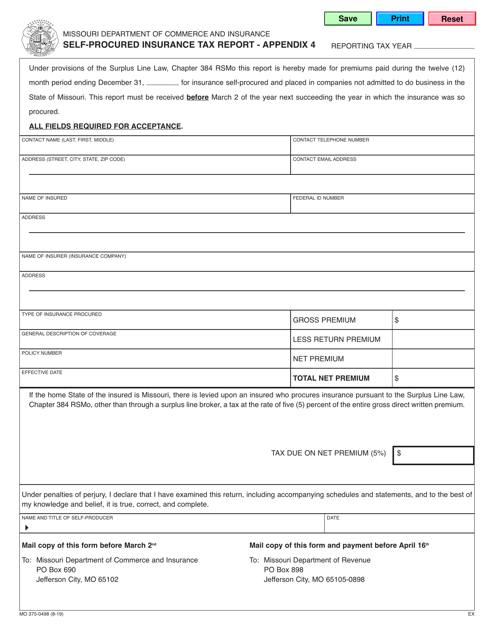

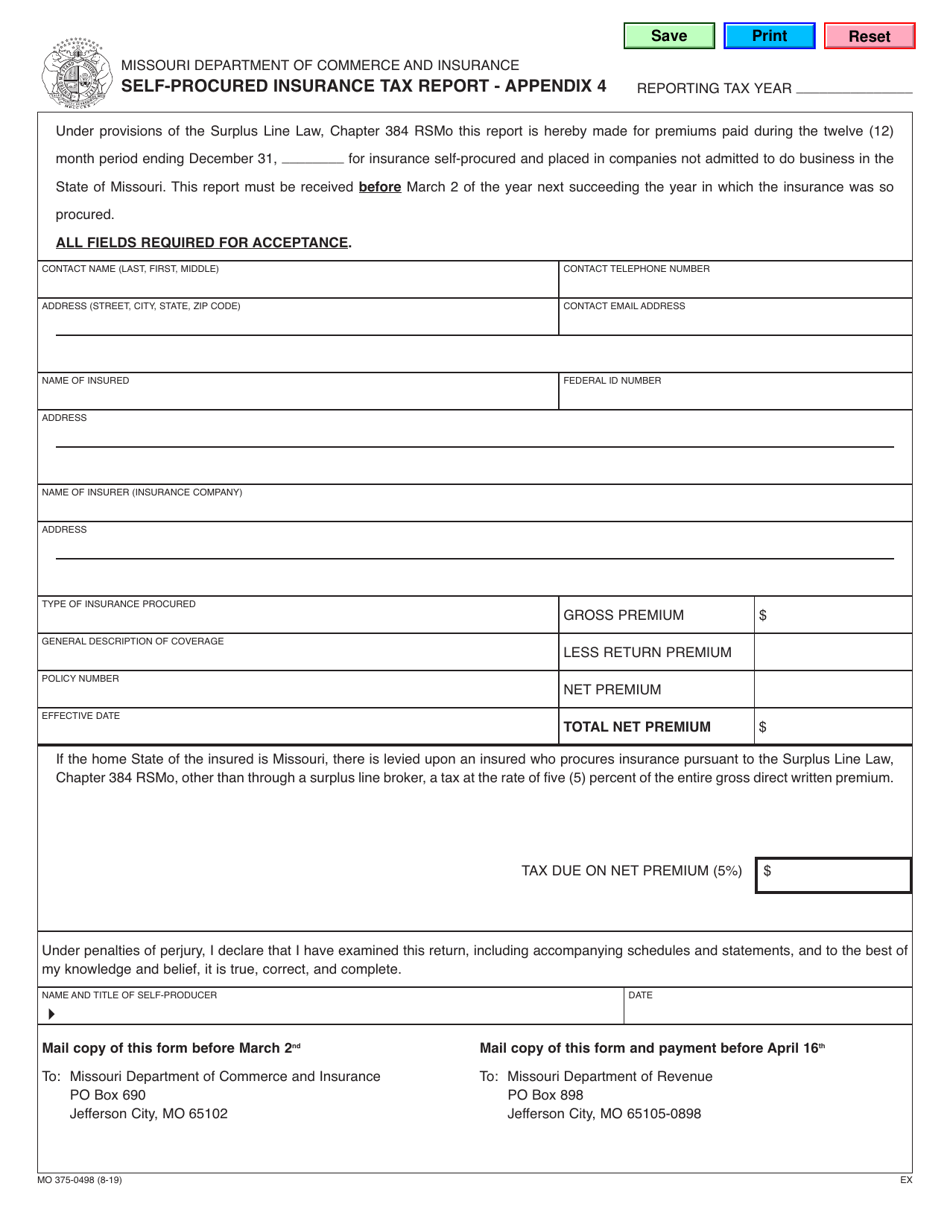

Form MO375-0498 Appendix 4 Self-procured Insurance Tax Report - Missouri

What Is Form MO375-0498 Appendix 4?

This is a legal form that was released by the Missouri Department of Commerce and Insurance - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MO375-0498?

A: Form MO375-0498 is a tax report specific to self-procured insurance in the state of Missouri.

Q: Who should file Form MO375-0498?

A: Individuals or entities who have purchased self-procured insurance in Missouri should file Form MO375-0498.

Q: What is self-procured insurance?

A: Self-procured insurance refers to insurance coverage that is obtained directly by the insured party, rather than through an insurance provider.

Q: What information is required on Form MO375-0498?

A: Form MO375-0498 requires information such as the insured's name, policy number, total premium paid, and applicable tax rate.

Q: When is the deadline to file Form MO375-0498?

A: The deadline to file Form MO375-0498 is usually April 15th of each year.

Q: Are there any penalties for not filing Form MO375-0498?

A: Failure to file Form MO375-0498 or providing false information may result in penalties, including fines and interest charges.

Q: Is Form MO375-0498 only for individuals?

A: No, Form MO375-0498 can be filed by both individuals and entities.

Q: Can I claim a deduction for the premiums paid on self-procured insurance?

A: Individuals may be able to claim a deduction for the premiums paid on self-procured insurance. It is recommended to consult a tax professional for specific advice.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Missouri Department of Commerce and Insurance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO375-0498 Appendix 4 by clicking the link below or browse more documents and templates provided by the Missouri Department of Commerce and Insurance.