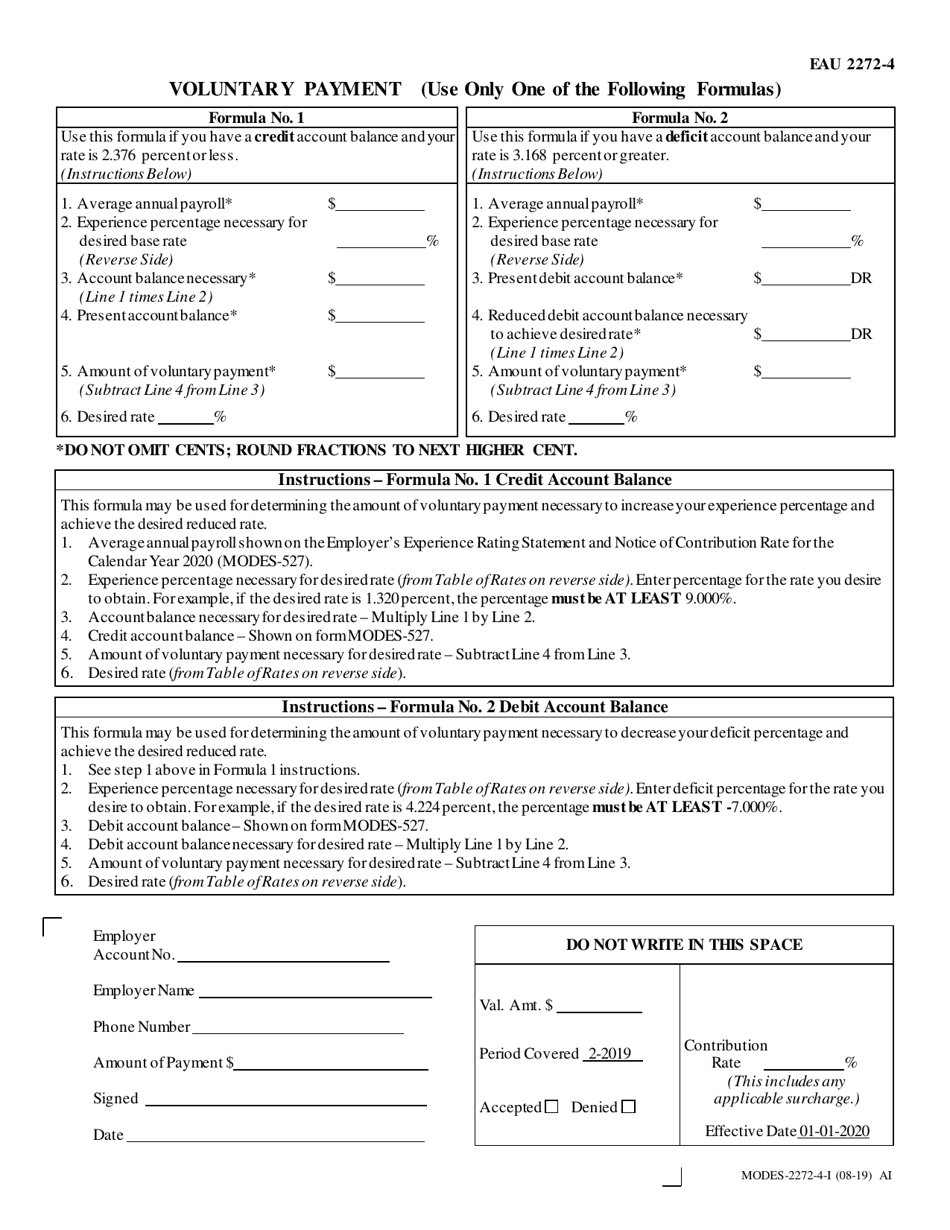

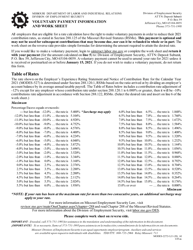

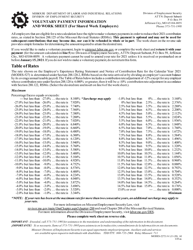

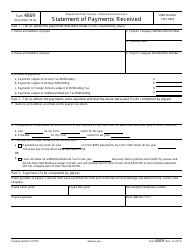

Form MODES-2272-4-I Voluntary Payment (Shared Work Employers) - Missouri

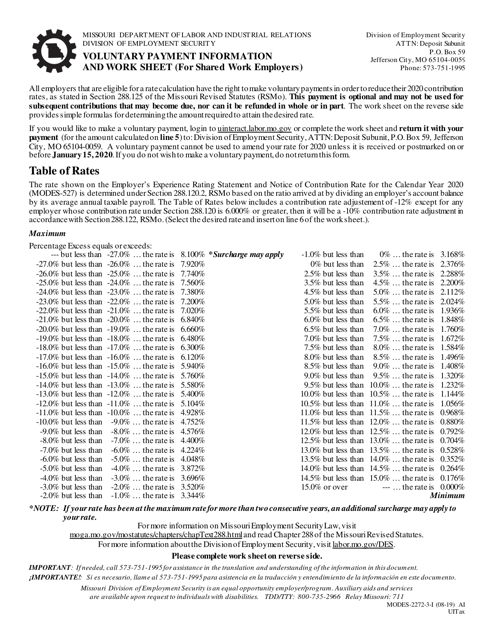

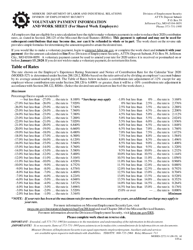

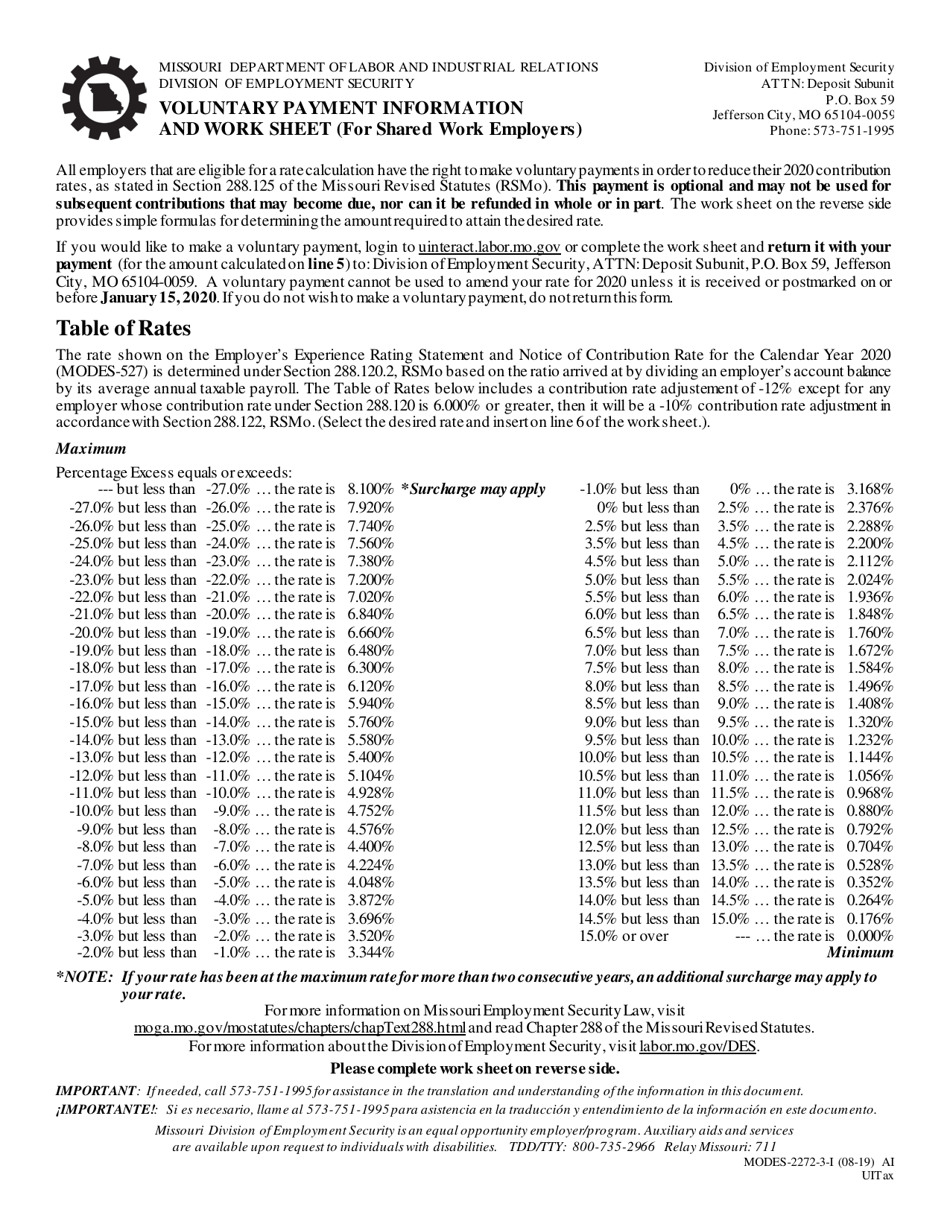

What Is Form MODES-2272-4-I?

This is a legal form that was released by the Missouri Department of Labor and Industrial Relations - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MODES-2272-4-I?

A: Form MODES-2272-4-I is a voluntary payment form for shared work employers in Missouri.

Q: Who is eligible to use Form MODES-2272-4-I?

A: Shared work employers in Missouri are eligible to use Form MODES-2272-4-I.

Q: What is a shared work employer?

A: A shared work employer is an employer who participates in a shared work program, which allows employees to receive partial unemployment benefits while working reduced hours.

Q: What is the purpose of Form MODES-2272-4-I?

A: The purpose of Form MODES-2272-4-I is for shared work employers to make voluntary payments to the Missouri Department of Labor on behalf of their employees.

Q: Are shared work employers required to use Form MODES-2272-4-I?

A: No, the use of Form MODES-2272-4-I is voluntary for shared work employers in Missouri.

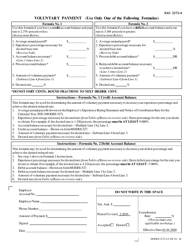

Q: How do I complete Form MODES-2272-4-I?

A: You will need to provide your employer information, payment amount, and employee information on Form MODES-2272-4-I.

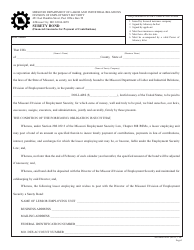

Q: What should I do with Form MODES-2272-4-I once it is completed?

A: You should submit Form MODES-2272-4-I along with your payment to the Missouri Department of Labor.

Q: Can I make voluntary payments using a method other than Form MODES-2272-4-I?

A: Yes, you may contact the Missouri Department of Labor to discuss alternative payment methods.

Q: Are there any penalties for not using Form MODES-2272-4-I?

A: No, there are no penalties for shared work employers who choose not to use Form MODES-2272-4-I.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Missouri Department of Labor and Industrial Relations;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MODES-2272-4-I by clicking the link below or browse more documents and templates provided by the Missouri Department of Labor and Industrial Relations.