This version of the form is not currently in use and is provided for reference only. Download this version of

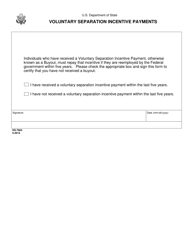

Form MODES-2272-I

for the current year.

Form MODES-2272-I Voluntary Payment Work Sheet - Missouri

What Is Form MODES-2272-I?

This is a legal form that was released by the Missouri Department of Labor and Industrial Relations - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

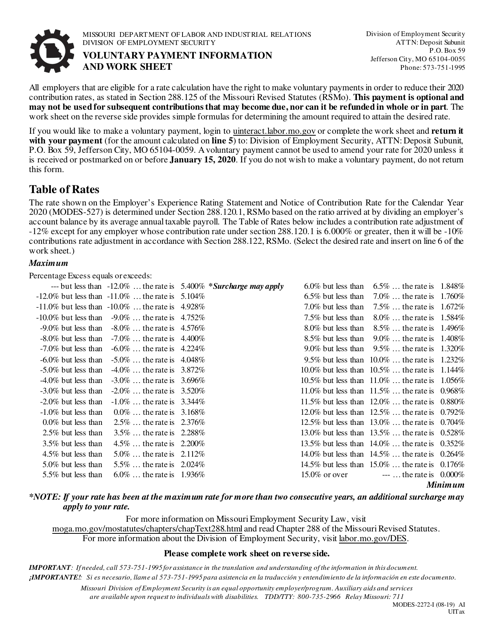

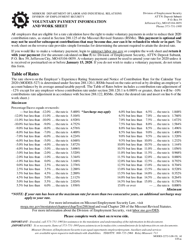

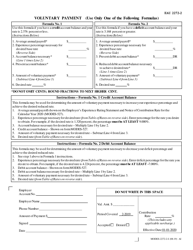

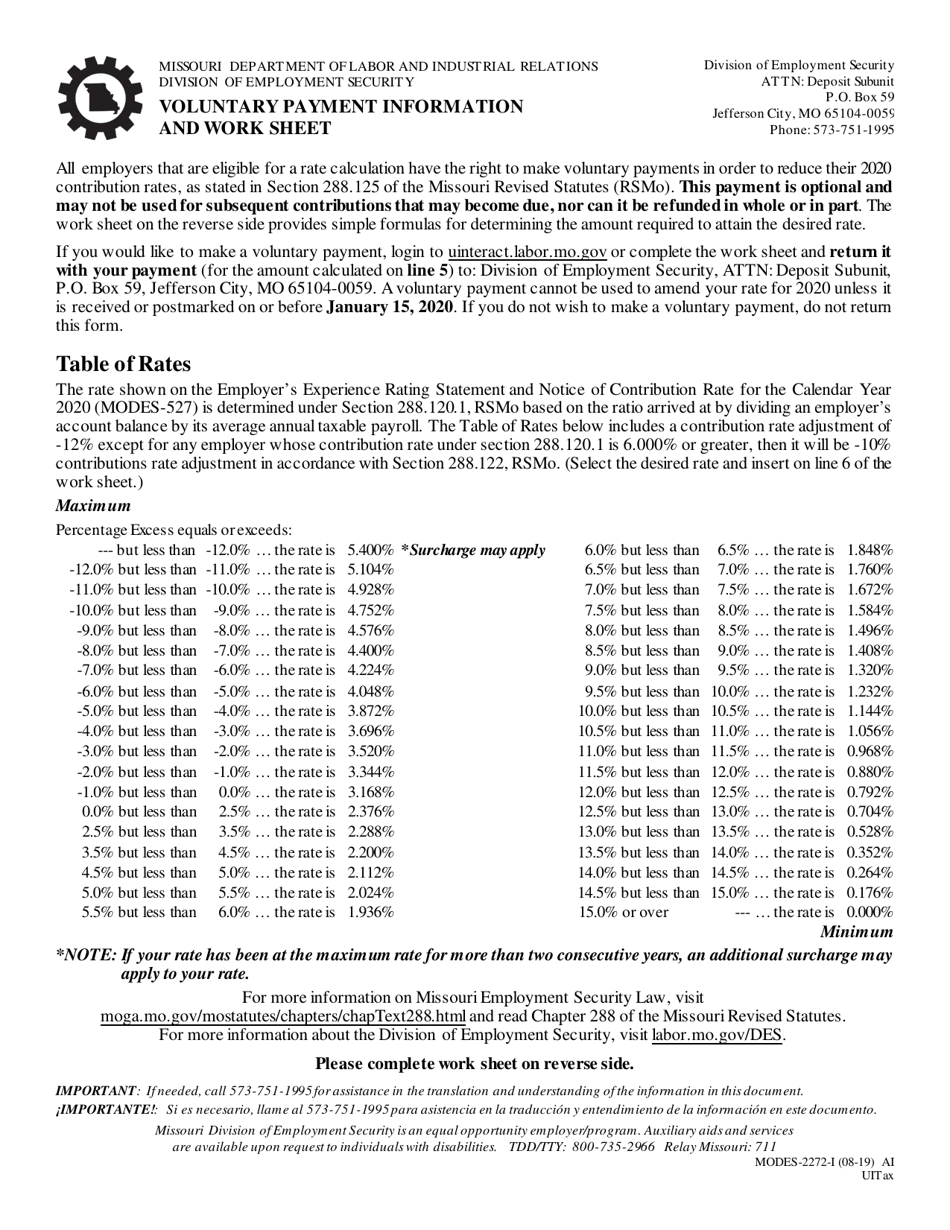

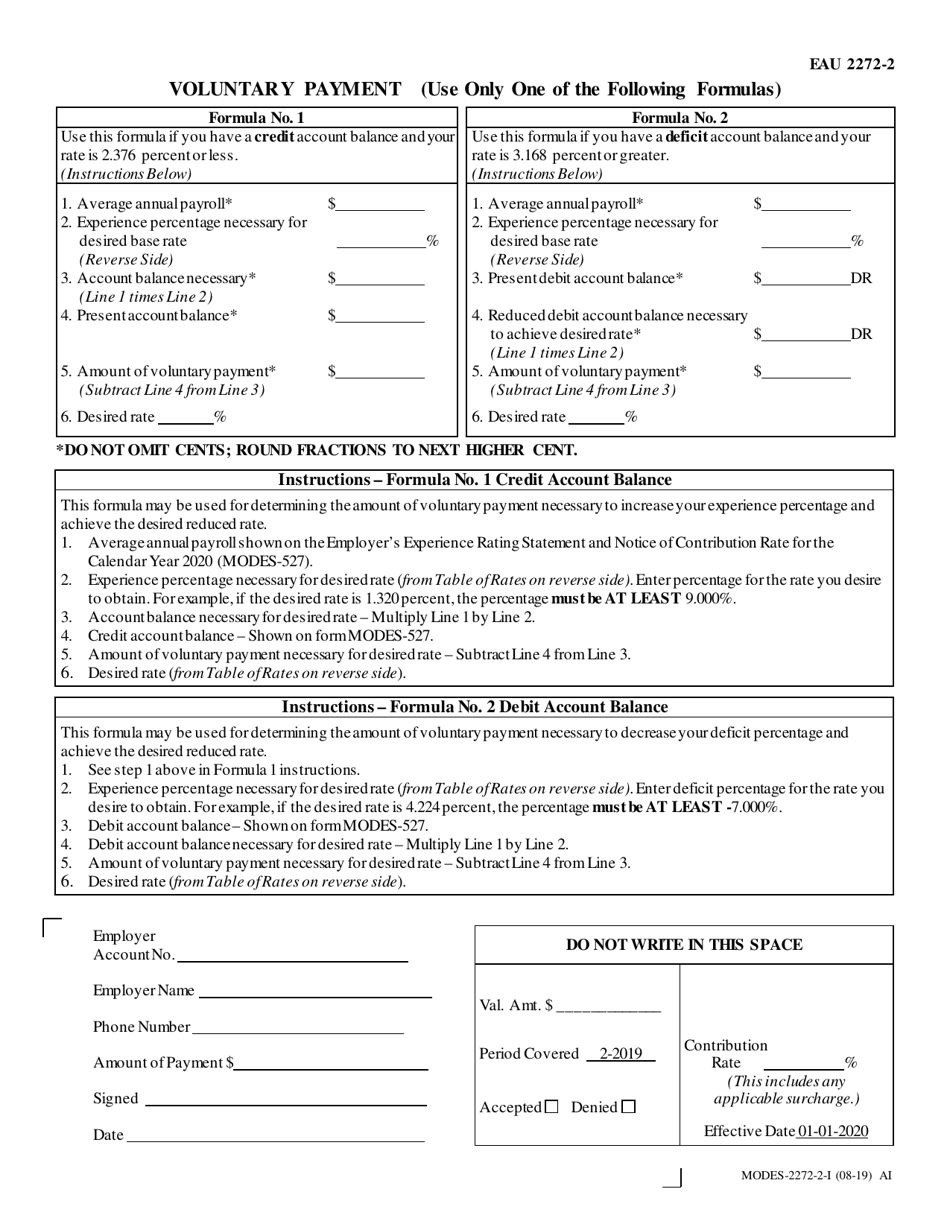

Q: What is the MODES-2272-I Voluntary Payment Work Sheet?

A: The MODES-2272-I Voluntary Payment Work Sheet is a document used in Missouri for voluntary tax payments.

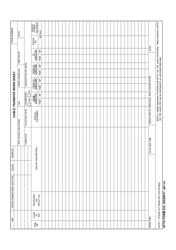

Q: Who should use the MODES-2272-I Voluntary Payment Work Sheet?

A: This work sheet is used by individuals or businesses who want to make voluntary tax payments to the state of Missouri.

Q: What is the purpose of the MODES-2272-I Voluntary Payment Work Sheet?

A: The purpose of this work sheet is to assist taxpayers in calculating and making voluntary tax payments to the state of Missouri.

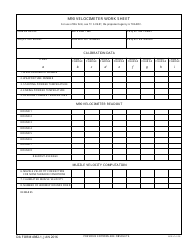

Q: Are voluntary tax payments required in Missouri?

A: No, voluntary tax payments are not required in Missouri. They are optional and made at the discretion of the taxpayer.

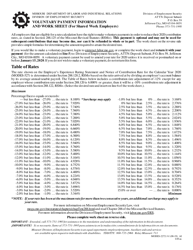

Q: What types of taxes can be paid using the MODES-2272-I Voluntary Payment Work Sheet?

A: The work sheet can be used to make voluntary payments for various taxes including income tax, sales and use tax, corporate tax, and motor fuel tax.

Q: Can I use the MODES-2272-I Voluntary Payment Work Sheet for federal taxes?

A: No, the MODES-2272-I Voluntary Payment Work Sheet is specific to making voluntary tax payments to the state of Missouri and cannot be used for federal tax payments.

Q: Is there a deadline for submitting the MODES-2272-I Voluntary Payment Work Sheet?

A: There is no specific deadline for submitting the work sheet. Taxpayers can make voluntary payments at any time throughout the year.

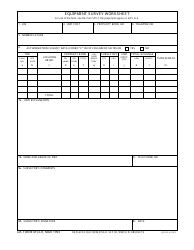

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Missouri Department of Labor and Industrial Relations;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MODES-2272-I by clicking the link below or browse more documents and templates provided by the Missouri Department of Labor and Industrial Relations.