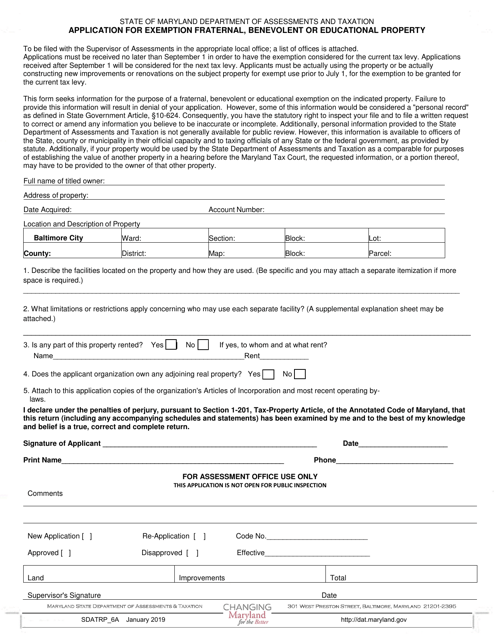

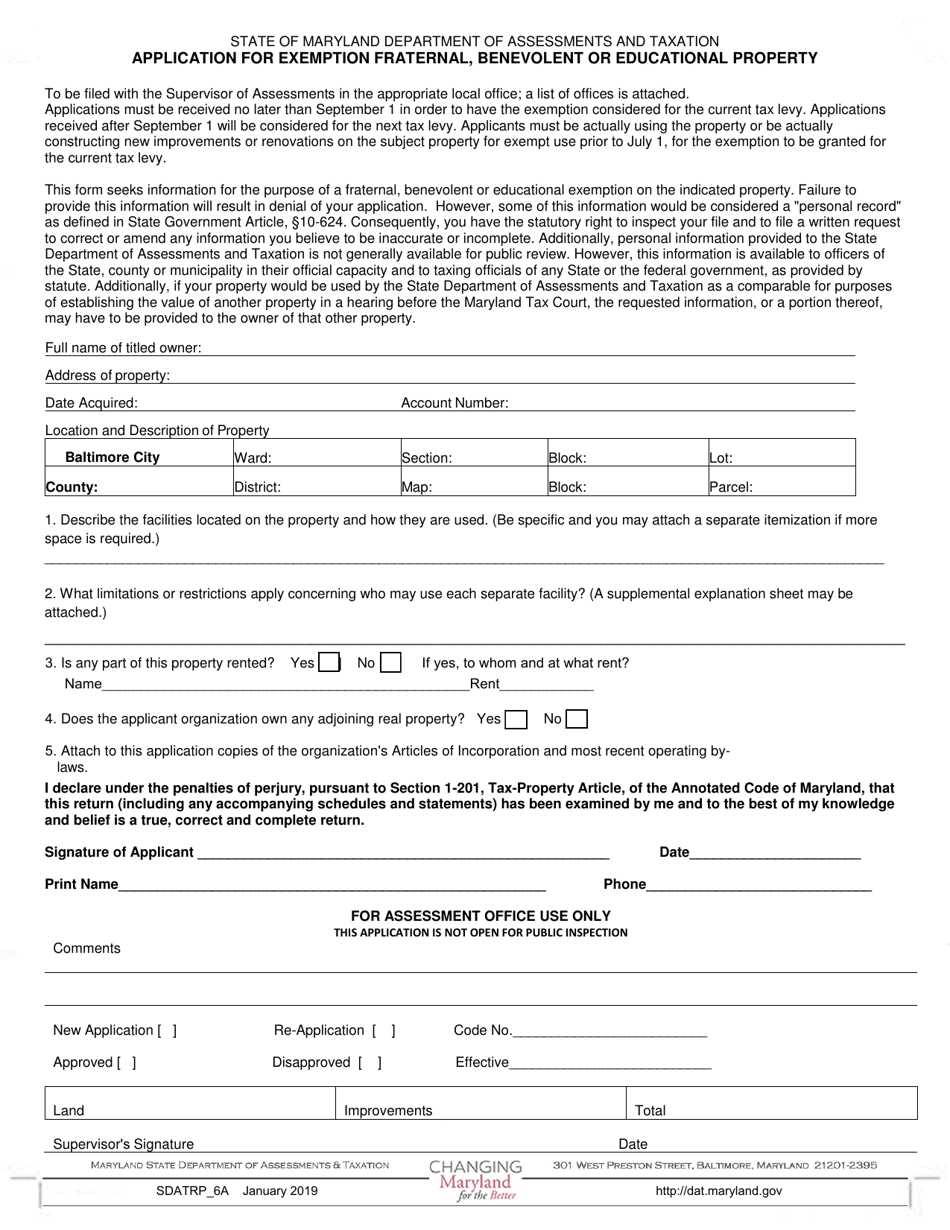

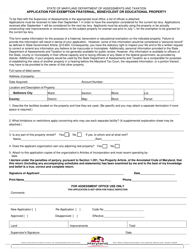

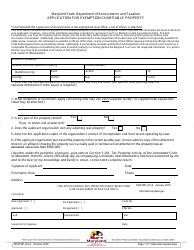

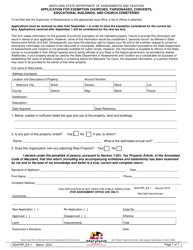

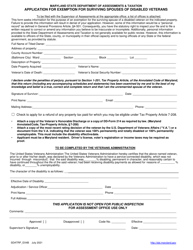

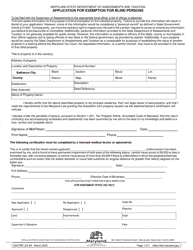

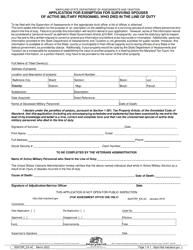

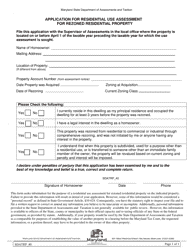

Form SDATRP_6A Application for Exemption Fraternal, Benevolent or Educational Property - Maryland

What Is Form SDATRP_6A?

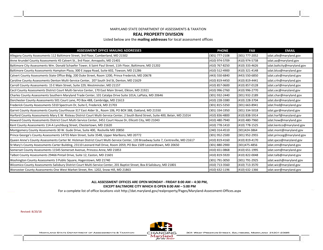

This is a legal form that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SDATRP_6A?

A: Form SDATRP_6A is an application for exemption for Fraternal, Benevolent or Educational Property in Maryland.

Q: Who can use Form SDATRP_6A?

A: Individuals or organizations seeking exemption for Fraternal, Benevolent or Educational Property in Maryland can use Form SDATRP_6A.

Q: What is the purpose of Form SDATRP_6A?

A: The purpose of Form SDATRP_6A is to apply for exemption for Fraternal, Benevolent or Educational Property in Maryland.

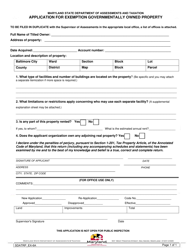

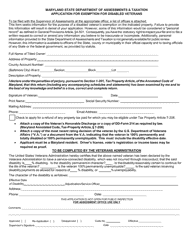

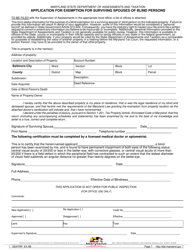

Q: What information is required on Form SDATRP_6A?

A: Form SDATRP_6A requires information regarding the applicant's identification, property details, and the basis for exemption.

Q: Are there any fees associated with Form SDATRP_6A?

A: Yes, there may be fees associated with the filing of Form SDATRP_6A. Please refer to the instructions or contact SDAT for more information.

Q: Is Form SDATRP_6A specific to Maryland?

A: Yes, Form SDATRP_6A is specific to the state of Maryland.

Q: What happens after I submit Form SDATRP_6A?

A: After submitting Form SDATRP_6A, the SDAT will review your application and notify you of their decision regarding the exemption.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Maryland Department of Assessments and Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SDATRP_6A by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.