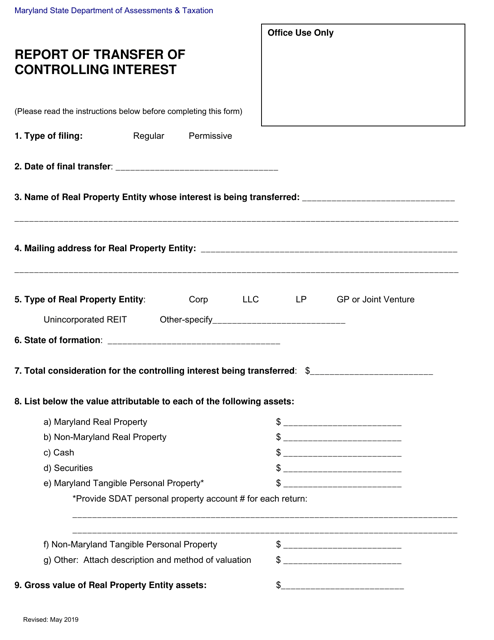

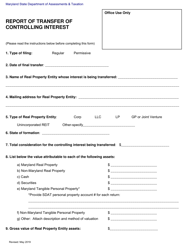

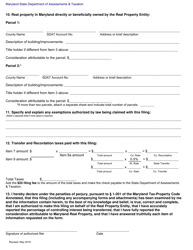

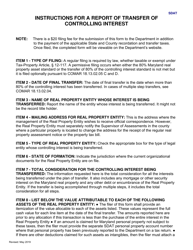

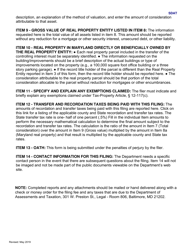

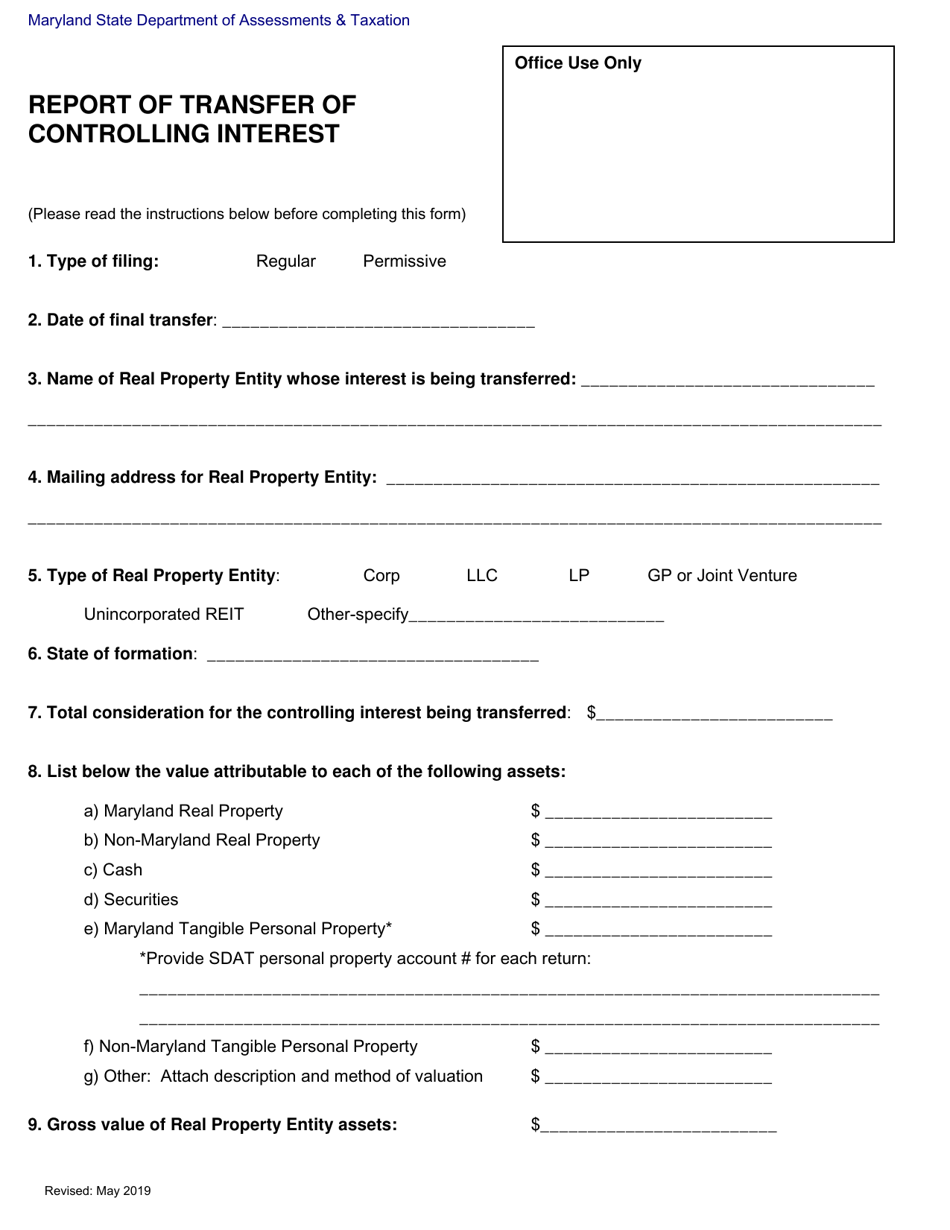

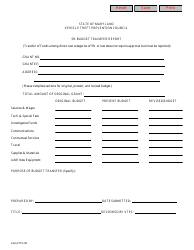

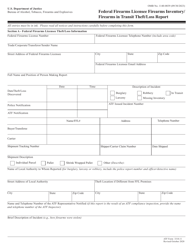

Report of Transfer of Controlling Interest - Maryland

Report of Transfer of Controlling Interest is a legal document that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland.

FAQ

Q: What is a report of transfer of controlling interest?

A: A report of transfer of controlling interest is a document that discloses the transfer of ownership or controlling interest in a company or business.

Q: Who is required to file a report of transfer of controlling interest?

A: Businesses in Maryland are required to file a report of transfer of controlling interest when there is a change in ownership or controlling interest.

Q: What information is included in a report of transfer of controlling interest?

A: The report typically includes details of the transfer, such as the names of the parties involved, the nature of the transfer, and the effective date of the transfer.

Q: Is there a deadline for filing a report of transfer of controlling interest in Maryland?

A: Yes, the report must typically be filed within 15 days of the transfer.

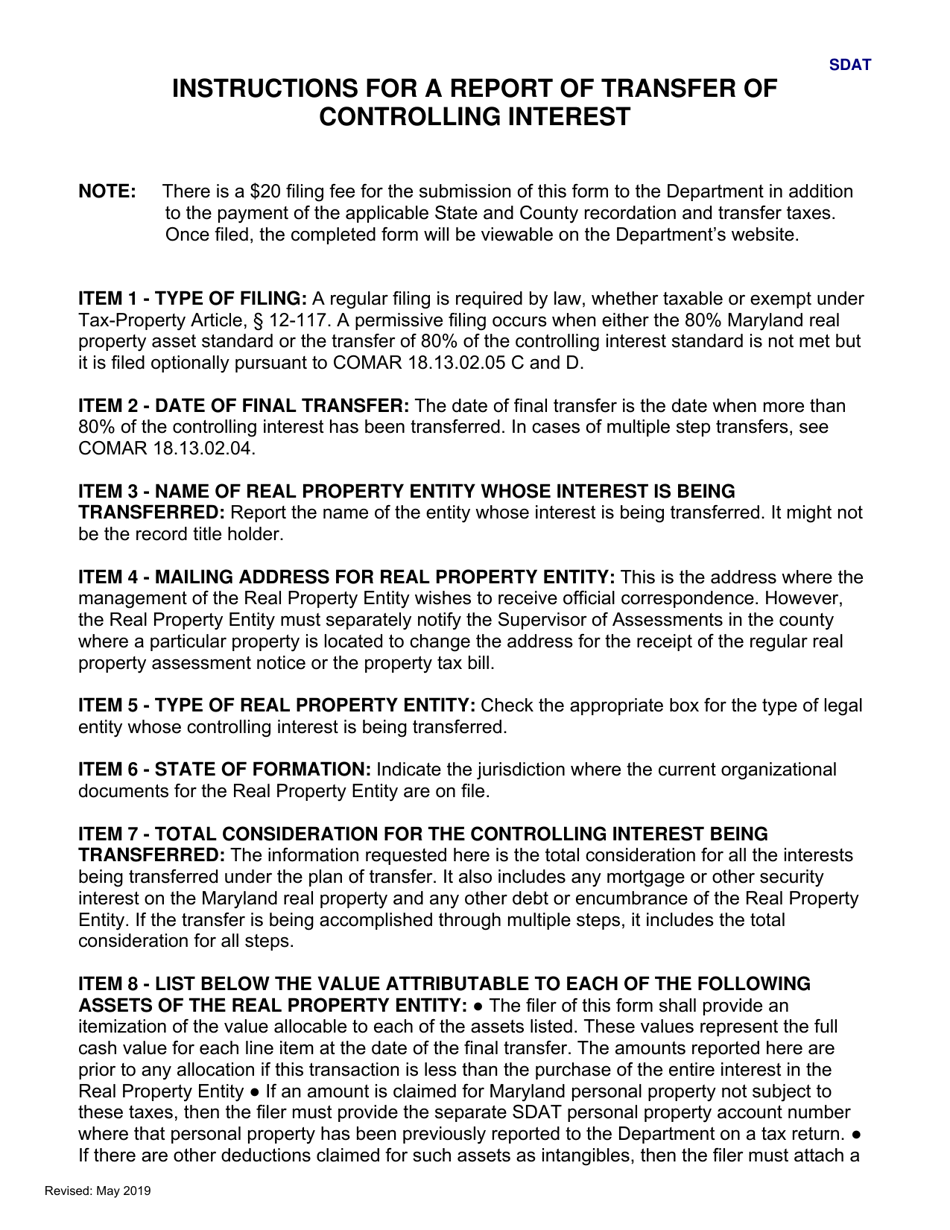

Q: Are there any fees associated with filing a report of transfer of controlling interest in Maryland?

A: Yes, there is a filing fee that must be paid when submitting the report.

Q: What happens if I fail to file a report of transfer of controlling interest in Maryland?

A: Failure to file the report may result in penalties or other legal consequences.

Q: Can I obtain a copy of a filed report of transfer of controlling interest?

A: Yes, you can request a copy of a filed report from the Maryland State Department of Assessments and Taxation.

Form Details:

- Released on May 1, 2019;

- The latest edition currently provided by the Maryland Department of Assessments and Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.