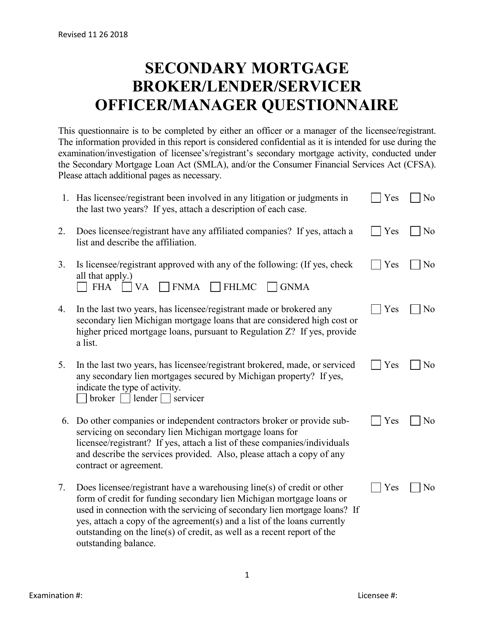

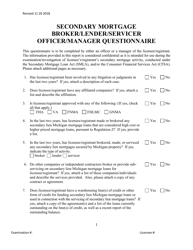

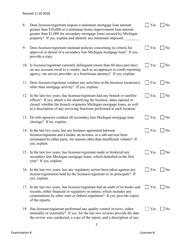

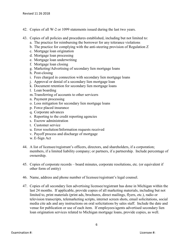

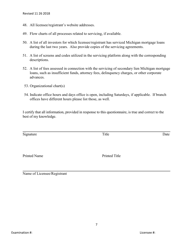

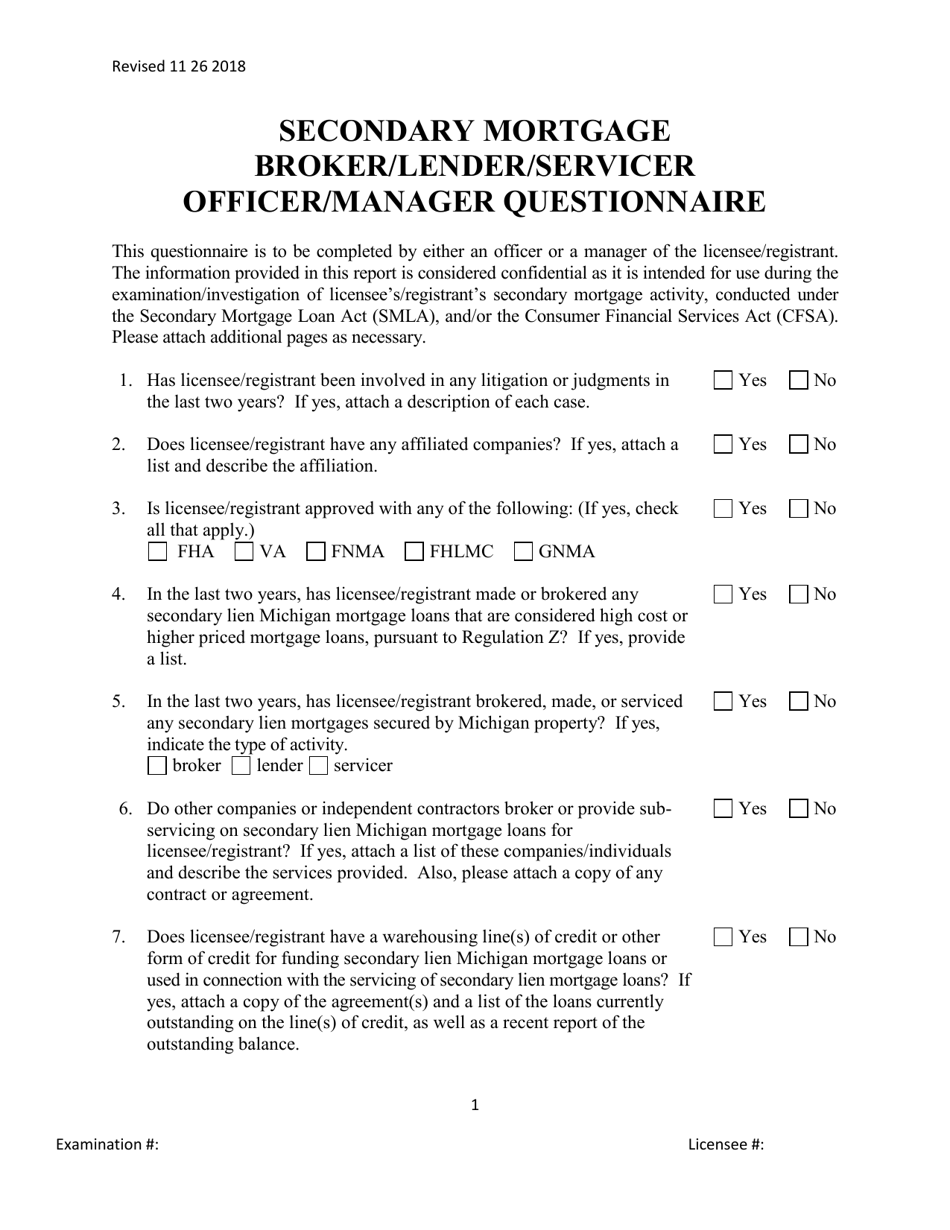

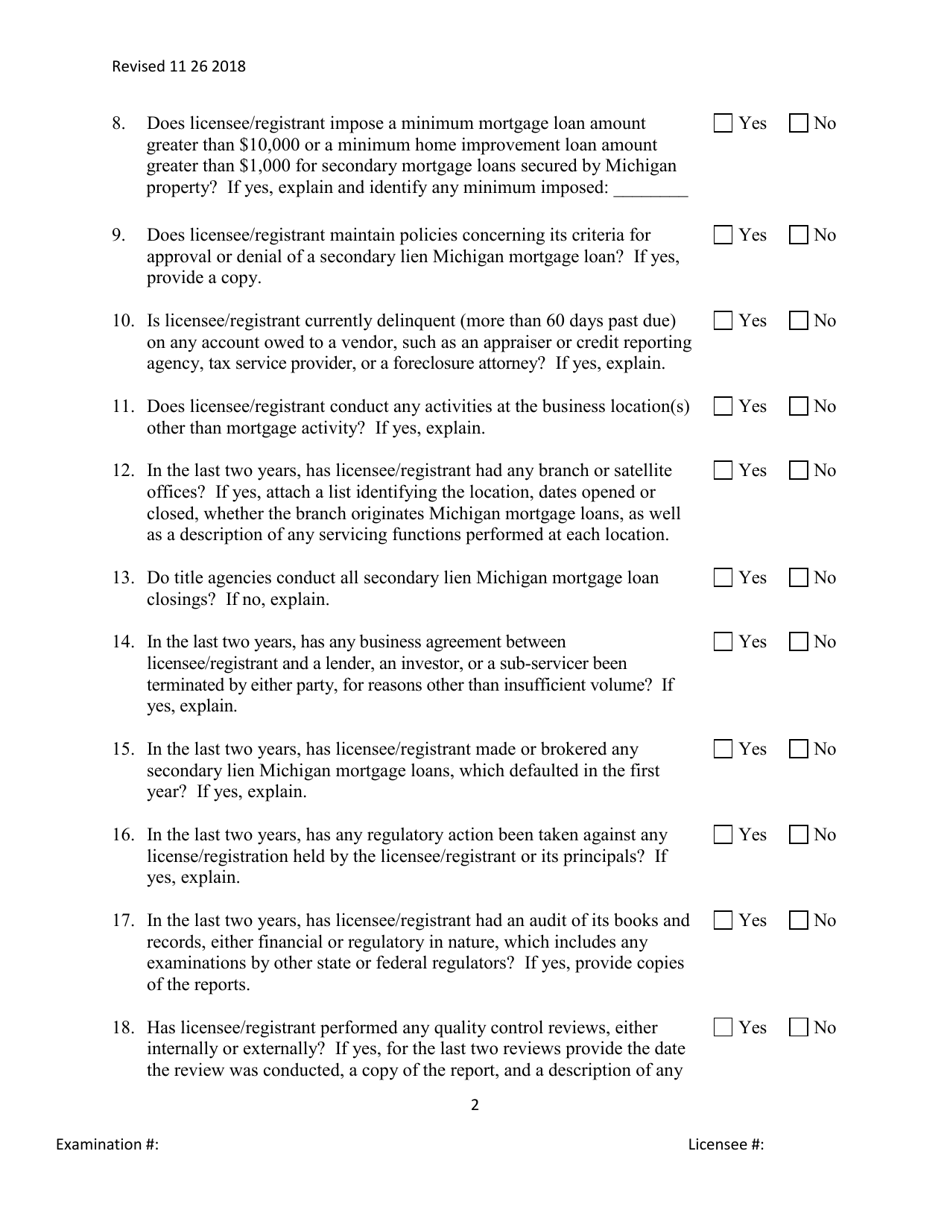

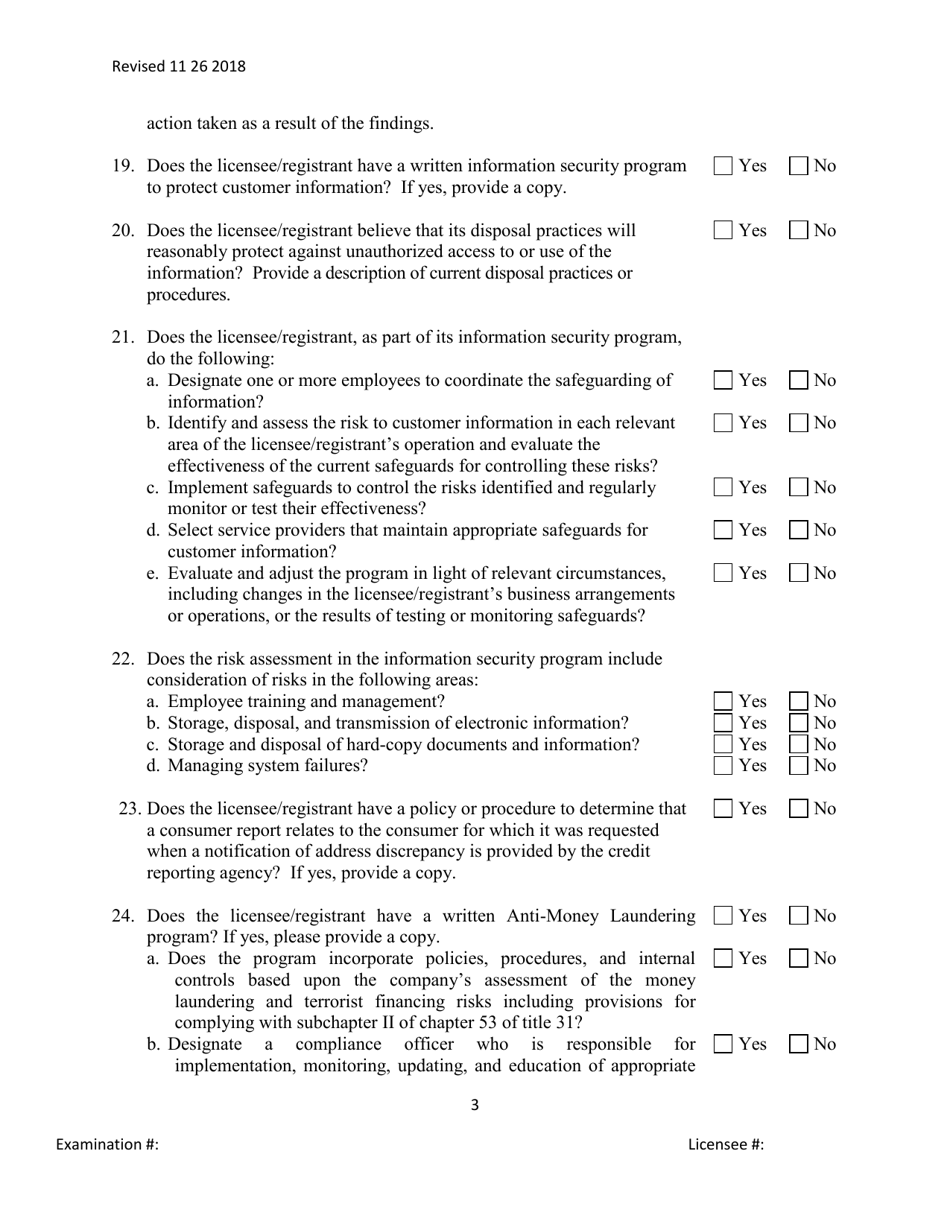

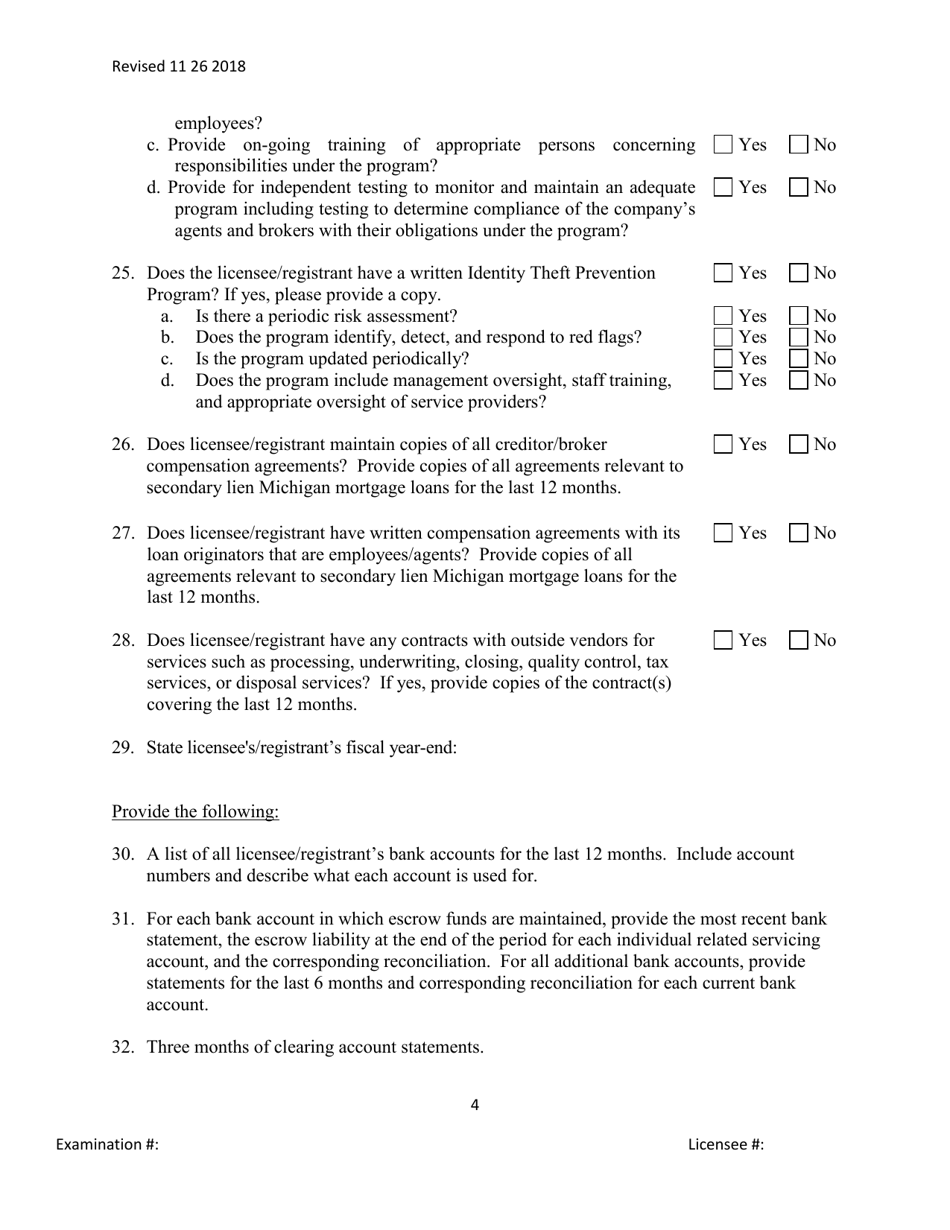

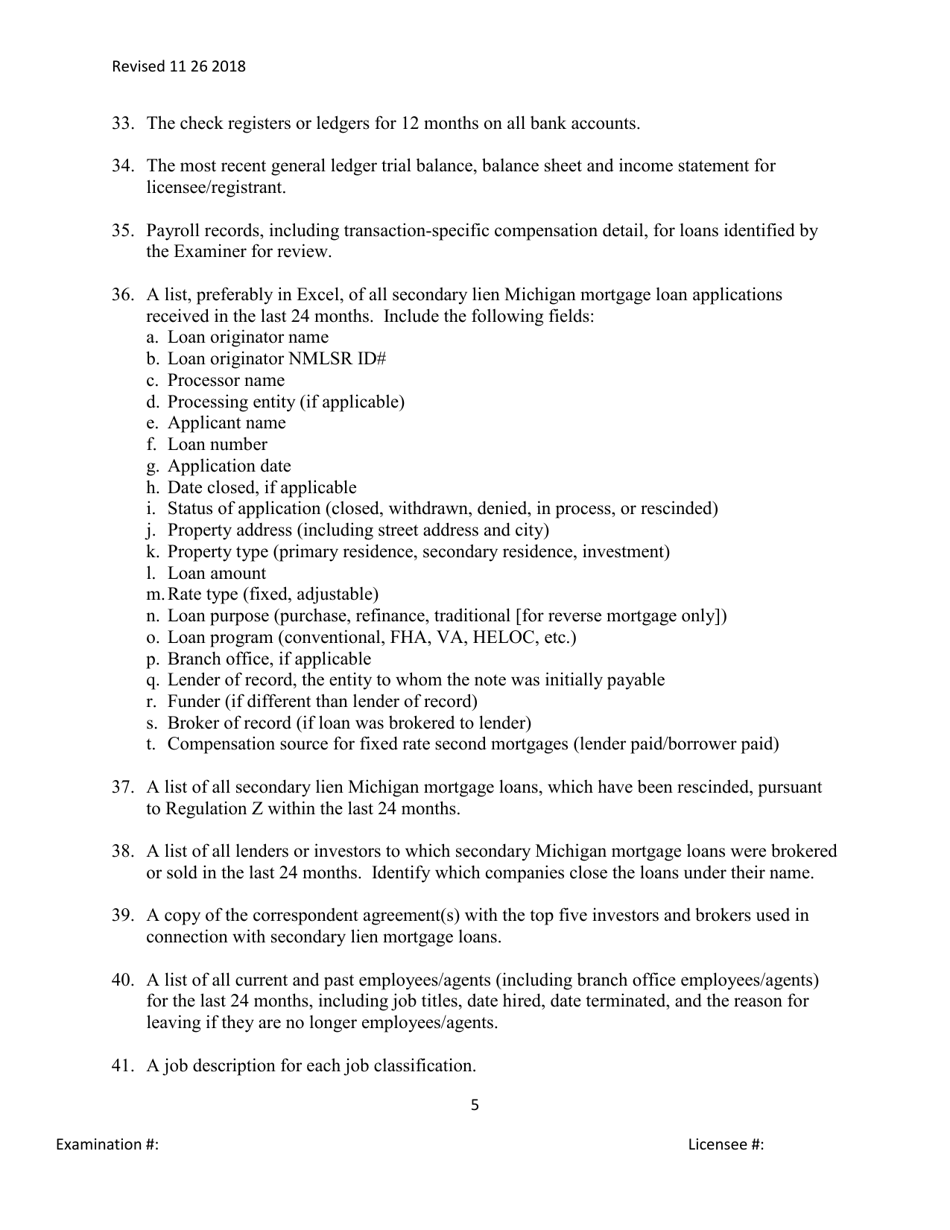

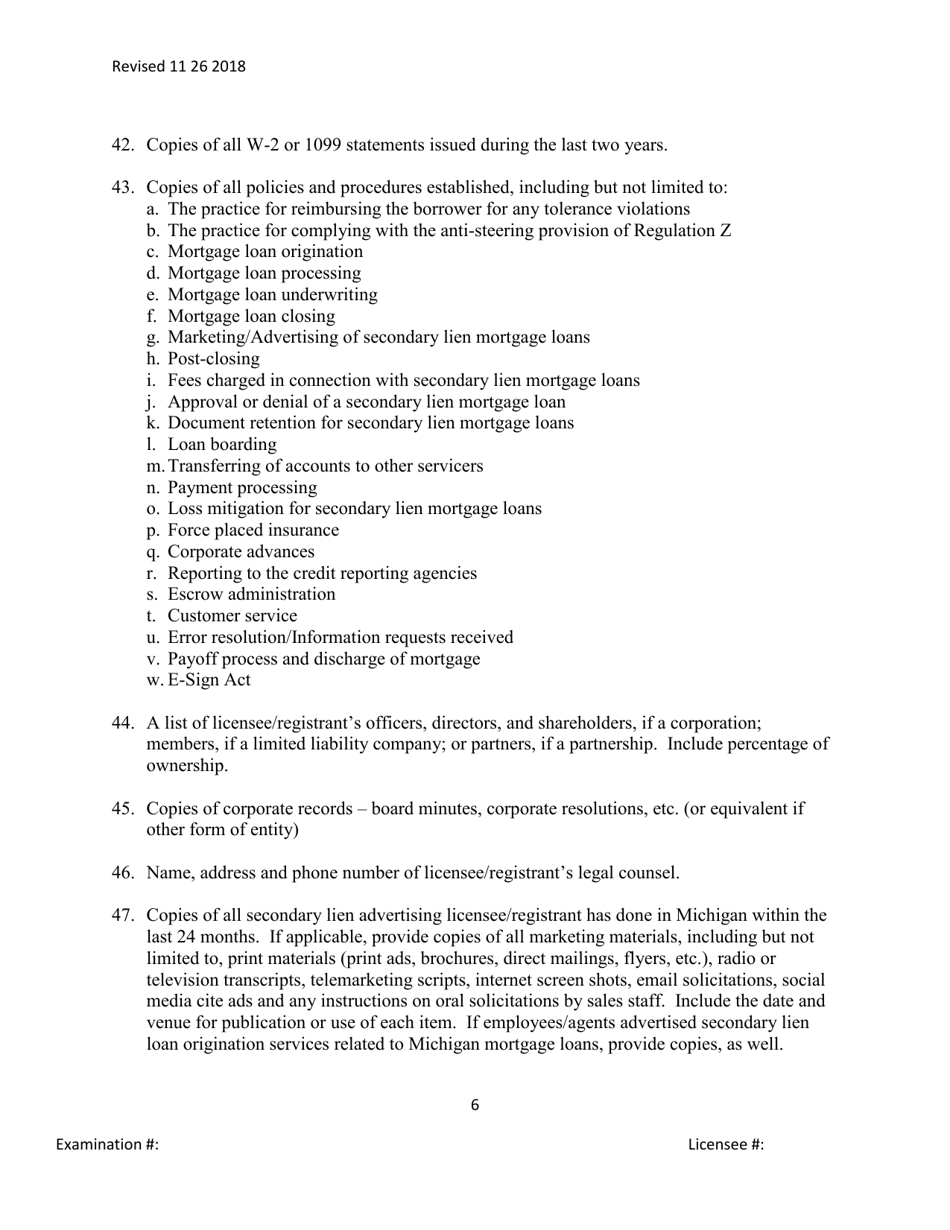

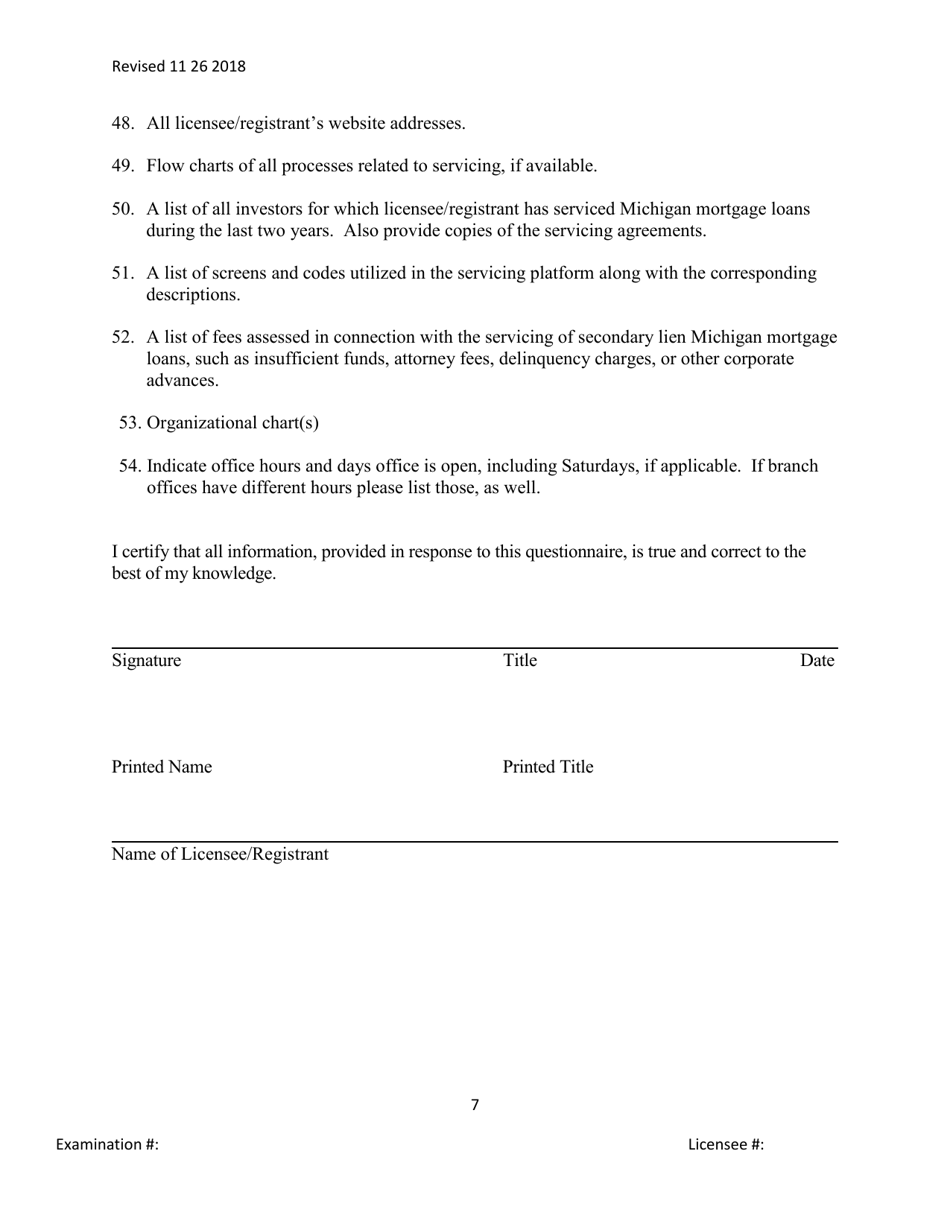

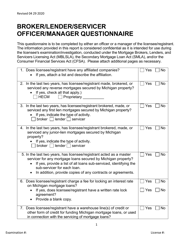

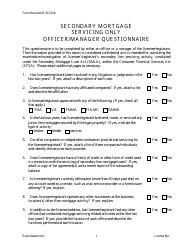

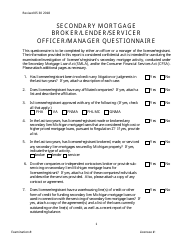

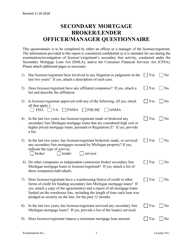

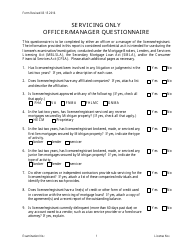

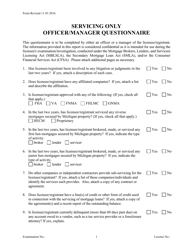

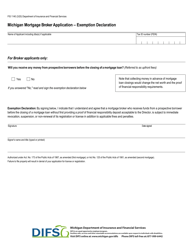

Secondary Mortgage Broker / Lender / Servicer Officer / Manager Questionnaire - Michigan

Secondary Mortgage Broker/Lender/Servicer Officer/Manager Questionnaire is a legal document that was released by the Michigan Department of Insurance and Financial Services - a government authority operating within Michigan.

FAQ

Q: What is a secondary mortgage broker?

A: A secondary mortgage broker is a person or entity that helps connect borrowers with lenders for mortgage loans that have already been originated.

Q: What is a secondary mortgage lender?

A: A secondary mortgage lender is a financial institution that purchases mortgage loans from primary lenders and may service those loans.

Q: What is a secondary mortgage servicer?

A: A secondary mortgage servicer is a company that collects mortgage payments from borrowers on behalf of the lender or investor who owns the loan.

Q: What is the role of a secondary mortgage officer?

A: A secondary mortgage officer is responsible for reviewing and approving mortgage loan applications, working closely with borrowers, and ensuring compliance with lending guidelines.

Q: What is the role of a secondary mortgage manager?

A: A secondary mortgage manager oversees the operations of a secondary mortgage department or division, including managing staff, developing strategies, and ensuring compliance with regulations.

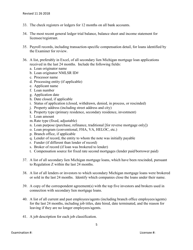

Form Details:

- Released on November 26, 2018;

- The latest edition currently provided by the Michigan Department of Insurance and Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Michigan Department of Insurance and Financial Services.