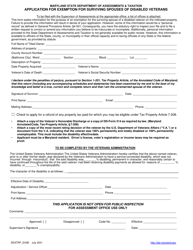

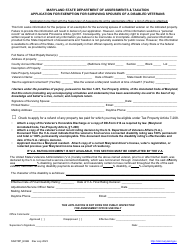

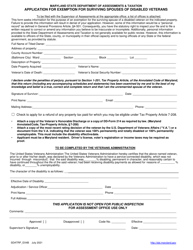

This version of the form is not currently in use and is provided for reference only. Download this version of

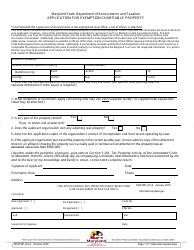

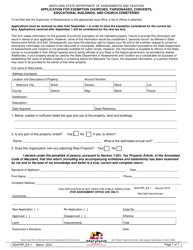

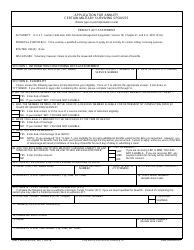

Form SDATRP_EX-4C

for the current year.

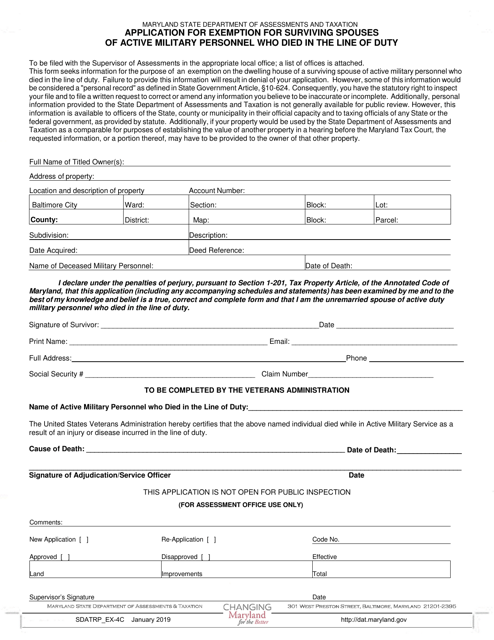

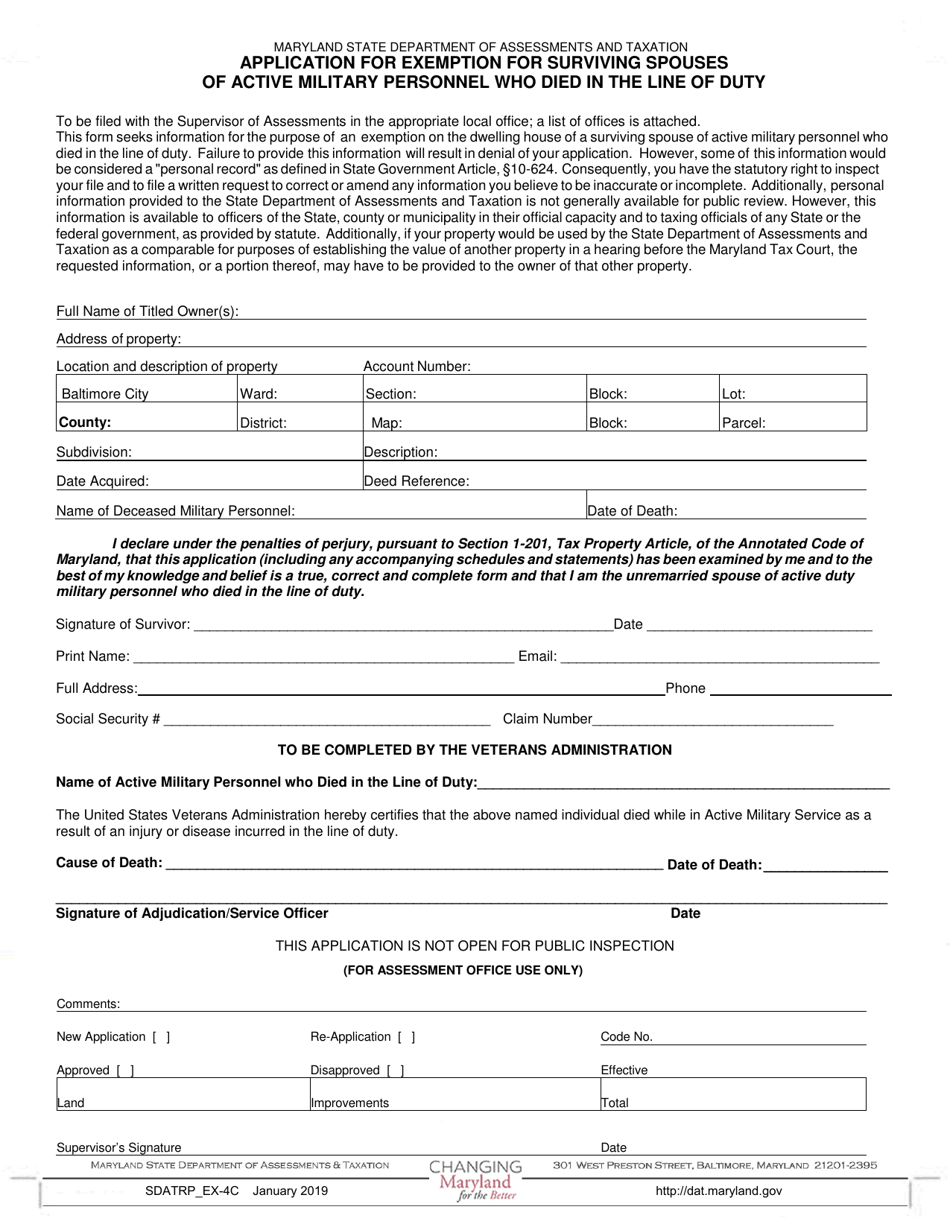

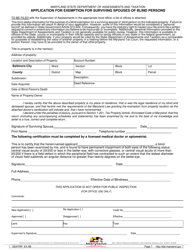

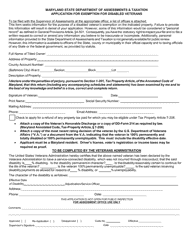

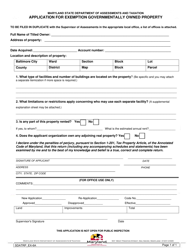

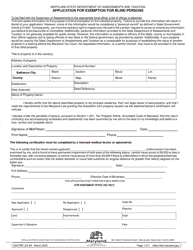

Form SDATRP_EX-4C Application for Exemption for Surviving Spouses - Maryland

What Is Form SDATRP_EX-4C?

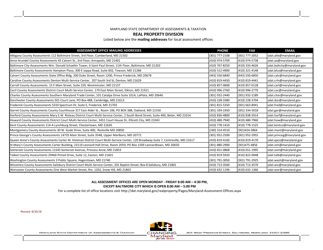

This is a legal form that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SDATRP_EX-4C?

A: SDATRP_EX-4C is the form for Application for Exemption for Surviving Spouses in Maryland.

Q: Who can apply for exemption for surviving spouses in Maryland?

A: Surviving spouses can apply for exemption in Maryland.

Q: What is the purpose of SDATRP_EX-4C?

A: The purpose of SDATRP_EX-4C is to apply for exemption for surviving spouses in Maryland.

Q: What information is required in SDATRP_EX-4C?

A: SDATRP_EX-4C requires information about the property and the surviving spouse.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Maryland Department of Assessments and Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SDATRP_EX-4C by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.