This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

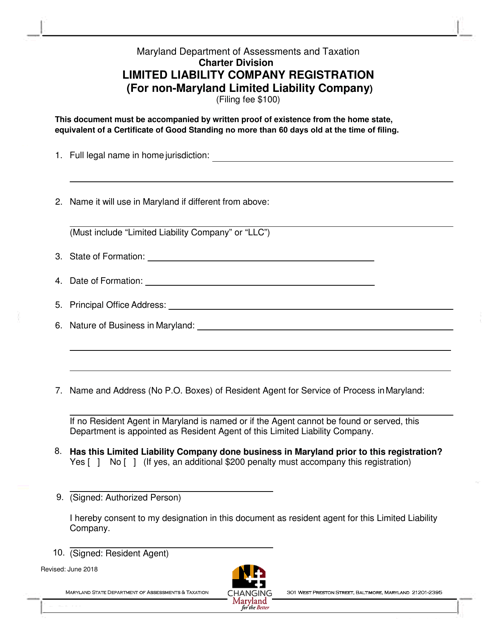

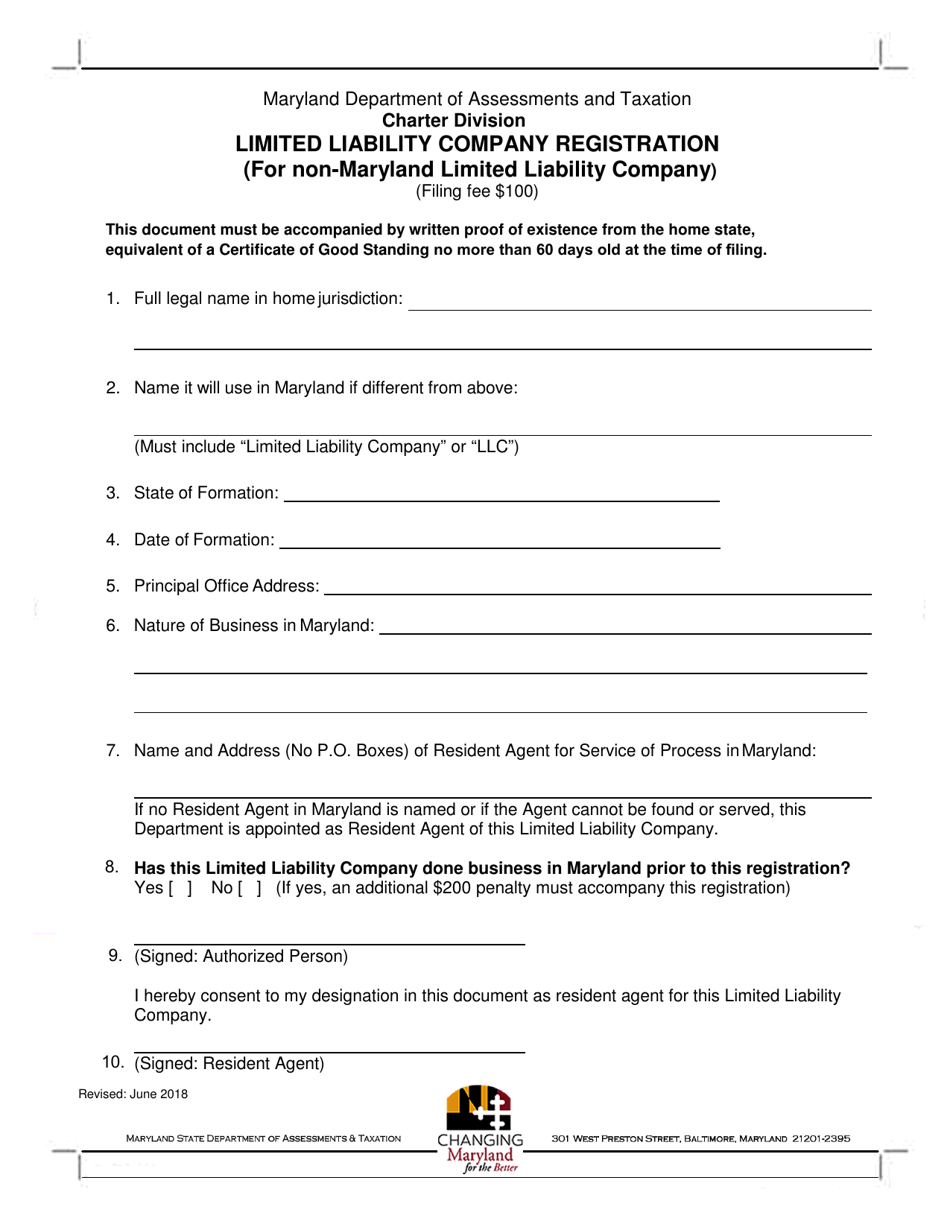

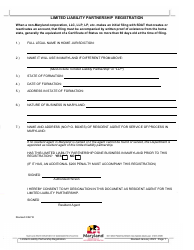

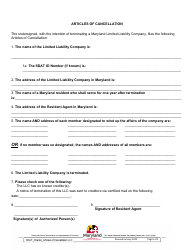

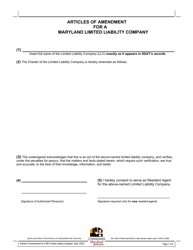

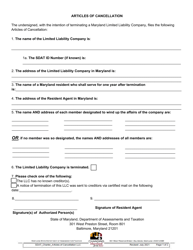

Limited Liability Company Registration (For Non-maryland Limited Liability Company) - Maryland

Limited Liability Company Registration (For Non-maryland Limited Liability Company) is a legal document that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland.

FAQ

Q: What is a Limited Liability Company (LLC)?

A: An LLC is a business structure that combines the limited liability protection of a corporation with the flexibility of a partnership.

Q: Who can form an LLC in Maryland?

A: Anyone who wants to start a business and operate it as an LLC.

Q: How do I register an LLC in Maryland?

A: You need to file Articles of Organization with the Maryland Department of Assessments and Taxation.

Q: What information do I need to provide when registering an LLC in Maryland?

A: You will need to provide the name of your LLC, the names and addresses of the members or managers, and the registered agent's name and address.

Q: How much does it cost to register an LLC in Maryland?

A: The filing fee for the Articles of Organization is $100.

Q: Do I need an attorney to register an LLC in Maryland?

A: No, you can complete and file the necessary documents yourself, or you can hire an attorney to assist you.

Q: Do I need to create an operating agreement for my LLC in Maryland?

A: It is not required by law, but it is highly recommended to have an operating agreement in place to outline the rights and responsibilities of the members and managers.

Q: What are the ongoing requirements for an LLC in Maryland?

A: LLCs in Maryland are required to file an Annual Report and pay an annual fee to the Department of Assessments and Taxation.

Q: Can a non-US resident form an LLC in Maryland?

A: Yes, there are no residency requirements for forming an LLC in Maryland.

Q: Can I change the name or address of my LLC in Maryland?

A: Yes, you can file an Amendment to Articles of Organization to make changes to your LLC's name or address.

Q: Can I dissolve my LLC in Maryland?

A: Yes, you can voluntarily dissolve your LLC by filing Articles of Dissolution with the Maryland Department of Assessments and Taxation.

Form Details:

- Released on June 1, 2018;

- The latest edition currently provided by the Maryland Department of Assessments and Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.