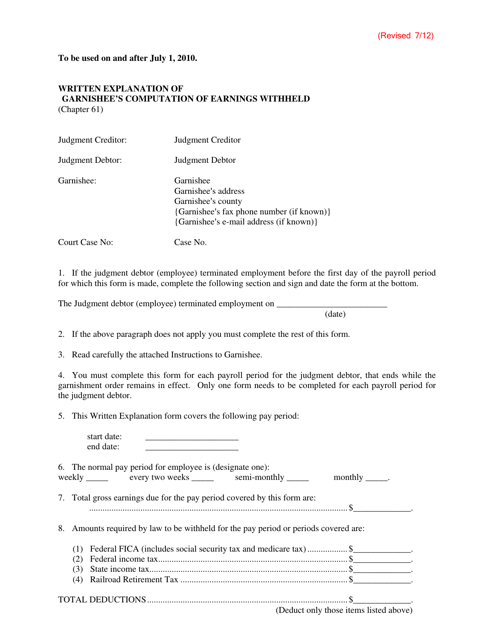

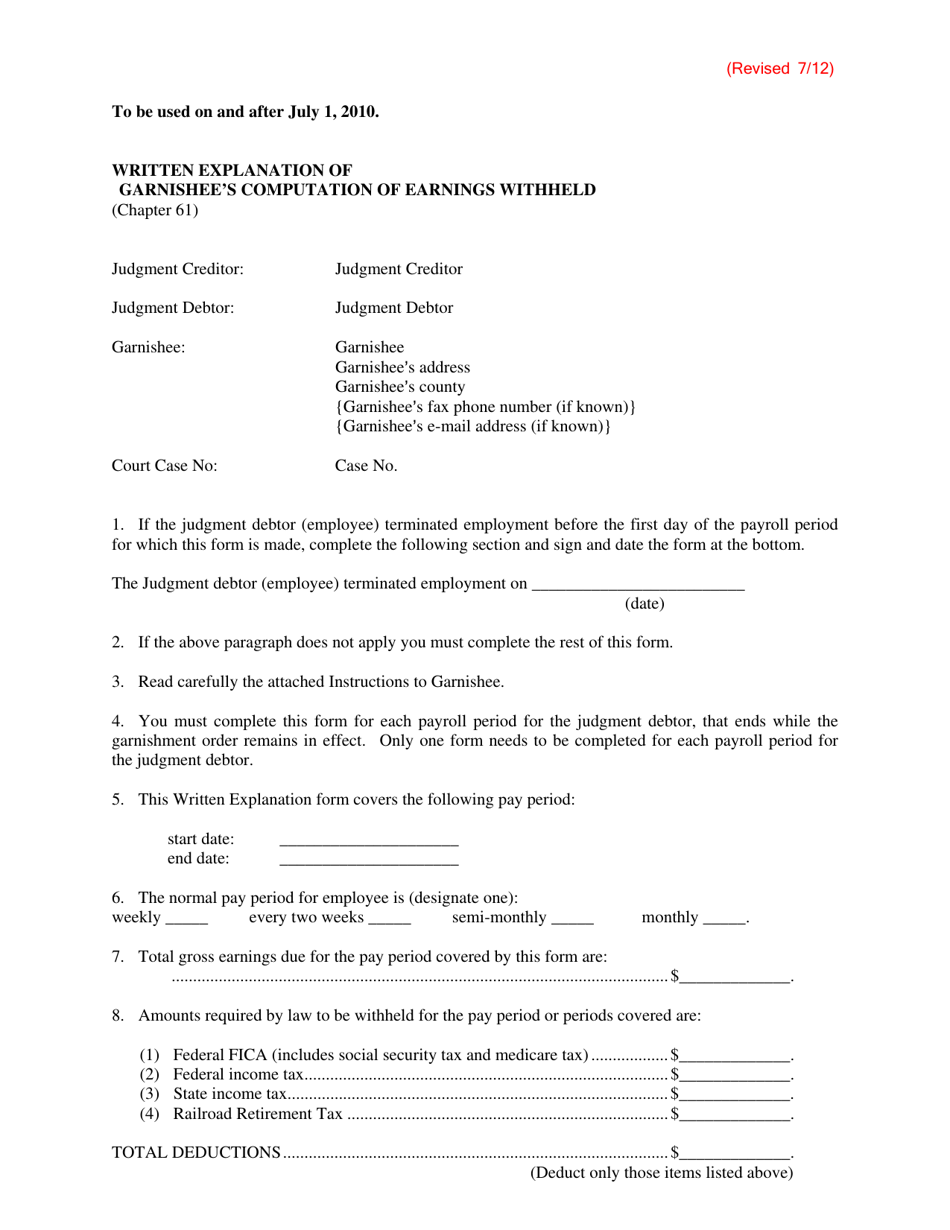

Written Explanation of Garnishee's Computation of Earnings Withheld - Kansas

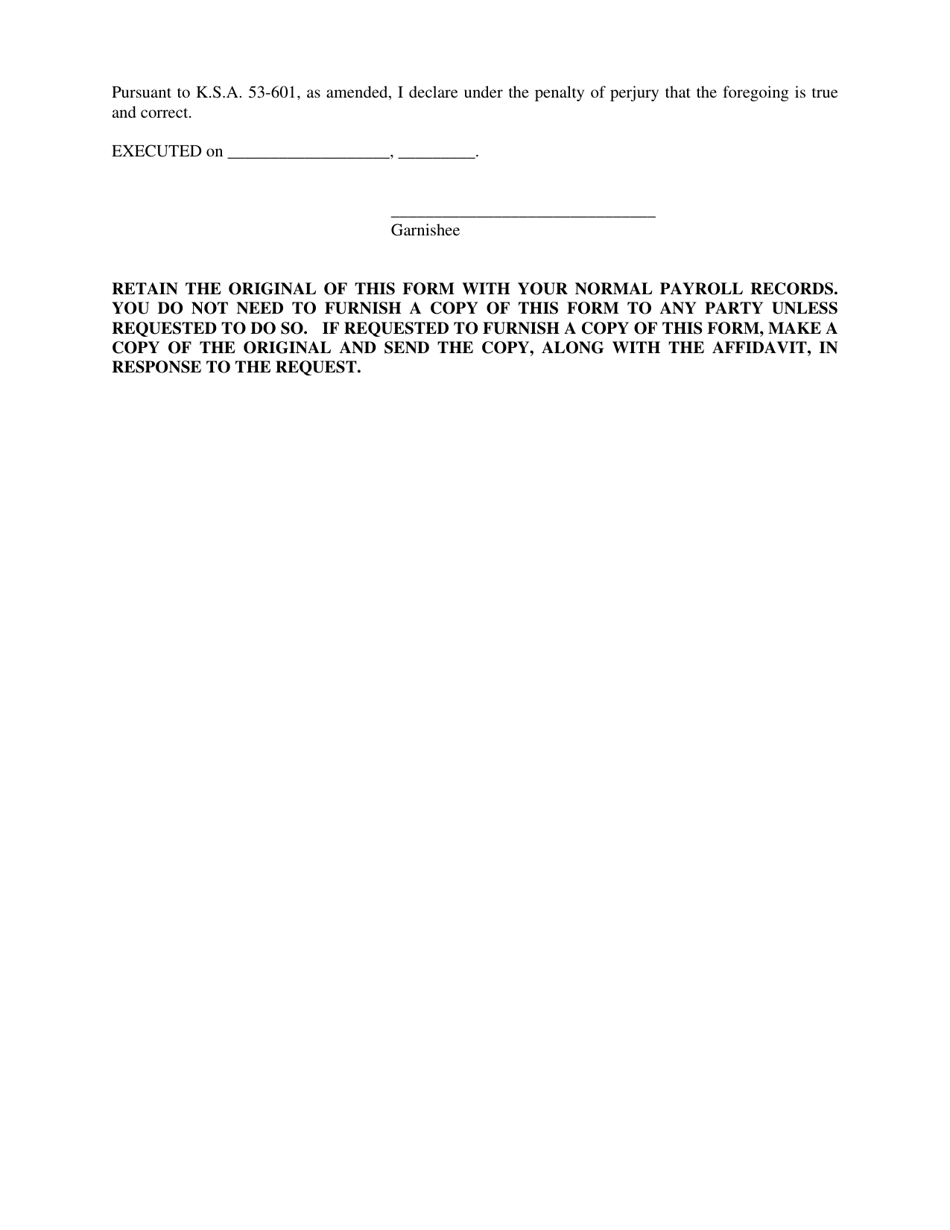

Written Explanation of Garnishee's Computation of Earnings Withheld is a legal document that was released by the Kansas Judicial Council - a government authority operating within Kansas.

FAQ

Q: What is a garnishment?

A: A garnishment is a legal process where a creditor collects a debt owed by an individual by obtaining a court order to have a portion of their wages or assets withheld.

Q: What is a garnishee?

A: A garnishee is the individual or entity that holds the funds or property that will be withheld to satisfy a debt.

Q: What are earnings?

A: Earnings refer to the income or wages earned by an individual through employment.

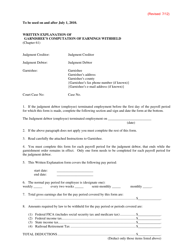

Q: How are earnings withheld in Kansas?

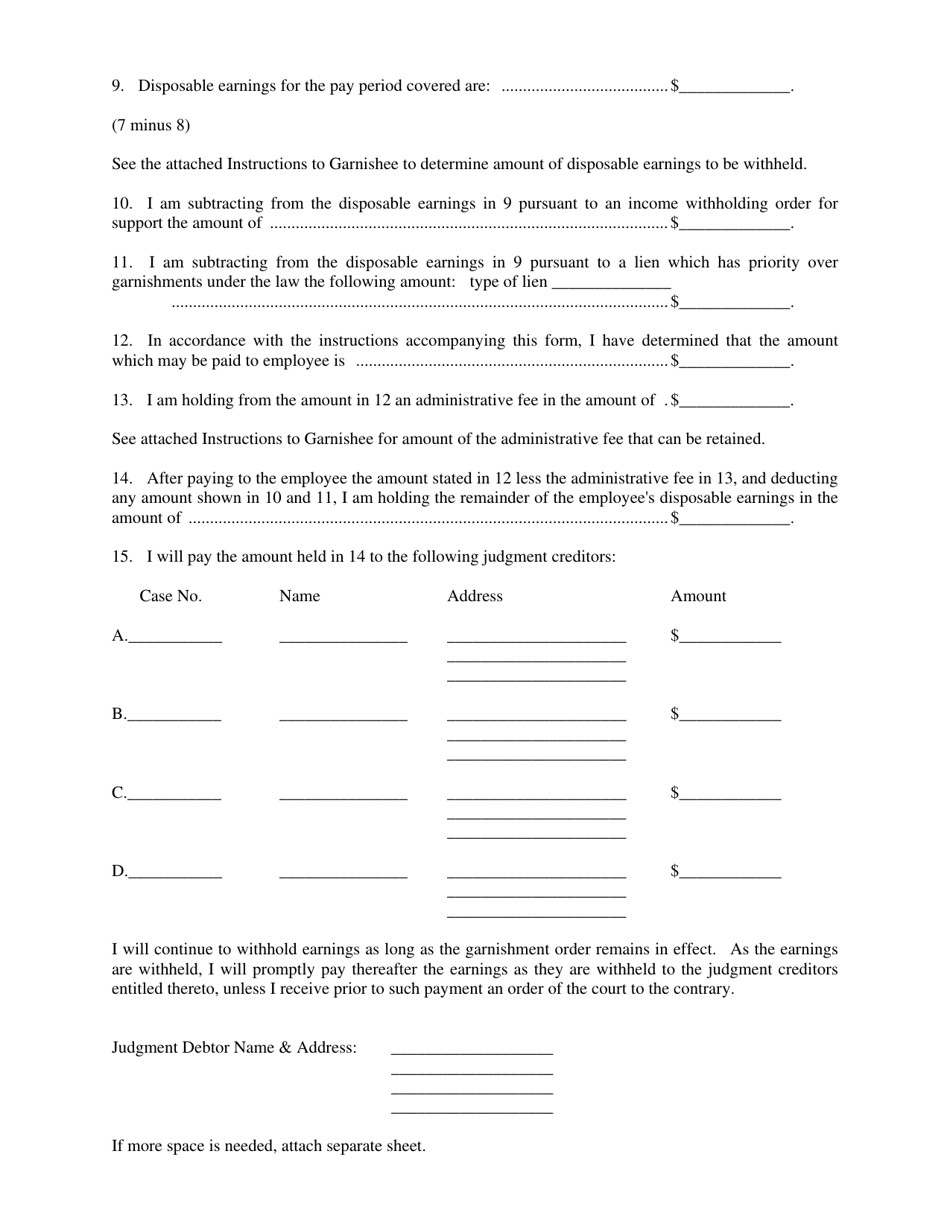

A: In Kansas, earnings are withheld based on a set formula that calculates the amount that can be withheld.

Q: How is the garnishee's computation of earnings withheld determined?

A: The garnishee's computation of earnings withheld is determined by multiplying the disposable earnings of the debtor by a certain percentage.

Q: What are disposable earnings?

A: Disposable earnings are the portion of an individual's wages or salary that is left after legally required deductions such as taxes and social security.

Q: What is the maximum percentage that can be withheld from earnings in Kansas?

A: In Kansas, the maximum percentage that can be withheld from earnings is 25% of disposable earnings or the amount by which disposable earnings exceed 30 times the federal minimum wage, whichever is less.

Q: Are there any exceptions to the maximum withholding limit in Kansas?

A: Yes, there are exceptions to the maximum withholding limit in Kansas. Some types of debts, such as child support or tax obligations, may have higher limits or different rules for withholding.

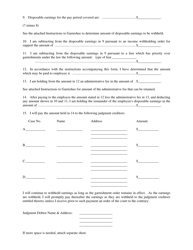

Q: Can an individual challenge a garnishment in Kansas?

A: Yes, an individual has the right to challenge a garnishment in Kansas. They can seek legal advice or representation to understand their rights and options.

Q: Is garnishment the only method for collecting a debt in Kansas?

A: No, garnishment is not the only method for collecting a debt in Kansas. There are other methods such as liens or asset seizure that creditors may pursue to satisfy a debt.

Form Details:

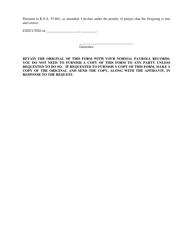

- Released on July 1, 2012;

- The latest edition currently provided by the Kansas Judicial Council;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Kansas Judicial Council.