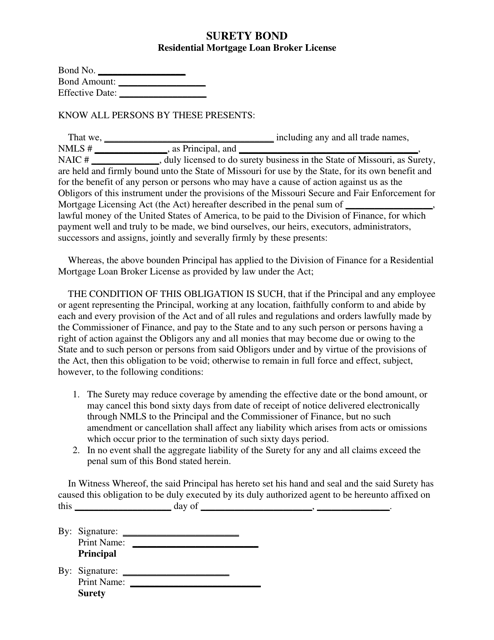

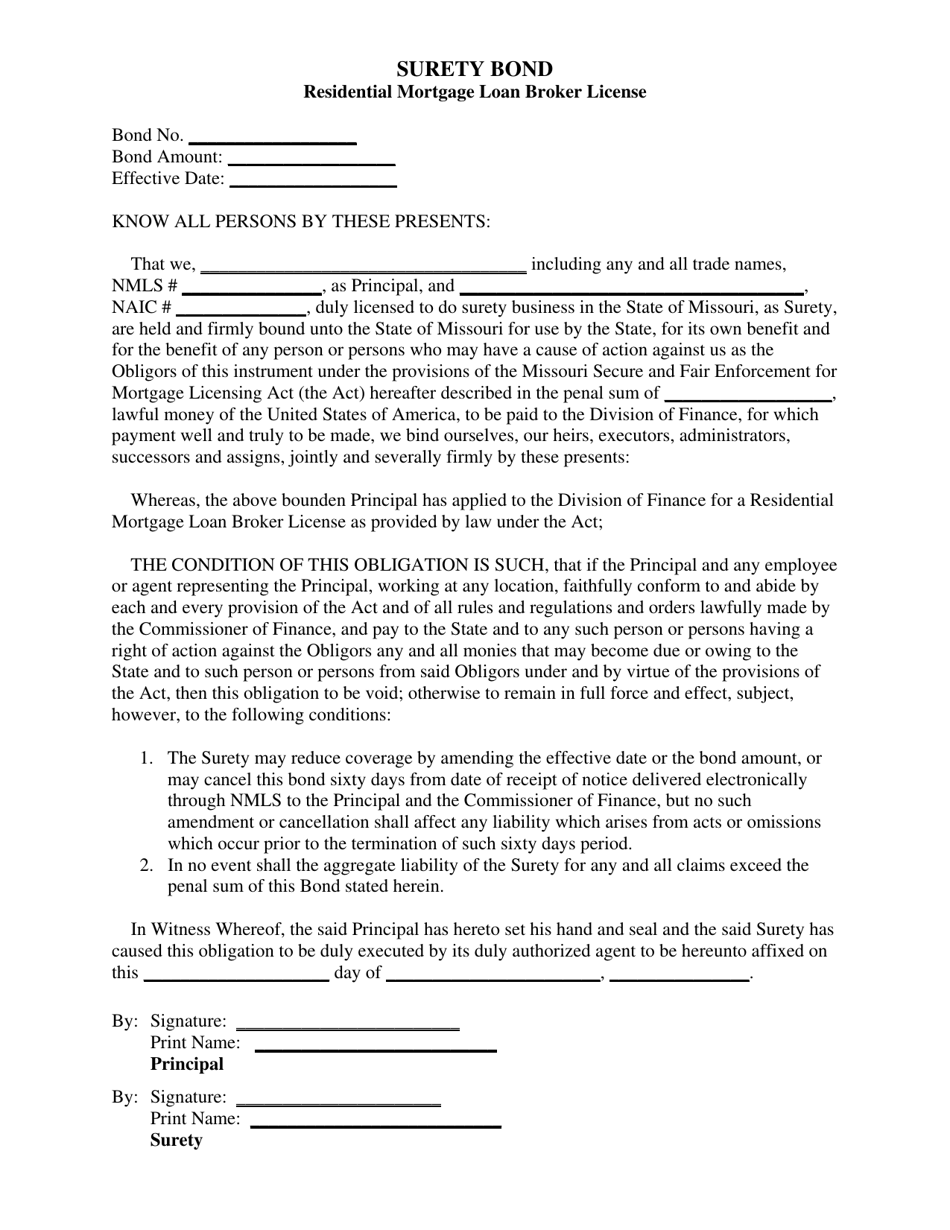

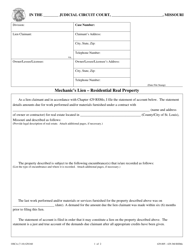

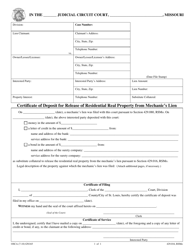

Residential Mortgage Loan Broker License Surety Bond - Missouri

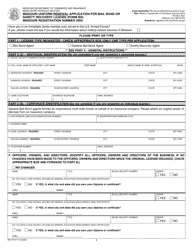

Residential Broker License Surety Bond is a legal document that was released by the Missouri Division of Finance - a government authority operating within Missouri.

FAQ

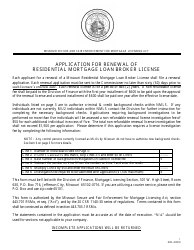

Q: What is a Residential Mortgage Loan Broker License Surety Bond?

A: A Residential Mortgage Loan Broker License Surety Bond is a type of bond required by the state of Missouri for individuals or businesses who want to become licensed mortgage loan brokers.

Q: Why do I need a Residential Mortgage Loan Broker License Surety Bond?

A: You need a Residential Mortgage Loan Broker License Surety Bond to protect consumers from financial harm in case you or your company engage in dishonest or unethical practices.

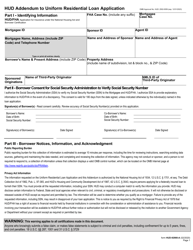

Q: How does a Residential Mortgage Loan Broker License Surety Bond work?

A: If a consumer suffers a financial loss due to your actions as a licensed mortgage loan broker, they can make a claim against the bond. If the claim is valid, the bond will provide financial compensation to the consumer.

Q: How much does a Residential Mortgage Loan Broker License Surety Bond cost?

A: The cost of the bond varies depending on factors such as the bond amount required by the state and your creditworthiness. It is usually a percentage of the bond amount.

Form Details:

- The latest edition currently provided by the Missouri Division of Finance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Missouri Division of Finance.