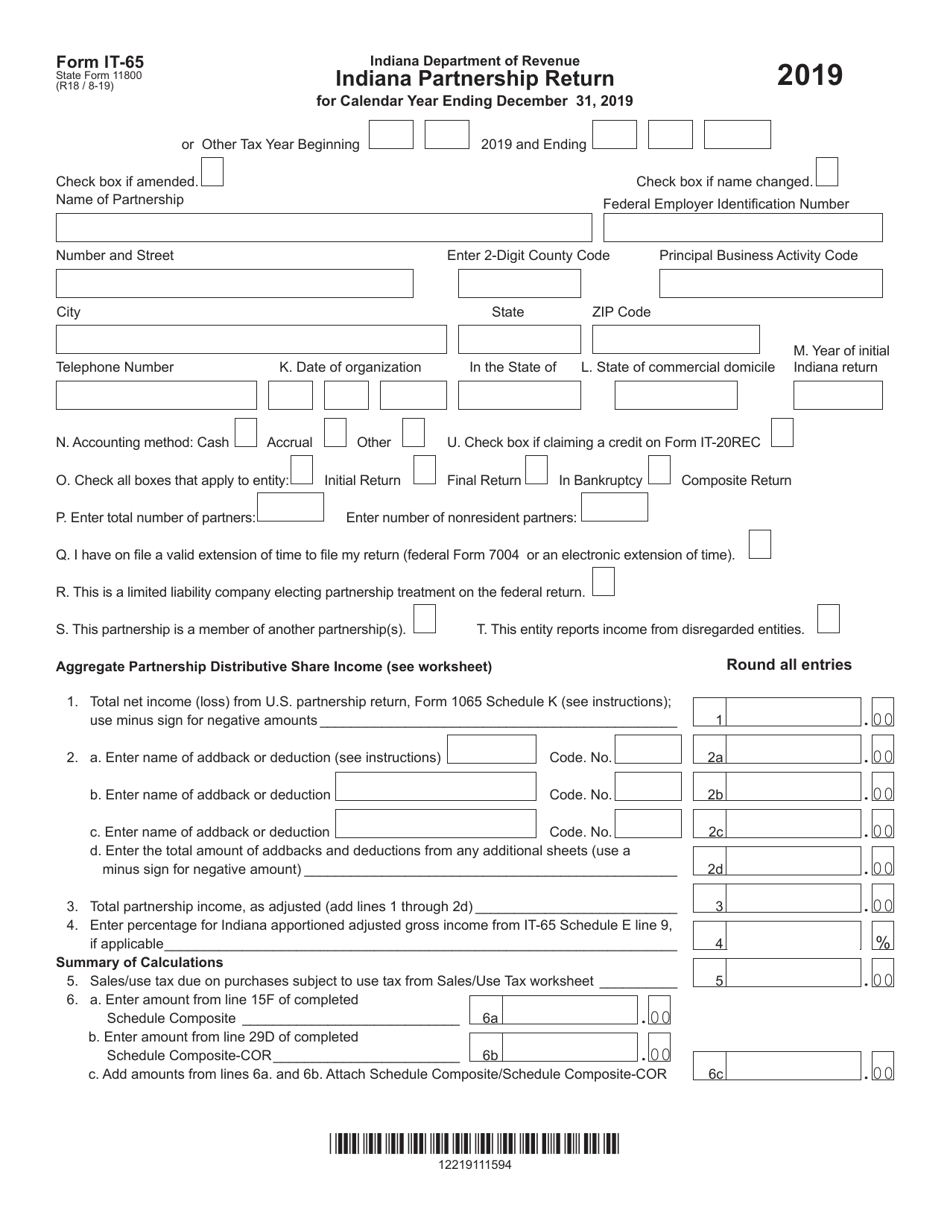

This version of the form is not currently in use and is provided for reference only. Download this version of

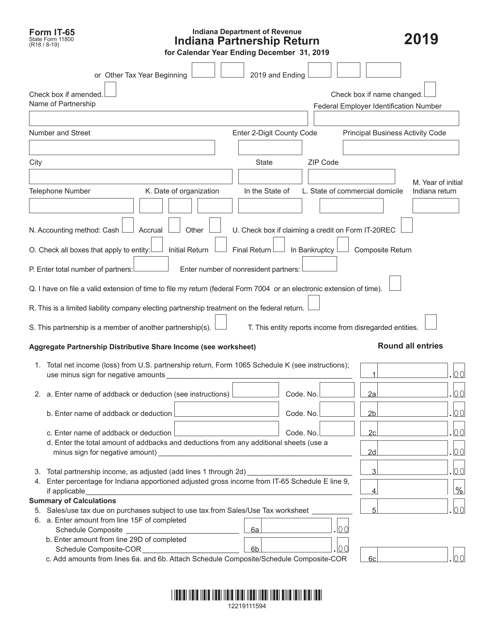

Form IT-65 (State Form 11800)

for the current year.

Form IT-65 (State Form 11800) Indiana Partnership Return - Indiana

What Is Form IT-65 (State Form 11800)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-65?

A: Form IT-65 is the Indiana Partnership Return.

Q: Who should file Form IT-65?

A: Partnerships in Indiana should file Form IT-65.

Q: What is the purpose of Form IT-65?

A: Form IT-65 is used to report partnership income, deductions, and credits in Indiana.

Q: When is the deadline for filing Form IT-65?

A: The deadline for filing Form IT-65 in Indiana is on or before the 15th day of the 4th month following the close of the partnership's taxable year.

Q: Are there any penalties for late filing of Form IT-65?

A: Yes, there may be penalties for late filing or failure to file Form IT-65 in Indiana.

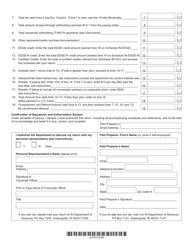

Q: Do I need to include any supporting documents with Form IT-65?

A: Yes, you may be required to attach certain schedules and forms to Form IT-65 depending on your partnership's specific circumstances.

Q: What should I do if I need help with Form IT-65?

A: If you need assistance with Form IT-65, you can contact the Indiana Department of Revenue or consult a tax professional.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-65 (State Form 11800) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.