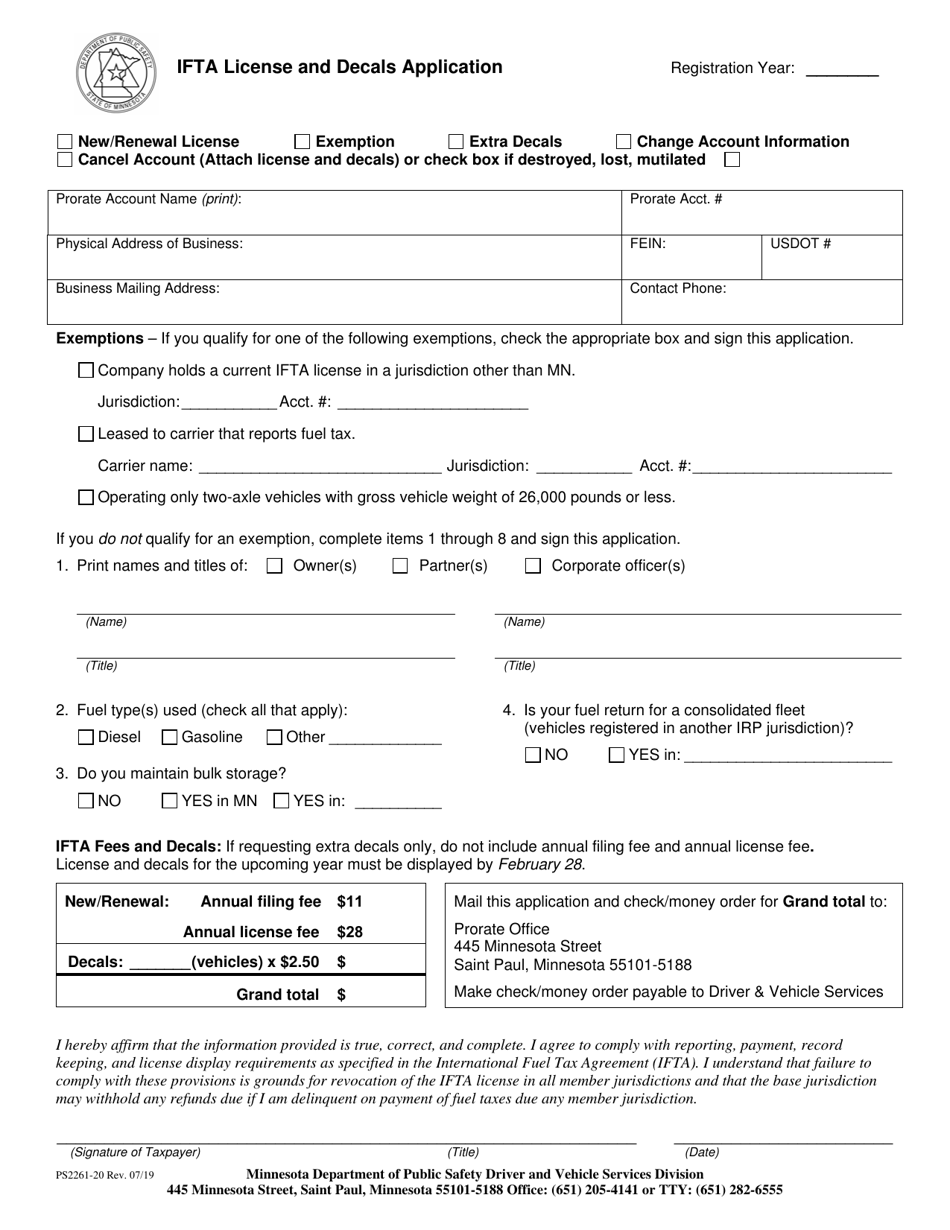

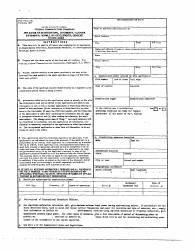

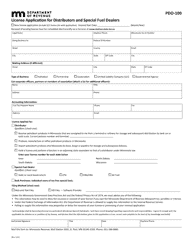

Form PS2261-20 Ifta License and Decals Application - Minnesota

What Is Form PS2261-20?

This is a legal form that was released by the Minnesota Department of Public Safety - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PS2261-20?

A: Form PS2261-20 is the IFTA License and Decals Application for Minnesota.

Q: What is IFTA?

A: IFTA stands for International Fuel Tax Agreement. It is an agreement between the United States and Canada that simplifies fuel tax reporting for motor carriers that operate in multiple jurisdictions.

Q: Who needs to file Form PS2261-20?

A: Motor carriers who operate qualified motor vehicles in more than one IFTA jurisdiction and wish to obtain an IFTA license and decals in Minnesota need to file this form.

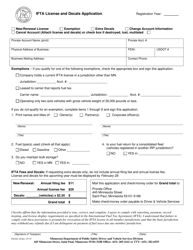

Q: What information do I need to provide on Form PS2261-20?

A: You will need to provide your business information, vehicle details, and fuel usage information for each motor vehicle operated in Minnesota.

Q: When should I file Form PS2261-20?

A: You should file this form at least 10 business days before your anticipated first trip into Minnesota.

Q: Are there any fees for filing Form PS2261-20?

A: Yes, there is a $113 annual license fee for obtaining an IFTA license and decals in Minnesota.

Q: How can I submit Form PS2261-20?

A: You can submit Form PS2261-20 by mail or in person to the Minnesota Department of Revenue.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the Minnesota Department of Public Safety;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PS2261-20 by clicking the link below or browse more documents and templates provided by the Minnesota Department of Public Safety.