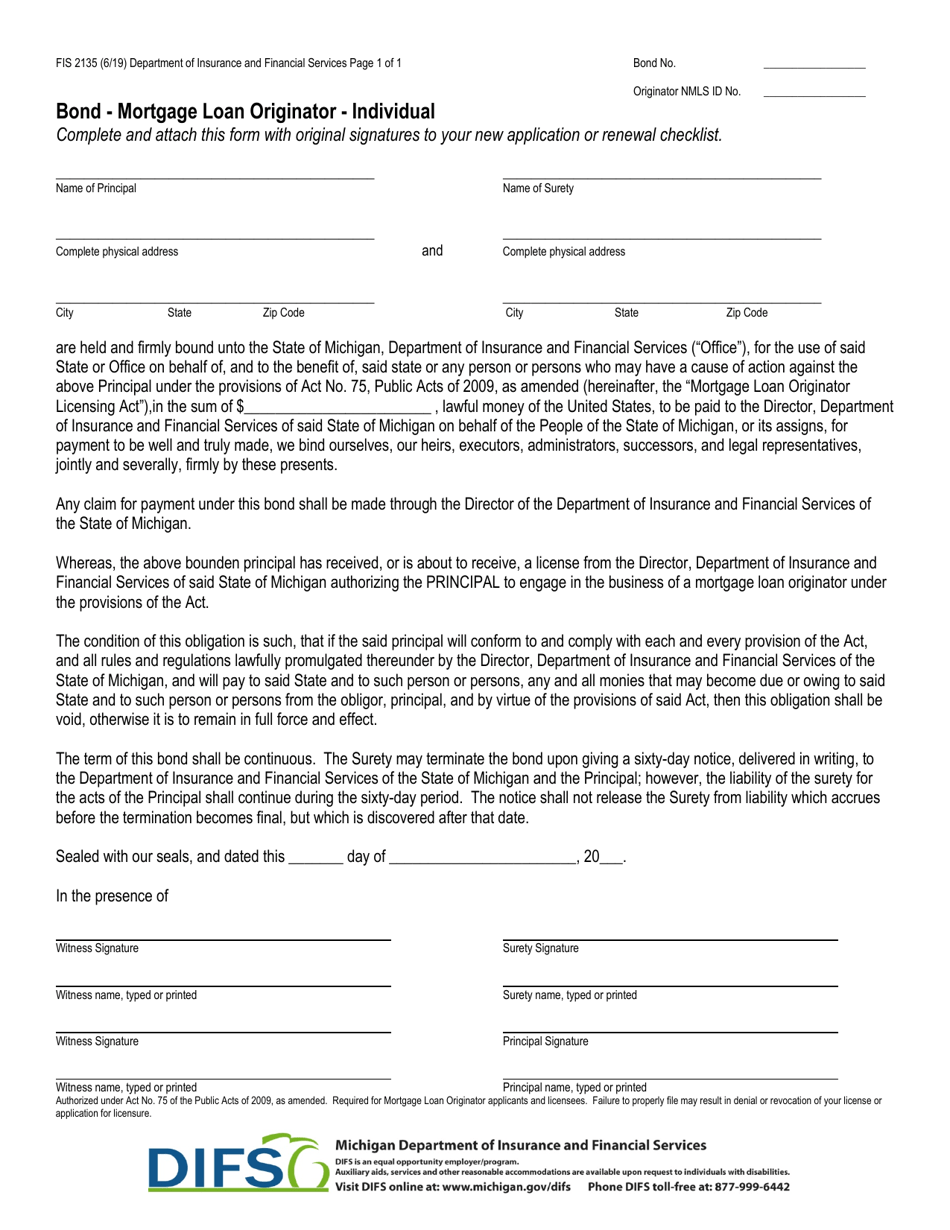

Form FIS2135 Bond - Mortgage Loan Originator - Individual - Michigan

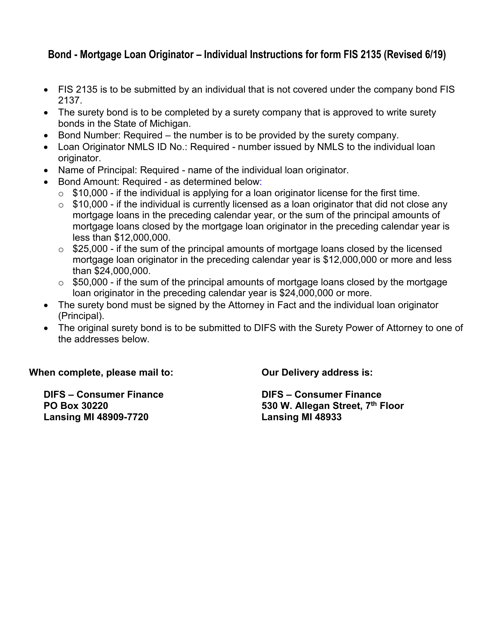

What Is Form FIS2135?

This is a legal form that was released by the Michigan Department of Insurance and Financial Services - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

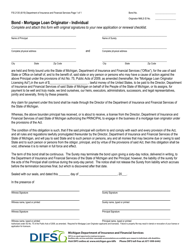

Q: What is FIS2135 Bond?

A: FIS2135 Bond is a bond required for Mortgage Loan Originators in Michigan.

Q: Who needs to obtain FIS2135 Bond?

A: Individual Mortgage Loan Originators in Michigan need to obtain FIS2135 Bond.

Q: What is the purpose of FIS2135 Bond?

A: FIS2135 Bond acts as a financial guarantee for the mortgage loan originator's compliance with state laws and regulations.

Q: How much does FIS2135 Bond cost?

A: The cost of FIS2135 Bond varies depending on the individual's credit history and the desired bond amount.

Q: How long is FIS2135 Bond valid for?

A: FIS2135 Bond is typically valid for one year and needs to be renewed annually.

Q: What happens if a mortgage loan originator does not have FIS2135 Bond?

A: Failure to have FIS2135 Bond can result in penalties, fines, and potential license suspension or revocation.

Q: Are there any alternatives to FIS2135 Bond?

A: Some individuals may be eligible for alternative forms of financial responsibility, such as a letter of credit or cash deposit, based on their creditworthiness and the approval of the Michigan Department of Insurance and Financial Services.

Q: Can FIS2135 Bond be canceled?

A: FIS2135 Bond can be canceled by the surety bond company with a written notice to the Michigan Department of Insurance and Financial Services.

Q: Is FIS2135 Bond the same as insurance?

A: No, FIS2135 Bond is not the same as insurance. It is a type of surety bond that guarantees the performance of the mortgage loan originator's obligations.

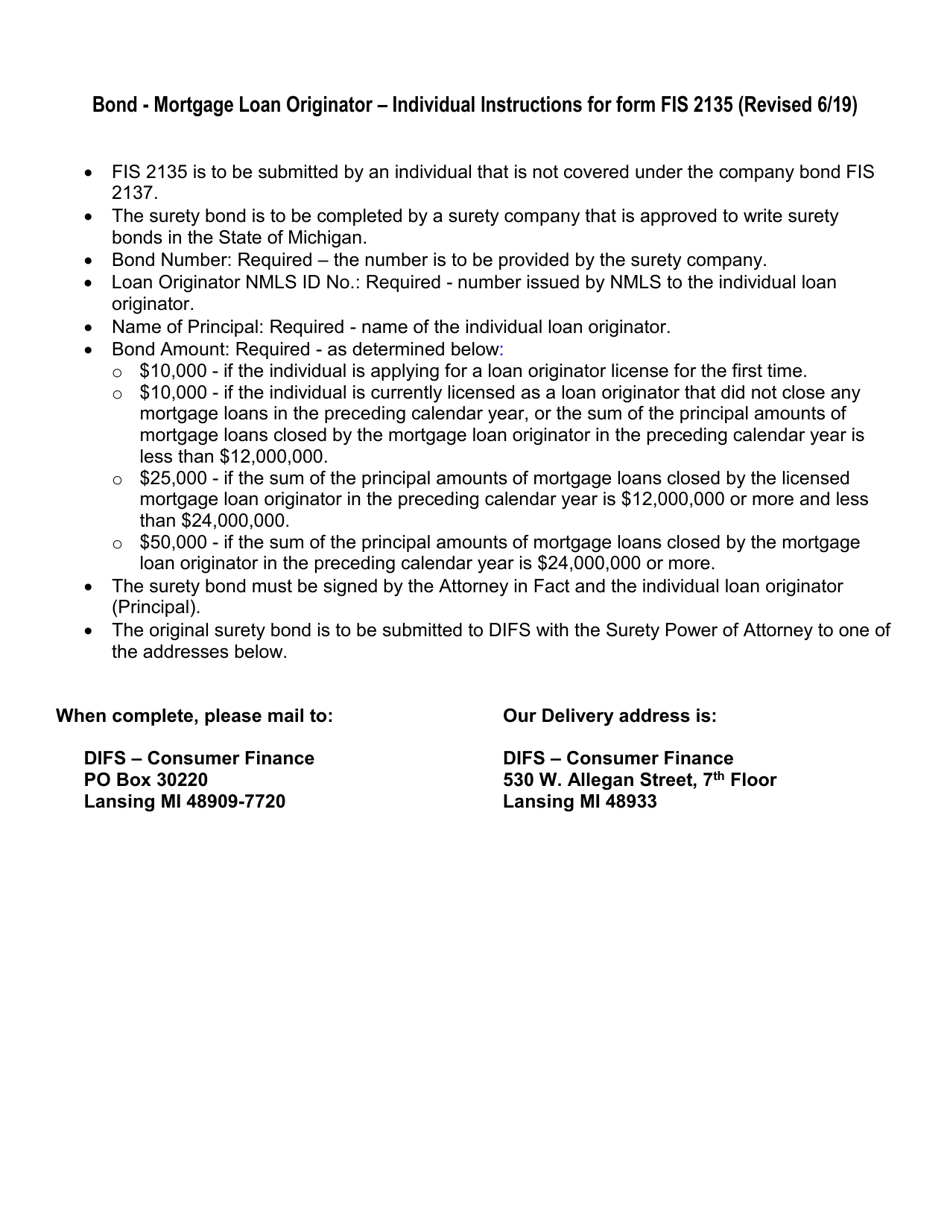

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Michigan Department of Insurance and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FIS2135 by clicking the link below or browse more documents and templates provided by the Michigan Department of Insurance and Financial Services.