This version of the form is not currently in use and is provided for reference only. Download this version of

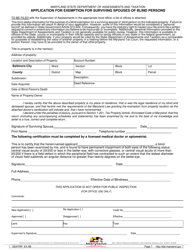

Form SDATRP_EX-1

for the current year.

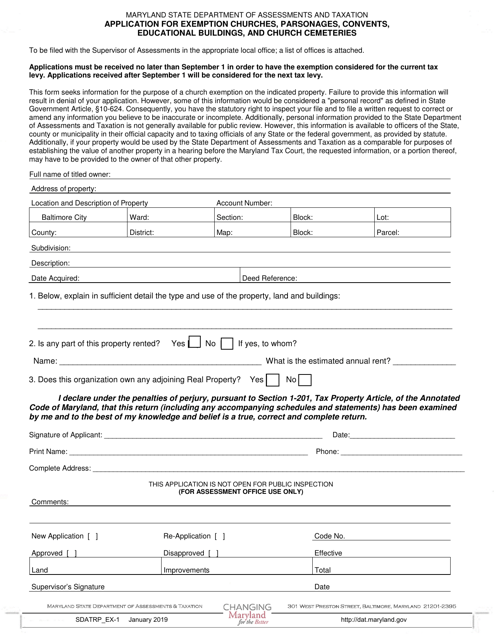

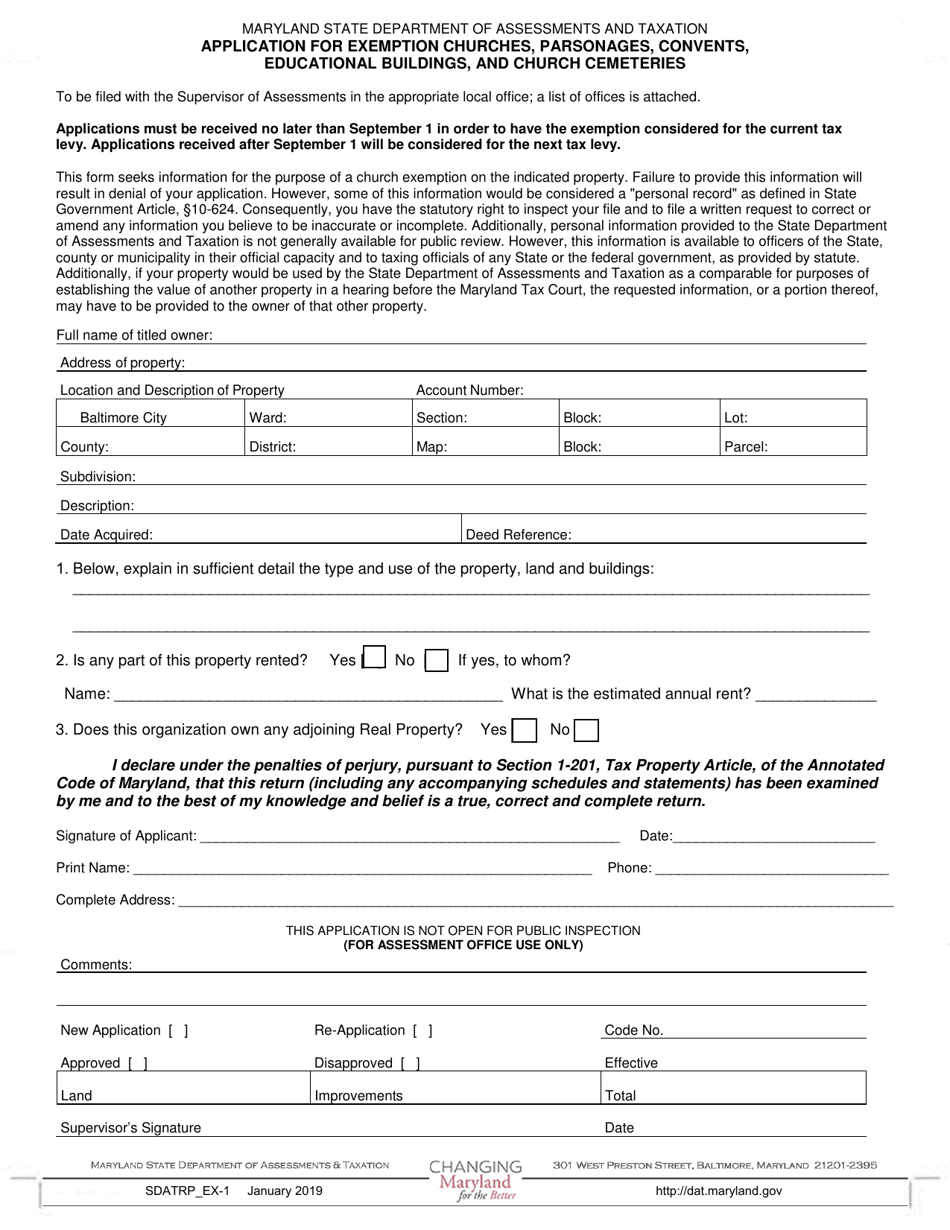

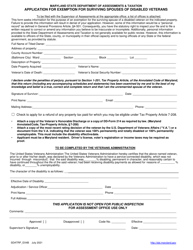

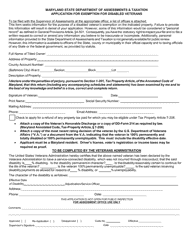

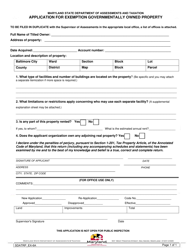

Form SDATRP_EX-1 Application for Exemption Churches, Parsonages, Convents, Educational Buildings, and Church Cemeteries - Maryland

What Is Form SDATRP_EX-1?

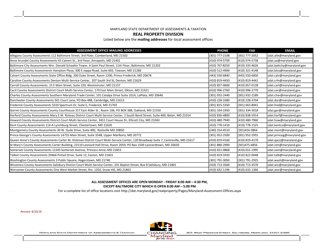

This is a legal form that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SDATRP_EX-1?

A: SDATRP_EX-1 is an application form for exemption for churches, parsonages, convents, educational buildings, and church cemeteries in Maryland.

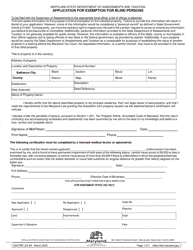

Q: Who is eligible to apply for exemption using SDATRP_EX-1?

A: Churches, parsonages, convents, educational buildings, and church cemeteries are eligible to apply for exemption using SDATRP_EX-1.

Q: What does the exemption cover?

A: The exemption covers properties used for religious purposes, such as churches, parsonages, convents, educational buildings, and church cemeteries.

Q: How to apply for exemption using SDATRP_EX-1?

A: To apply for exemption, you need to fill out the SDATRP_EX-1 form and submit it to the appropriate authority in Maryland.

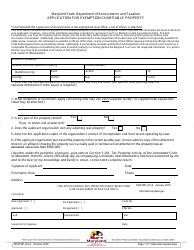

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Maryland Department of Assessments and Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SDATRP_EX-1 by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.