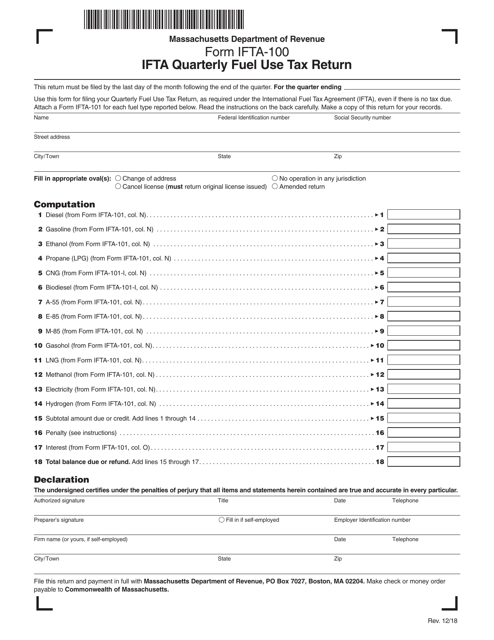

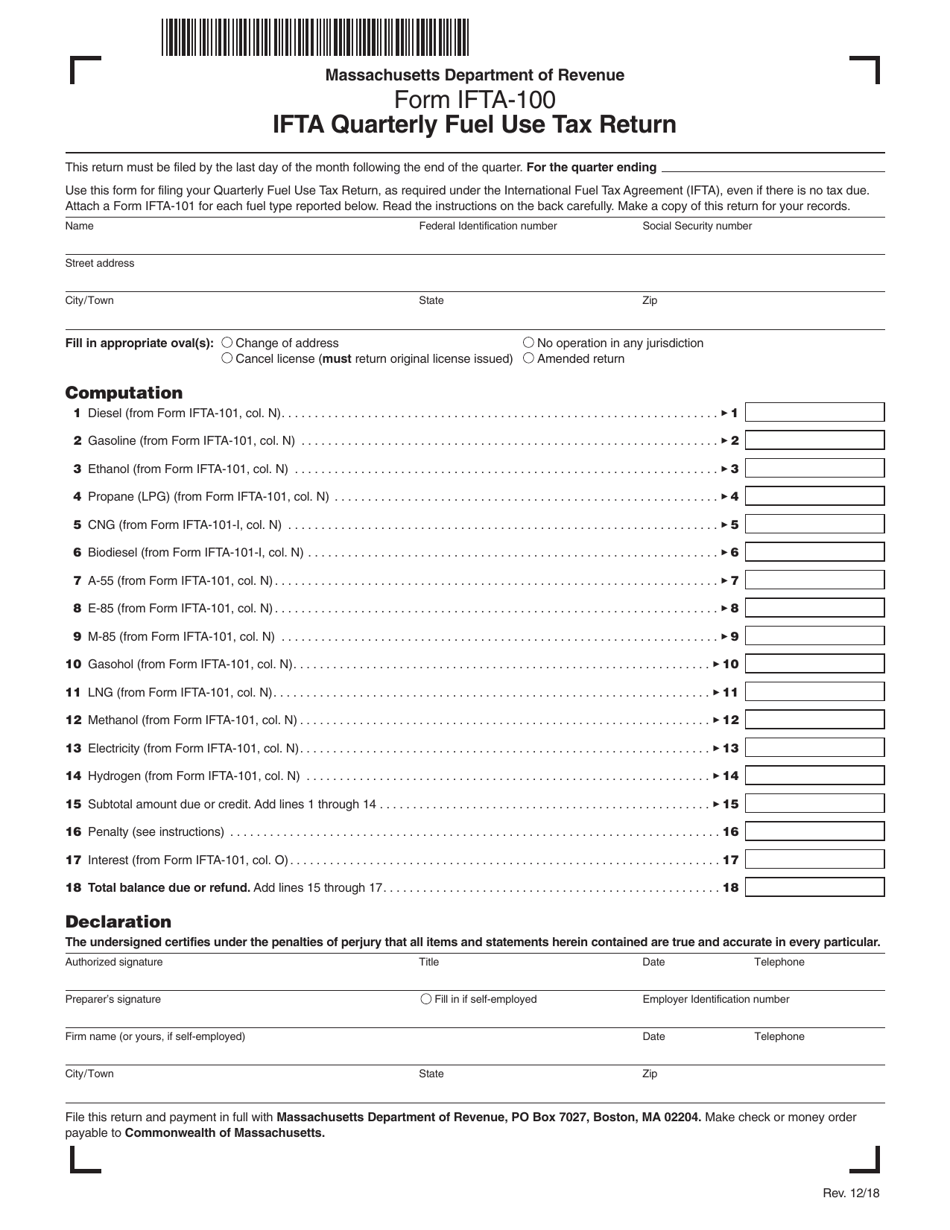

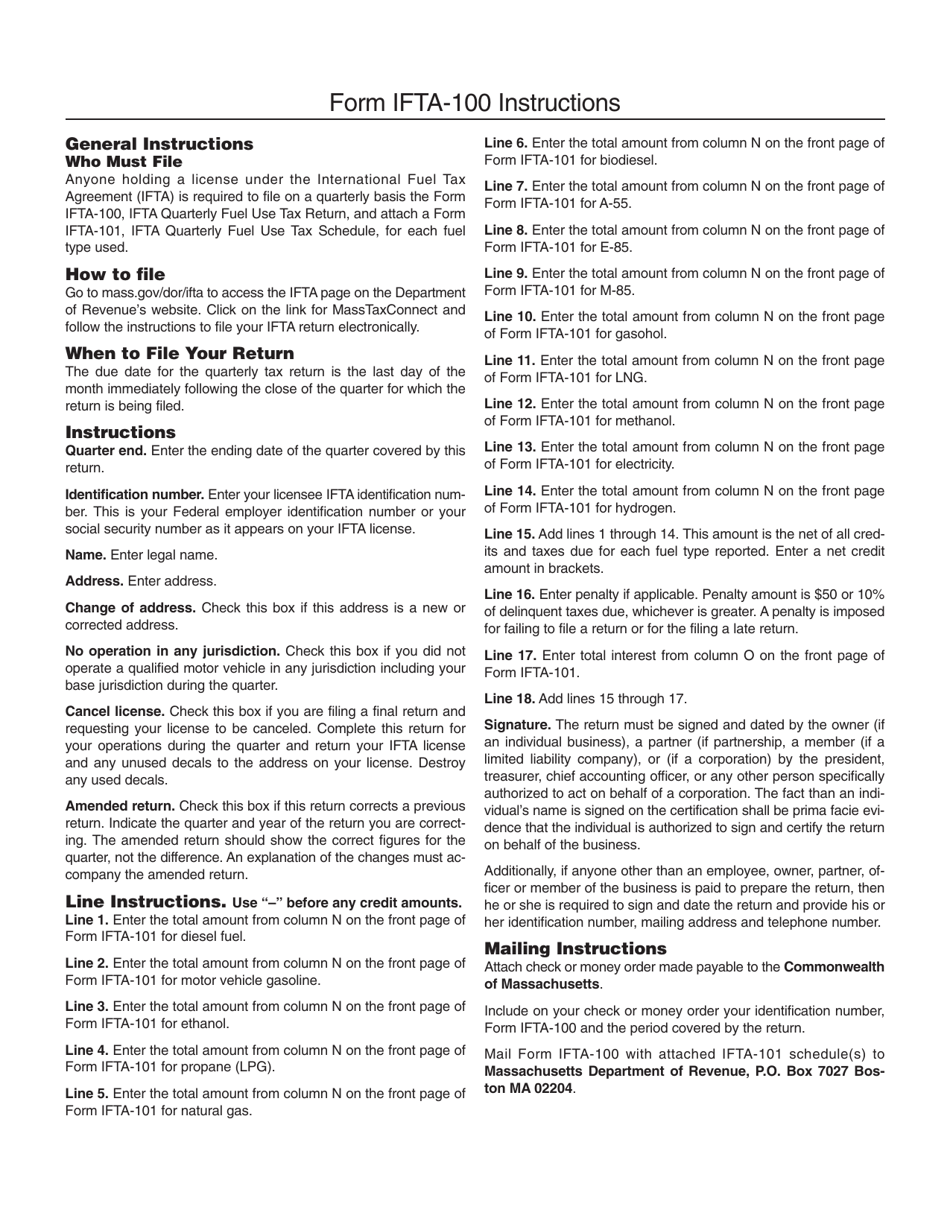

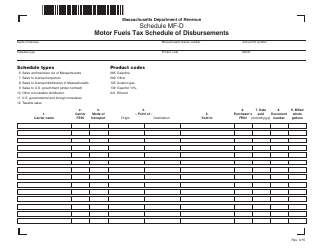

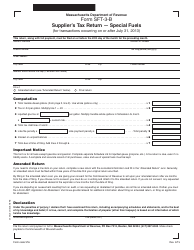

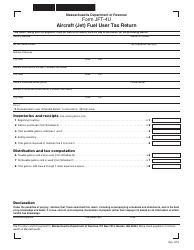

Form IFTA-100 Ifta Quarterly Fuel Use Tax Return - Massachusetts

What Is Form IFTA-100?

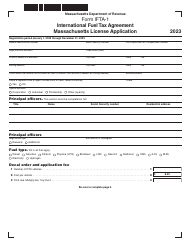

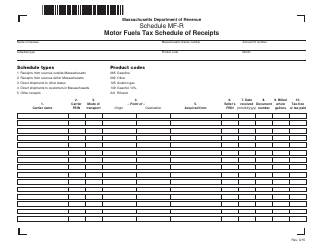

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IFTA-100?

A: Form IFTA-100 is the IFTA Quarterly Fuel Use Tax Return for Massachusetts.

Q: What is IFTA?

A: IFTA stands for International Fuel Tax Agreement. It is an agreement among U.S. states and Canadian provinces to simplify the reporting and payment of fuel taxes by interstate motor carriers.

Q: Who needs to file Form IFTA-100?

A: Motor carriers operating qualified motor vehicles in Massachusetts and other member jurisdictions need to file Form IFTA-100.

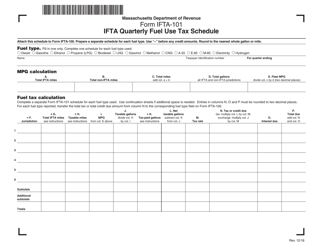

Q: What information is required on Form IFTA-100?

A: Form IFTA-100 requires information about the miles traveled and fuel consumed in each member jurisdiction.

Q: When should Form IFTA-100 be filed?

A: Form IFTA-100 should be filed on a quarterly basis, with the due dates typically falling on the last day of the month following the end of the quarter.

Q: Are there any penalties for non-compliance with Form IFTA-100?

A: Yes, failure to file or late filing of Form IFTA-100 may result in penalties, including interest charges and suspension or revocation of the motor carrier's operating privileges.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form IFTA-100 by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.