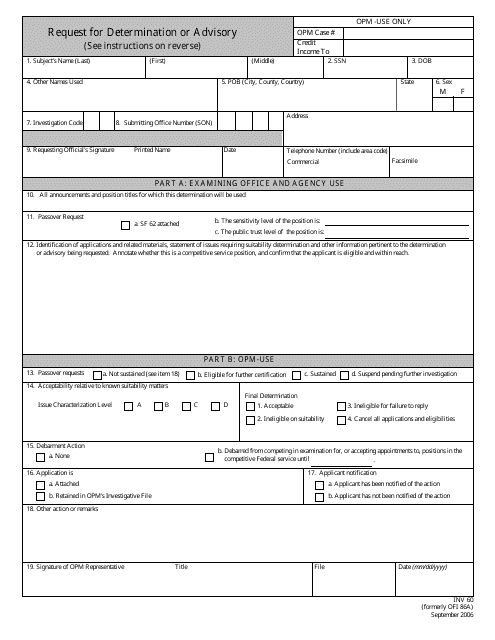

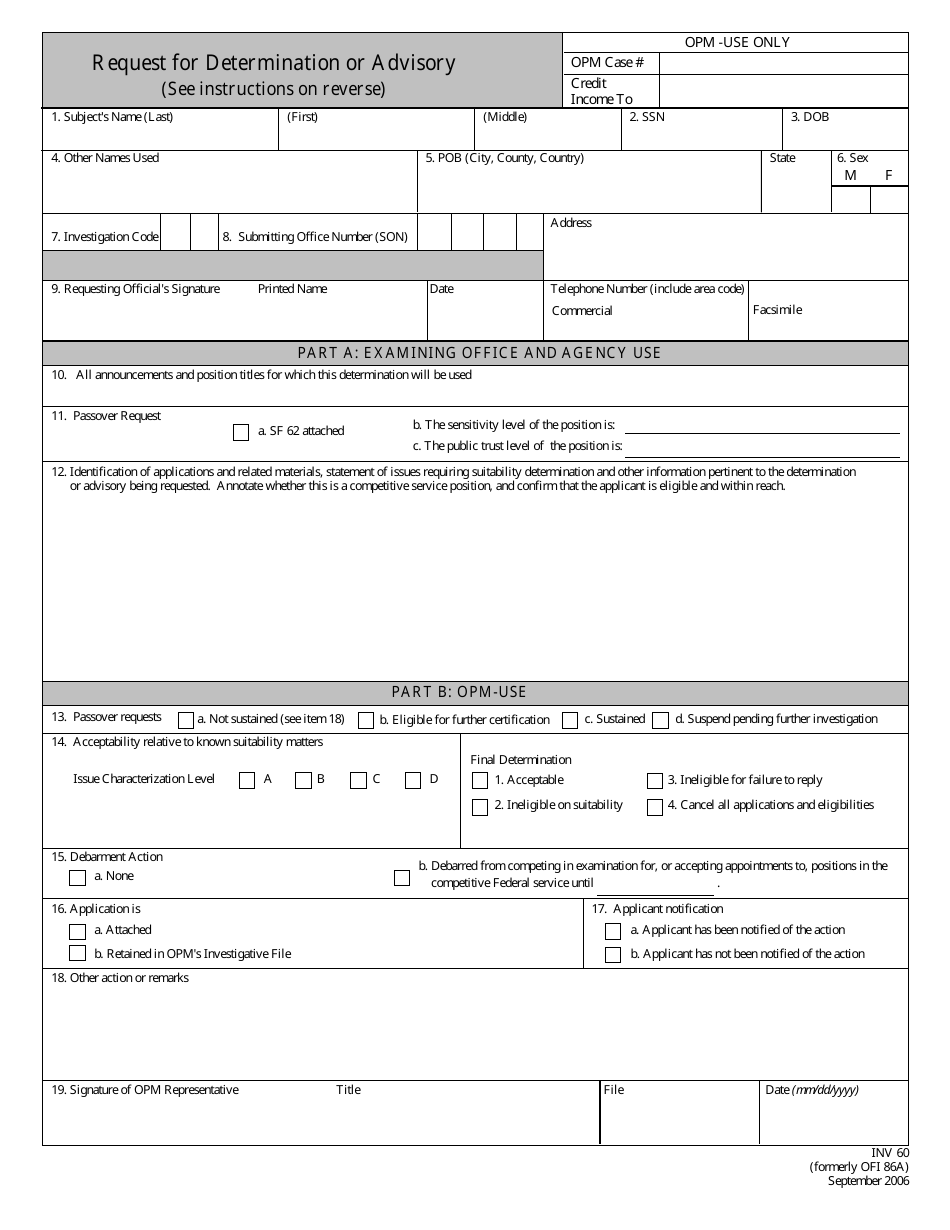

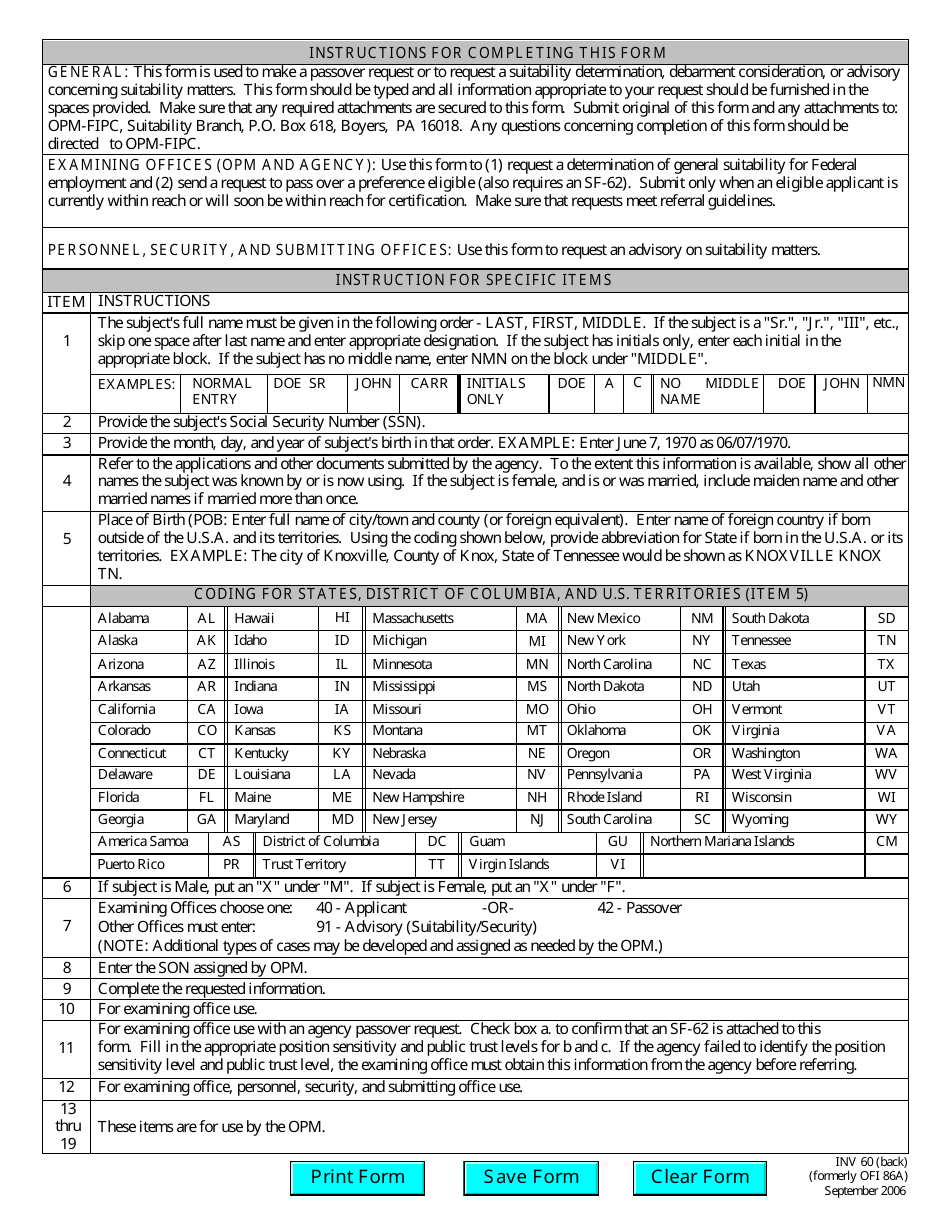

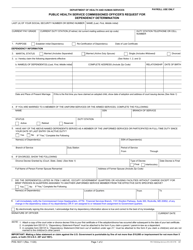

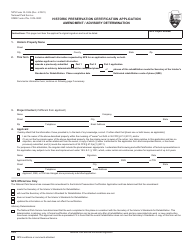

Form INV60 Request for Determination or Advisory

What Is Form INV60?

This is a legal form that was released by the U.S. Office of Personnel Management on September 1, 2006 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form INV60 used for?

A: Form INV60 is used to request a determination or advisory from the United States and Canada tax authorities.

Q: Who can use Form INV60?

A: Individuals, businesses, and other entities can use Form INV60 to request a determination or advisory.

Q: What types of determinations or advisories can be requested on Form INV60?

A: Form INV60 can be used to request determinations or advisories on a range of tax-related issues, including residency status, tax treaty interpretation, and the application of specific tax provisions.

Q: Are there any fees associated with submitting Form INV60?

A: Yes, there may be fees associated with submitting Form INV60. The specific fees vary depending on the nature of the request and the rules of the tax authorities.

Q: How long does it take to receive a determination or advisory after submitting Form INV60?

A: The time it takes to receive a determination or advisory after submitting Form INV60 varies and depends on the complexity of the issue and the workload of the tax authorities. It is recommended to contact the tax authorities for an estimate of the processing time.

Q: Can I appeal a determination or advisory received after submitting Form INV60?

A: Yes, it is possible to appeal a determination or advisory received after submitting Form INV60. The specific procedures for appealing may vary, so it is important to review the instructions and guidelines provided by the tax authorities.

Form Details:

- Released on September 1, 2006;

- The latest available edition released by the U.S. Office of Personnel Management;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form INV60 by clicking the link below or browse more documents and templates provided by the U.S. Office of Personnel Management.