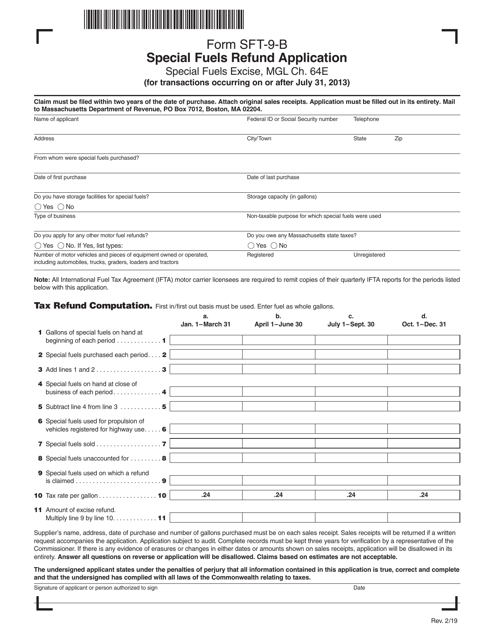

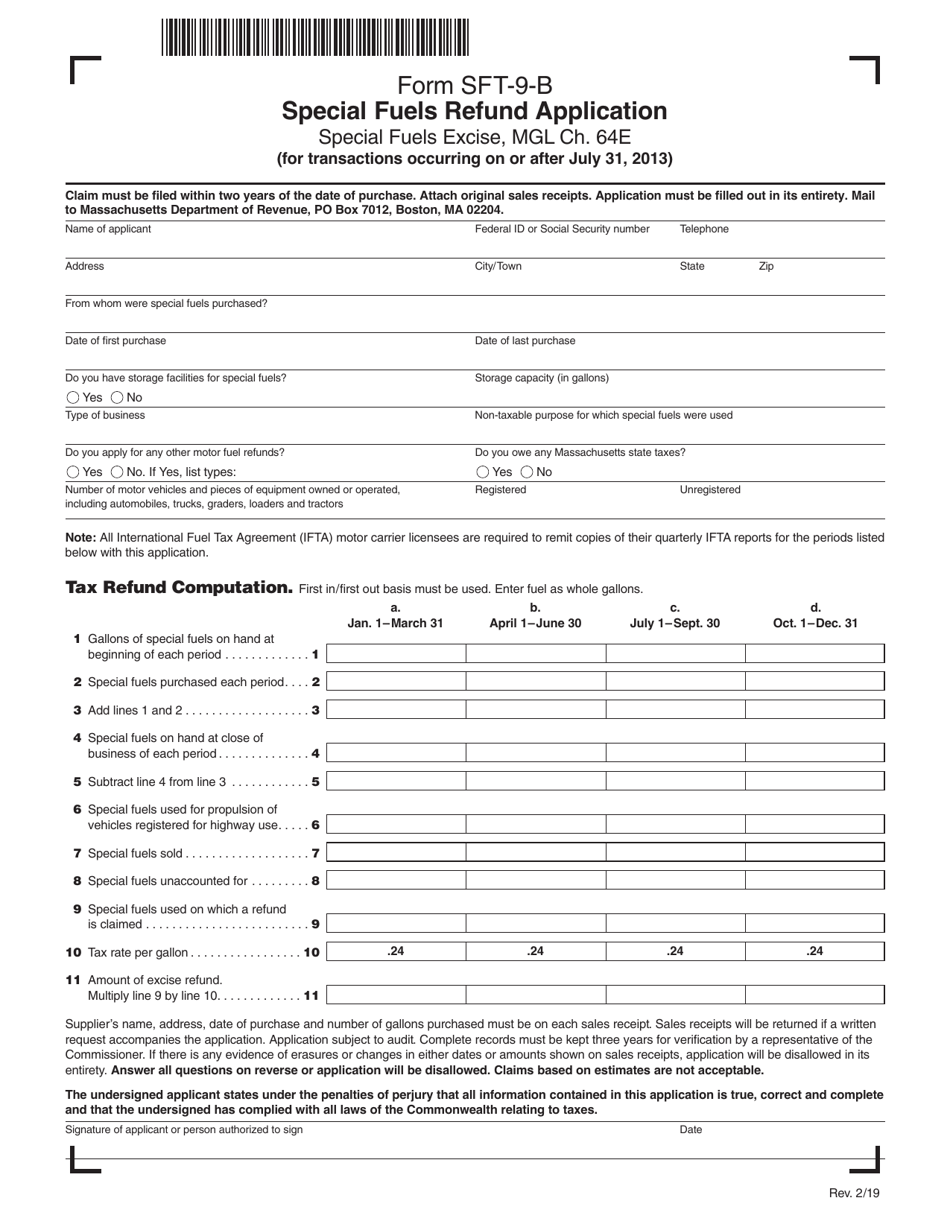

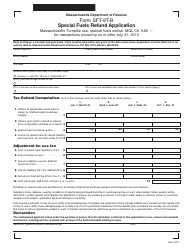

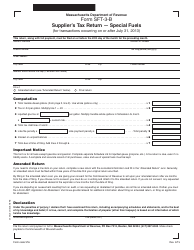

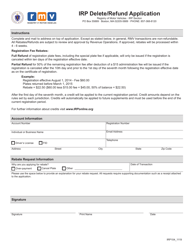

Form SFT-9-B Special Fuels Refund Application - Massachusetts

What Is Form SFT-9-B?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

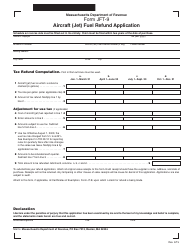

Q: What is Form SFT-9-B?

A: Form SFT-9-B is a Special Fuels Refund Application specific to Massachusetts.

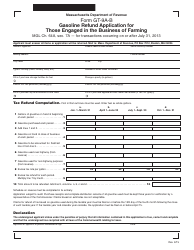

Q: What is a Special Fuels Refund Application?

A: A Special Fuels Refund Application is a form used to claim a refund of taxes paid on special fuels such as diesel or gasoline.

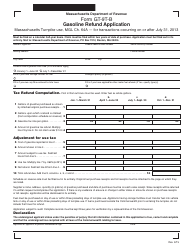

Q: Who needs to file Form SFT-9-B?

A: Individuals or businesses in Massachusetts who have paid taxes on special fuels and are eligible for a refund need to file Form SFT-9-B.

Q: What are special fuels?

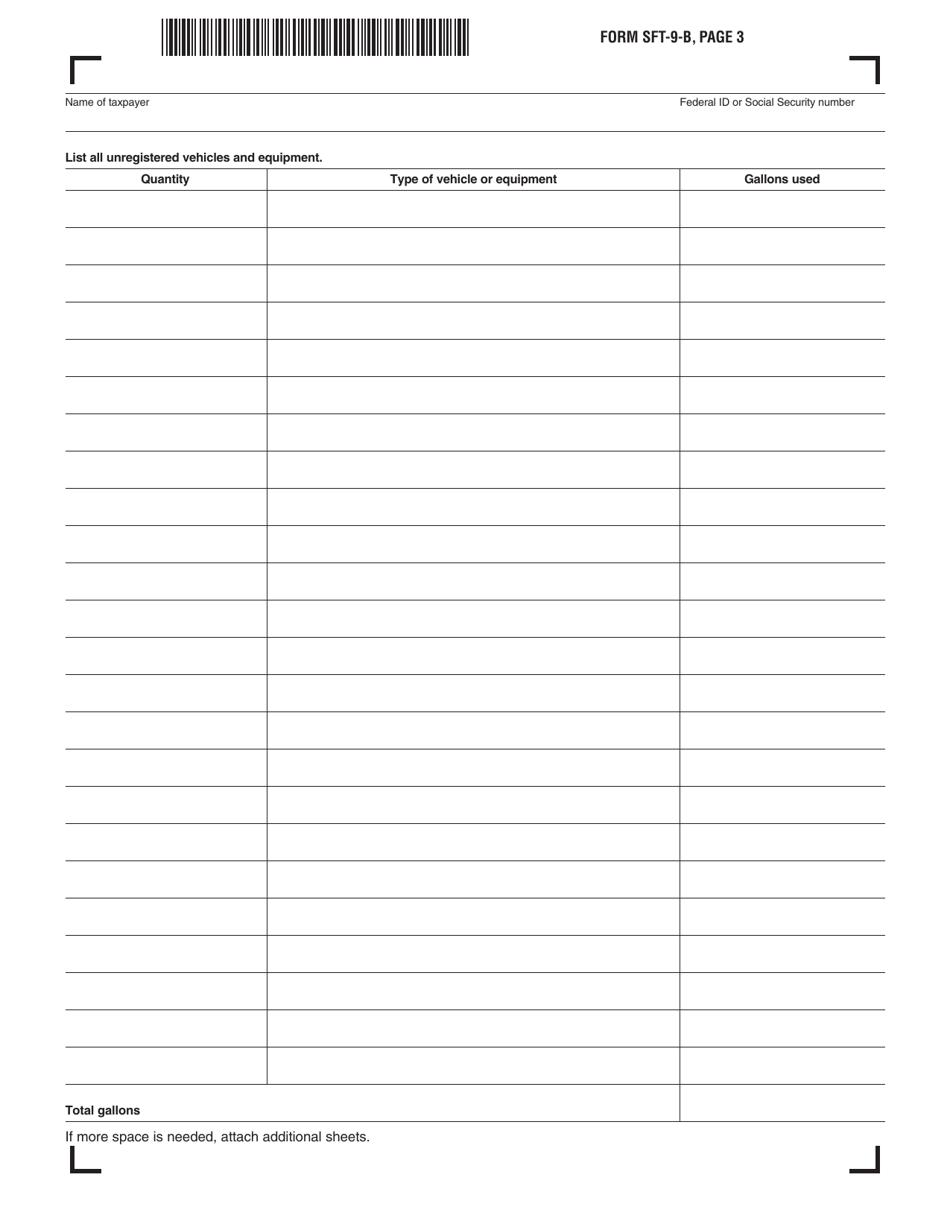

A: Special fuels are fuels such as diesel or gasoline that are used for non-highway purposes, such as in off-road vehicles or equipment.

Q: When is Form SFT-9-B due?

A: Form SFT-9-B is due on a quarterly basis, with specific due dates listed on the form.

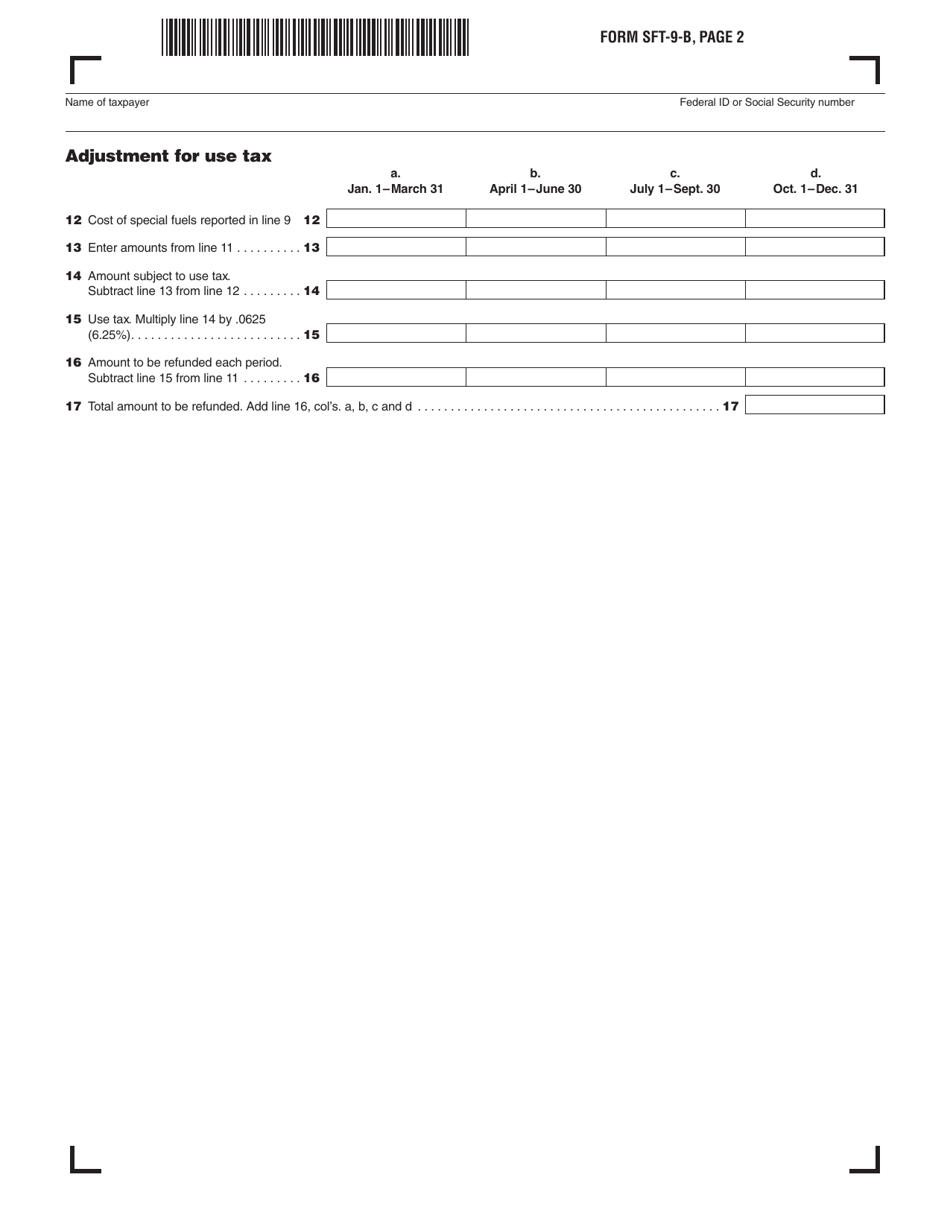

Q: What information do I need to complete Form SFT-9-B?

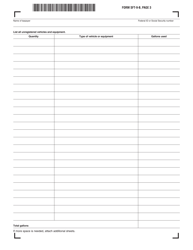

A: To complete Form SFT-9-B, you will need details about the quantity of special fuels purchased, the amount of taxes paid, and other relevant information.

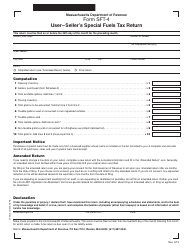

Q: Can I electronically file Form SFT-9-B?

A: Yes, Massachusetts allows for electronic filing of Form SFT-9-B.

Q: What happens after I file Form SFT-9-B?

A: After filing Form SFT-9-B, the Massachusetts Department of Revenue will review your application and process your refund if eligible.

Q: Are there any penalties for late or incorrect filing of Form SFT-9-B?

A: Yes, there may be penalties for late or incorrect filing of Form SFT-9-B. It is important to ensure timely and accurate submission.

Form Details:

- Released on February 1, 2019;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SFT-9-B by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.