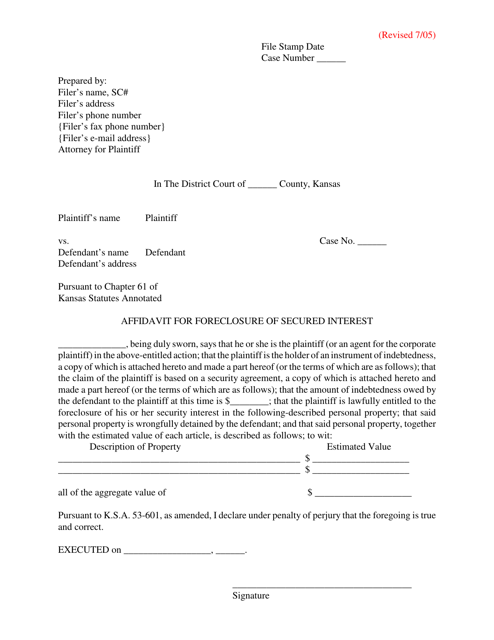

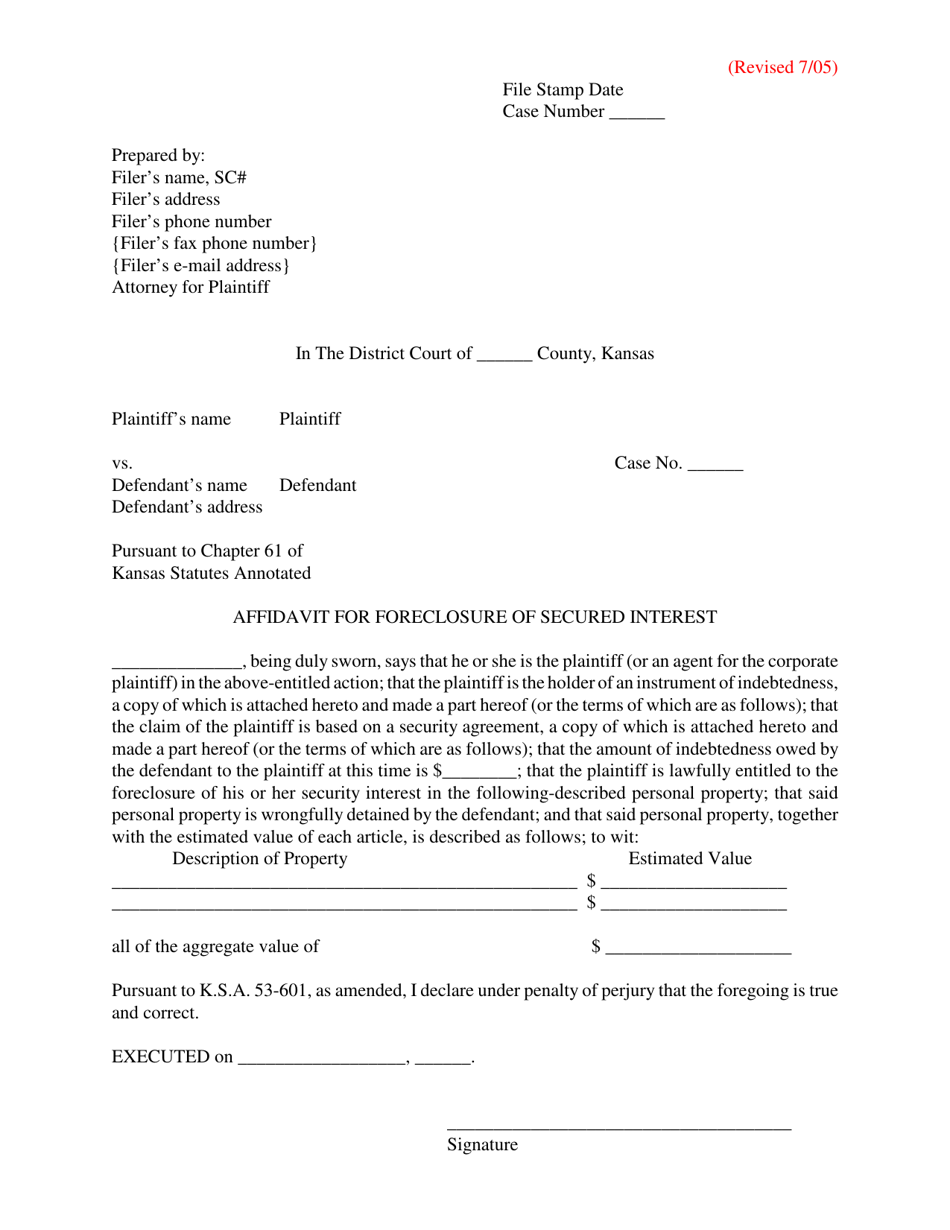

Affidavit for Foreclosure of Secured Interest - Kansas

Affidavit for Foreclosure of Secured Interest is a legal document that was released by the Kansas District Courts - a government authority operating within Kansas.

FAQ

Q: What is an affidavit for foreclosure of secured interest?

A: An affidavit for foreclosure of secured interest is a legal document used in Kansas to initiate the process of foreclosing on a secured interest, typically in relation to a mortgage or lien on real property.

Q: Why would someone file an affidavit for foreclosure of secured interest?

A: Someone would file an affidavit for foreclosure of secured interest if the borrower has failed to make required payments on a loan or is otherwise in default, and the lender wants to initiate the foreclosure process to recover the property.

Q: Who can file an affidavit for foreclosure of secured interest in Kansas?

A: Generally, the lender or the party who holds the secured interest can file an affidavit for foreclosure of secured interest in Kansas.

Q: What is the purpose of filing an affidavit for foreclosure of secured interest?

A: The purpose of filing an affidavit for foreclosure of secured interest is to officially start the legal process of foreclosing on a property to recover the debt owed.

Q: What steps are involved in the foreclosure process in Kansas?

A: The foreclosure process in Kansas typically involves filing the affidavit for foreclosure of secured interest, providing notice to the borrower, holding a foreclosure sale, and distributing the proceeds.

Q: What happens after the foreclosure sale?

A: After the foreclosure sale, the proceeds are used to satisfy the debt owed, in order of priority. Any remaining funds may be returned to the borrower if applicable.

Form Details:

- Released on July 1, 2005;

- The latest edition currently provided by the Kansas District Courts;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Kansas District Courts.