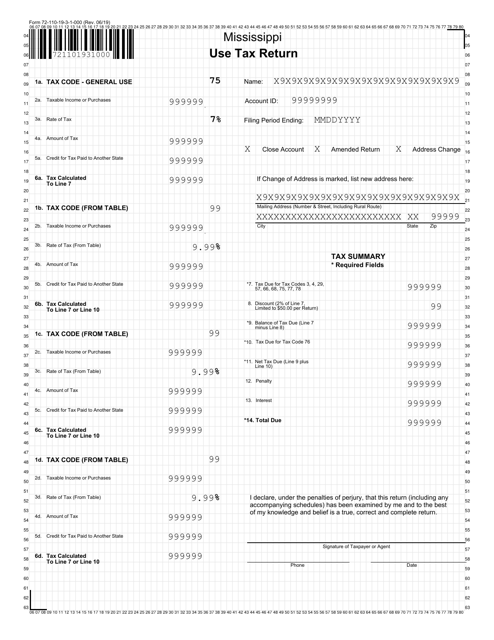

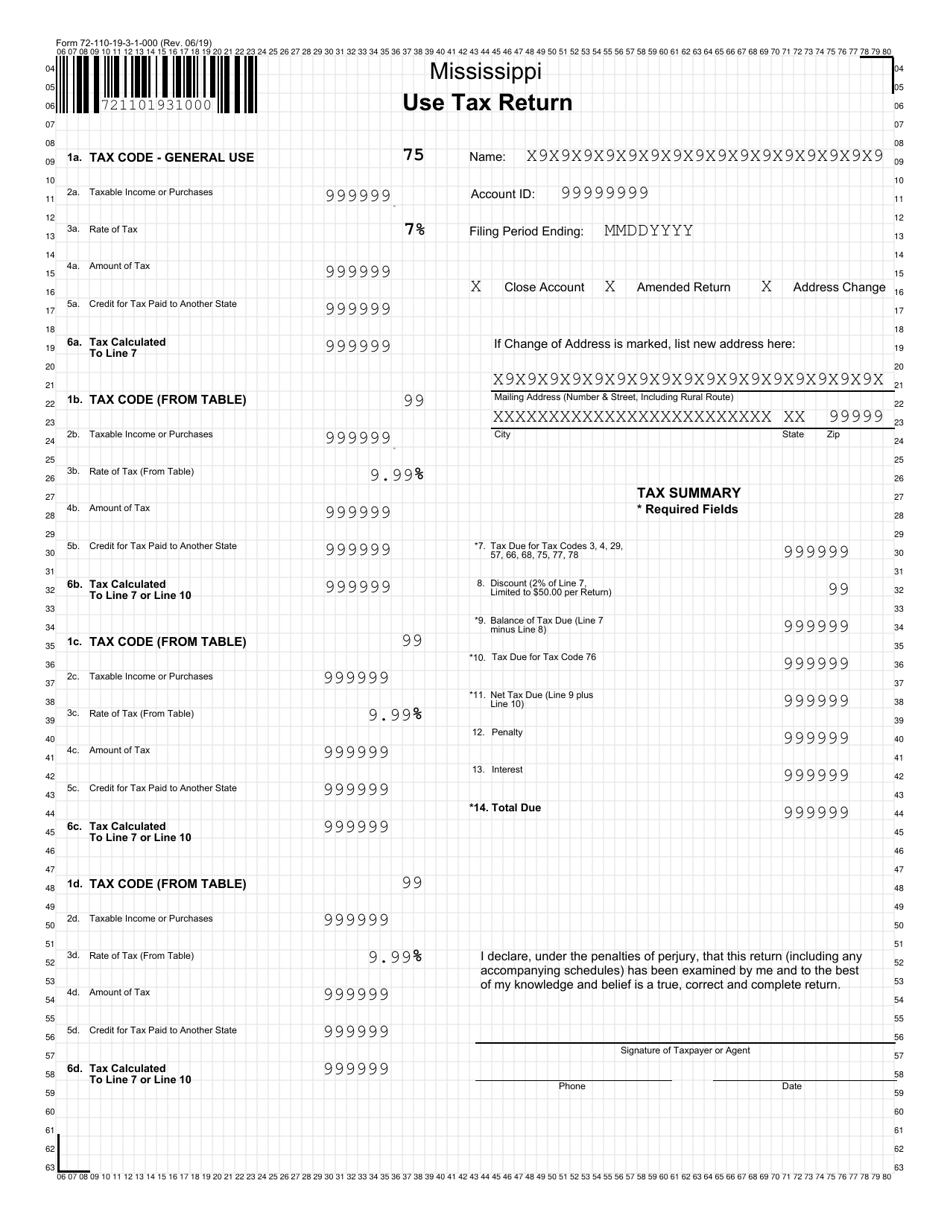

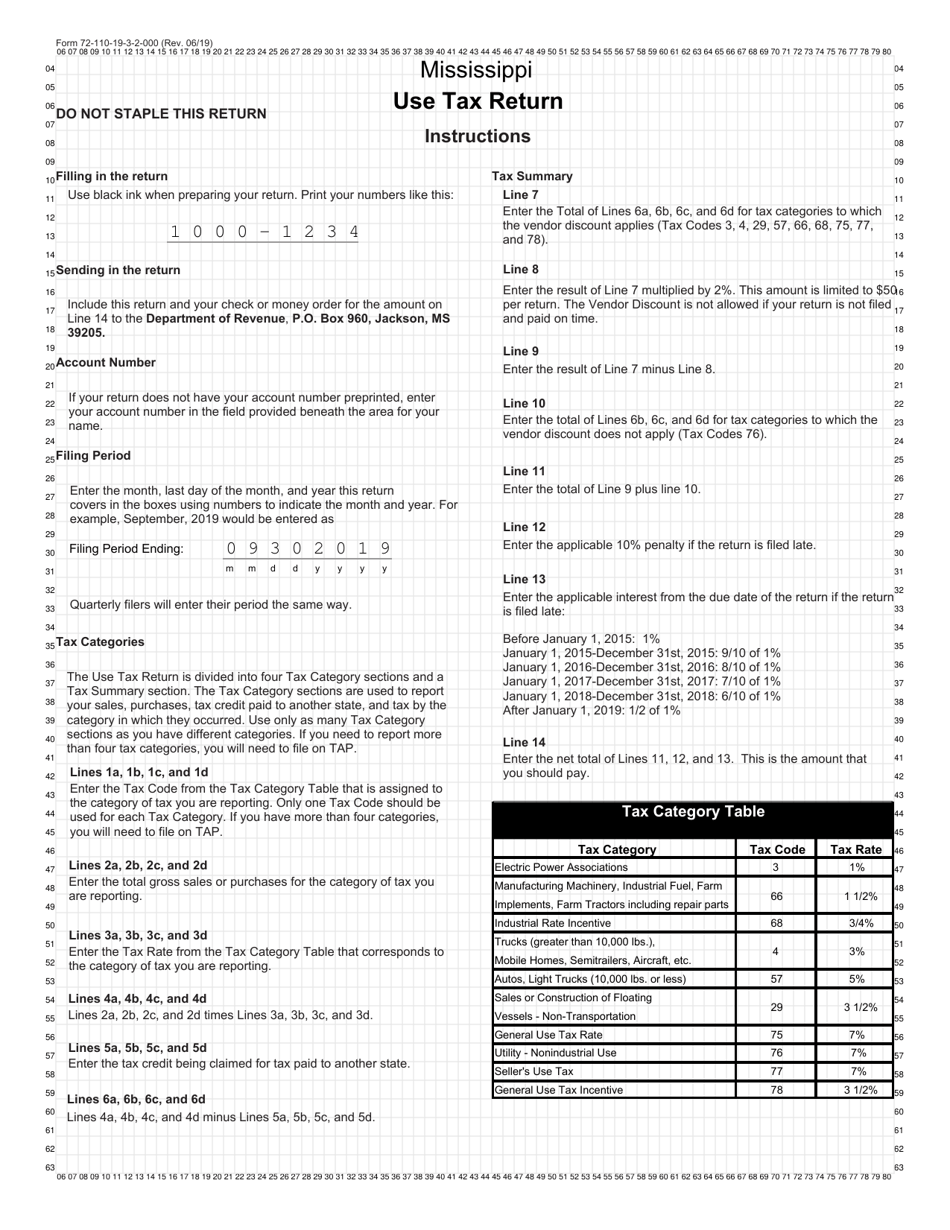

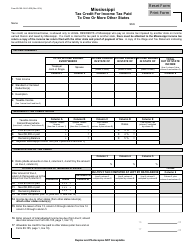

Form 72-110-19-3 Use Tax Form - Mississippi

What Is Form 72-110-19-3?

This is a legal form that was released by the Mississippi Department of Revenue - a government authority operating within Mississippi. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 72-110-19-3?

A: Form 72-110-19-3 is the Use Tax Form used in Mississippi.

Q: What is Use Tax?

A: Use Tax is a tax on goods or services that were purchased out of state and brought into Mississippi for use, storage, or consumption.

Q: Who needs to file Form 72-110-19-3?

A: Any individual or business in Mississippi that has purchased taxable goods or services from out of state and did not pay Mississippi sales tax needs to file Form 72-110-19-3.

Q: What information is required to complete Form 72-110-19-3?

A: You will need to provide your name, address, social security number or taxpayer identification number, description of the taxable goods or services, their purchase price, and the date of purchase.

Q: How often do I need to file Form 72-110-19-3?

A: Form 72-110-19-3 must be filed on a quarterly basis. The due dates are April 15, July 15, October 15, and January 15.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Mississippi Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 72-110-19-3 by clicking the link below or browse more documents and templates provided by the Mississippi Department of Revenue.