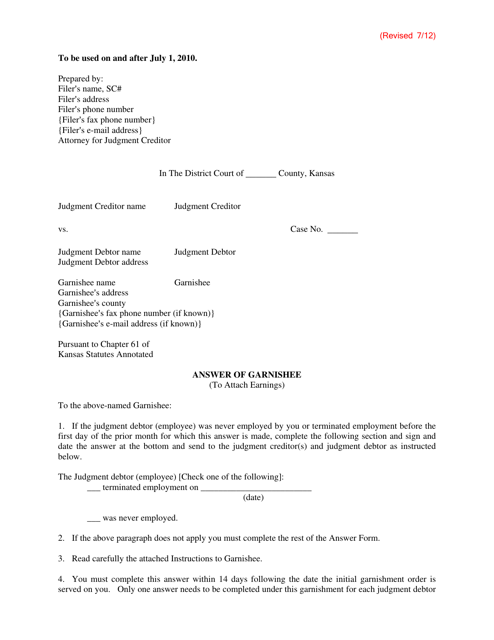

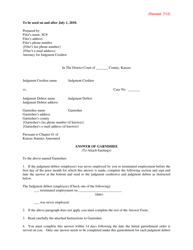

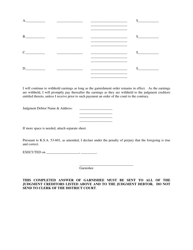

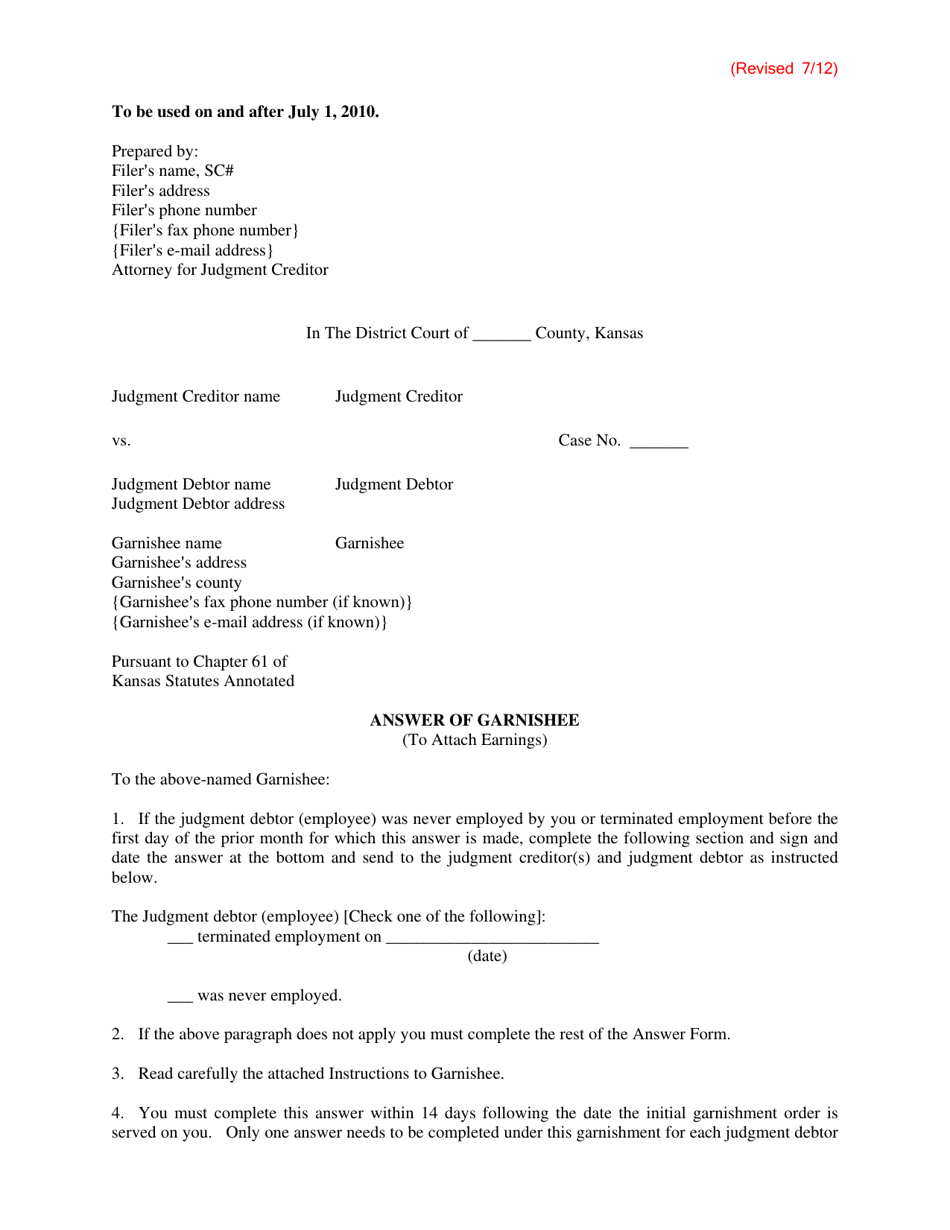

Answer of Garnishee (Earnings) - Kansas

Answer of Garnishee (Earnings) is a legal document that was released by the Kansas District Courts - a government authority operating within Kansas.

FAQ

Q: What is a garnishee (earnings) in Kansas?

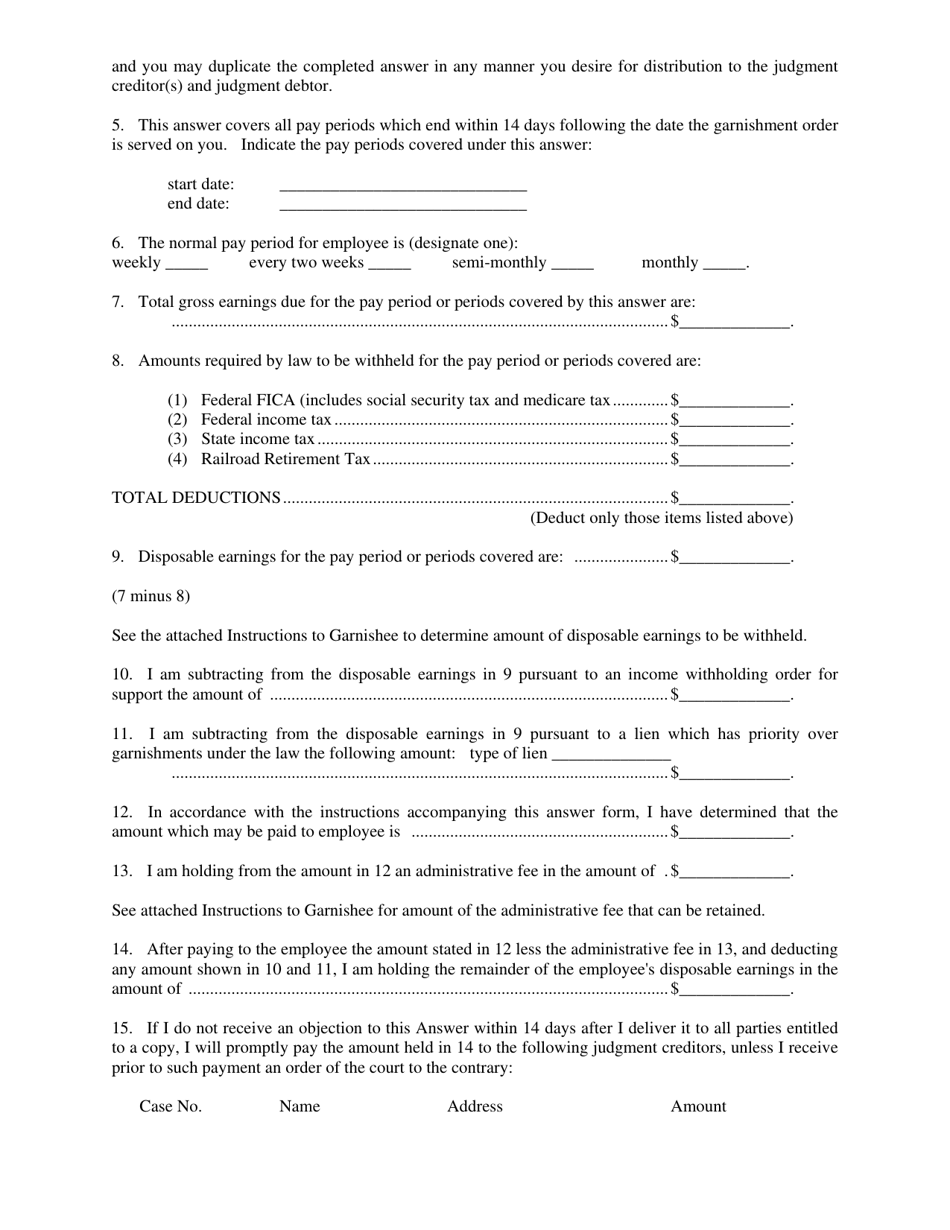

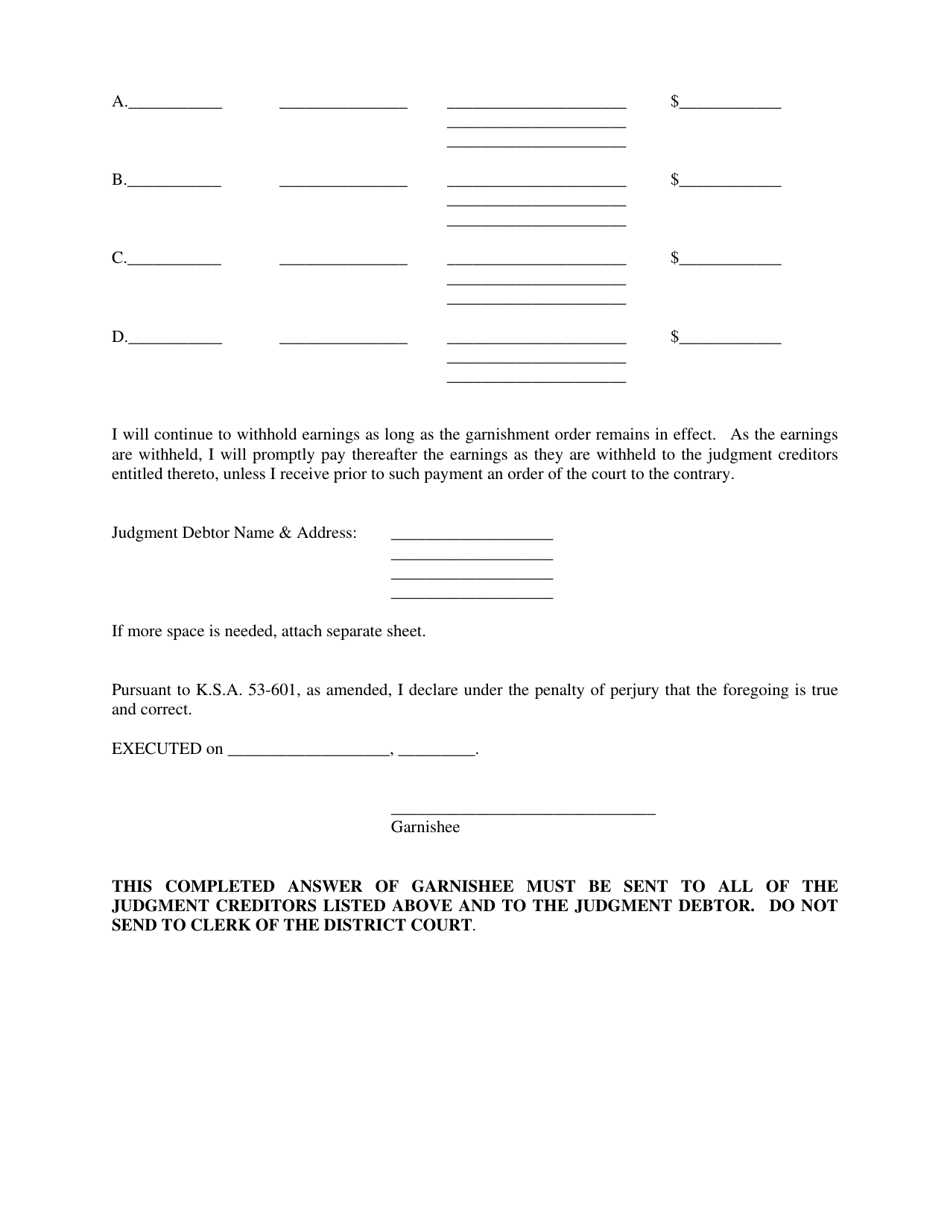

A: A garnishee (earnings) is a legal process in Kansas where a portion of a person's wages are withheld to satisfy a debt.

Q: Can all types of debts be garnished from earnings in Kansas?

A: No, only certain types of debts can be garnished from earnings in Kansas, such as unpaid child support, taxes, and student loans.

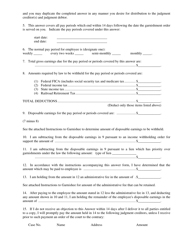

Q: How much of a person's earnings can be garnished in Kansas?

A: In Kansas, up to 25% of a person's disposable earnings can be garnished, or the amount by which their disposable earnings exceed 30 times the federal minimum wage, whichever is less.

Q: Are there any exemptions to garnishment of earnings in Kansas?

A: Yes, certain types of income are exempt from garnishment in Kansas, including social security benefits, certain retirement benefits, and certain public assistance benefits.

Q: What should a person do if they are facing garnishment of their earnings in Kansas?

A: If a person is facing garnishment of their earnings in Kansas, they should seek legal advice and may want to consider options such as negotiating a payment plan or filing for bankruptcy.

Form Details:

- Released on July 1, 2012;

- The latest edition currently provided by the Kansas District Courts;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Kansas District Courts.