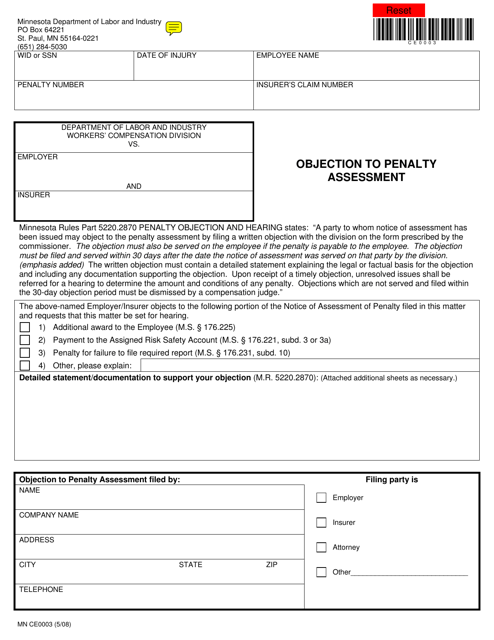

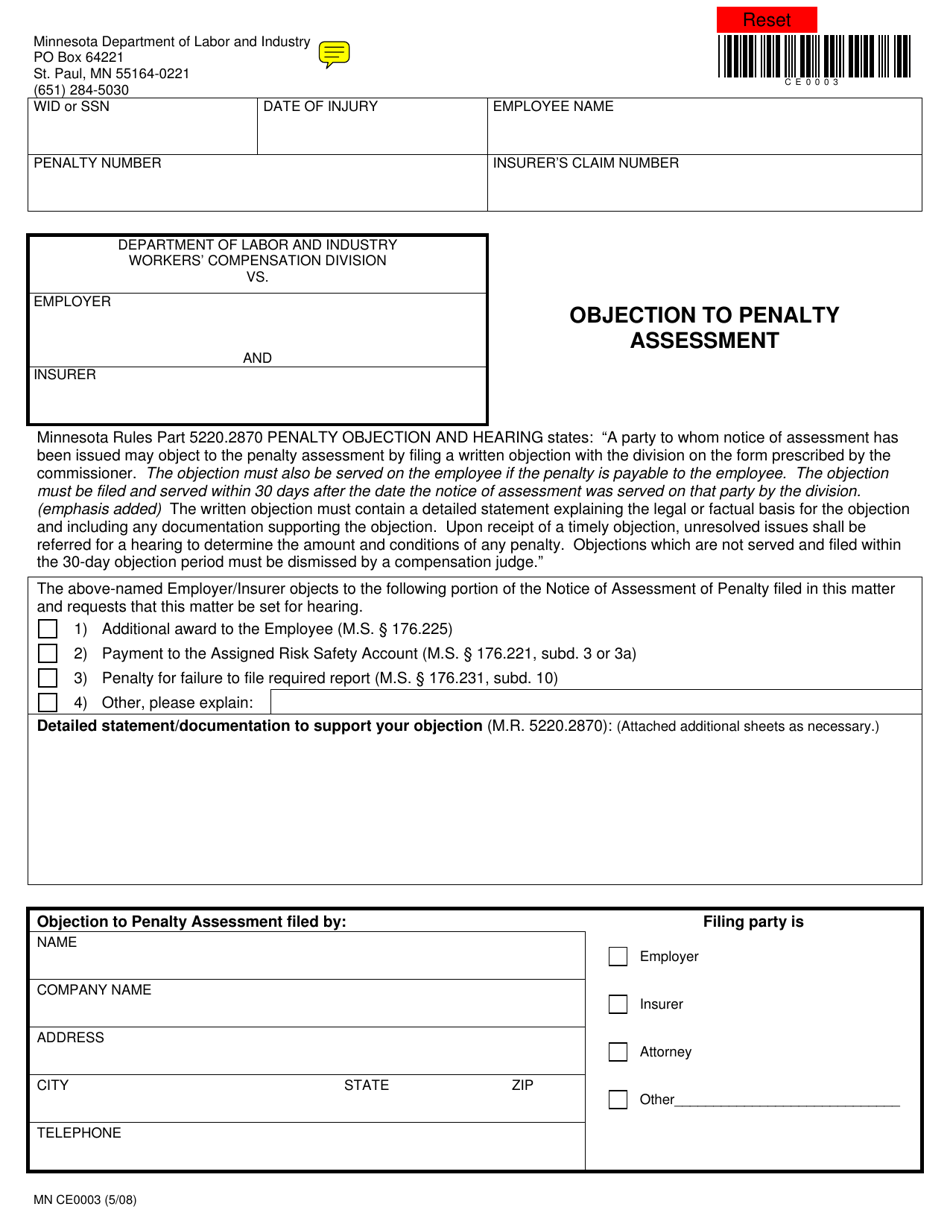

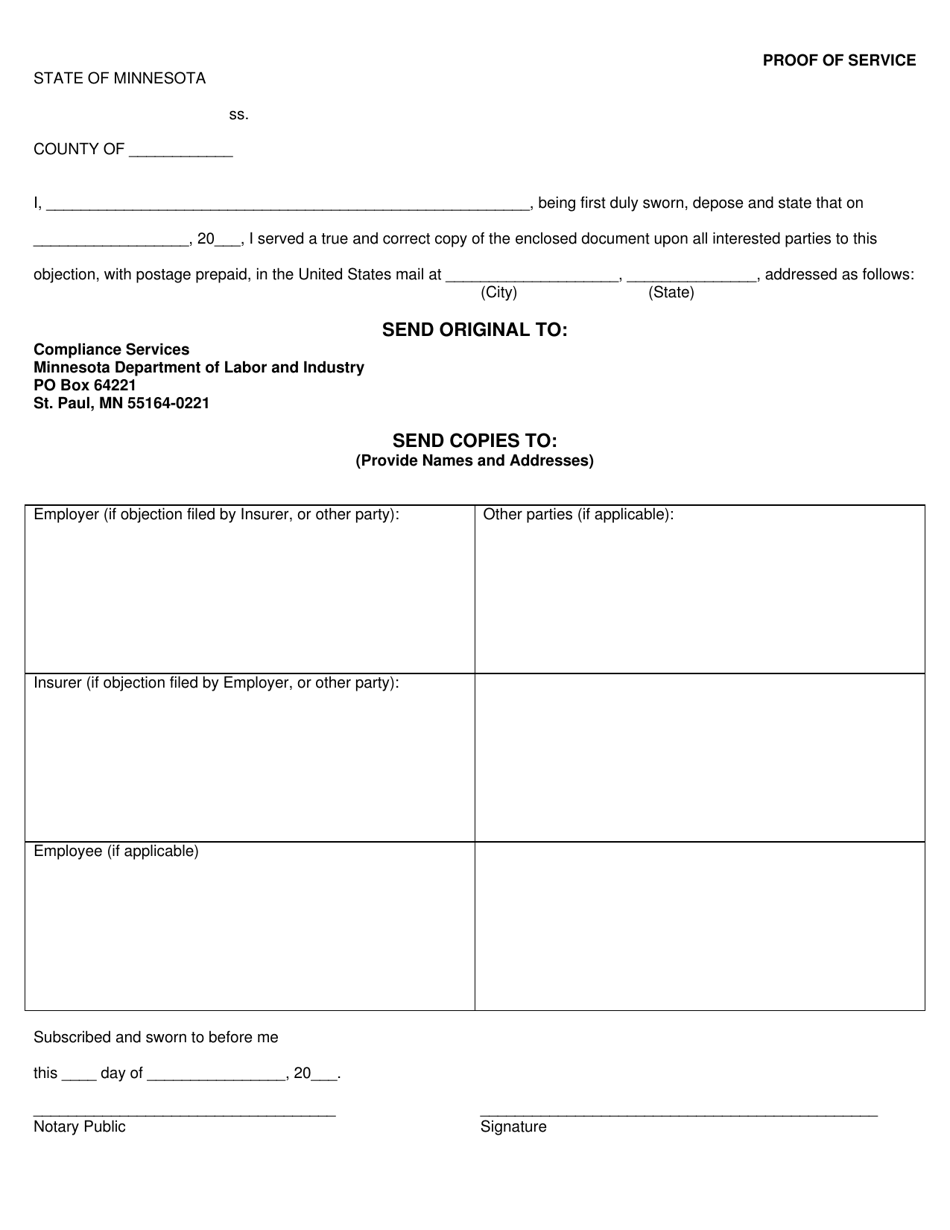

Form MN CE0003 Objection to Penalty Assessment - Minnesota

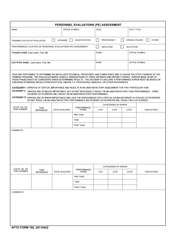

What Is Form MN CE0003?

This is a legal form that was released by the Minnesota Department of Labor and Industry - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

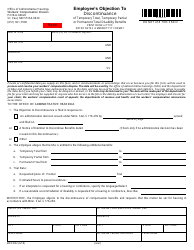

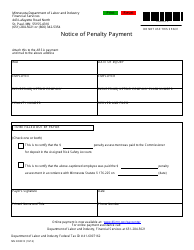

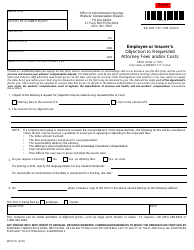

Q: What is Form MN CE0003?

A: Form MN CE0003 is the Objection to Penalty Assessment form in Minnesota.

Q: Who should use Form MN CE0003?

A: Form MN CE0003 should be used by individuals or businesses in Minnesota who want to object to a penalty assessment.

Q: What is the purpose of Form MN CE0003?

A: The purpose of Form MN CE0003 is to provide a formal means for individuals or businesses to object to a penalty assessment imposed by the Minnesota Department of Revenue.

Q: How do I fill out Form MN CE0003?

A: To fill out Form MN CE0003, you will need to provide your personal information, the penalty assessment you are objecting to, and the reasons for your objection.

Q: Are there any filing fees for Form MN CE0003?

A: No, there are no filing fees for submitting Form MN CE0003.

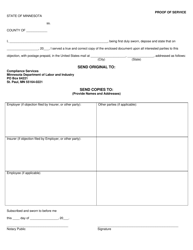

Q: What should I do after submitting Form MN CE0003?

A: After submitting Form MN CE0003, you should keep a copy of the form for your records and wait for a response from the Minnesota Department of Revenue.

Q: Can I appeal if my objection is denied?

A: Yes, if your objection is denied, you have the right to appeal the decision through the appropriate channels.

Q: Is there a deadline for submitting Form MN CE0003?

A: Yes, there is a deadline for submitting Form MN CE0003. The deadline is specified on the penalty assessment notice you received.

Q: What if I need help filling out Form MN CE0003?

A: If you need help filling out Form MN CE0003, you can contact the Minnesota Department of Revenue for assistance.

Form Details:

- Released on May 1, 2008;

- The latest edition provided by the Minnesota Department of Labor and Industry;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MN CE0003 by clicking the link below or browse more documents and templates provided by the Minnesota Department of Labor and Industry.