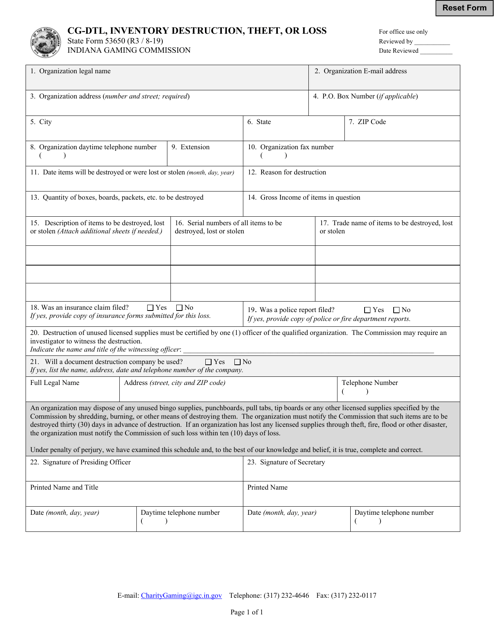

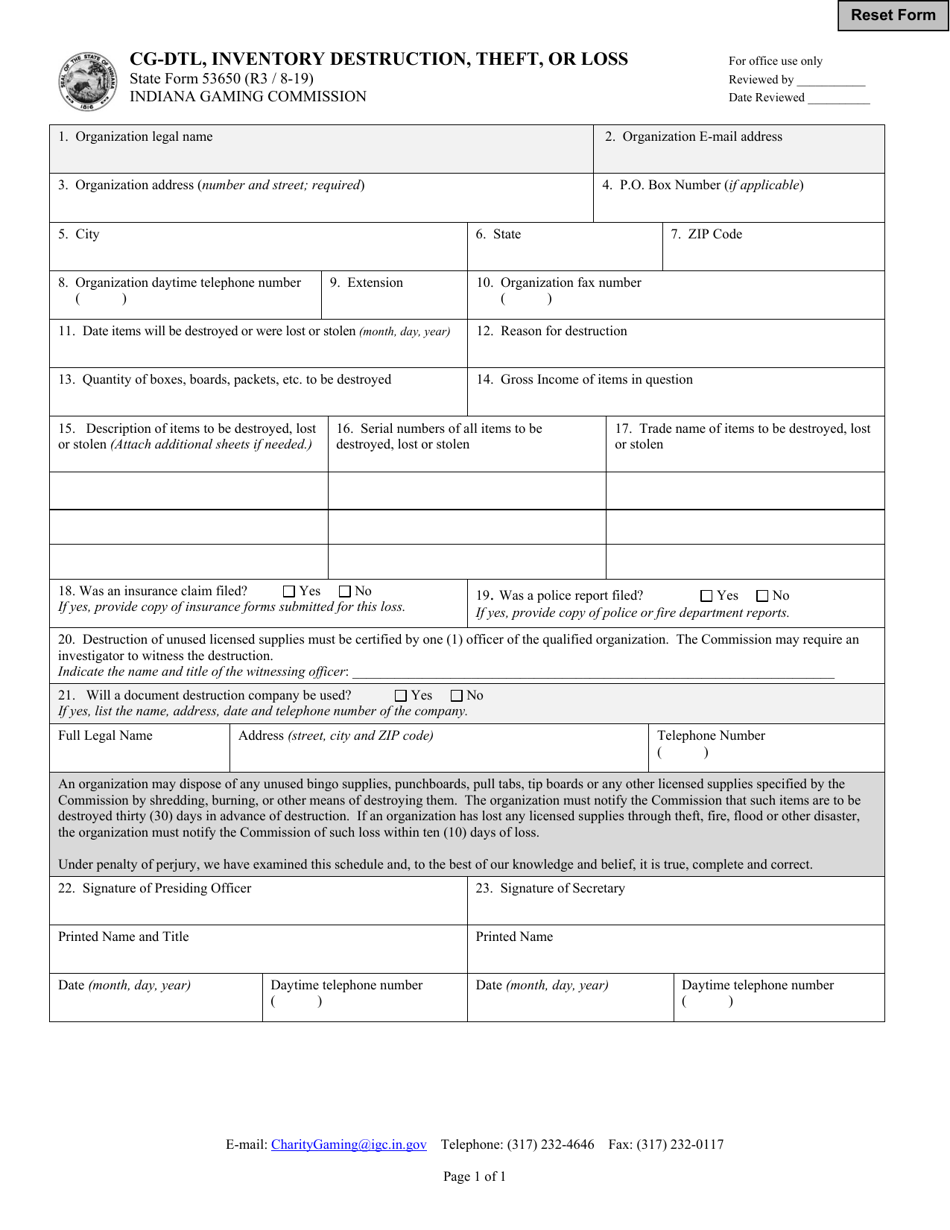

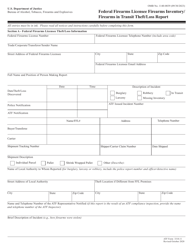

Form CG-DTL (State Form 53650) Inventory Destruction, Theft, or Loss - Indiana

What Is Form CG-DTL (State Form 53650)?

This is a legal form that was released by the Indiana Gaming Commission - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CG-DTL?

A: Form CG-DTL is also known as State Form 53650. It is used to report inventory destruction, theft, or loss in Indiana.

Q: Who needs to fill out Form CG-DTL?

A: Anyone who experiences inventory destruction, theft, or loss in Indiana needs to fill out Form CG-DTL.

Q: What information is required on Form CG-DTL?

A: Form CG-DTL requires you to provide details about the inventory item, such as its description, quantity, cost, and value at the time of destruction, theft, or loss.

Q: When is Form CG-DTL due?

A: Form CG-DTL is due within 30 days of the inventory destruction, theft, or loss event.

Q: What happens after I submit Form CG-DTL?

A: After submitting Form CG-DTL, the Indiana Department of Revenue will review your claim and may contact you for additional information.

Q: Is there a fee for filing Form CG-DTL?

A: No, there is no fee for filing Form CG-DTL in Indiana.

Q: Can I amend Form CG-DTL if I made an error?

A: Yes, you can amend Form CG-DTL by filing a corrected version with the Indiana Department of Revenue.

Q: Are there any penalties for not filing Form CG-DTL?

A: Failure to file Form CG-DTL or filing false information may result in penalties and interest charges.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Indiana Gaming Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CG-DTL (State Form 53650) by clicking the link below or browse more documents and templates provided by the Indiana Gaming Commission.