This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

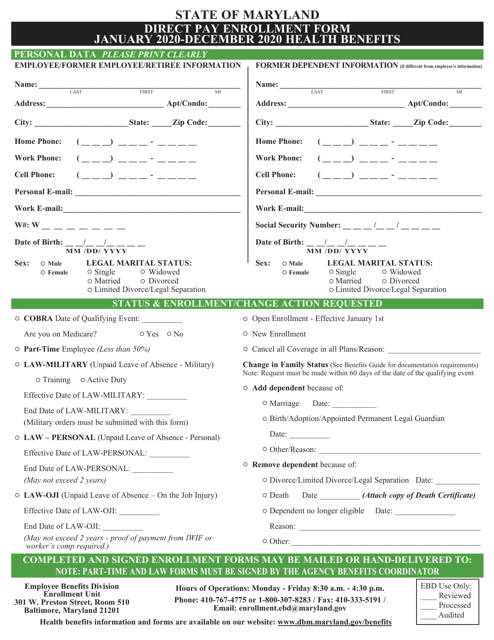

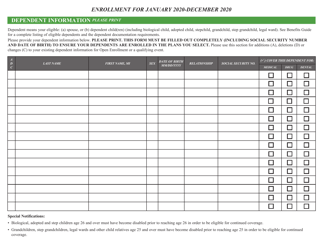

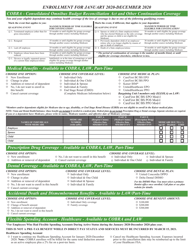

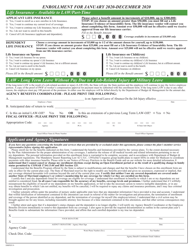

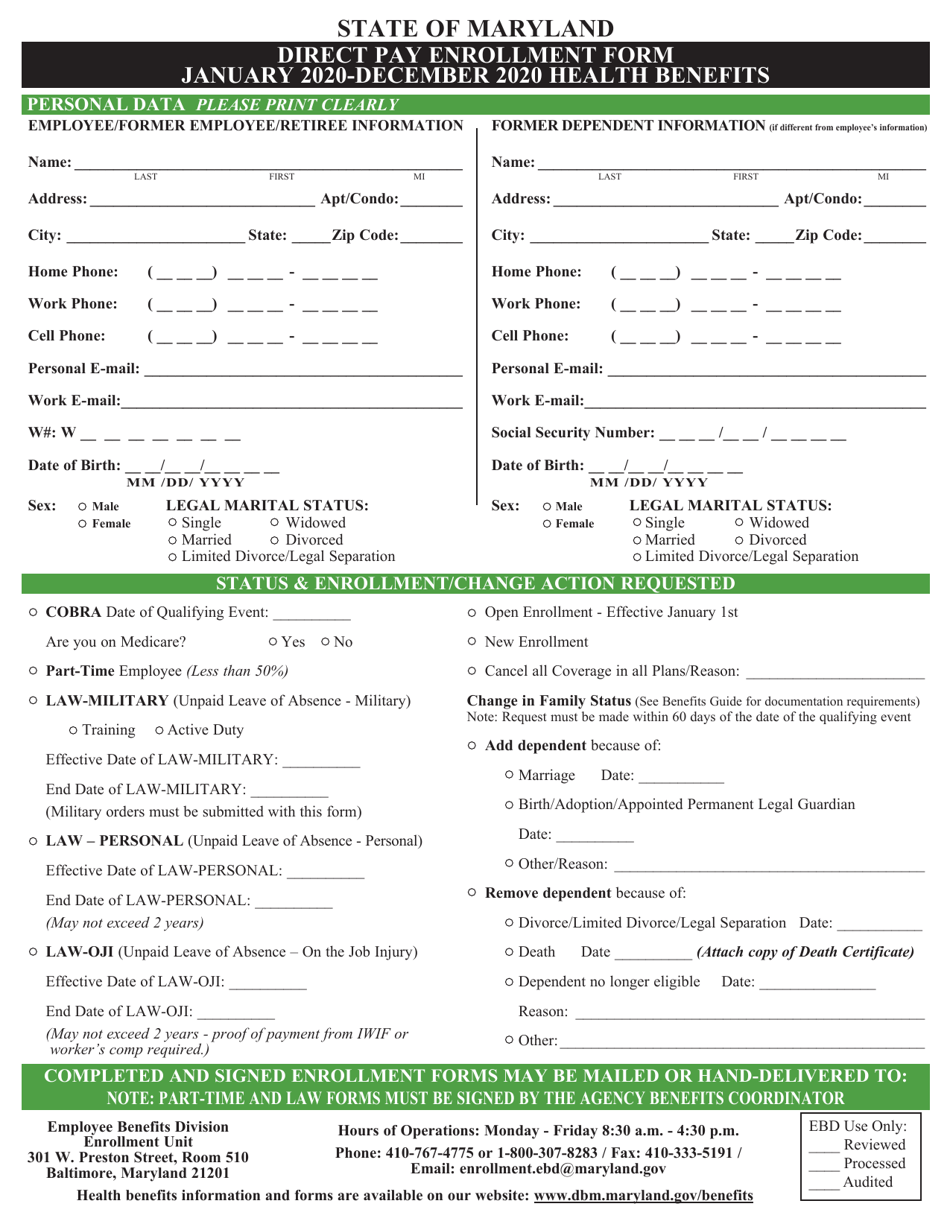

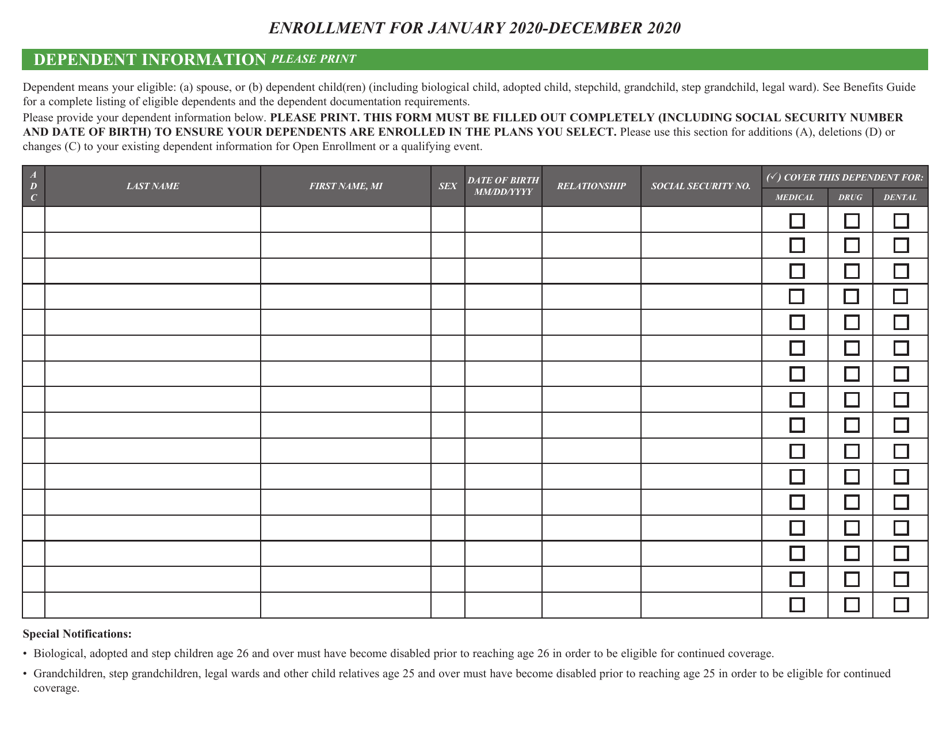

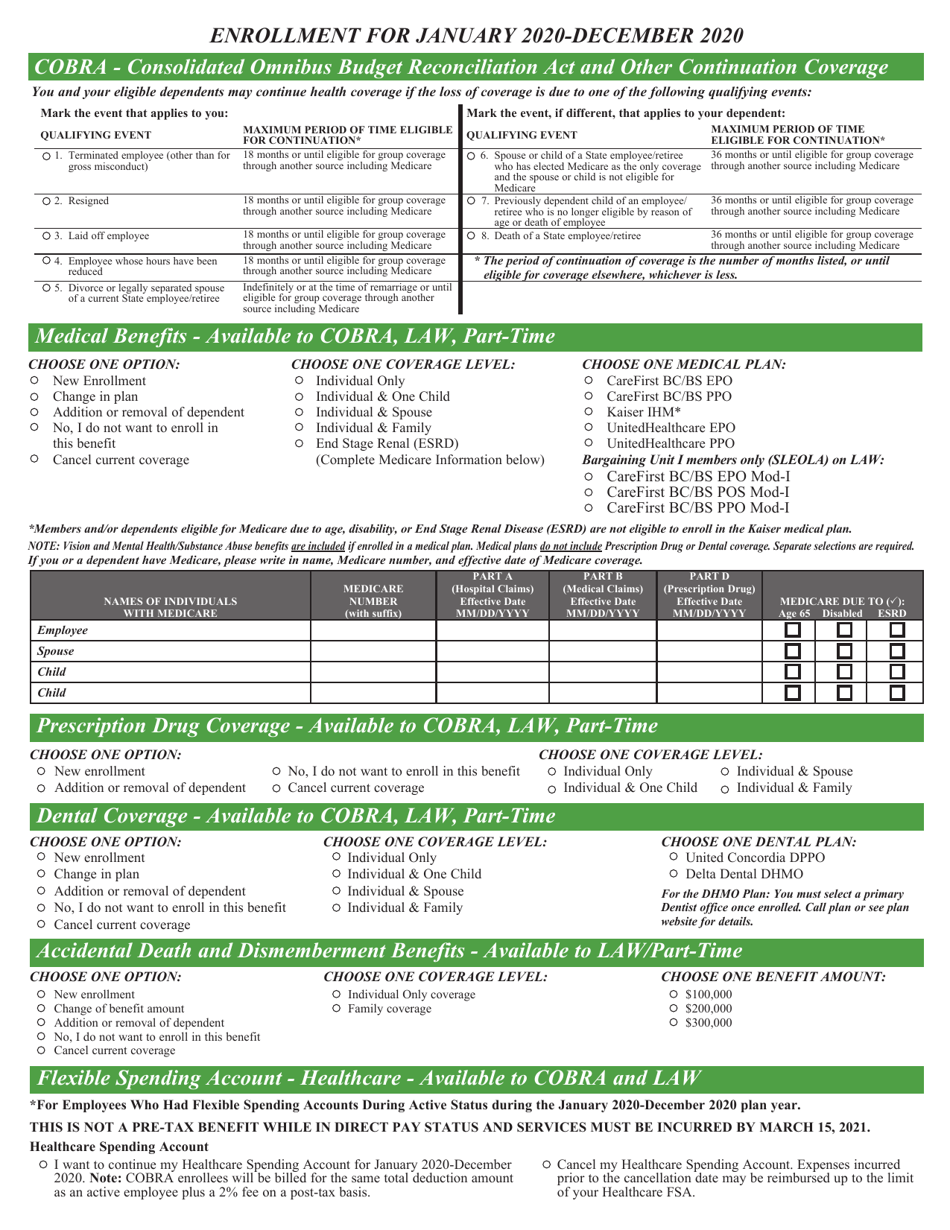

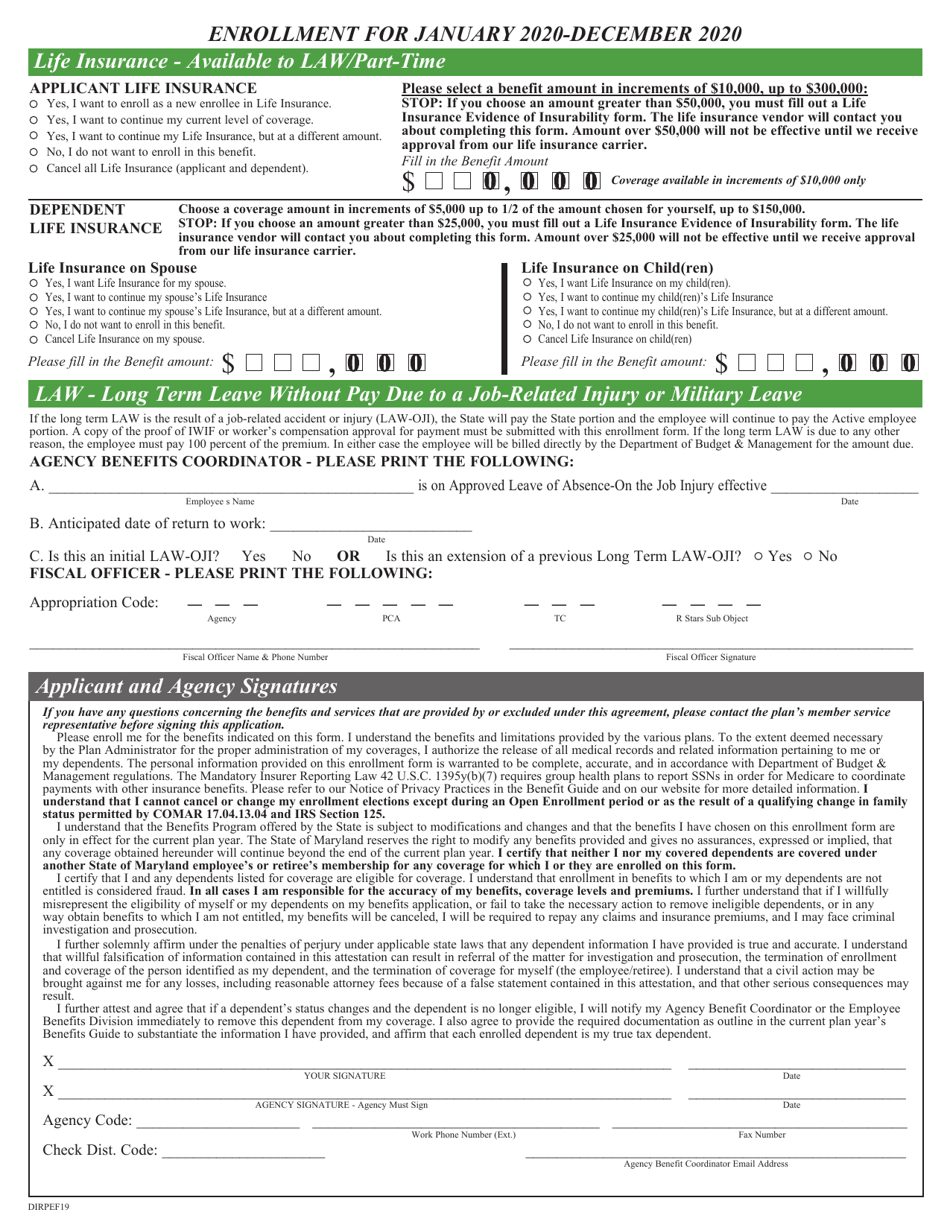

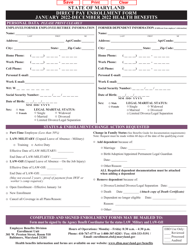

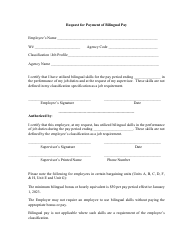

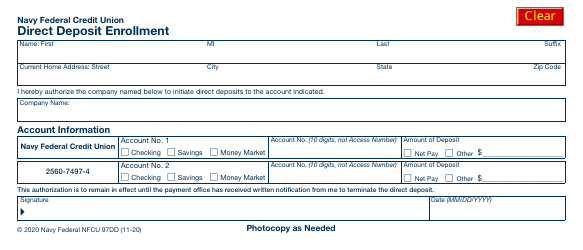

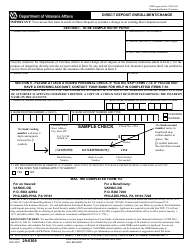

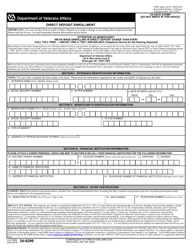

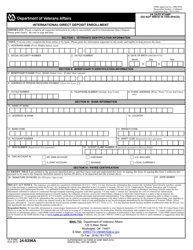

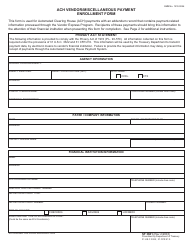

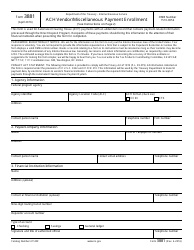

Direct Pay Enrollment Form - Maryland

Direct Pay Enrollment Form is a legal document that was released by the Maryland Department of Budget and Management - a government authority operating within Maryland.

FAQ

Q: What is the Direct Pay Enrollment Form?

A: The Direct Pay Enrollment Form is a document used to enroll in the Direct Pay program in Maryland.

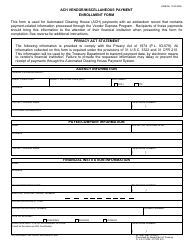

Q: What is the Direct Pay program?

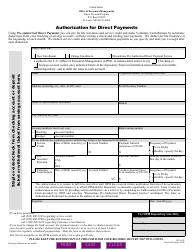

A: The Direct Pay program is a method of electronic payment that allows individuals to pay their taxes directly from their bank account.

Q: Who can use the Direct Pay program?

A: Any individual who owes taxes to the state of Maryland can use the Direct Pay program to make their payment.

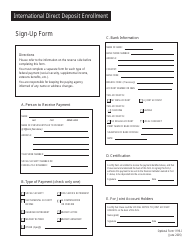

Q: How do I enroll in the Direct Pay program?

A: To enroll in the Direct Pay program, you need to fill out and submit the Direct Pay Enrollment Form.

Q: Are there any fees for using the Direct Pay program?

A: No, there are no fees for using the Direct Pay program to make your tax payment.

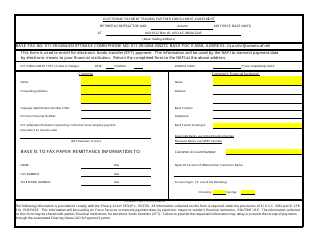

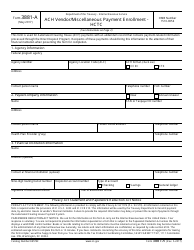

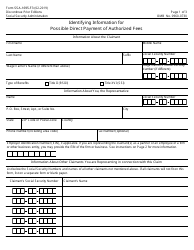

Q: What information do I need to provide on the Direct Pay Enrollment Form?

A: You will need to provide your personal information, including your name, address, social security number, and bank account details.

Q: How long does it take to process the Direct Pay Enrollment Form?

A: The processing time for the Direct Pay Enrollment Form varies, but it usually takes a few business days.

Q: Can I cancel my enrollment in the Direct Pay program?

A: Yes, you can cancel your enrollment in the Direct Pay program by contacting the Maryland Comptroller's Office.

Q: Is the Direct Pay program secure?

A: Yes, the Direct Pay program is secure. The Maryland Comptroller's Office uses industry-standard security measures to protect your personal and financial information.

Form Details:

- The latest edition currently provided by the Maryland Department of Budget and Management;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Maryland Department of Budget and Management.