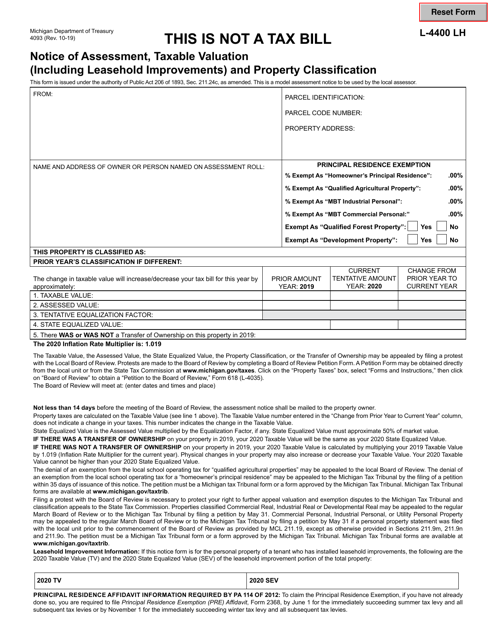

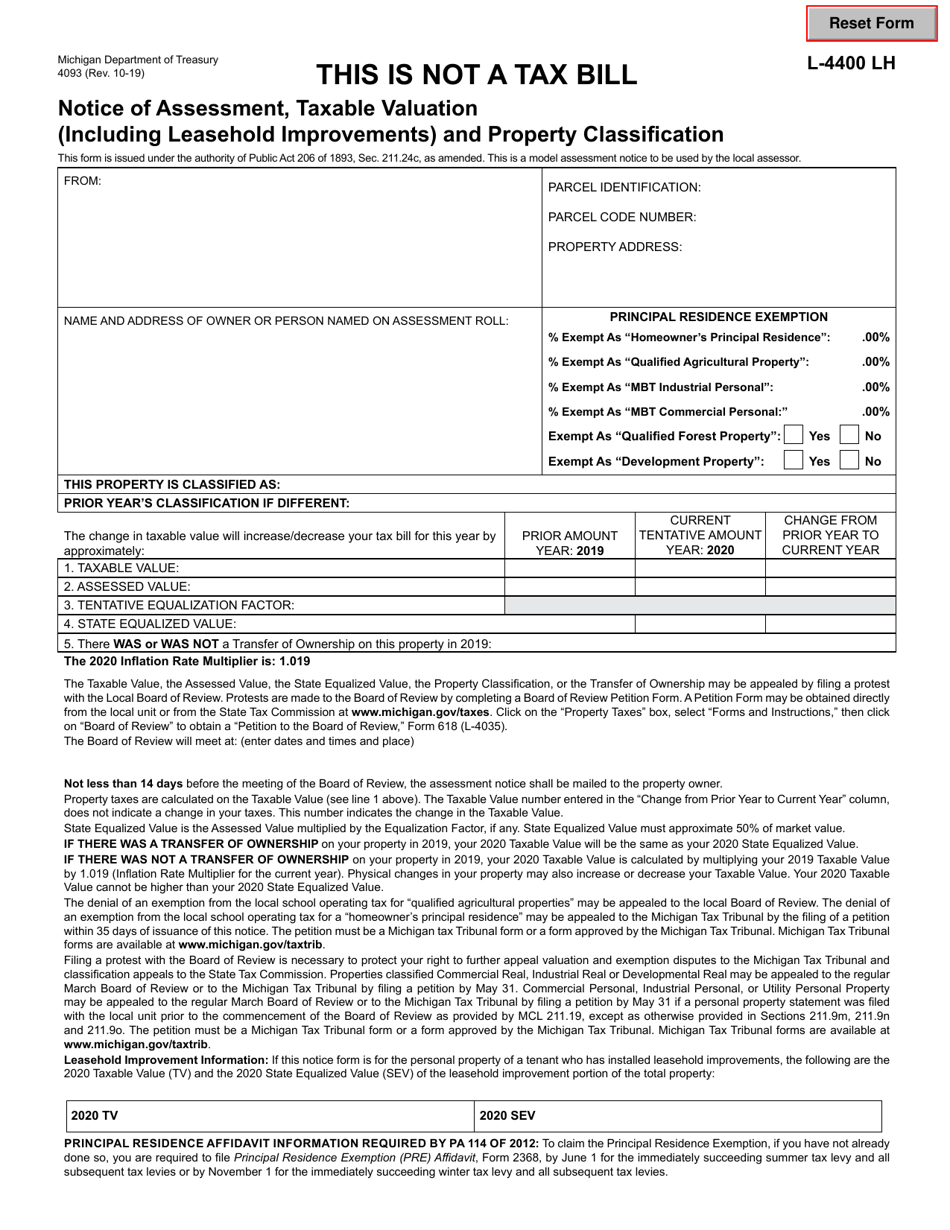

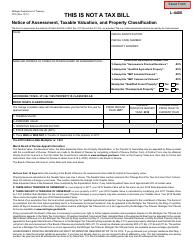

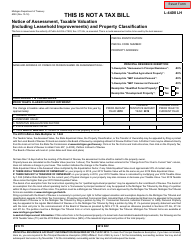

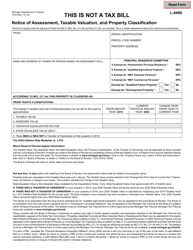

Form L-4400 LH (4093) Notice of Assessment, Taxable Valuation (Including Leasehold Improvements) and Property Classification - Michigan

What Is Form L-4400 LH (4093)?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form L-4400 LH?

A: Form L-4400 LH is a Notice of Assessment, Taxable Valuation (Including Leasehold Improvements) and Property Classification form in Michigan.

Q: What does Form L-4400 LH include?

A: Form L-4400 LH includes information about the assessment, taxable valuation, property classification, and leasehold improvements of a property in Michigan.

Q: What is the purpose of Form L-4400 LH?

A: The purpose of Form L-4400 LH is to provide property owners with information regarding the assessment, taxable valuation, and classification of their property in Michigan.

Q: Who is required to complete Form L-4400 LH?

A: Form L-4400 LH is completed by the assessing officer and sent to property owners in Michigan.

Q: What information is included in the Notice of Assessment?

A: The Notice of Assessment includes the assessed value, taxable value, and property classification of a property in Michigan.

Q: What is taxable valuation?

A: Taxable valuation is the value used to calculate property taxes in Michigan. It is based on the assessed value and is subject to certain limitations.

Q: What are leasehold improvements?

A: Leasehold improvements are improvements made to a property by a lessee or tenant. These improvements are separate from the property's assessed value.

Q: Why is property classification important?

A: Property classification is important because it determines the percentage of assessed value that is subject to taxation in Michigan.

Q: What should property owners do if they have questions about Form L-4400 LH?

A: Property owners should contact their local assessing officer or the Michigan Department of Treasury for assistance with Form L-4400 LH.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form L-4400 LH (4093) by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.