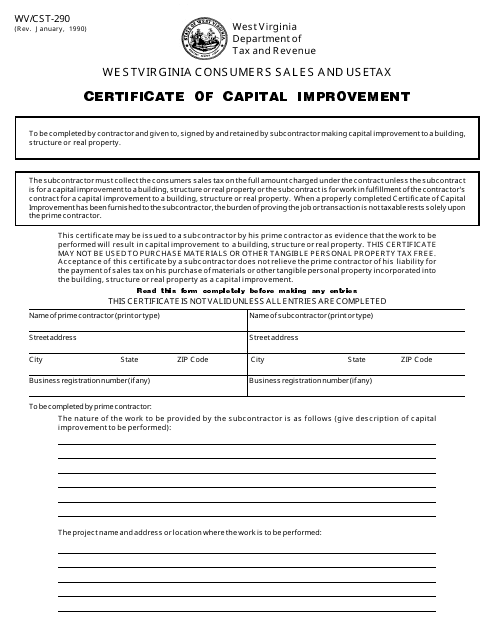

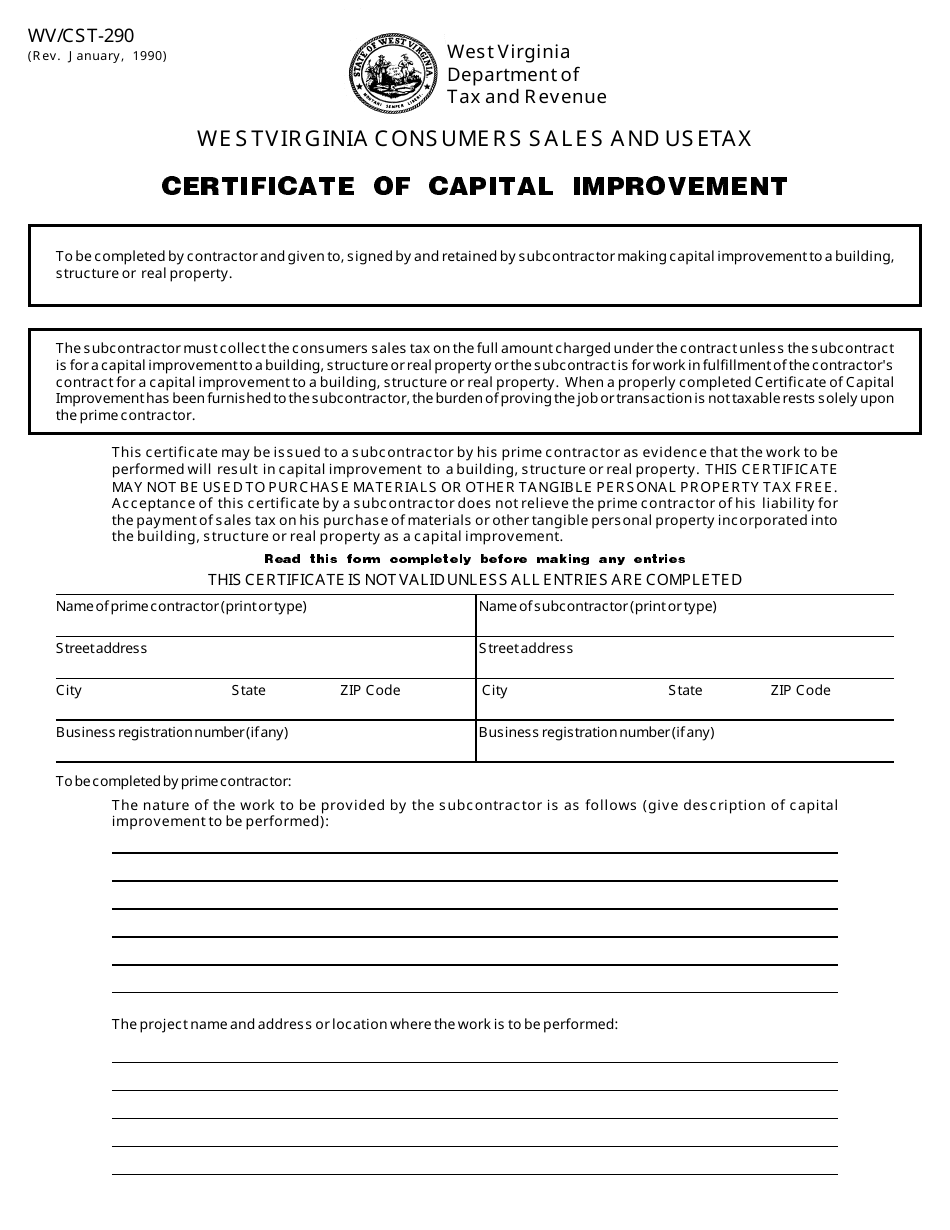

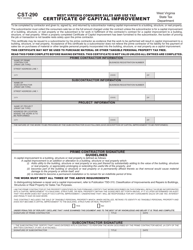

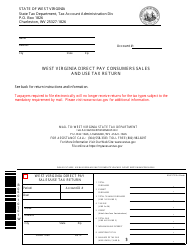

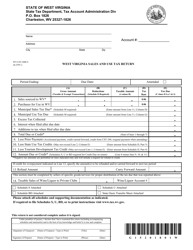

Form WV / CST-290 Certificate of Capital Improvement - West Virginia

What Is Form WV/CST-290?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WV/CST-290?

A: Form WV/CST-290 is the Certificate of Capital Improvement form used in the state of West Virginia.

Q: What is the purpose of Form WV/CST-290?

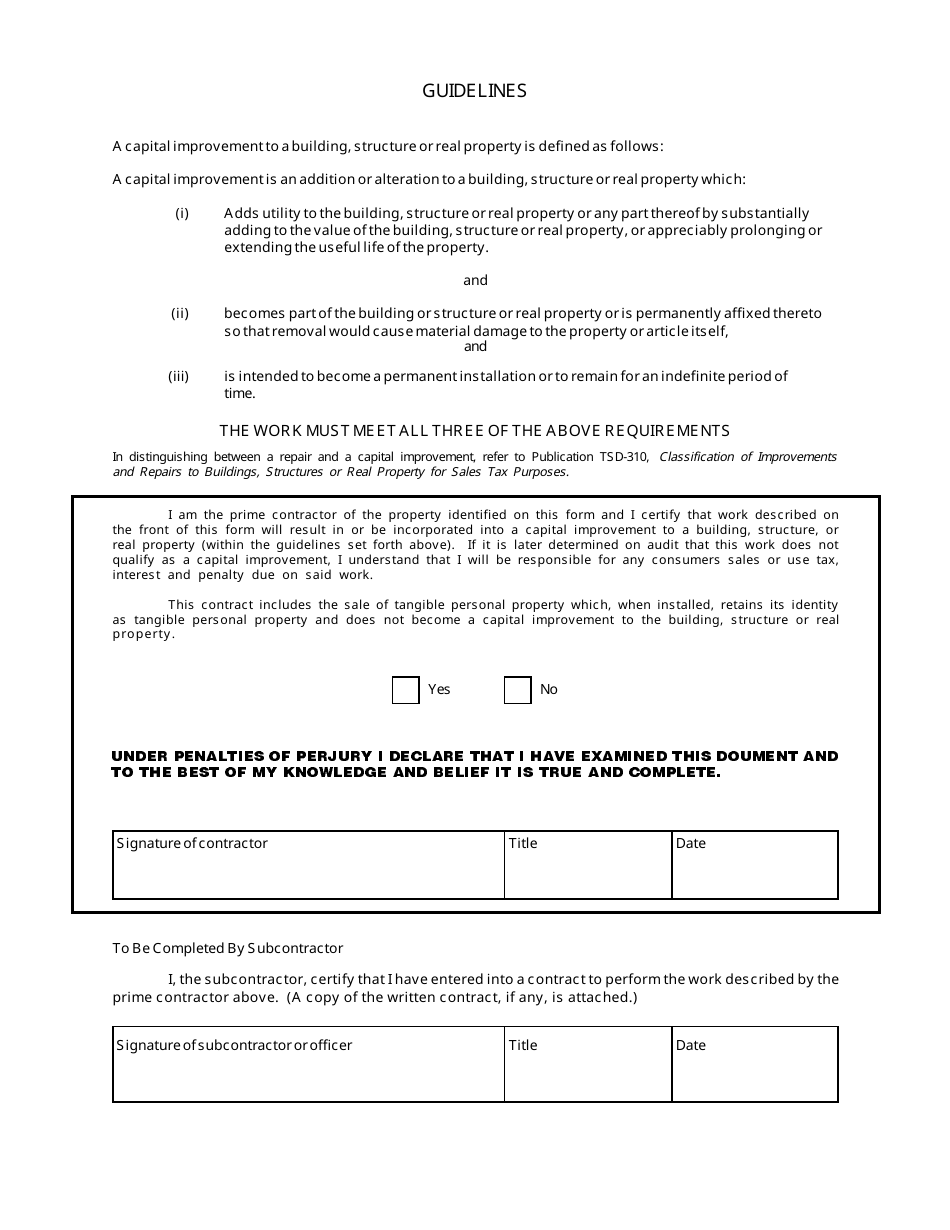

A: The purpose of Form WV/CST-290 is to certify that certain purchases or improvements made to real property qualify as capital improvements and are therefore eligible for sales tax exemption.

Q: Who needs to file Form WV/CST-290?

A: Property owners or contractors who have made qualifying capital improvements to real property in West Virginia need to file Form WV/CST-290.

Q: What qualifies as a capital improvement?

A: A capital improvement refers to the construction, reconstruction, enlargement, or remodeling of a building or other structure.

Q: How do I fill out Form WV/CST-290?

A: You need to provide information about the property owner, contractor, and details of the capital improvements made on the form.

Q: Is there a fee to file Form WV/CST-290?

A: No, there is no fee to file Form WV/CST-290.

Q: When should Form WV/CST-290 be filed?

A: Form WV/CST-290 should be filed within 90 days from the completion of the capital improvement project.

Form Details:

- Released on January 1, 1990;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WV/CST-290 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.