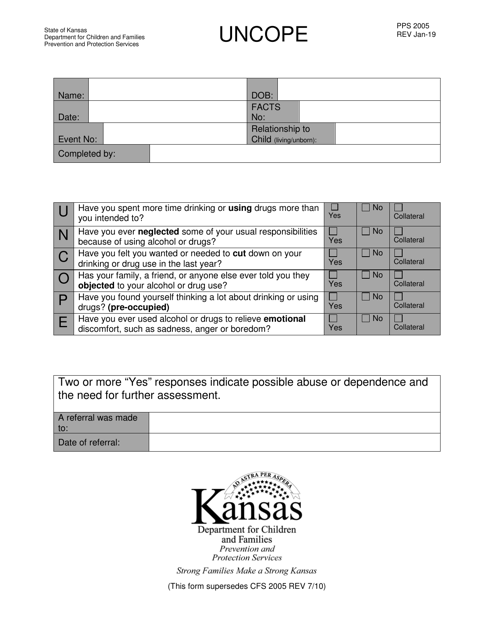

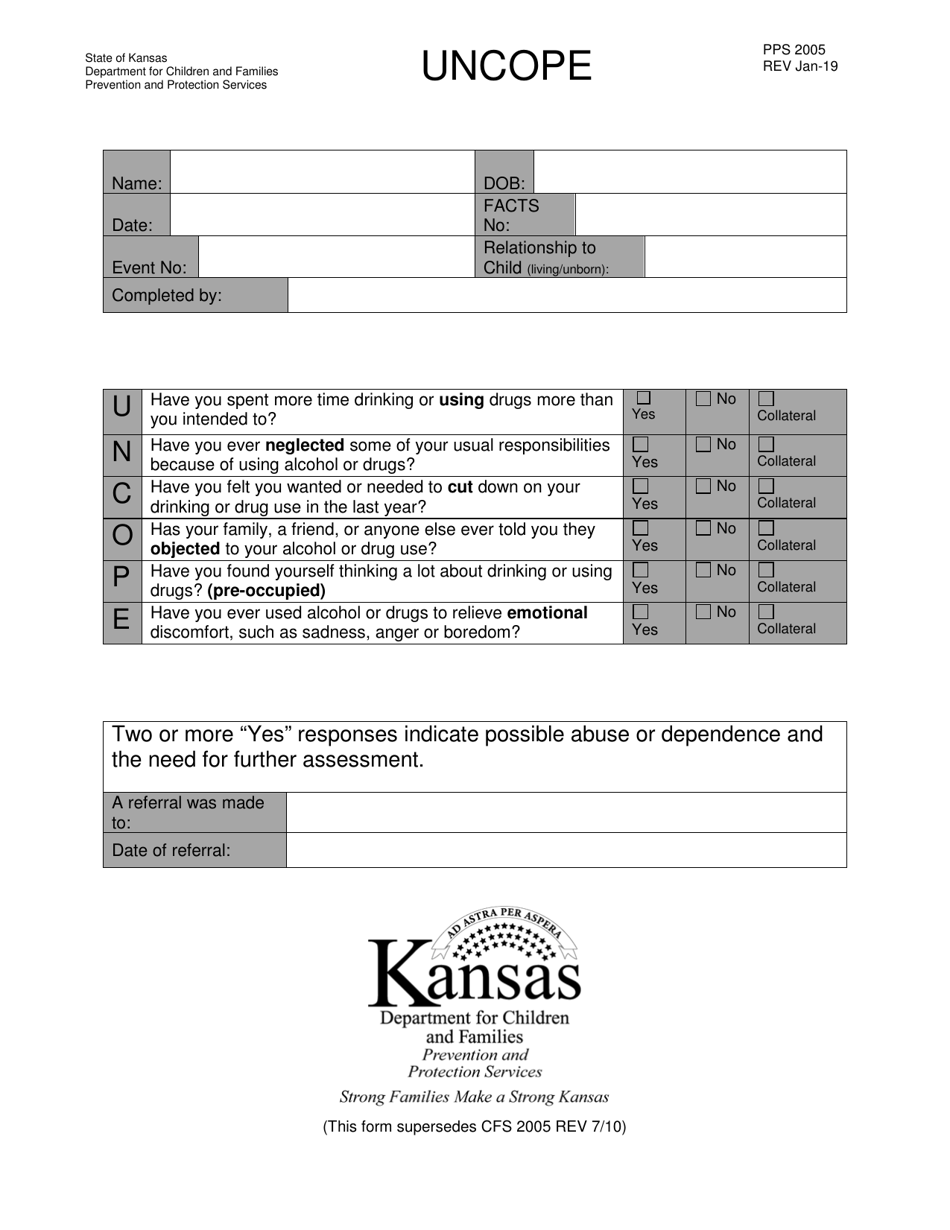

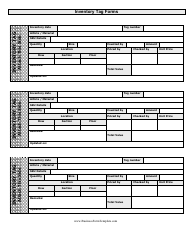

Form PPS2005 Uncope - Kansas

What Is Form PPS2005?

This is a legal form that was released by the Kansas Department for Children and Families - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PPS2005?

A: Form PPS2005 is a form used for property tax exemptions in Kansas.

Q: What is Uncope?

A: Uncope is the acronym for the Uniform Capitalization of California Partnership Exchanges.

Q: Who is eligible to use Form PPS2005?

A: Any property owner in Kansas who meets the eligibility requirements can use Form PPS2005.

Q: What is the purpose of Form PPS2005?

A: Form PPS2005 is used to apply for property tax exemptions in Kansas.

Q: What are the eligibility requirements for property tax exemptions in Kansas?

A: Eligibility requirements vary depending on the type of exemption, but generally include ownership and use requirements.

Q: What types of property tax exemptions are available in Kansas?

A: Kansas offers various exemptions, including exemptions for veterans, disabled individuals, and religious organizations.

Q: Can I claim multiple exemptions on Form PPS2005?

A: Yes, you can claim multiple exemptions on Form PPS2005 as long as you meet the eligibility requirements for each exemption.

Q: Is there a deadline for submitting Form PPS2005?

A: Yes, the deadline for submitting Form PPS2005 is usually March 15th of each year.

Q: Are property tax exemptions permanent?

A: Property tax exemptions in Kansas are typically granted for a specified period of time and may need to be renewed periodically.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Kansas Department for Children and Families;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PPS2005 by clicking the link below or browse more documents and templates provided by the Kansas Department for Children and Families.