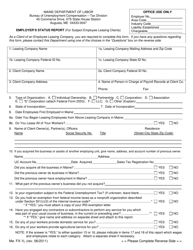

This version of the form is not currently in use and is provided for reference only. Download this version of

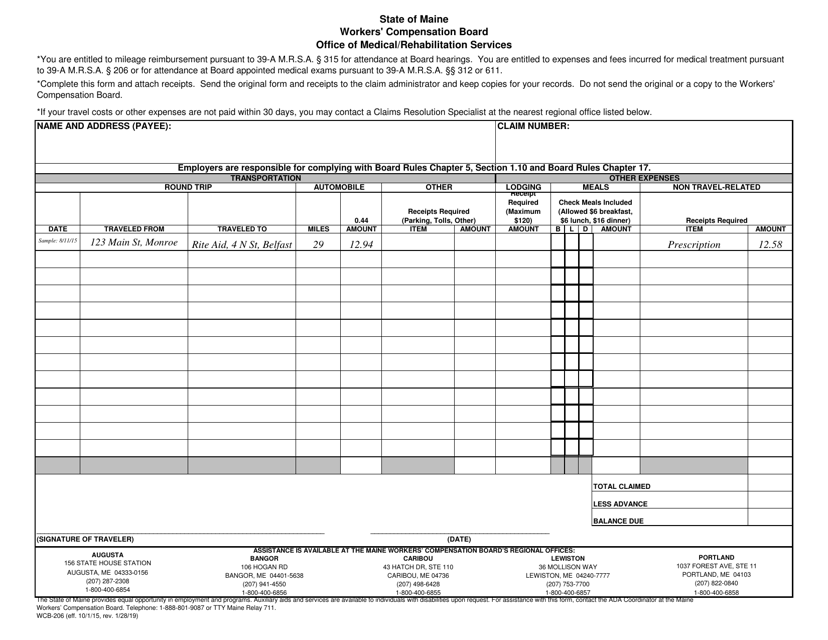

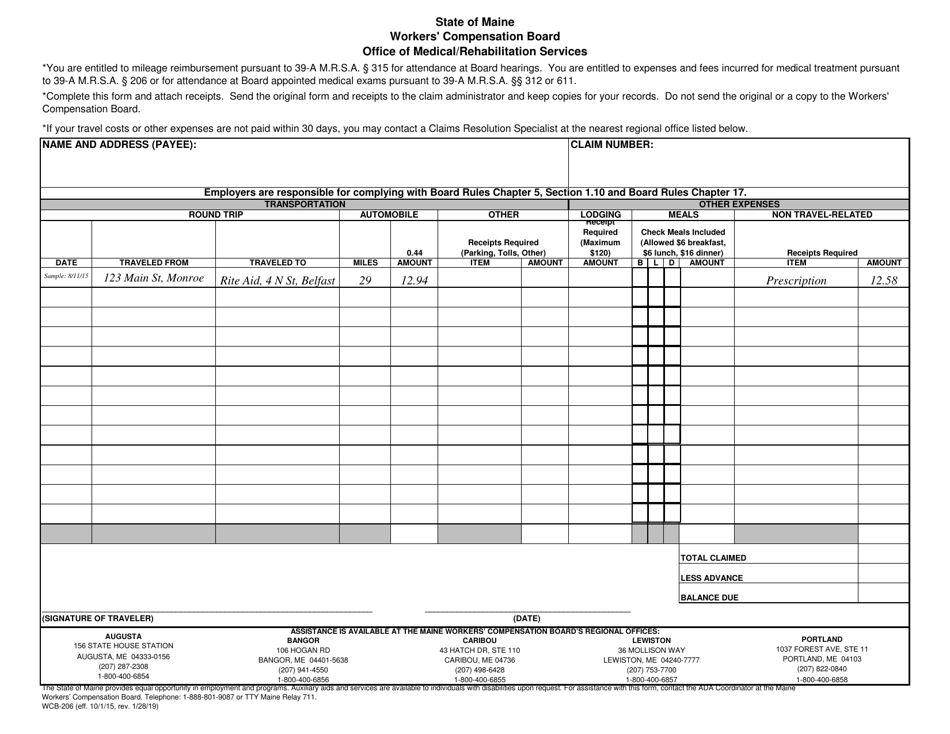

Form WCB-206

for the current year.

Form WCB-206 Employee Expense Form - Maine

What Is Form WCB-206?

This is a legal form that was released by the Maine Workers' Compensation Board - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the WCB-206 Employee Expense Form?

A: The WCB-206 Employee Expense Form is a form used by employees in Maine to report expenses they incurred while performing work for their employer.

Q: Who needs to fill out the WCB-206 Employee Expense Form?

A: Employees in Maine who have incurred expenses related to their work and are seeking reimbursement from their employer need to fill out the WCB-206 Employee Expense Form.

Q: What kind of expenses can be reported on the WCB-206 Employee Expense Form?

A: Expenses such as mileage, travel, meals, and supplies that were necessary for work-related tasks can be reported on the WCB-206 Employee Expense Form.

Q: When should the WCB-206 Employee Expense Form be submitted?

A: The WCB-206 Employee Expense Form should be submitted to the employer within a reasonable time frame after the expenses were incurred, typically within 30 days.

Q: What happens after I submit the WCB-206 Employee Expense Form?

A: After you submit the WCB-206 Employee Expense Form, your employer will review the expenses and determine if they are eligible for reimbursement. If approved, you will be reimbursed for the expenses.

Q: Are there any specific guidelines for filling out the WCB-206 Employee Expense Form?

A: Yes, the WCB-206 Employee Expense Form has instructions on how to fill it out correctly. Make sure to carefully follow these guidelines to ensure accurate reporting of your expenses.

Form Details:

- Released on January 28, 2019;

- The latest edition provided by the Maine Workers' Compensation Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form WCB-206 by clicking the link below or browse more documents and templates provided by the Maine Workers' Compensation Board.