This version of the form is not currently in use and is provided for reference only. Download this version of

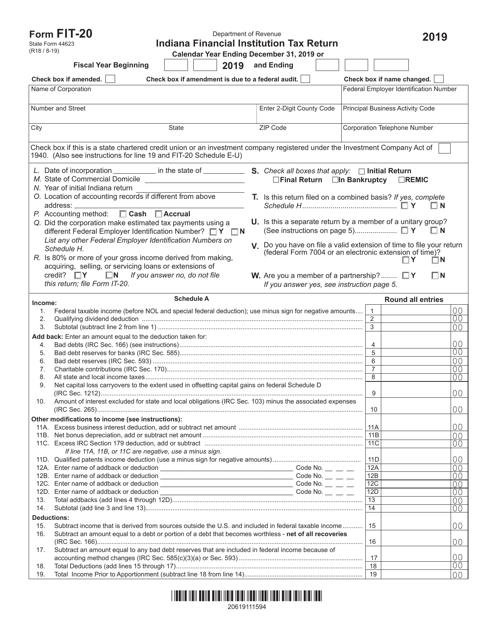

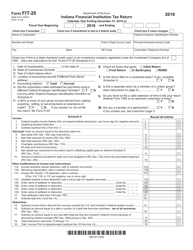

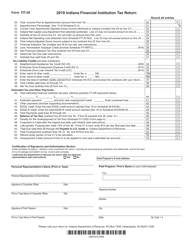

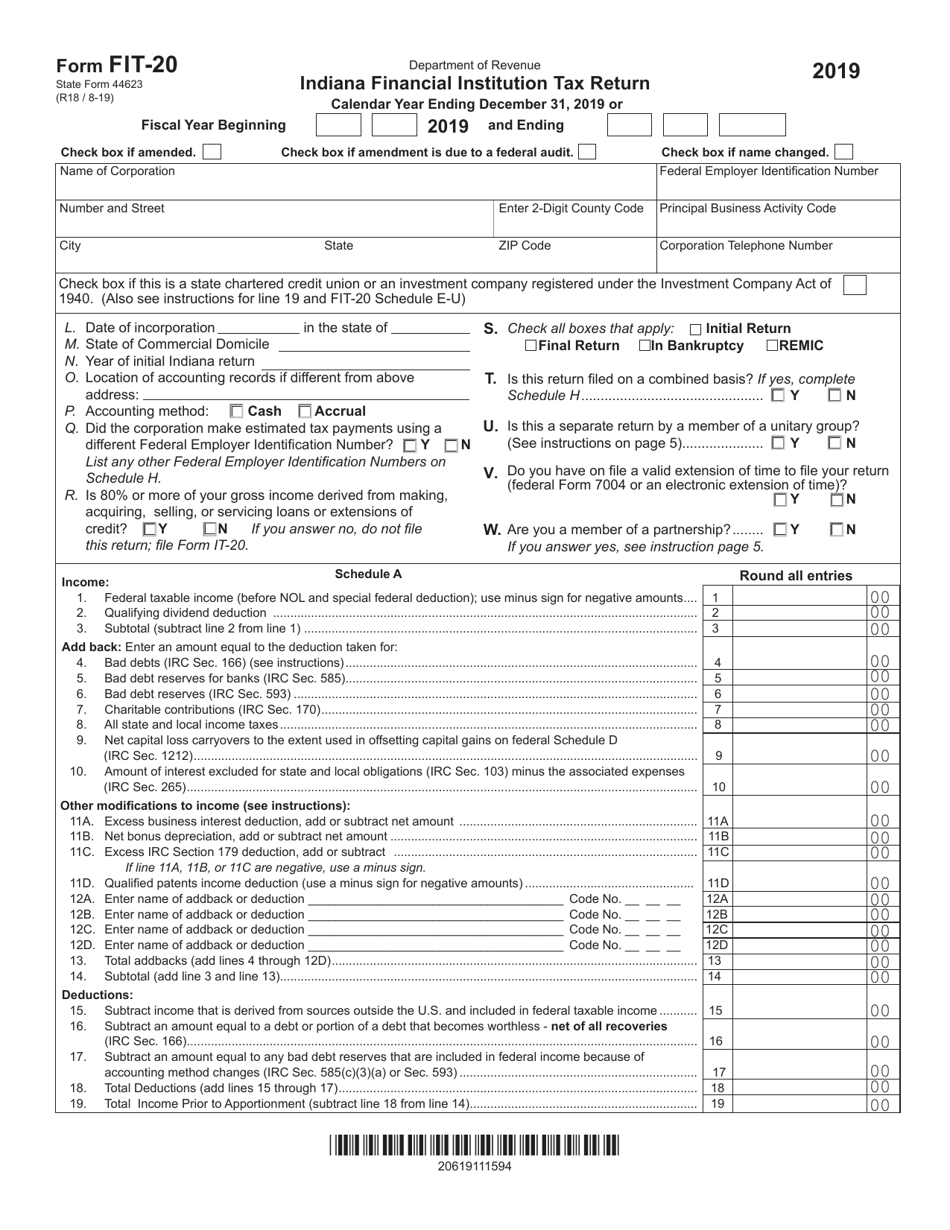

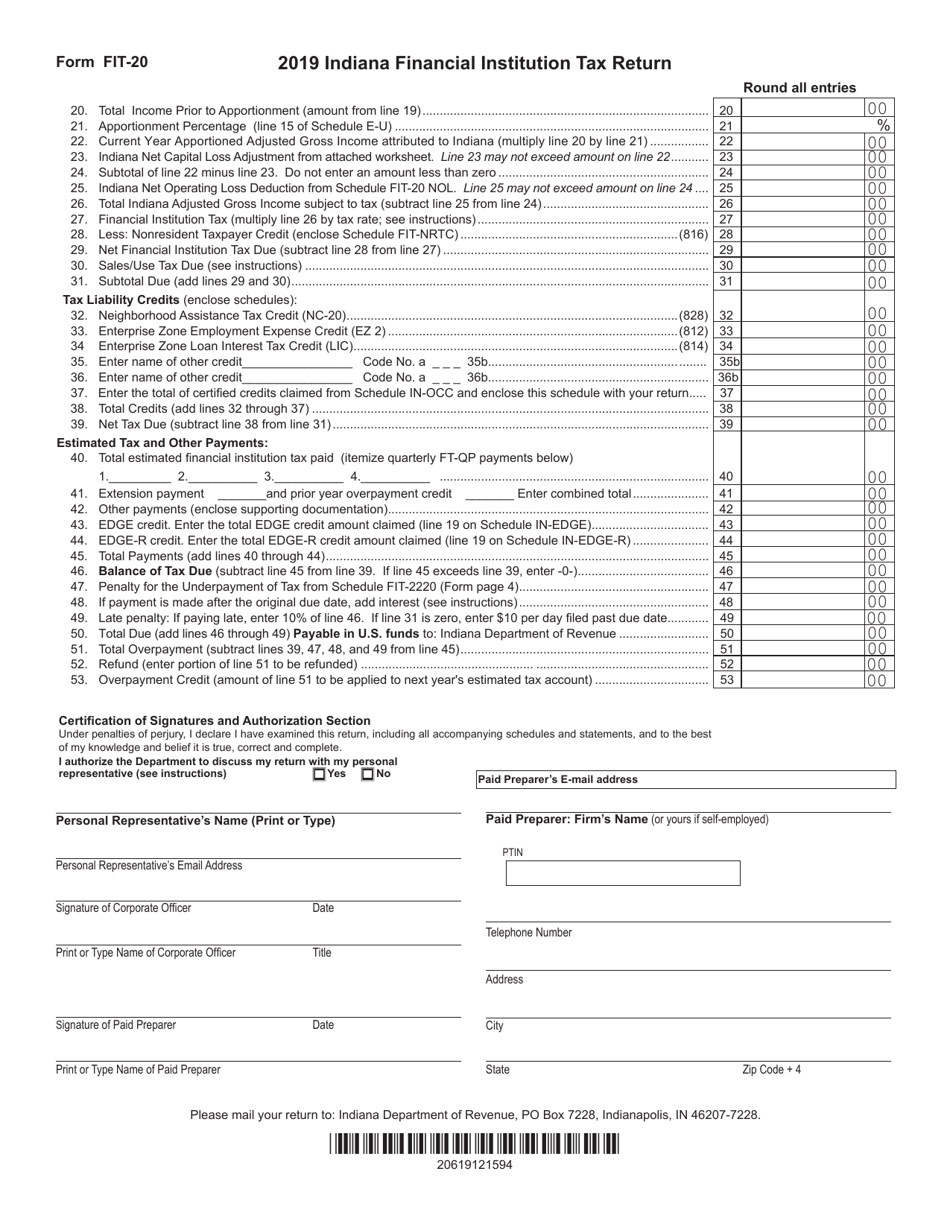

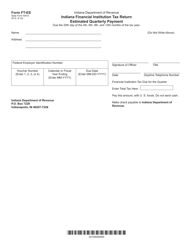

Form FIT-20 (State Form 44623)

for the current year.

Form FIT-20 (State Form 44623) Indiana Financial Institution Tax Return - Indiana

What Is Form FIT-20 (State Form 44623)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form FIT-20 (State Form 44623)?

A: Form FIT-20 (State Form 44623) is the Indiana Financial Institution Tax Return.

Q: Who needs to file Form FIT-20?

A: Financial institutions operating in Indiana need to file Form FIT-20.

Q: What is the purpose of Form FIT-20?

A: Form FIT-20 is used to report and calculate the financial institution tax owed by the institution.

Q: When is Form FIT-20 due?

A: Form FIT-20 is due on the 15th day of the fourth month following the close of the financial institution's taxable year.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FIT-20 (State Form 44623) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.