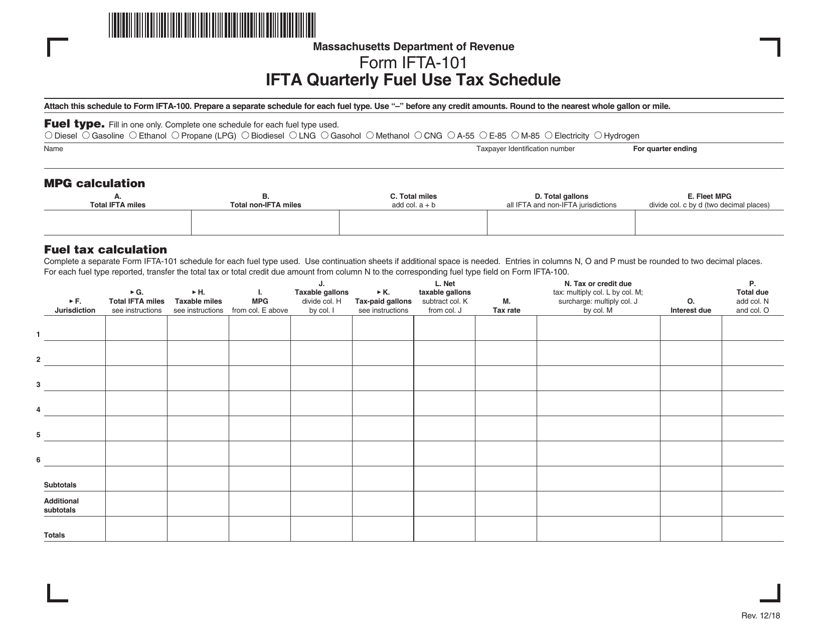

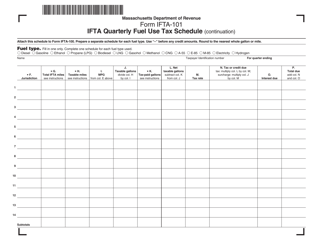

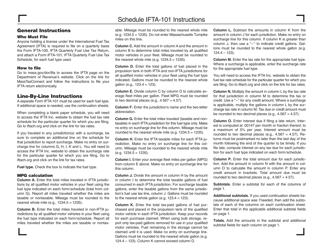

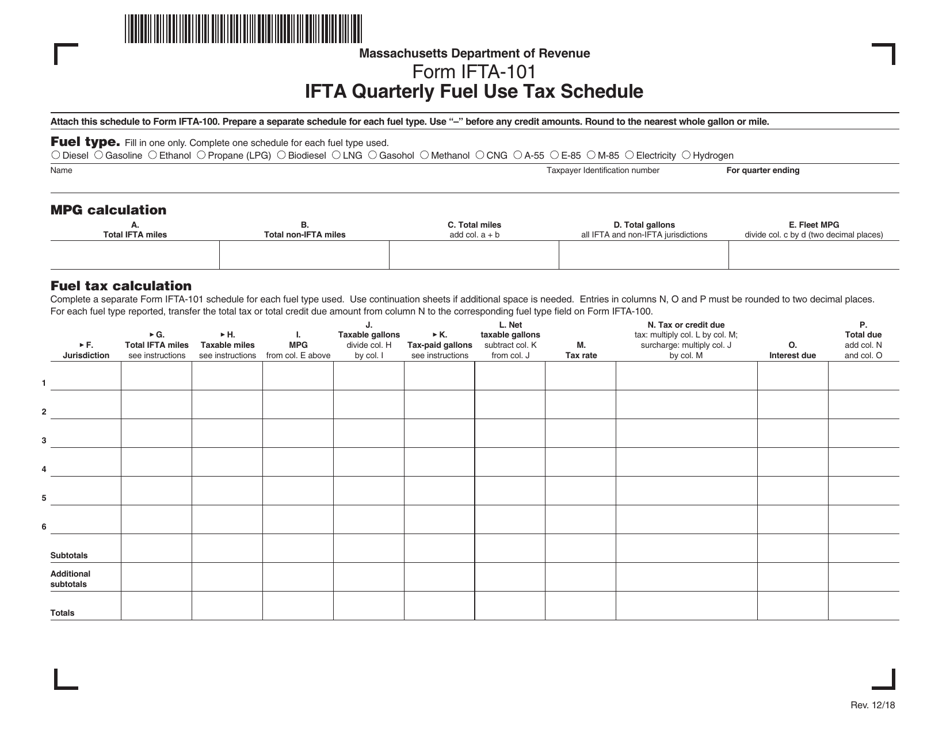

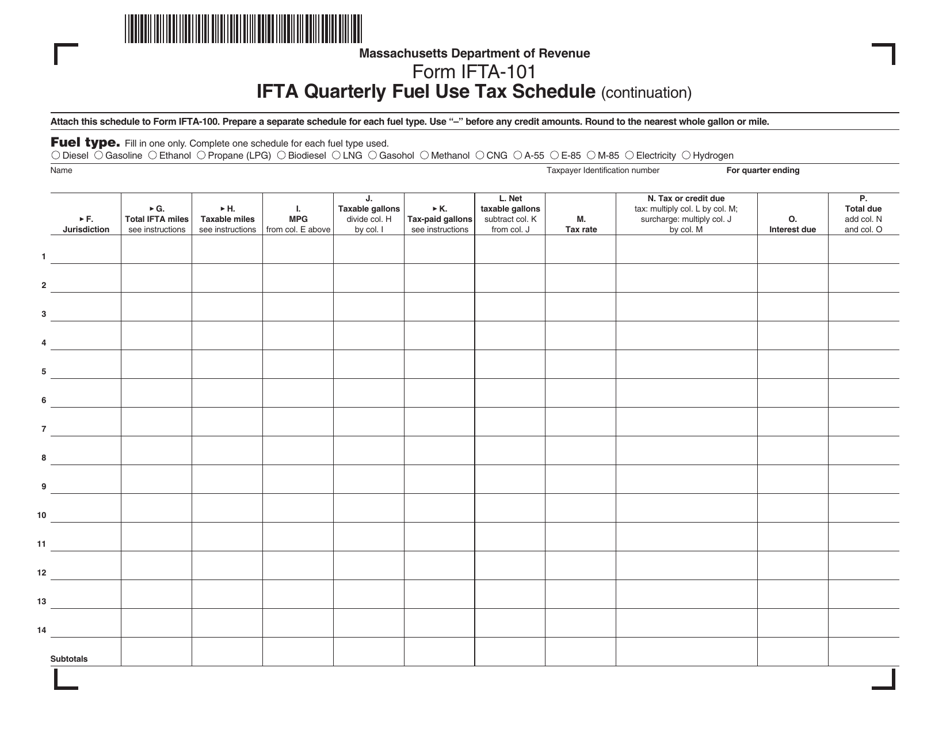

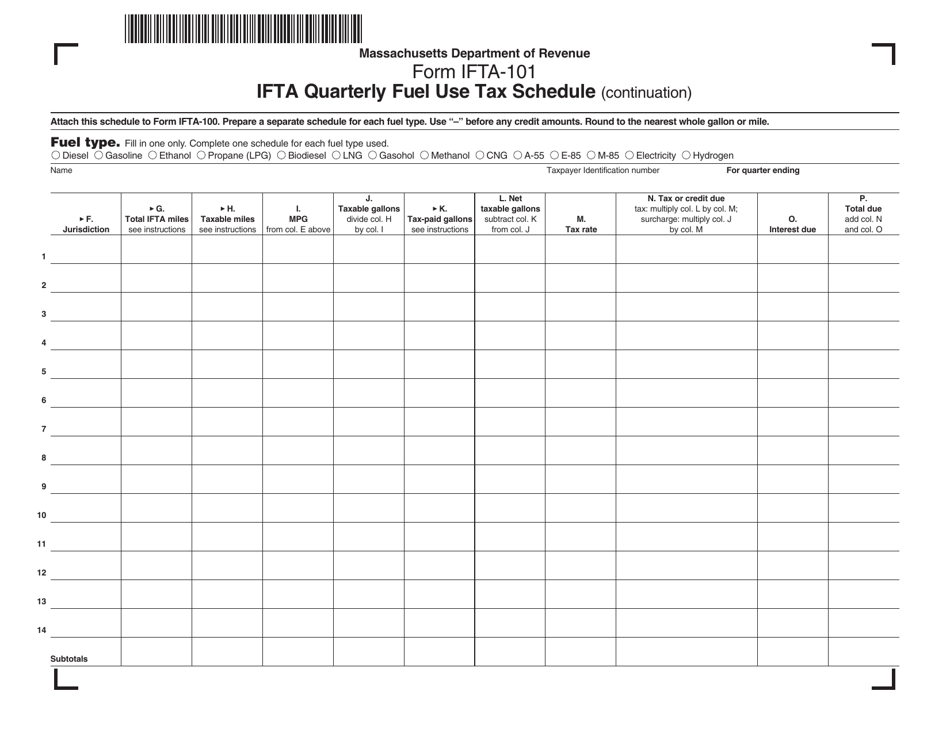

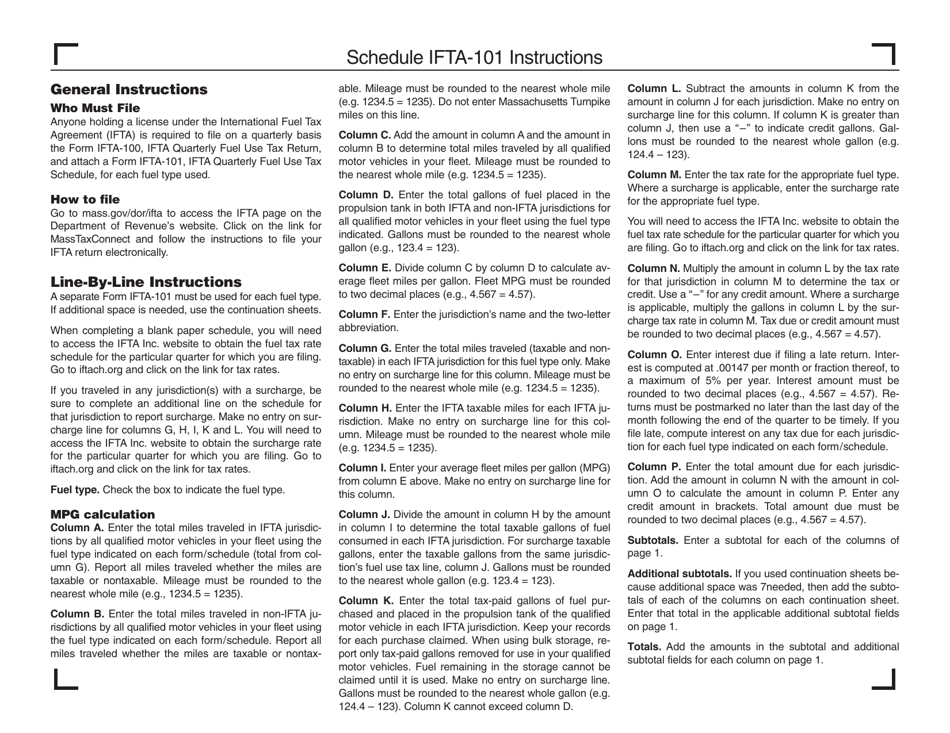

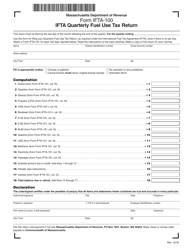

Form IFTA-101 Ifta Quarterly Fuel Use Tax Schedule - Massachusetts

What Is Form IFTA-101?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IFTA-101?

A: Form IFTA-101, also known as IFTA Quarterly Fuel Use Tax Schedule, is a tax form used by commercial motor vehicle owners and operators to report and pay fuel taxes for interstate travel.

Q: What is IFTA?

A: IFTA stands for the International Fuel Tax Agreement. It is an agreement between the United States and Canadian provinces that simplifies fuel tax reporting for motor carriers operating across multiple jurisdictions.

Q: Who needs to file Form IFTA-101?

A: Commercial motor vehicle owners and operators who travel interstate and operate in jurisdictions participating in the IFTA agreement must file Form IFTA-101.

Q: Do I need to file Form IFTA-101 if I only operate within one state?

A: No, Form IFTA-101 is only required for motor carriers who travel across state lines and operate in multiple jurisdictions.

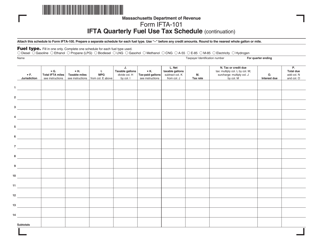

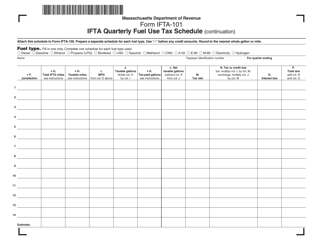

Q: What information is required on Form IFTA-101?

A: Form IFTA-101 requires information on the total miles traveled and the total fuel consumed in each jurisdiction during the quarter.

Q: When is Form IFTA-101 due?

A: Form IFTA-101 must be filed and the taxes paid by the last day of the month following the end of the quarter. For example, the first quarter return is due by April 30th.

Q: What happens if I don't file Form IFTA-101?

A: Failure to file Form IFTA-101 or pay the required taxes can result in penalties and interest being assessed.

Q: Are there any exemptions or special provisions for Form IFTA-101?

A: Exemptions and special provisions may vary by jurisdiction. It is best to consult the specific regulations and guidelines of each jurisdiction in which you operate.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form IFTA-101 by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.