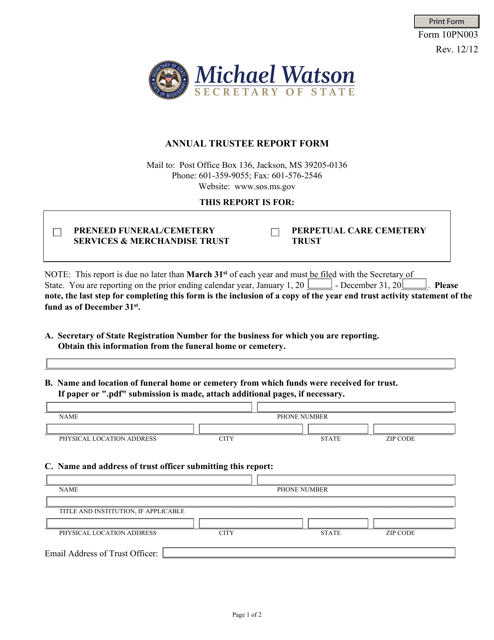

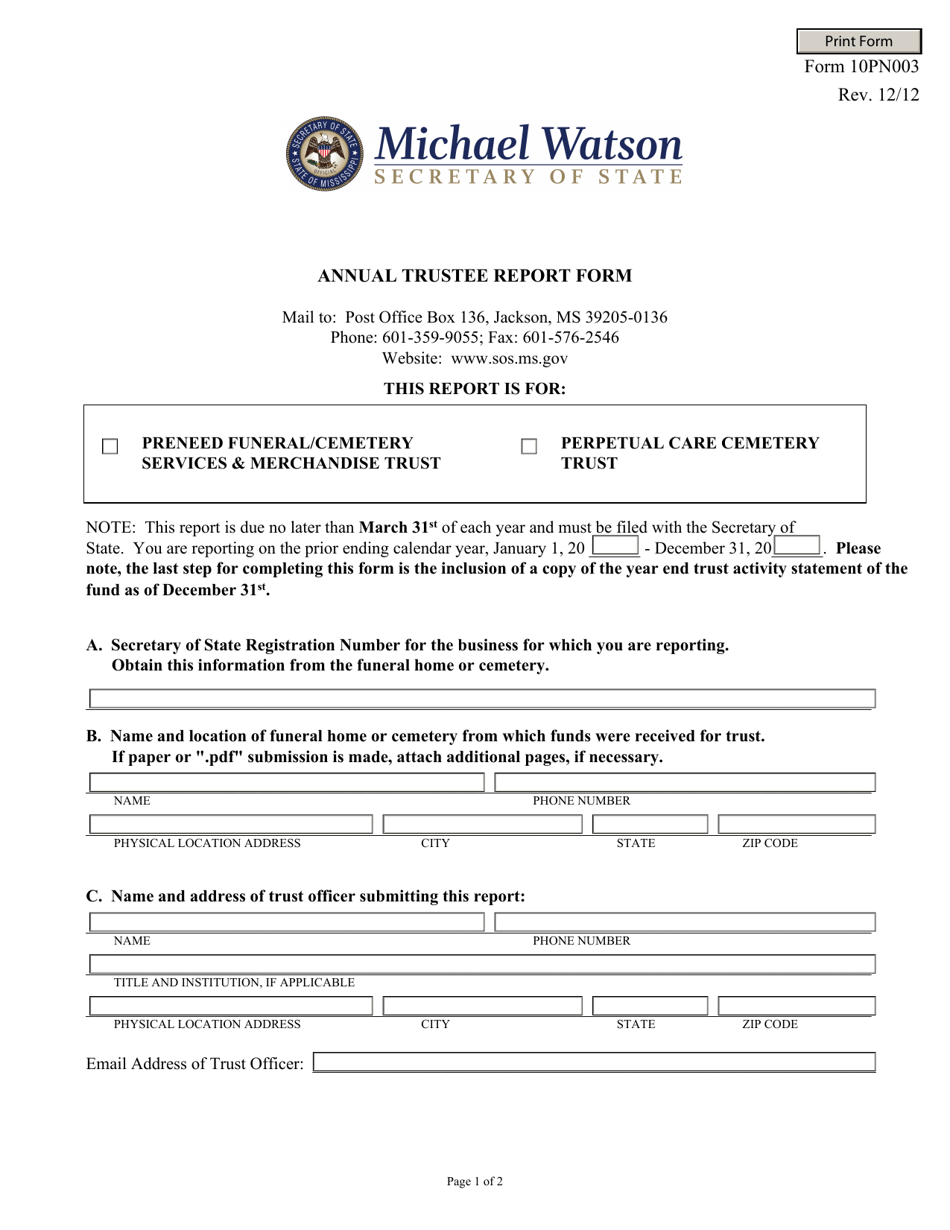

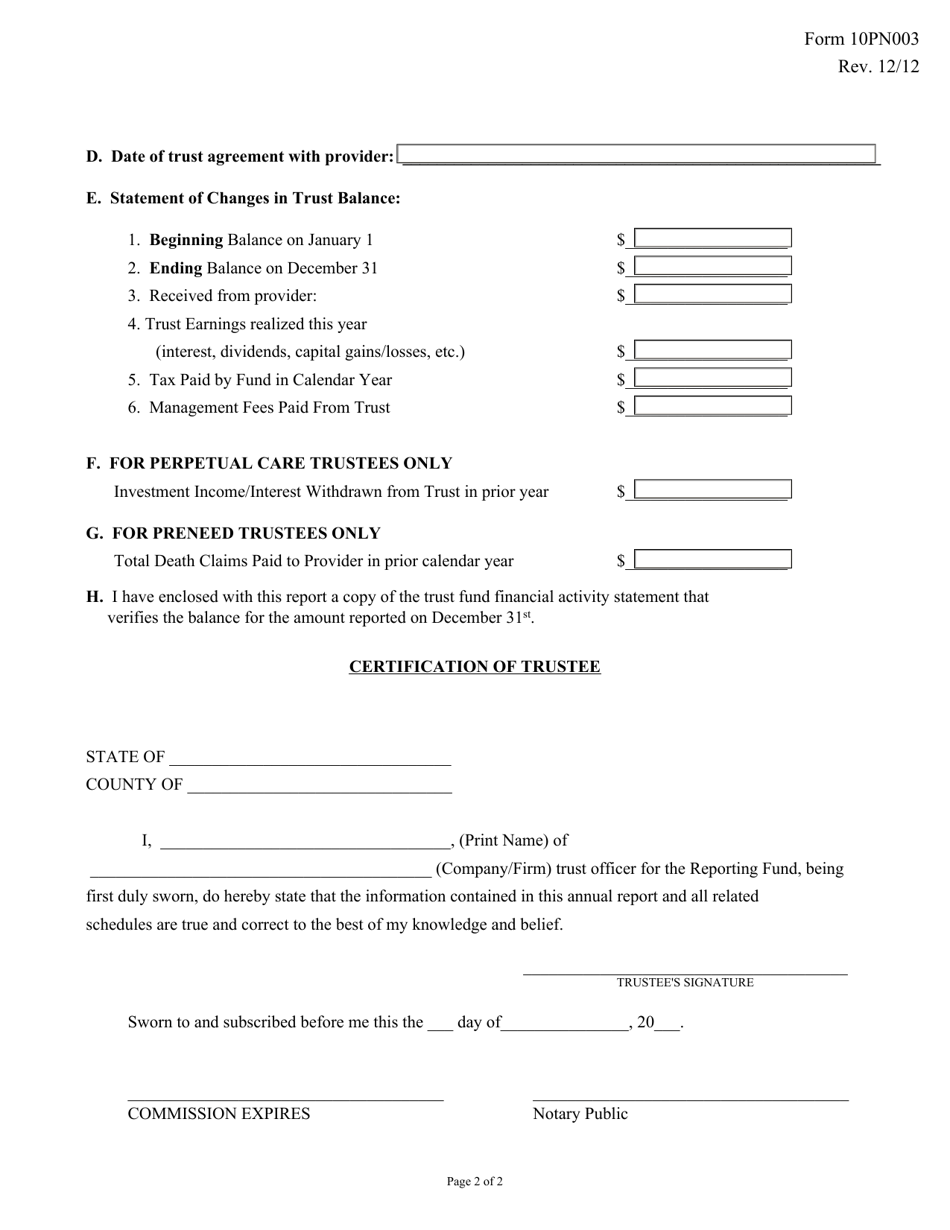

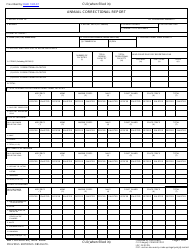

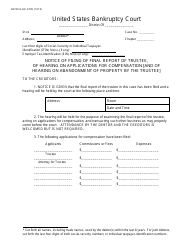

Form 10PN003 Annual Trustee Report Form - Mississippi

What Is Form 10PN003?

This is a legal form that was released by the Mississippi Secretary of State - a government authority operating within Mississippi. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 10PN003?

A: Form 10PN003 is the Annual Trustee Report Form for Mississippi.

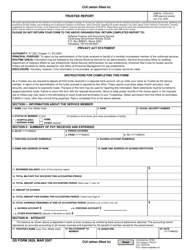

Q: Who needs to file Form 10PN003?

A: Trustees of certain trusts in Mississippi are required to file Form 10PN003.

Q: What is the purpose of Form 10PN003?

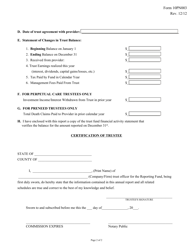

A: The purpose of Form 10PN003 is to provide information about the trust's assets, income, and expenses.

Q: When is Form 10PN003 due?

A: Form 10PN003 is due on or before the 15th day of the fifth month following the close of the trust's taxable year.

Q: Are there any penalties for late filing of Form 10PN003?

A: Yes, there are penalties for late filing of Form 10PN003. The penalties vary depending on the amount of tax due.

Q: What should I do if I have questions or need assistance with Form 10PN003?

A: If you have questions or need assistance with Form 10PN003, you should contact the Mississippi Department of Revenue for guidance.

Form Details:

- Released on December 1, 2012;

- The latest edition provided by the Mississippi Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 10PN003 by clicking the link below or browse more documents and templates provided by the Mississippi Secretary of State.