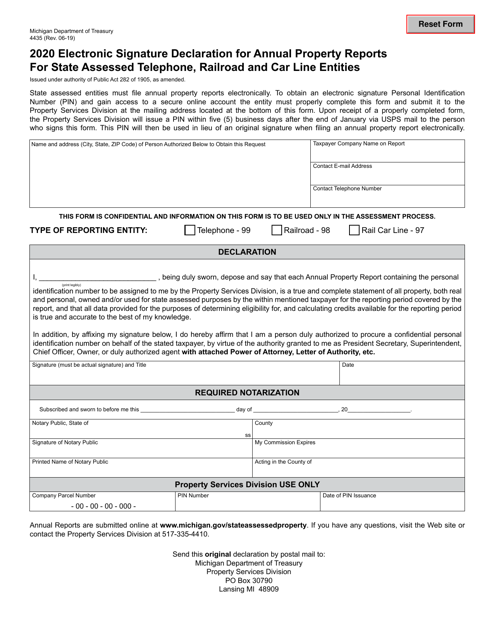

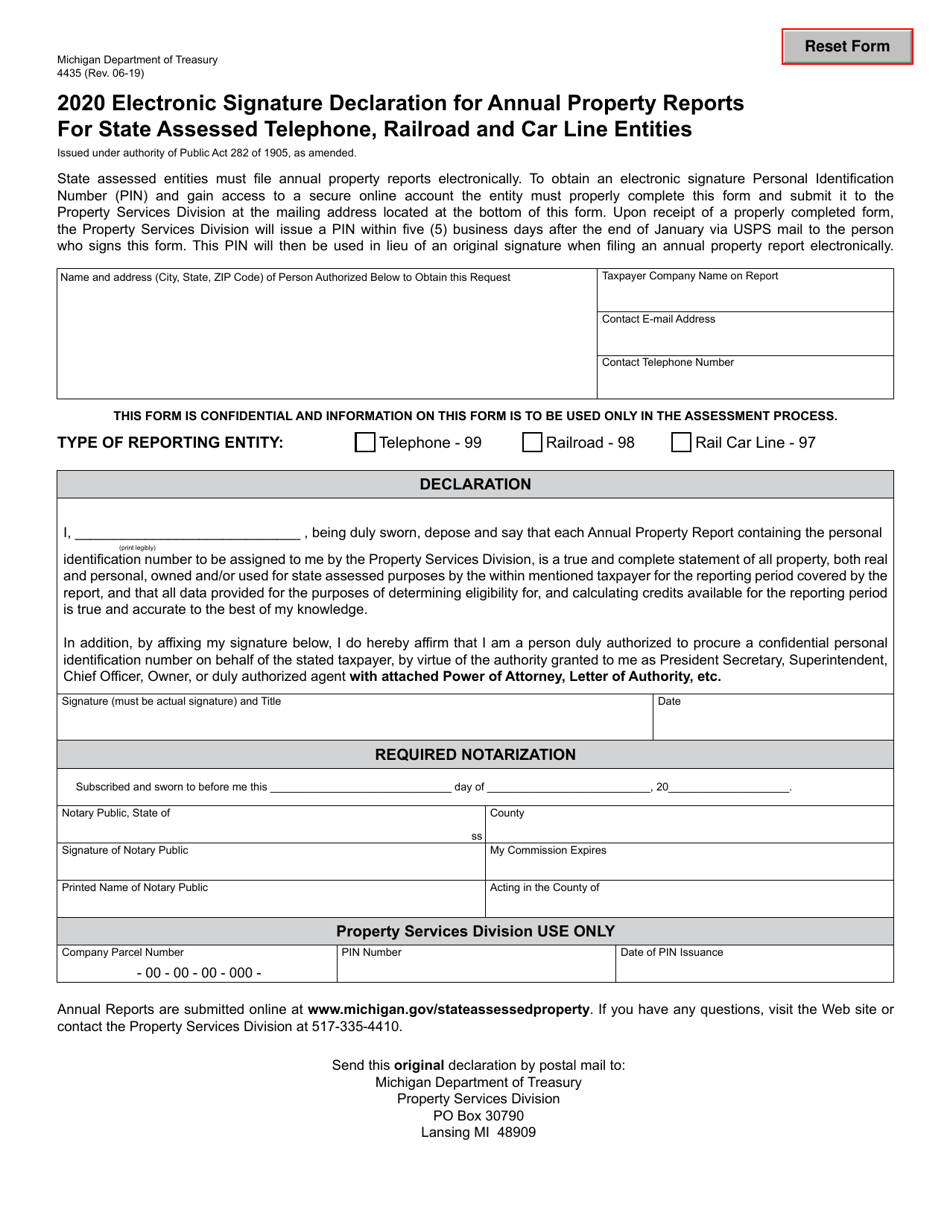

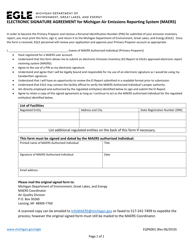

Form 4435 Electronic Signature Declaration for Annual Property Reports for State Assessed Telephone, Railroad and Car Line Entities - Michigan

What Is Form 4435?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 4435?

A: Form 4435 is the Electronic Signature Declaration for Annual Property Reports for State Assessed Telephone, Railroad and Car Line Entities in Michigan.

Q: Who needs to file Form 4435?

A: State assessed telephone, railroad, and car line entities in Michigan need to file Form 4435.

Q: What is the purpose of Form 4435?

A: The purpose of Form 4435 is to declare the electronic signature for the Annual Property Reports for state assessed telephone, railroad, and car line entities.

Q: Is Form 4435 mandatory?

A: Yes, filing Form 4435 is mandatory for state assessed telephone, railroad, and car line entities in Michigan.

Q: Are there any deadlines for filing Form 4435?

A: Yes, the deadline for filing Form 4435 is determined by the Michigan Department of Treasury and may vary.

Q: Is there any penalty for not filing Form 4435?

A: Yes, failure to file Form 4435 may result in penalties and interest as determined by the Michigan Department of Treasury.

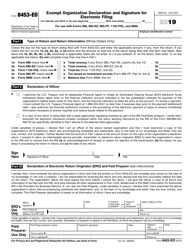

Q: Can Form 4435 be filed electronically?

A: Yes, Form 4435 can be filed electronically with a valid electronic signature.

Q: What information is required on Form 4435?

A: Form 4435 requires information such as the entity's name, contact information, and the details of the Annual Property Report.

Q: Are there any supporting documents required with Form 4435?

A: The Michigan Department of Treasury may require supporting documents to be submitted along with Form 4435.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4435 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.