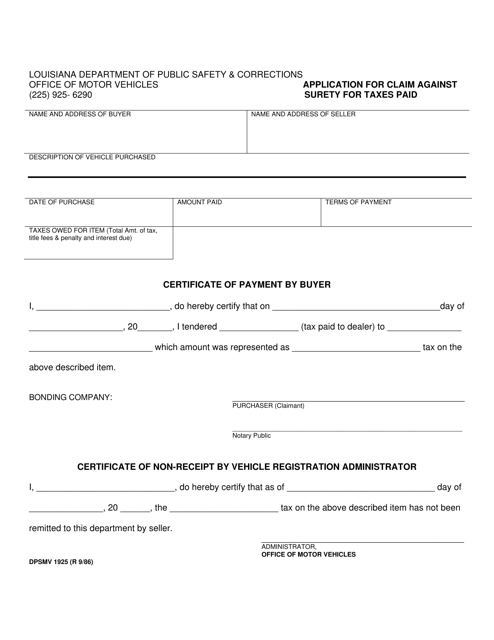

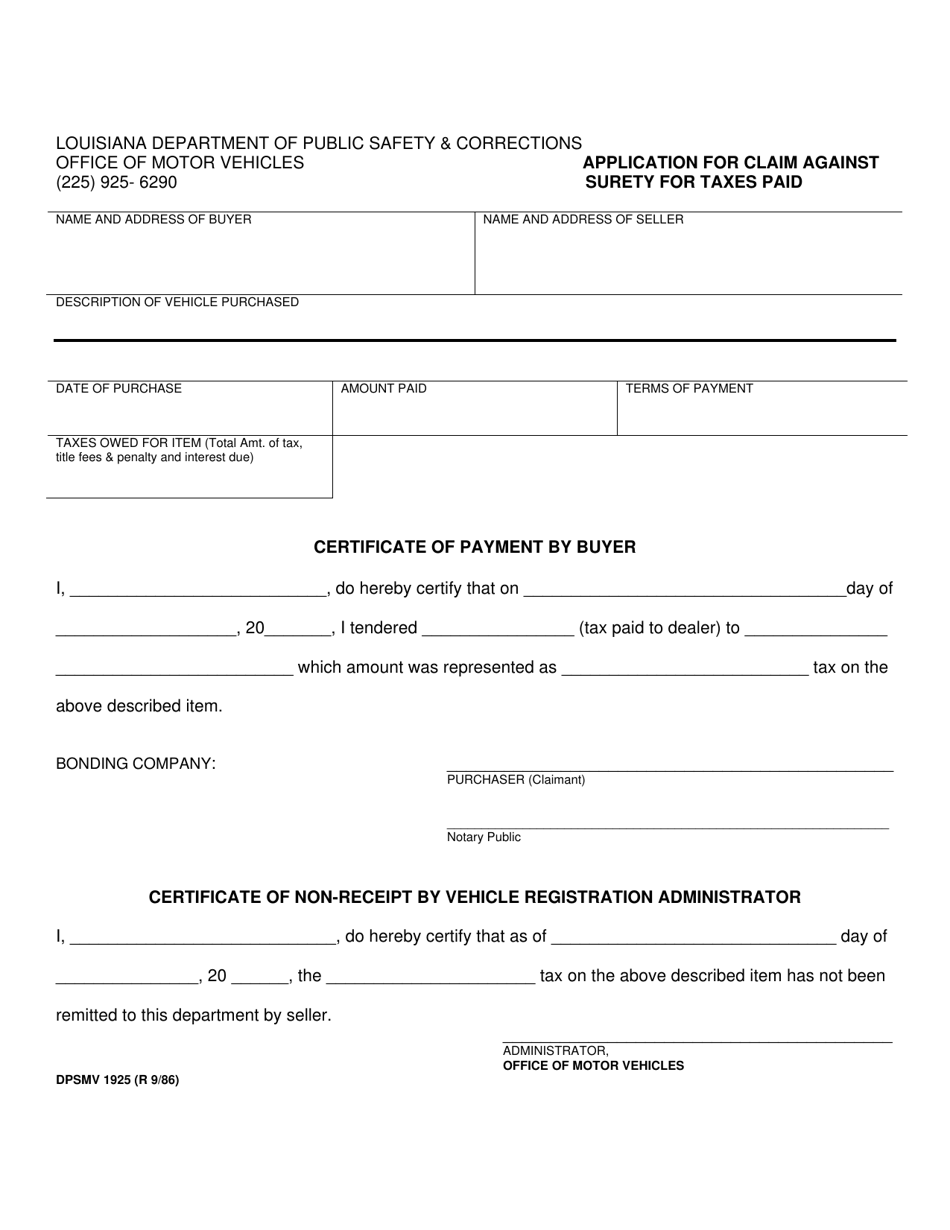

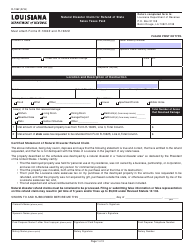

Form DPSMV1925 Application for Claim Against Surety for Taxes Paid - Louisiana

What Is Form DPSMV1925?

This is a legal form that was released by the Louisiana Department of Public Safety & Corrections - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the DPSMV1925 form?

A: The DPSMV1925 form is an Application for Claim Against Surety for Taxes Paid in Louisiana.

Q: What is the purpose of the DPSMV1925 form?

A: The purpose of the DPSMV1925 form is to request a refund for taxes paid on a vehicle that was later determined to have been exempt from those taxes.

Q: Who can submit the DPSMV1925 form?

A: The DPSMV1925 form can be submitted by individuals who have paid taxes on a vehicle that was later determined to be exempt, such as government entities or diplomatic personnel.

Q: Is there a fee to submit the DPSMV1925 form?

A: No, there is no fee to submit the DPSMV1925 form.

Q: What documents do I need to include with the DPSMV1925 form?

A: Along with the DPSMV1925 form, you will need to include supporting documents such as proof of payment, proof of exemption, and any other relevant documentation to support your claim.

Q: How long does it take to process the DPSMV1925 form?

A: The processing time for the DPSMV1925 form can vary, but it typically takes several weeks to receive a response.

Q: Can I track the status of my DPSMV1925 form?

A: Yes, you can contact the Louisiana Office of Motor Vehicles, Surety Division to inquire about the status of your DPSMV1925 form.

Form Details:

- Released on September 1, 1986;

- The latest edition provided by the Louisiana Department of Public Safety & Corrections;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DPSMV1925 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Public Safety & Corrections.