This version of the form is not currently in use and is provided for reference only. Download this version of

Form ST-21PEC

for the current year.

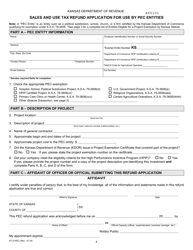

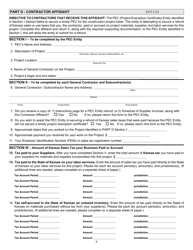

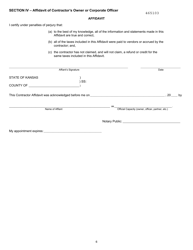

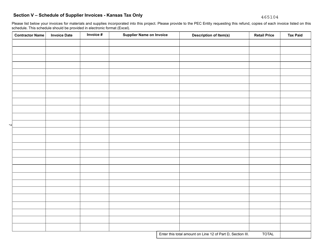

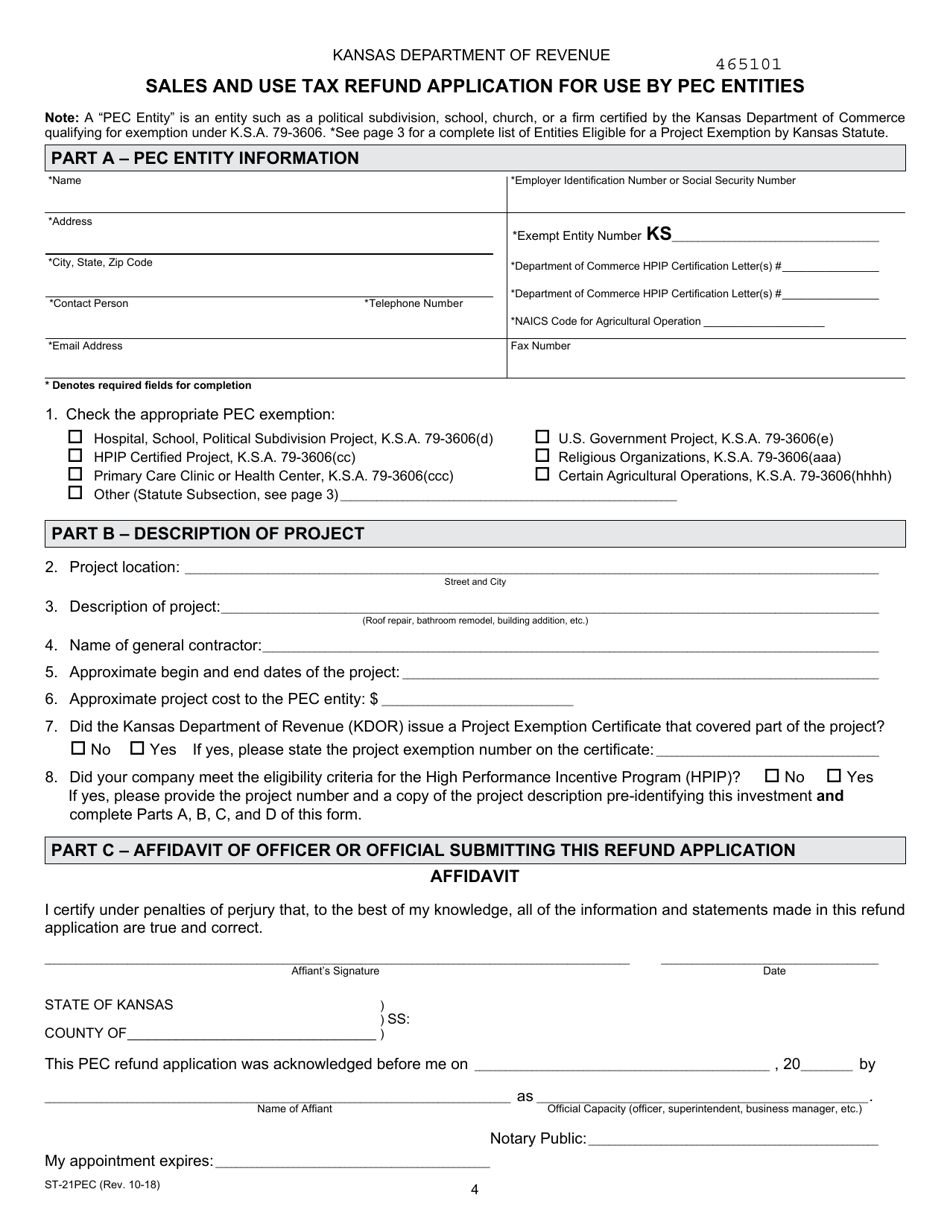

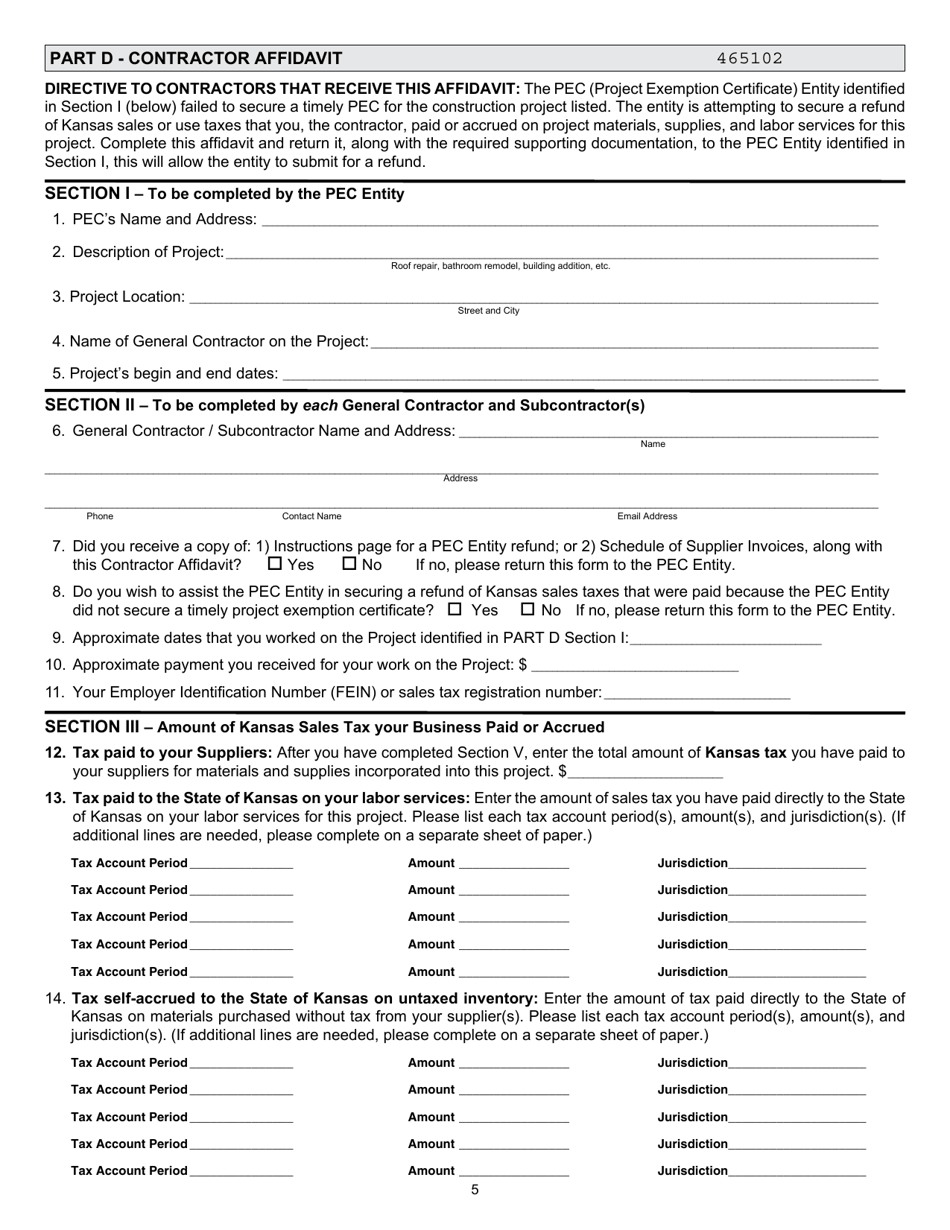

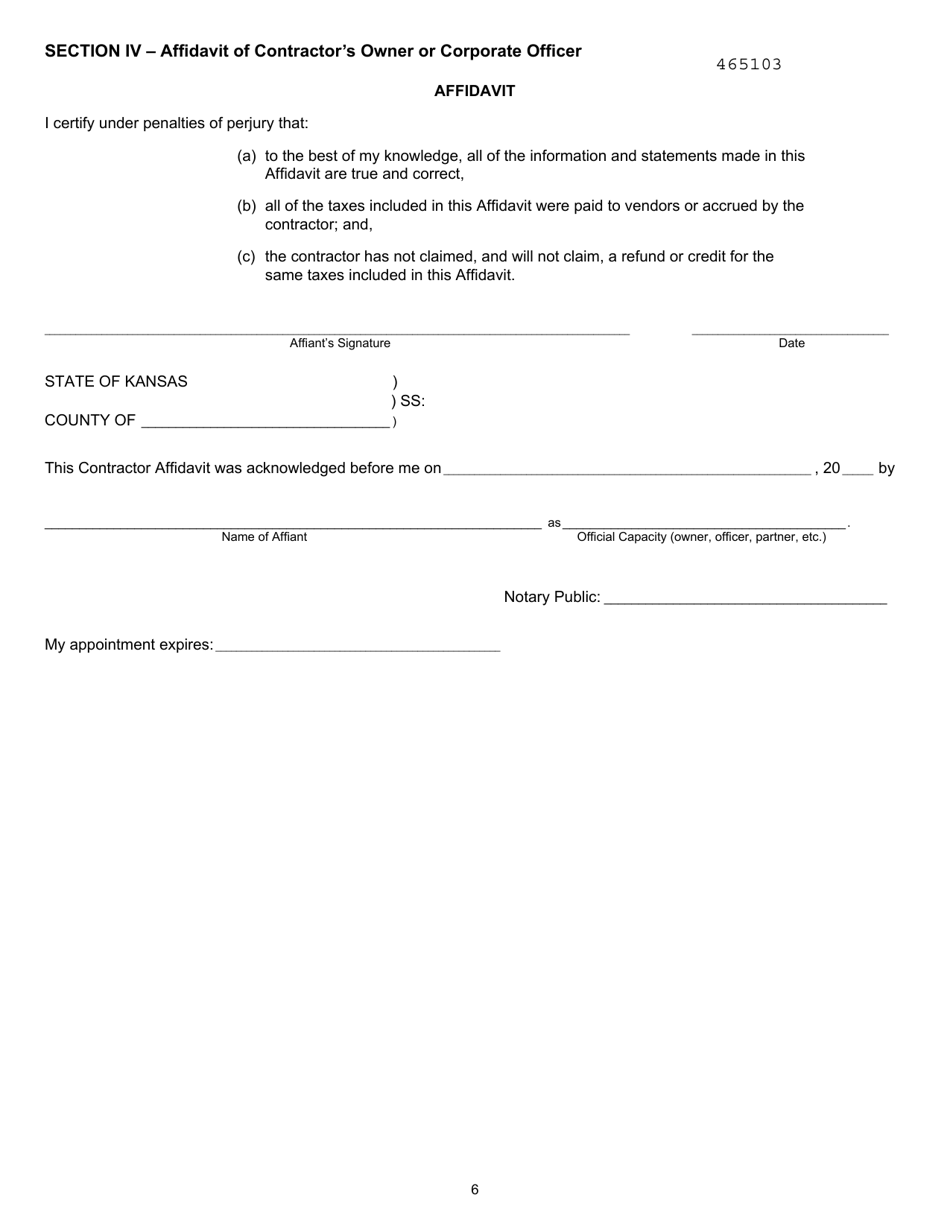

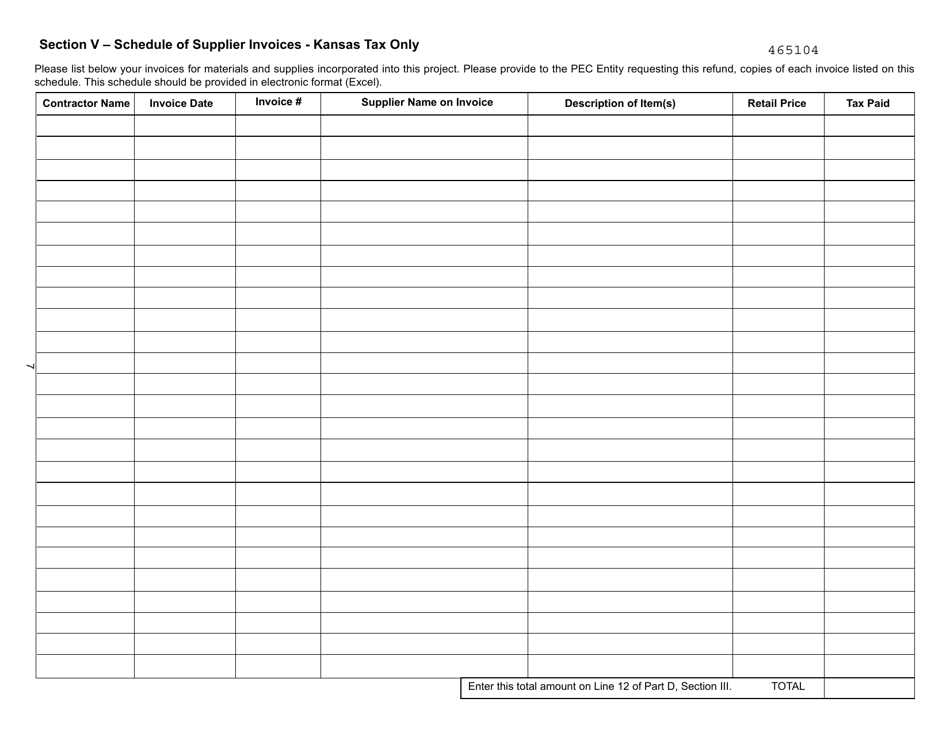

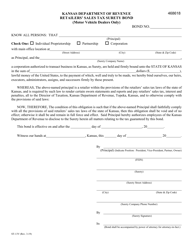

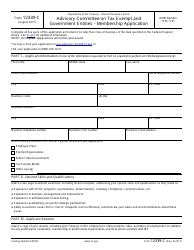

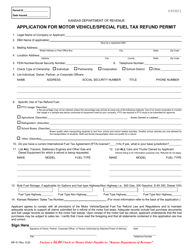

Form ST-21PEC Sales and Use Tax Refund Application for Use by Pec Entities - Kansas

What Is Form ST-21PEC?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

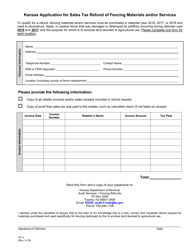

Q: What is the Form ST-21PEC?

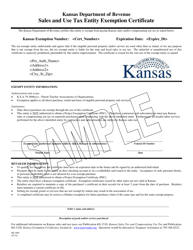

A: Form ST-21PEC is a Sales and Use Tax Refund Application specifically for use by Pec Entities in Kansas.

Q: Who can use the Form ST-21PEC?

A: The Form ST-21PEC can only be used by Pec Entities in Kansas.

Q: What is the purpose of the Form ST-21PEC?

A: The purpose of the Form ST-21PEC is to apply for a refund of sales and use tax paid on select purchases made by Pec Entities.

Q: Can individuals or businesses other than Pec Entities use the Form ST-21PEC?

A: No, the Form ST-21PEC is exclusively for use by Pec Entities and cannot be used by individuals or other businesses.

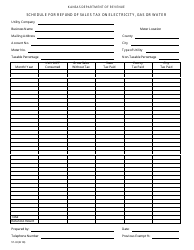

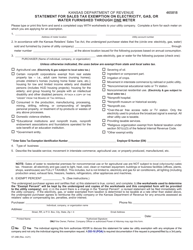

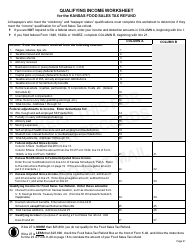

Q: Are there any specific requirements for completing the Form ST-21PEC?

A: Yes, there are specific requirements and instructions provided on the form itself. It is important to carefully follow these instructions while completing the form.

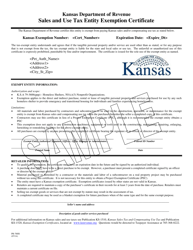

Q: Is there a deadline for submitting the Form ST-21PEC?

A: Yes, the Form ST-21PEC must be filed within three years from the due date of the return or within two years from the date the tax was paid, whichever is later.

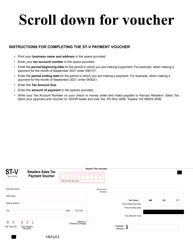

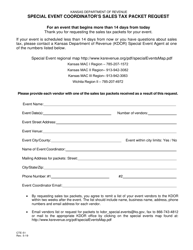

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-21PEC by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.