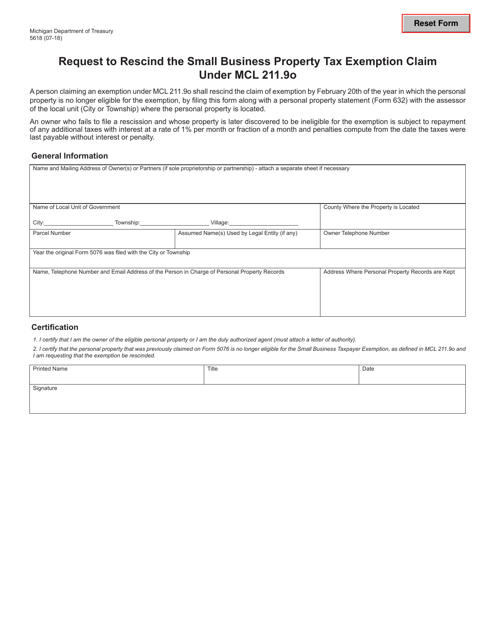

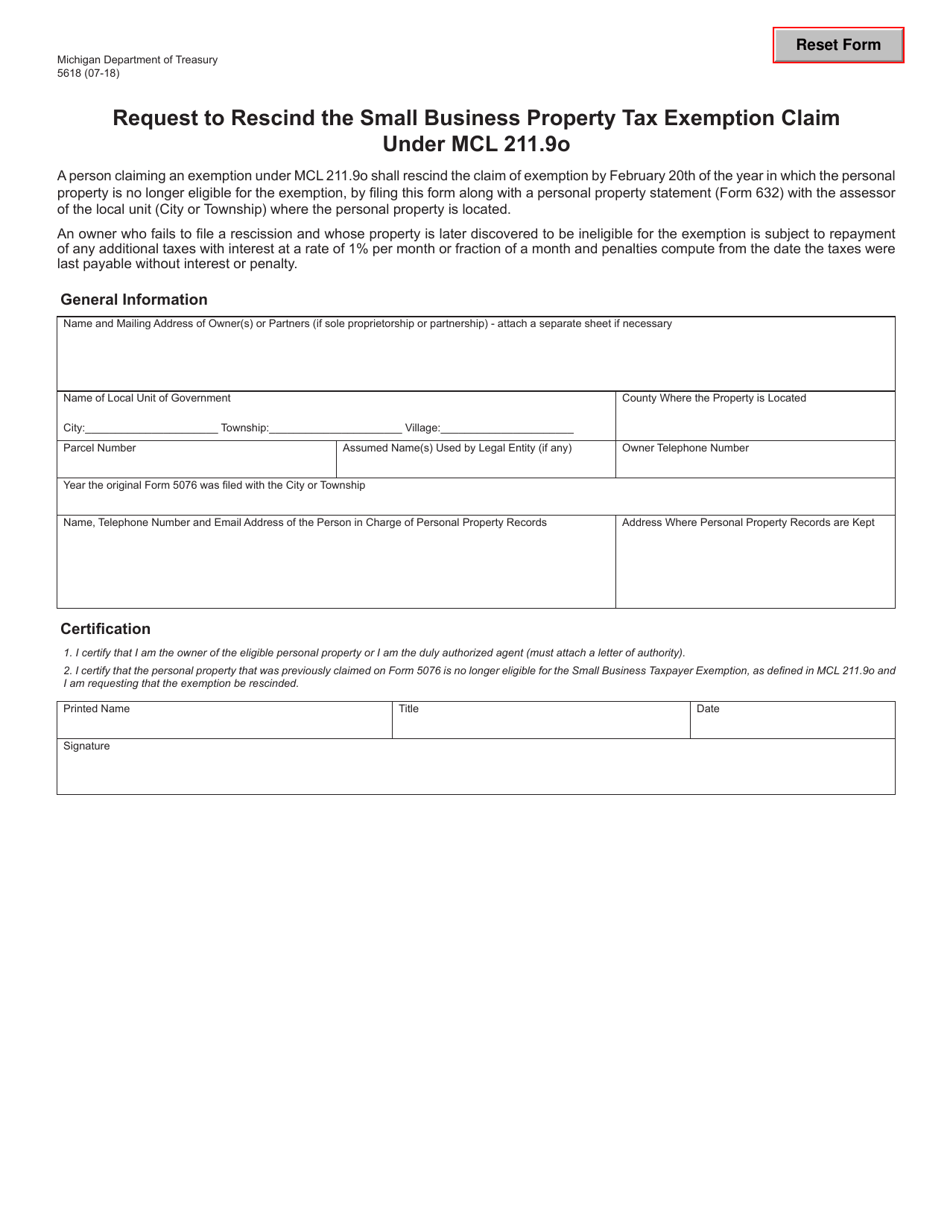

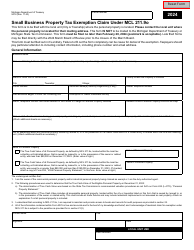

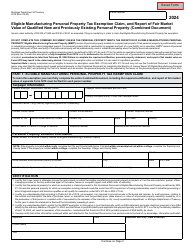

Form 5618 Request to Rescind the Small Business Property Tax Exemption Claim Under Mcl 211.9o - Michigan

What Is Form 5618?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form 5618?

A: Form 5618 is a request to rescind the small business property tax exemption claim under MCL 211.9o in Michigan.

Q: What does the form 5618 do?

A: Form 5618 allows individuals or businesses to request the rescission of a small business property tax exemption claim.

Q: What is the small business property tax exemption claim?

A: The small business property tax exemption claim is a tax exemption available to eligible small businesses in Michigan.

Q: Who needs to file form 5618?

A: Individuals or businesses who want to rescind their small business property tax exemption claim need to file form 5618.

Q: Are there any fees associated with filing form 5618?

A: No, there are no fees associated with filing form 5618.

Q: Is there a deadline to file form 5618?

A: Yes, the form must be filed on or before May 1 of the year following the year for which the exemption would apply.

Q: What happens after filing form 5618?

A: After filing form 5618, the small business property tax exemption will be rescinded, and the property will be subject to taxation.

Q: Can I appeal the rescission of my small business property tax exemption?

A: Yes, individuals or businesses can appeal the rescission of their small business property tax exemption.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5618 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.