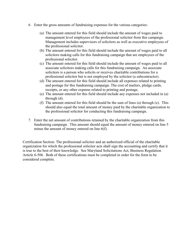

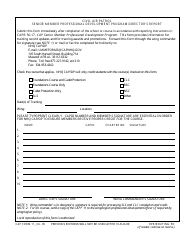

Accounting Report for Professional Solicitors - Maryland

Accounting Report for Professional Solicitors is a legal document that was released by the Maryland Secretary of State - a government authority operating within Maryland.

FAQ

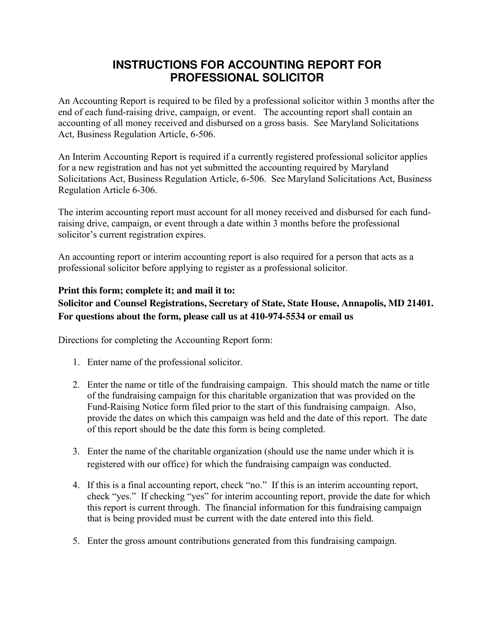

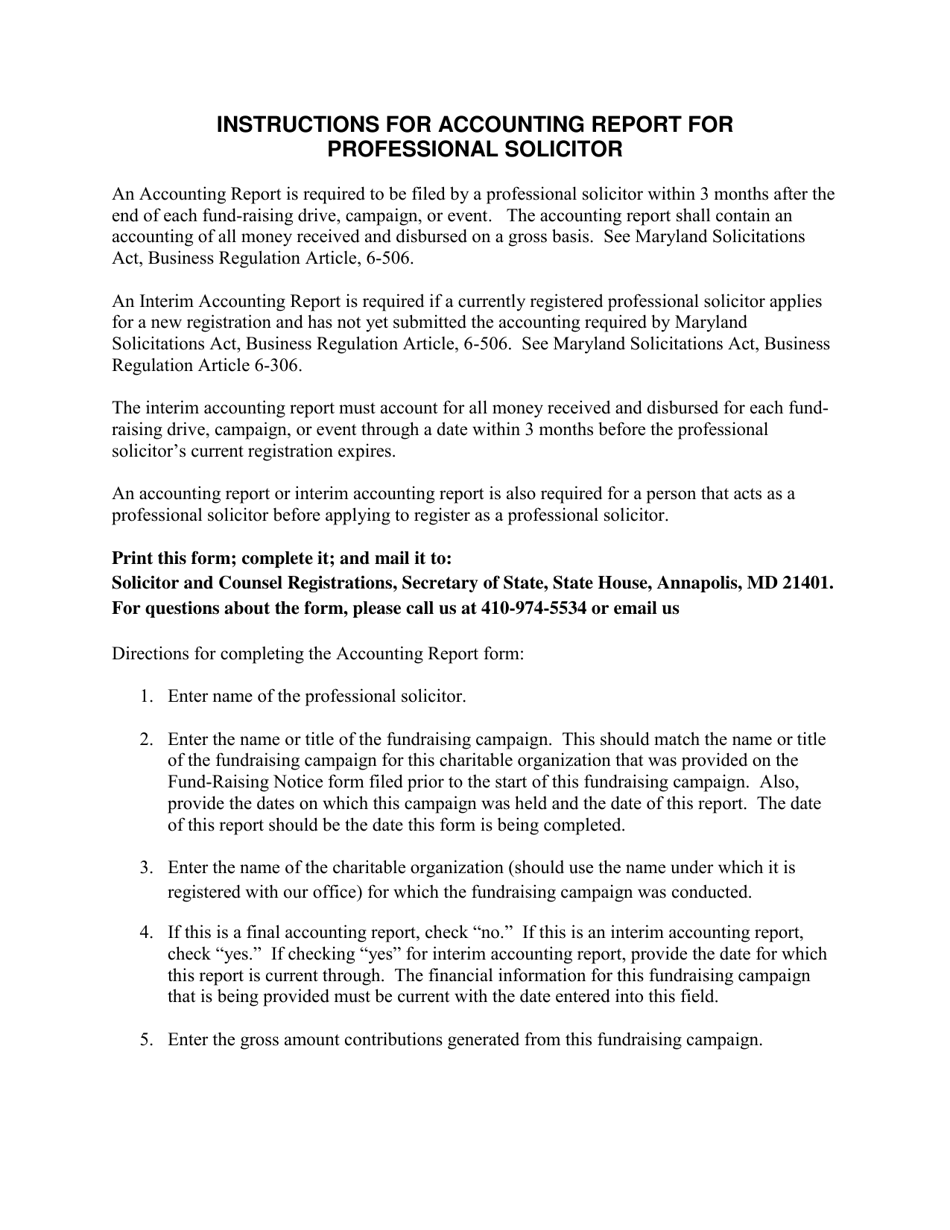

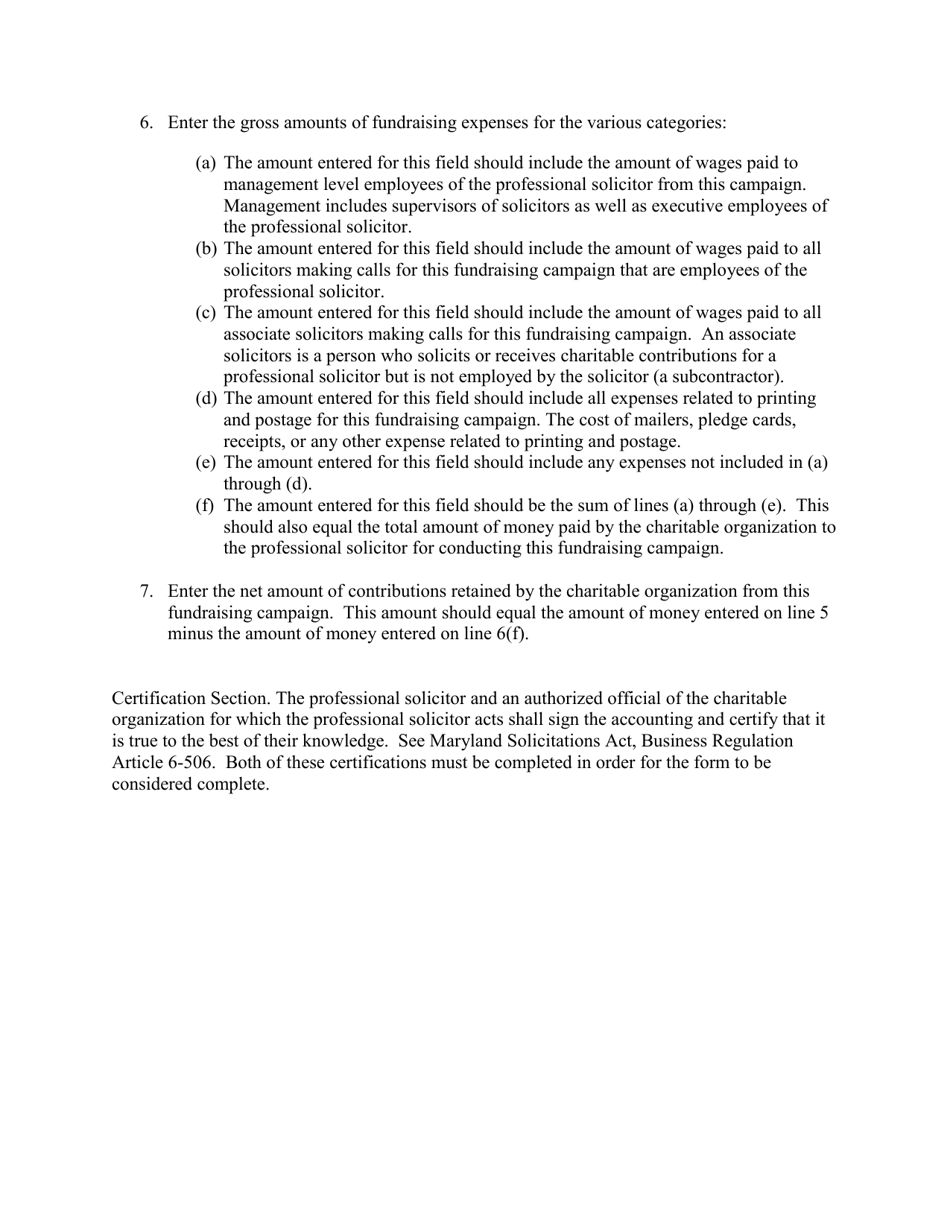

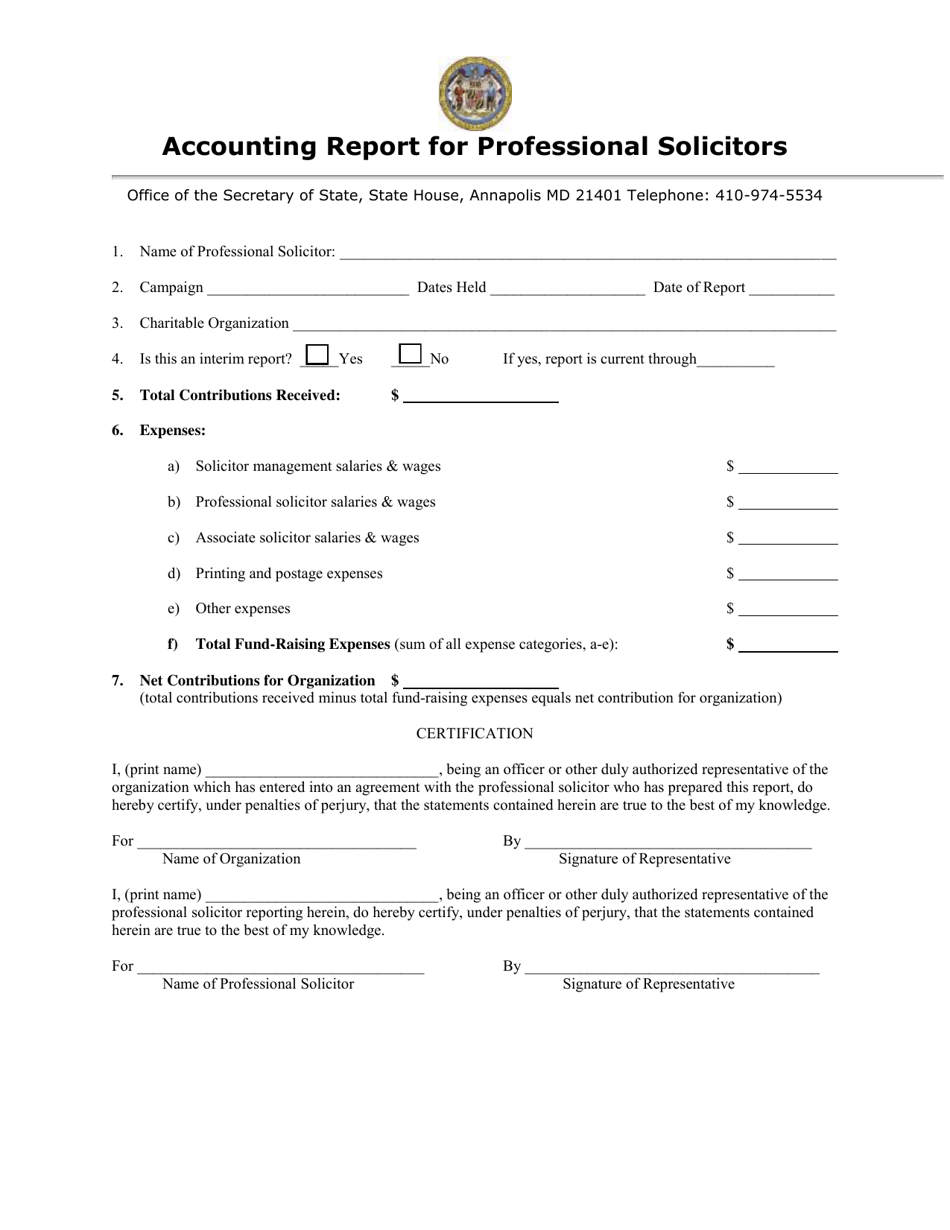

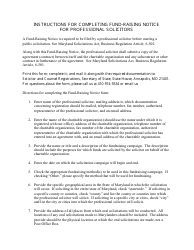

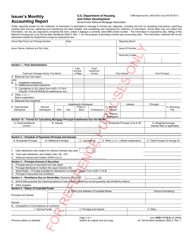

Q: What is an accounting report for professional solicitors?

A: An accounting report for professional solicitors is a financial document that provides information about the funds received and disbursed by a professional solicitor in Maryland.

Q: Who needs to submit an accounting report for professional solicitors in Maryland?

A: Any professional solicitor operating in Maryland needs to submit an accounting report.

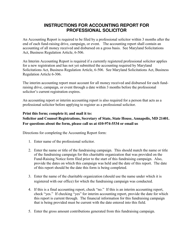

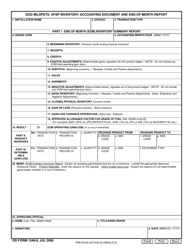

Q: What information is included in an accounting report for professional solicitors?

A: An accounting report for professional solicitors includes details about the funds received, expenses incurred, and the purpose of solicitation.

Q: When is the deadline to submit an accounting report for professional solicitors in Maryland?

A: The accounting report for professional solicitors must be submitted annually within 90 days after the end of the fiscal year.

Q: Are there any fees associated with submitting an accounting report for professional solicitors in Maryland?

A: Yes, there is a filing fee of $300 to submit an accounting report for professional solicitors.

Q: What are the consequences for failing to submit an accounting report for professional solicitors in Maryland?

A: Failure to submit an accounting report may result in penalties, fines, or the revocation of the professional solicitor's registration.

Q: Can an accounting report for professional solicitors be amended in Maryland?

A: Yes, an accounting report for professional solicitors can be amended by filing a corrected report with the Maryland Secretary of State.

Form Details:

- The latest edition currently provided by the Maryland Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maryland Secretary of State.