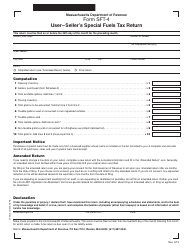

This version of the form is not currently in use and is provided for reference only. Download this version of

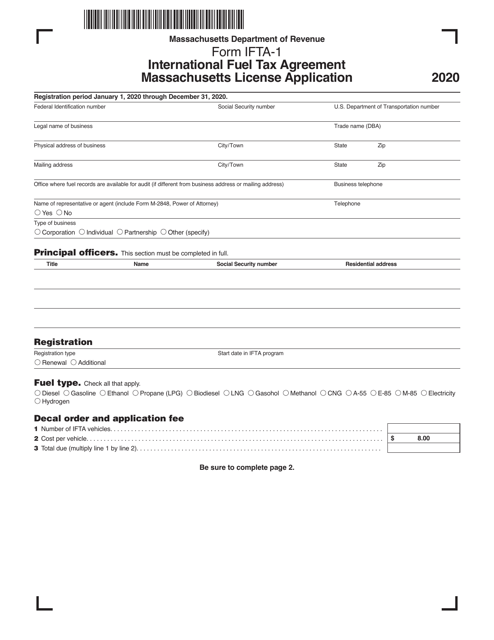

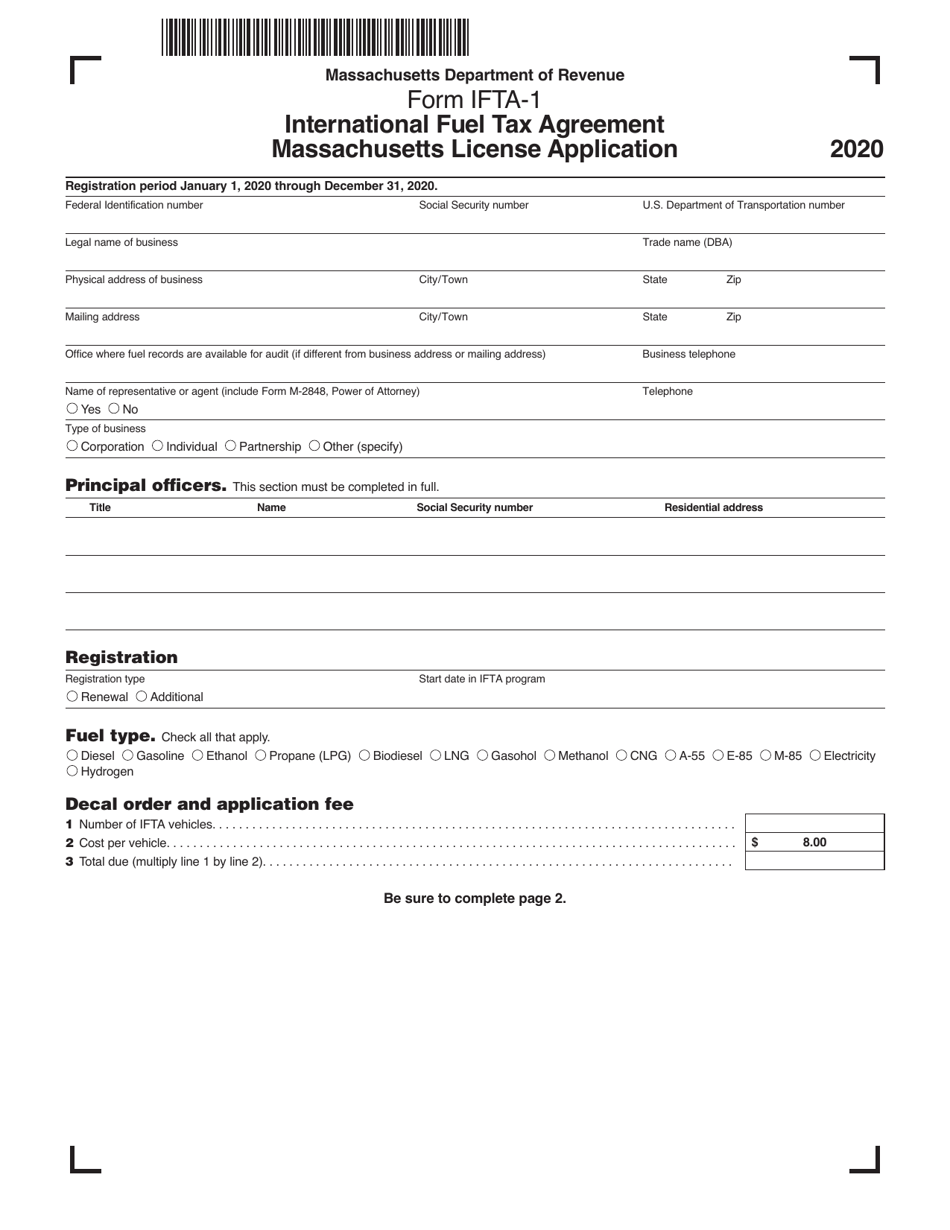

Form IFTA-1

for the current year.

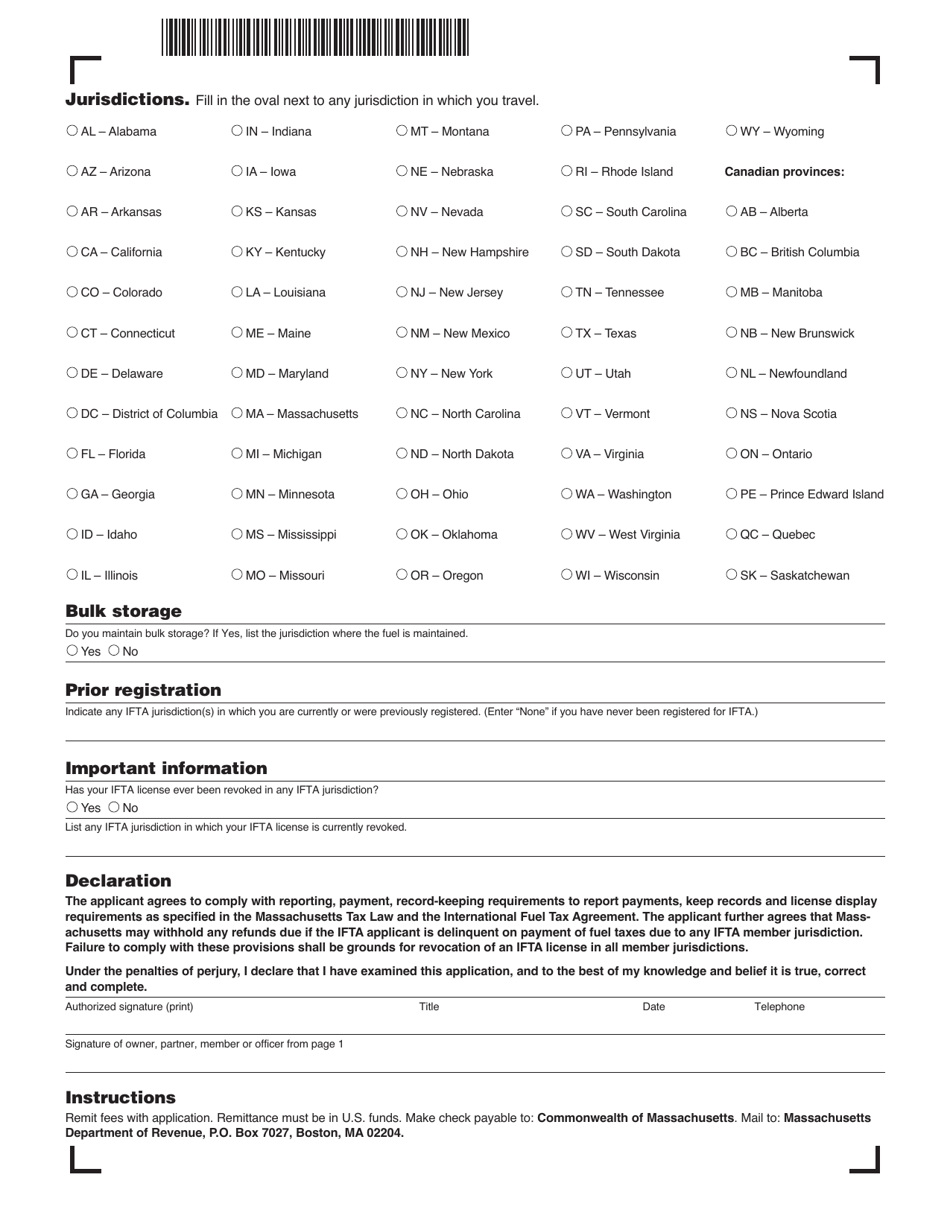

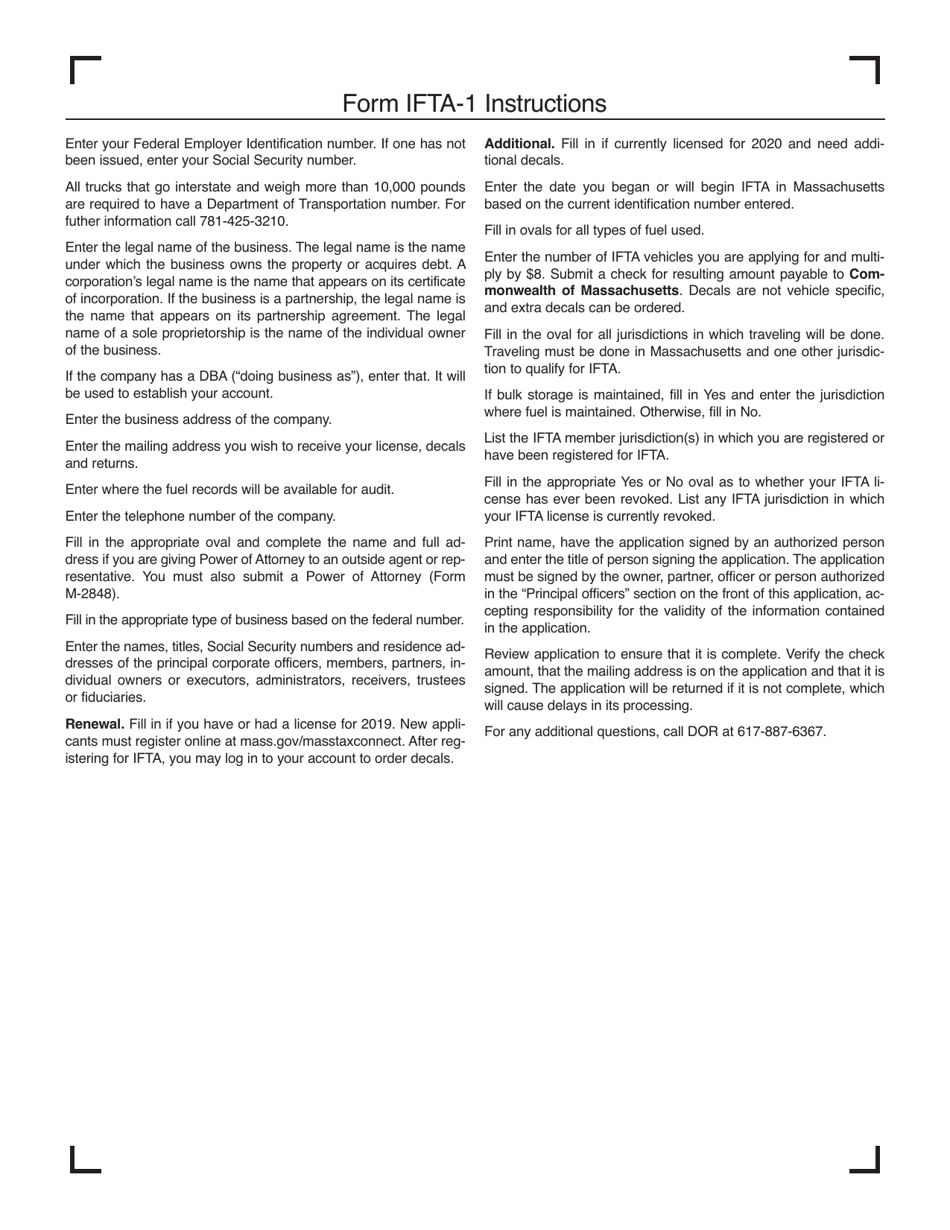

Form IFTA-1 International Fuel Tax Agreement Massachusetts License Application - Massachusetts

What Is Form IFTA-1?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the IFTA-1 form?

A: The IFTA-1 form is the International Fuel Tax Agreement Massachusetts License Application.

Q: What is the purpose of the IFTA-1 form?

A: The purpose of the IFTA-1 form is to apply for an IFTA license in the state of Massachusetts.

Q: What is the International Fuel Tax Agreement (IFTA)?

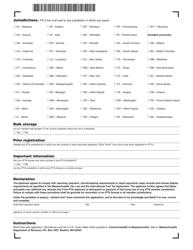

A: The International Fuel Tax Agreement (IFTA) is an agreement among U.S. states and Canadian provinces that simplifies the reporting and payment of fuel taxes by interstate motor carriers.

Q: Who needs to fill out the IFTA-1 form?

A: Interstate motor carriers who operate qualified motor vehicles across state lines and want to obtain an IFTA license in Massachusetts need to fill out the IFTA-1 form.

Q: What information is required on the IFTA-1 form?

A: The IFTA-1 form requires information such as the vehicle's identification details, fleet information, and fuel consumption records.

Q: Are there any fees associated with the IFTA-1 form?

A: Yes, there is an annual fee for obtaining an IFTA license in Massachusetts. The fee amount may vary.

Q: When should the IFTA-1 form be submitted?

A: The IFTA-1 form should be submitted before the start of the reporting period for which you are applying for the license.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form IFTA-1 by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.