties, lack of support, or changes in the organization's goals or leadership.

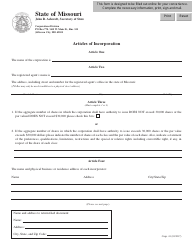

Q: What is the process for filing a Notice of Dissolution in Missouri?

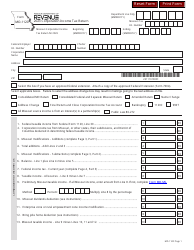

A: To file a Notice of Dissolution in Missouri, the Not-For-Profit Corporation must complete the required form provided by the Missouri Secretary of State's office, and submit it along with the appropriate filing fee.

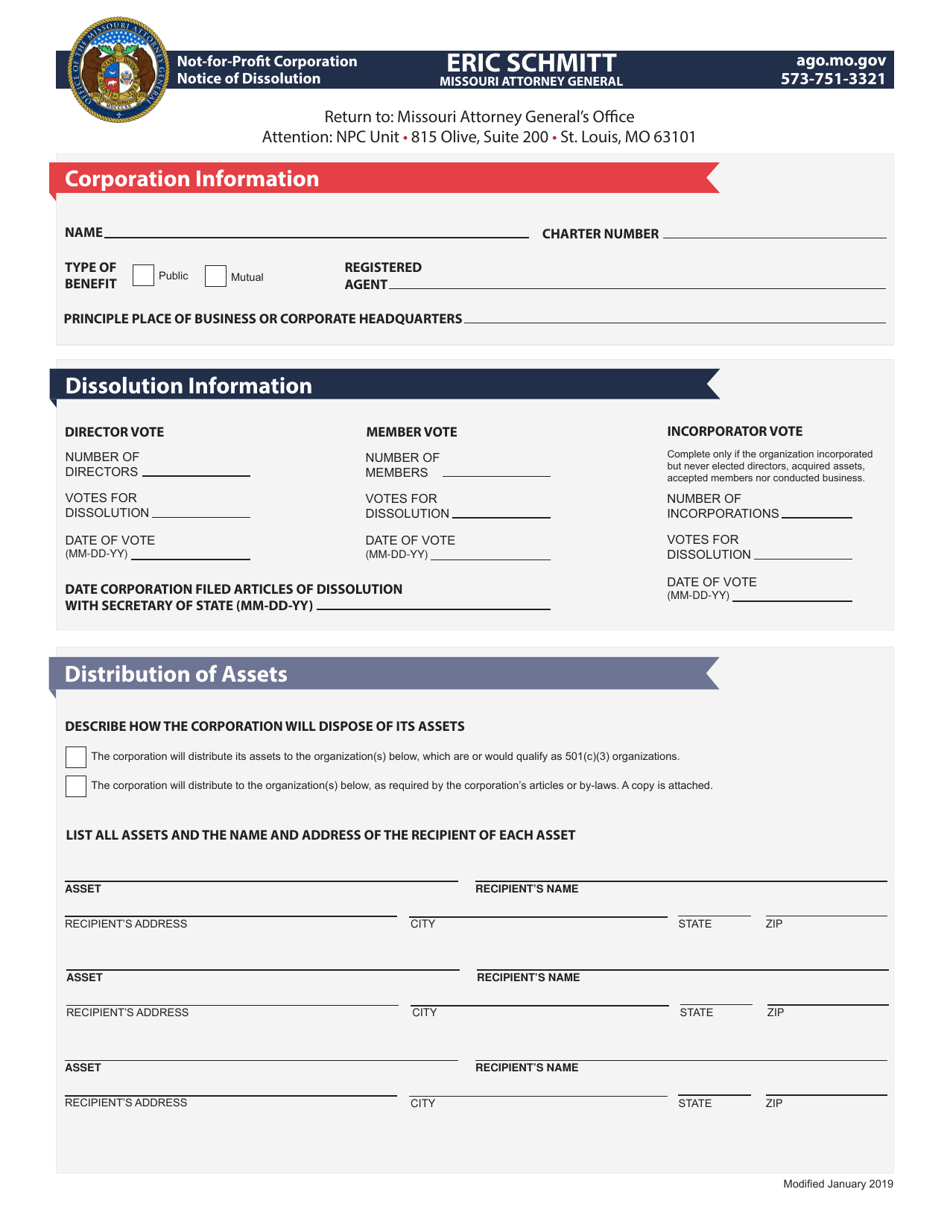

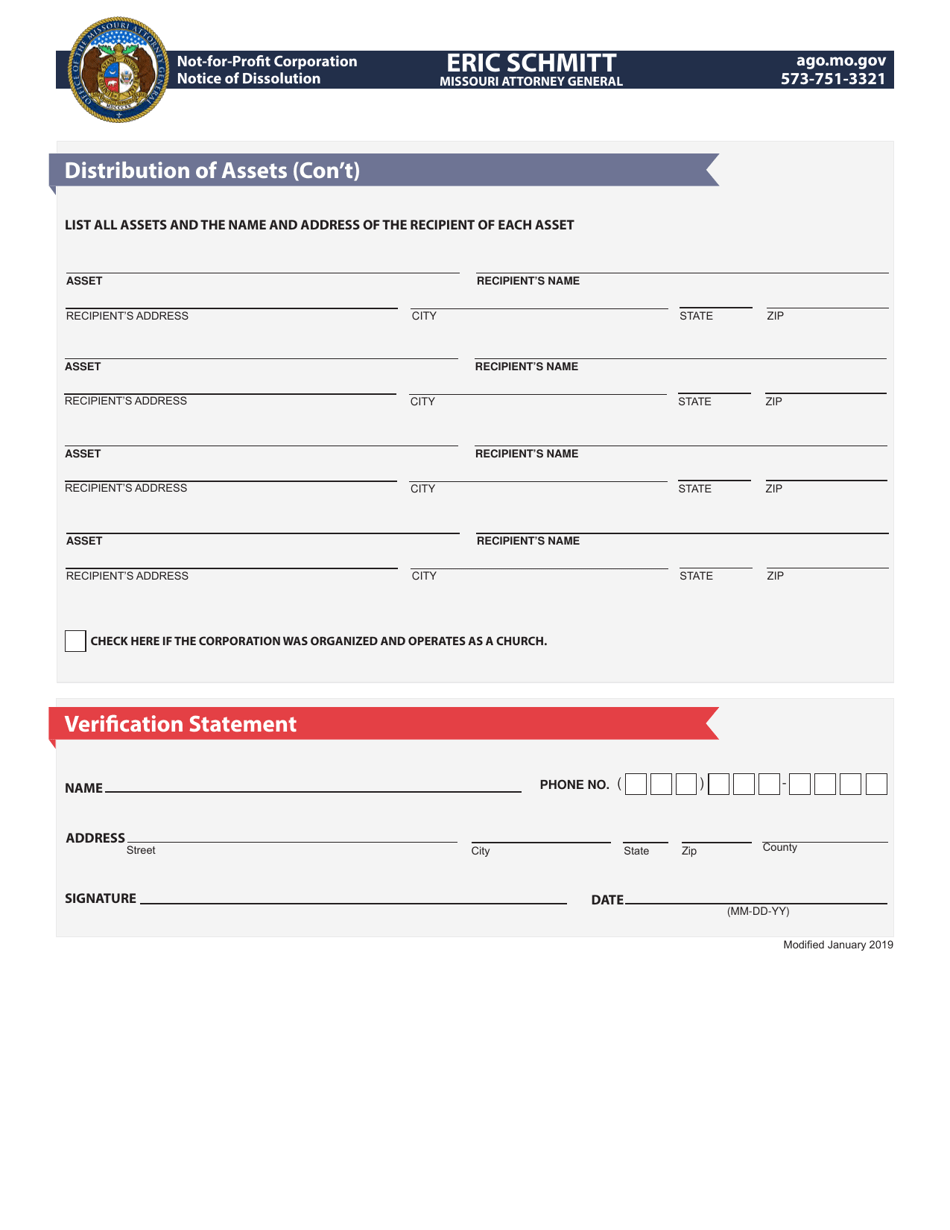

Q: What information is required in a Notice of Dissolution?

A: The Notice of Dissolution typically requires information such as the name of the Not-For-Profit Corporation, date of dissolution, reason for dissolution, and the names and addresses of the organization's officers or directors.

Q: What happens after filing a Notice of Dissolution?

A: After filing a Notice of Dissolution, the Missouri Secretary of State's office will review the document and, if everything is in order, formally dissolve the Not-For-Profit Corporation's legal existence.

Q: Are there any additional steps required after filing a Notice of Dissolution?

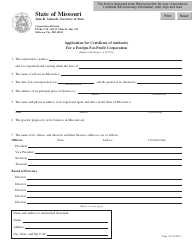

A: Yes, there may be additional steps required, such as notifying the Missouri Attorney General's office and the Internal Revenue Service (IRS) of the dissolution, and properly distributing any remaining assets or funds.

Q: Can a Not-For-Profit Corporation be revived or reinstated after dissolution?

A: Yes, in some cases a Not-For-Profit Corporation can be revived or reinstated if certain requirements are met, such as filing a reinstatement application and paying any applicable fees.

Q: What are the consequences of not filing a Notice of Dissolution?

A: Failing to file a Notice of Dissolution can have legal and financial consequences, such as ongoing obligations or liabilities for the Not-For-Profit Corporation, and potential penalties imposed by the state.

Form Details:

- Released on January 1, 2019;

- The latest edition currently provided by the Missouri Attorney General;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Missouri Attorney General.