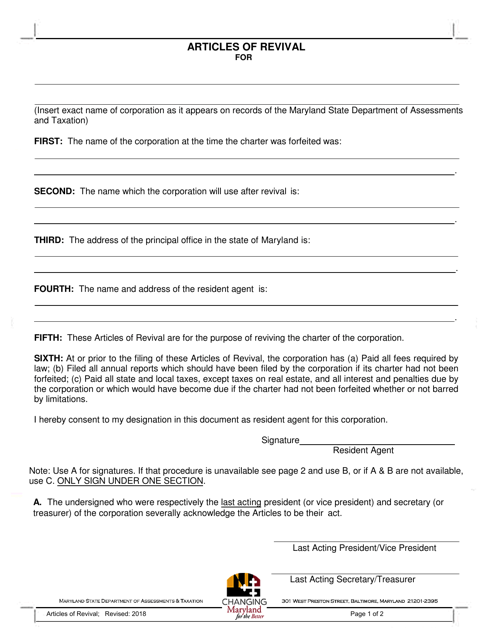

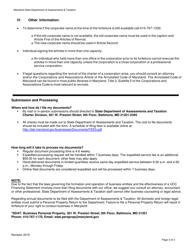

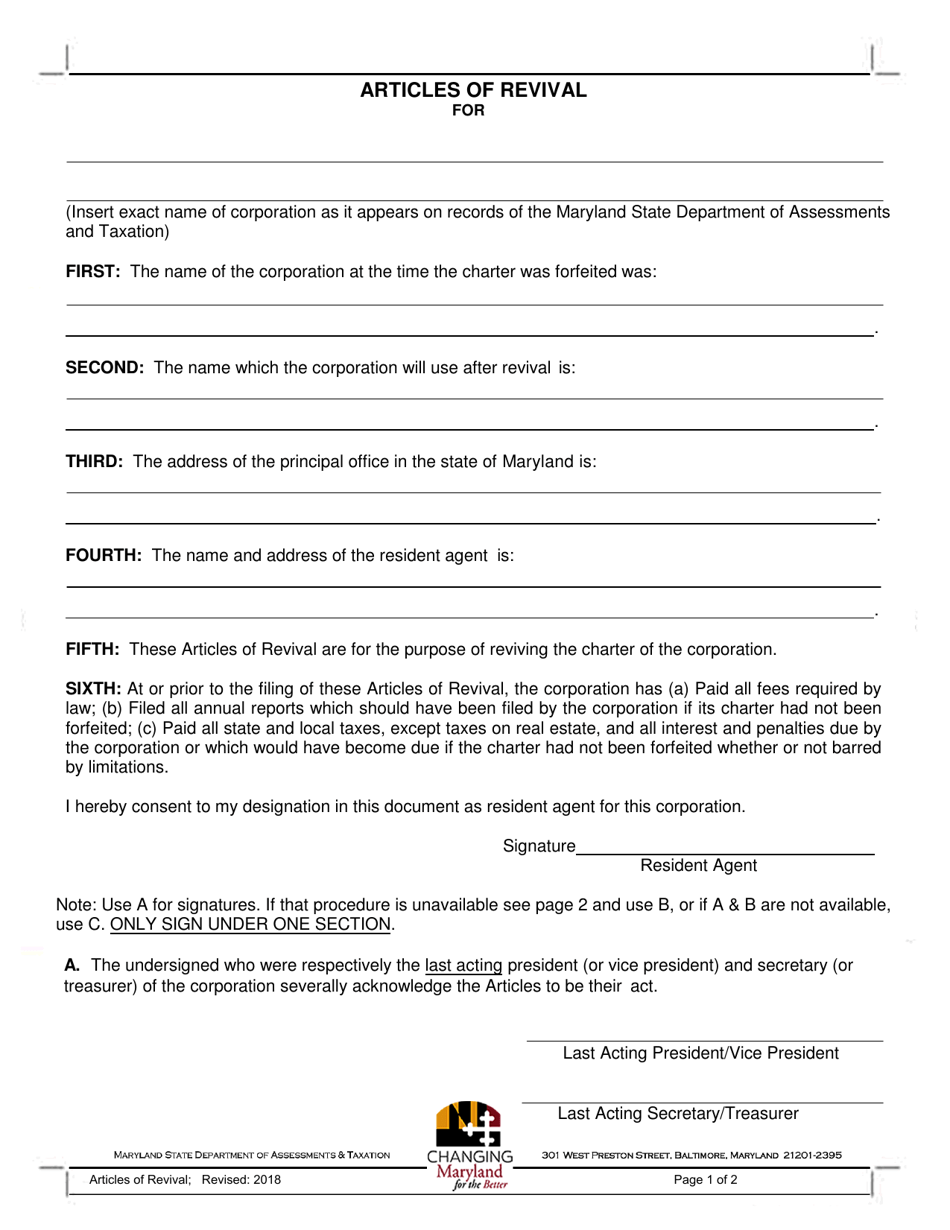

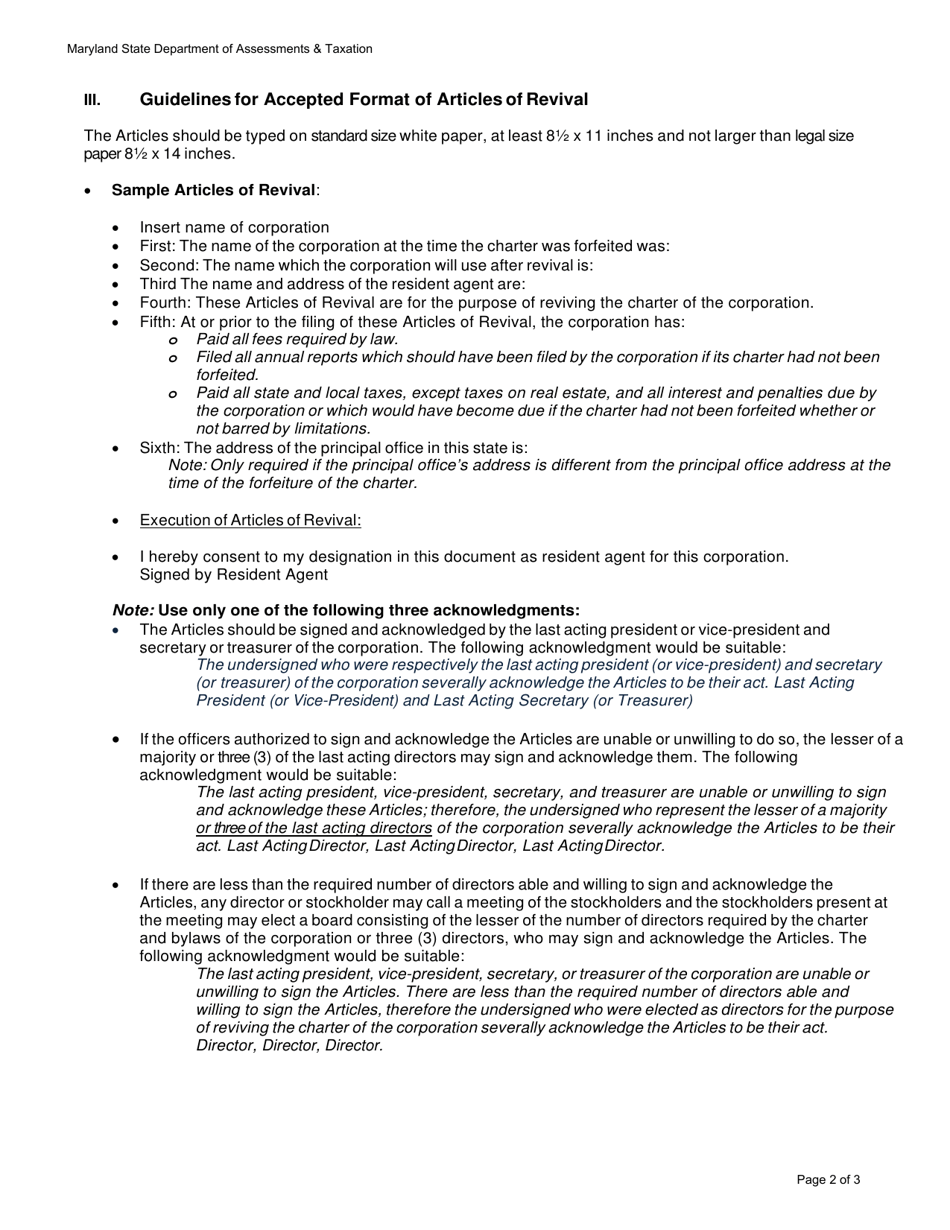

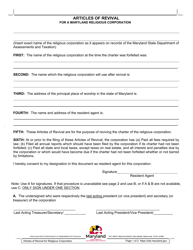

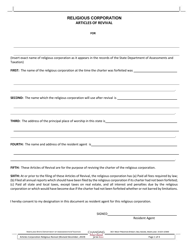

Articles of Revival - Maryland

Articles of Revival is a legal document that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland.

FAQ

Q: What are the Articles of Revival in Maryland?

A: The Articles of Revival in Maryland are legal documents used to reinstate a company or corporation that was administratively dissolved.

Q: Why would a company need to file Articles of Revival?

A: A company may need to file Articles of Revival if it was administratively dissolved for failing to file required reports or pay fees.

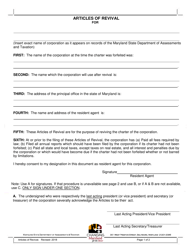

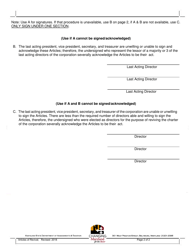

Q: How can a company file Articles of Revival in Maryland?

A: A company can file Articles of Revival in Maryland by submitting the necessary forms and fees to the State Department of Assessments and Taxation.

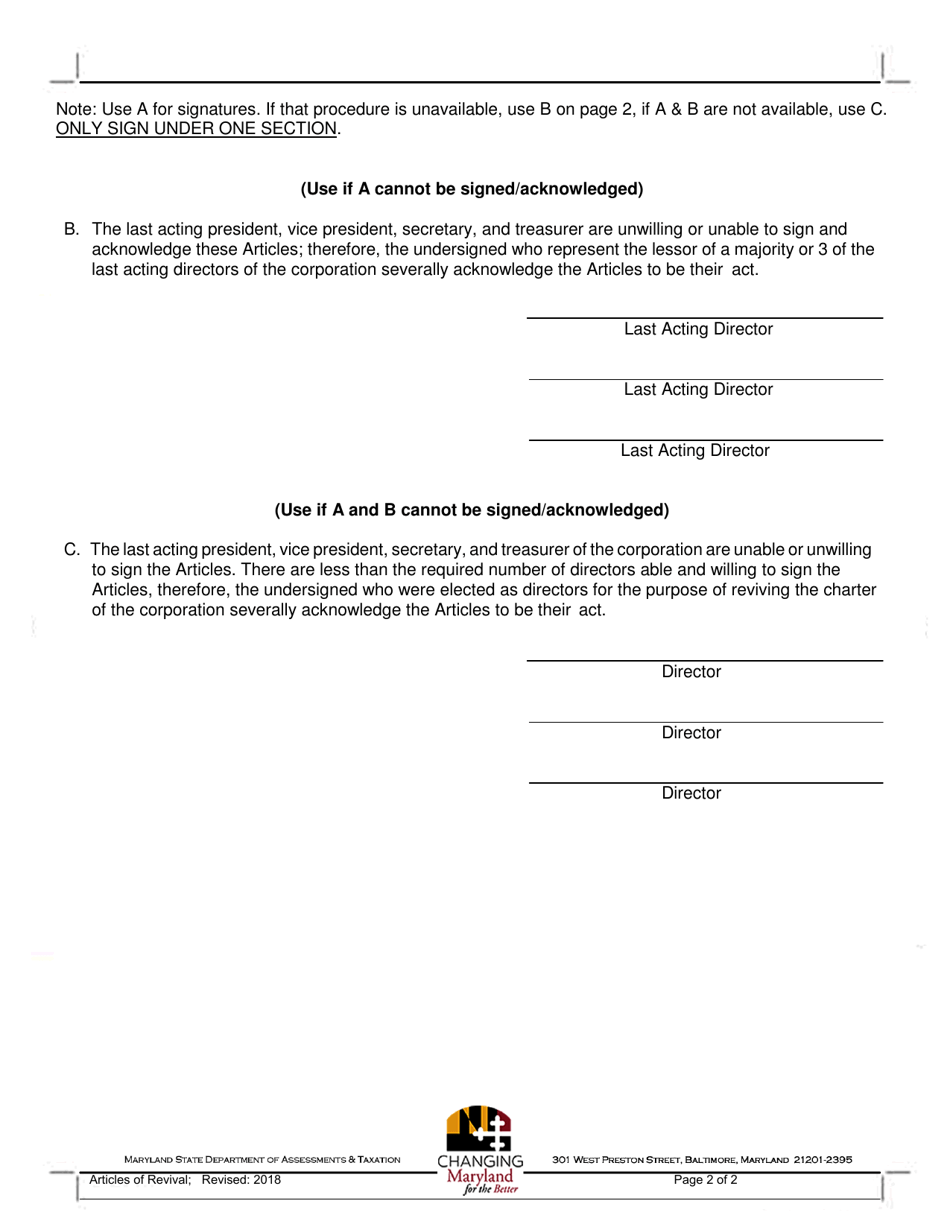

Q: Are there any specific requirements or deadlines for filing Articles of Revival in Maryland?

A: Yes, there are specific requirements and deadlines for filing Articles of Revival in Maryland. It is best to consult the State Department of Assessments and Taxation for detailed information.

Q: What happens after a company's Articles of Revival are accepted?

A: After a company's Articles of Revival are accepted, it will be reinstated and its legal status will be restored.

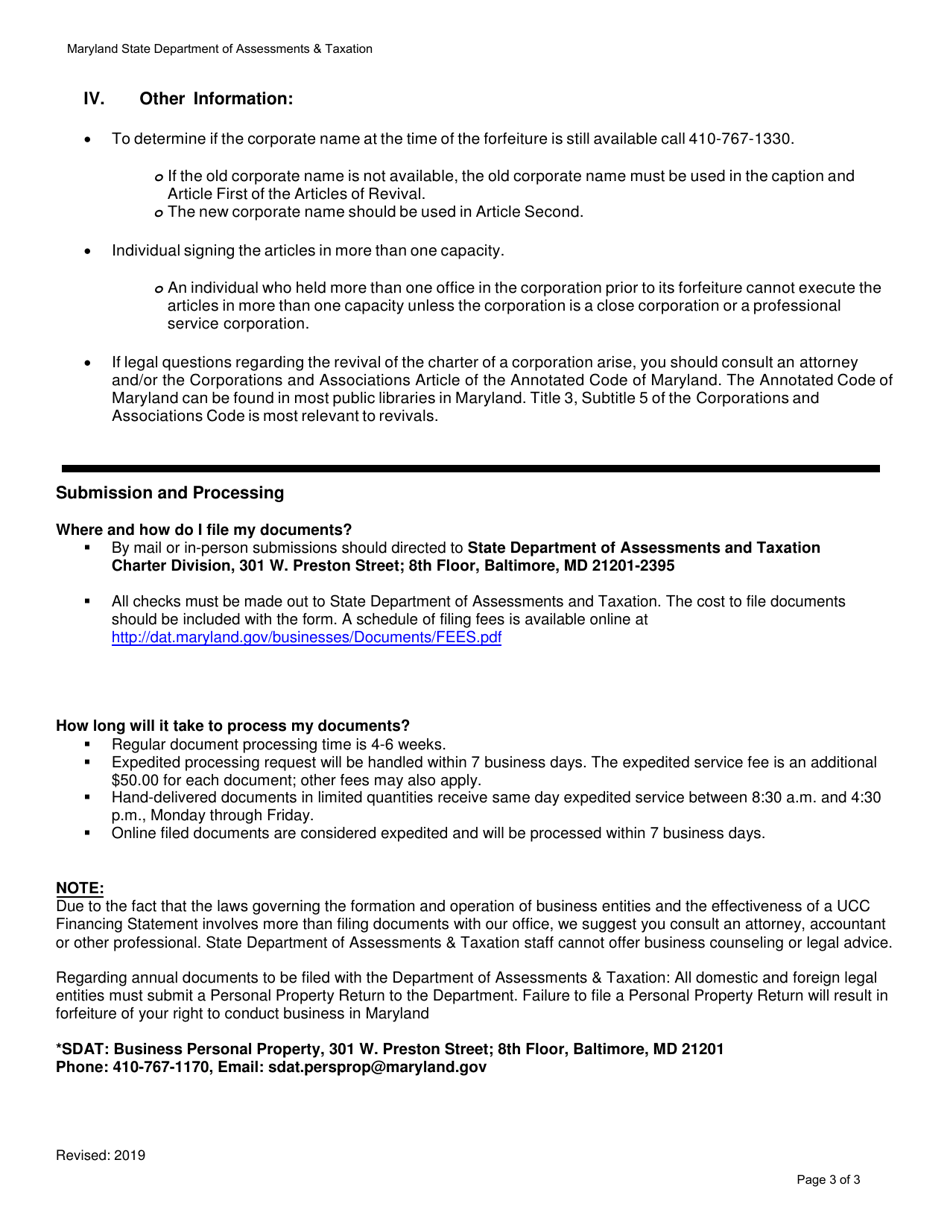

Form Details:

- Released on January 1, 2019;

- The latest edition currently provided by the Maryland Department of Assessments and Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.