This version of the form is not currently in use and is provided for reference only. Download this version of

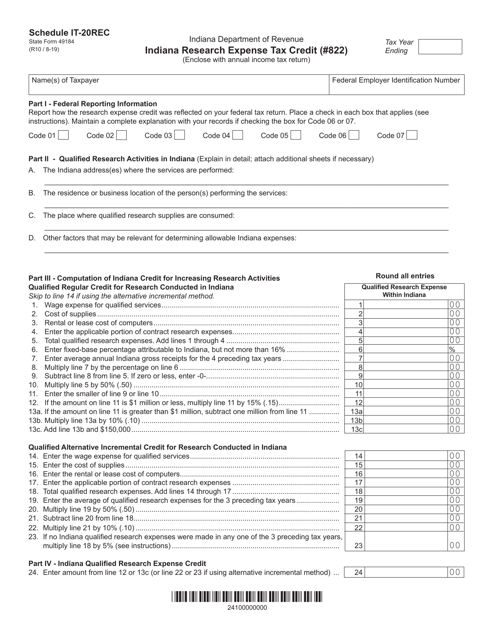

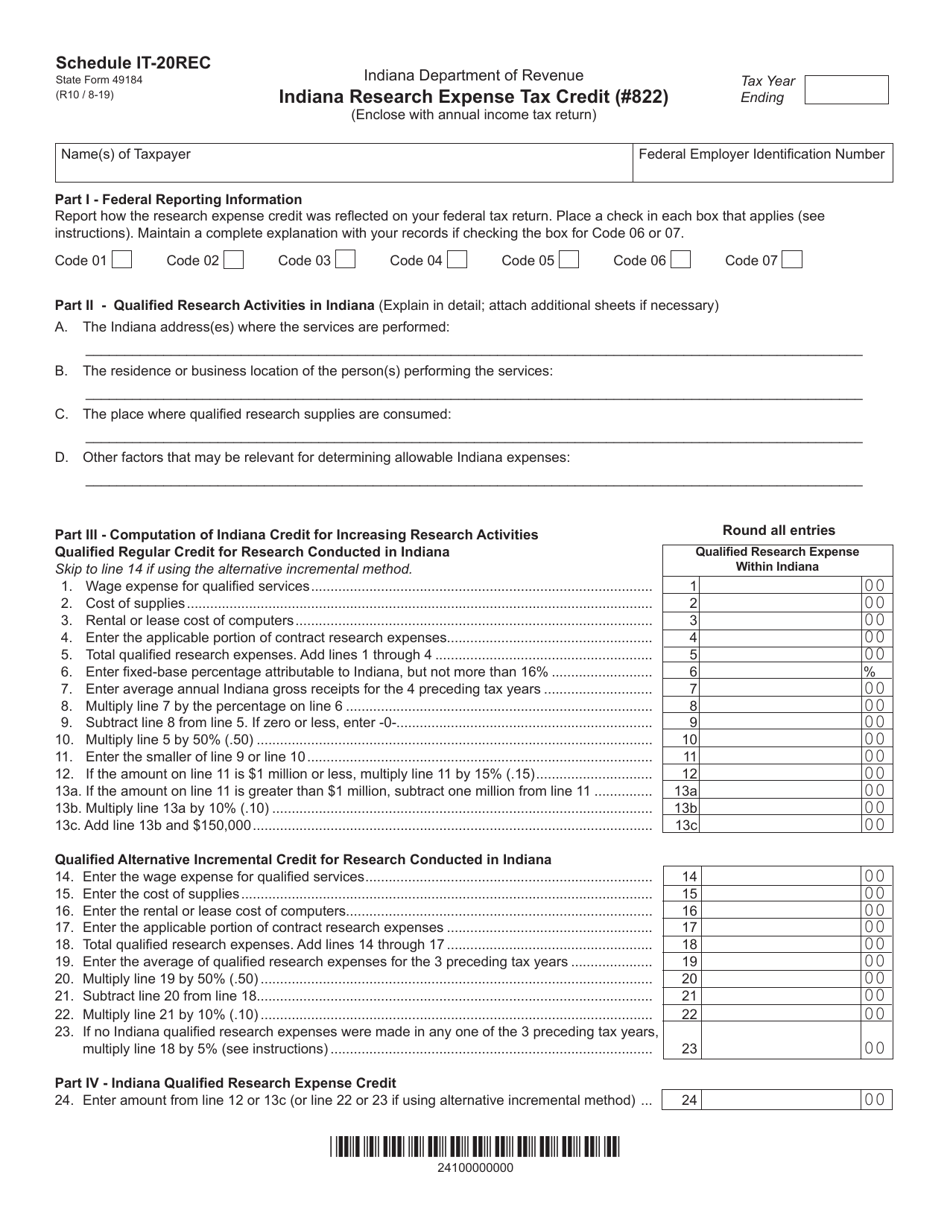

State Form 49184 Schedule IT-20REC

for the current year.

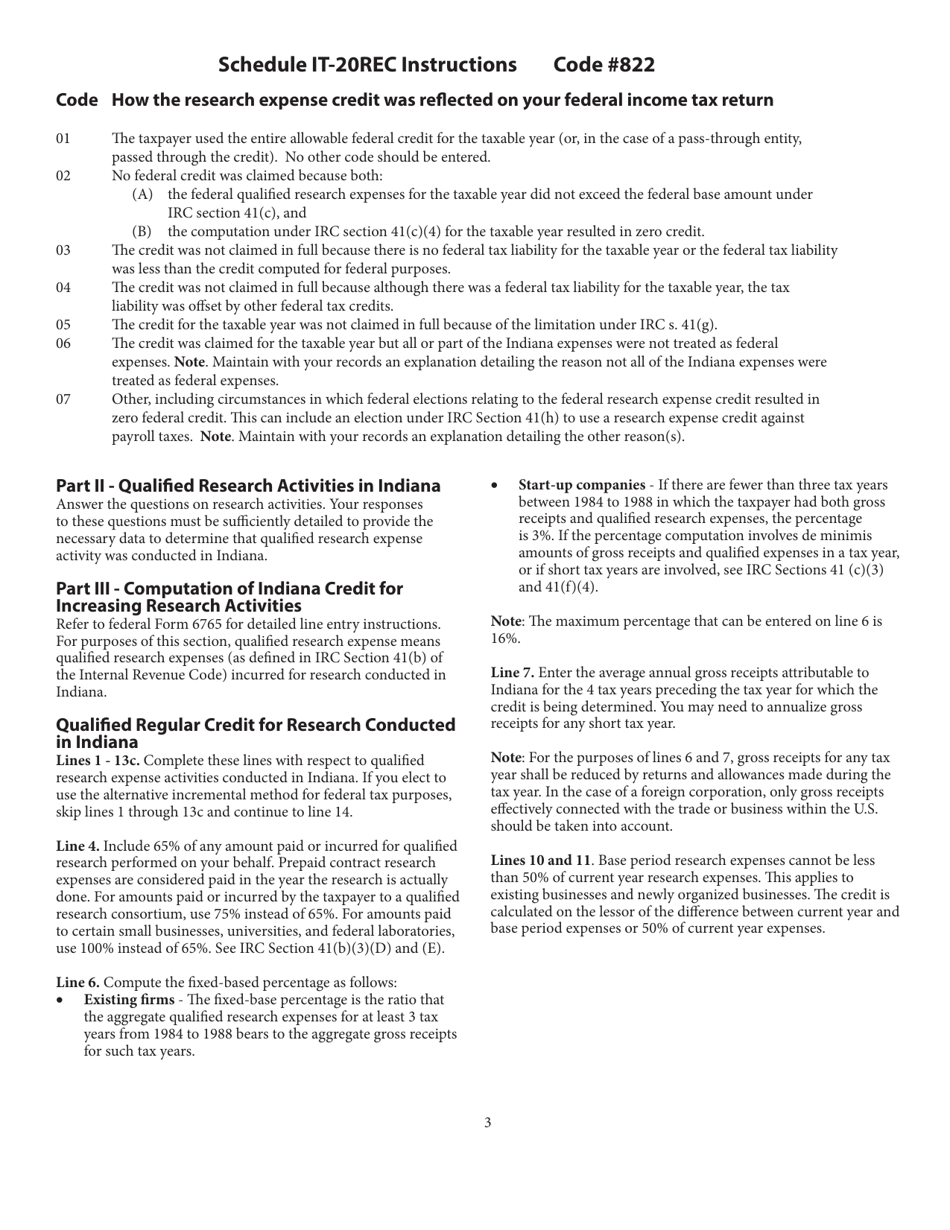

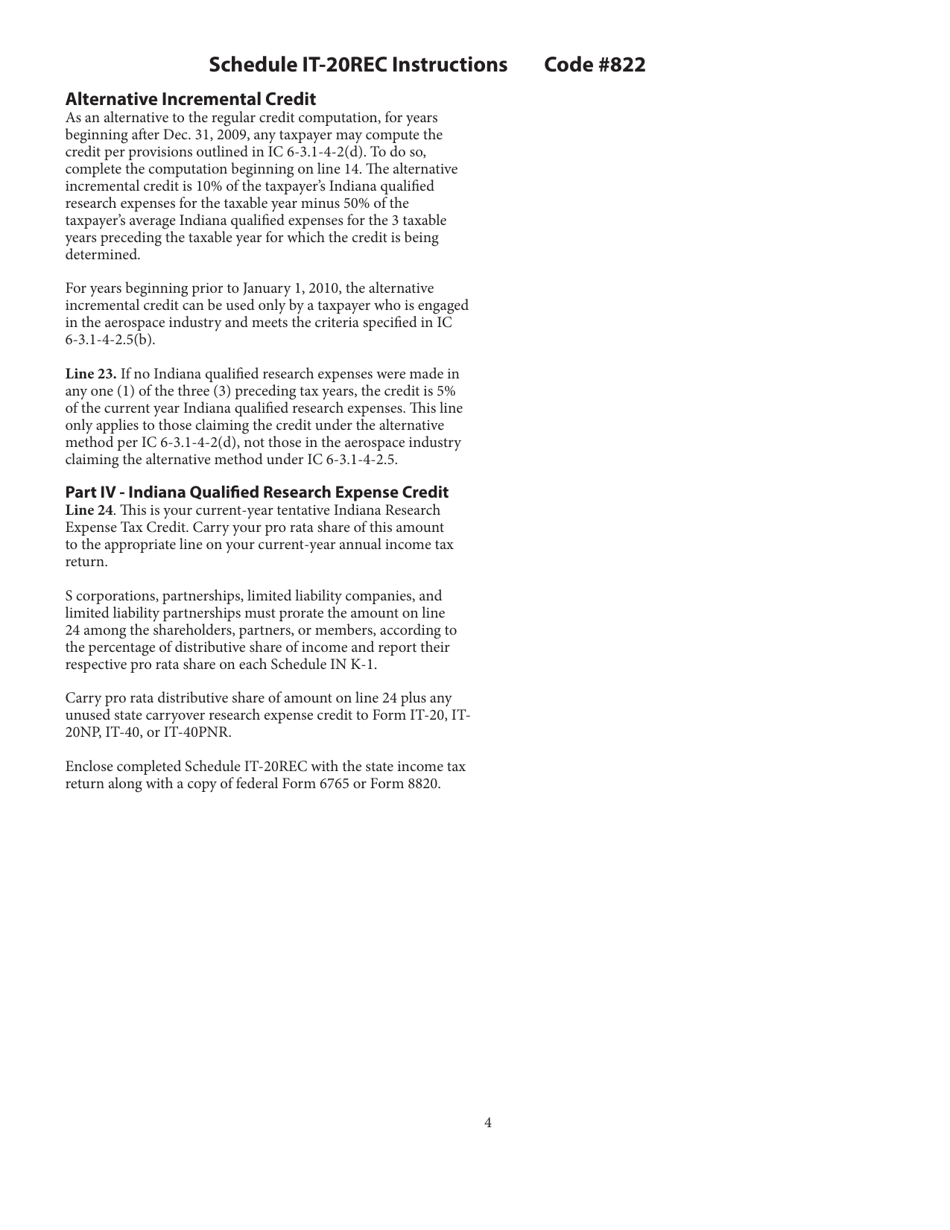

State Form 49184 Schedule IT-20REC Indiana Research Expense Tax Credit (#822) - Indiana

What Is State Form 49184 Schedule IT-20REC?

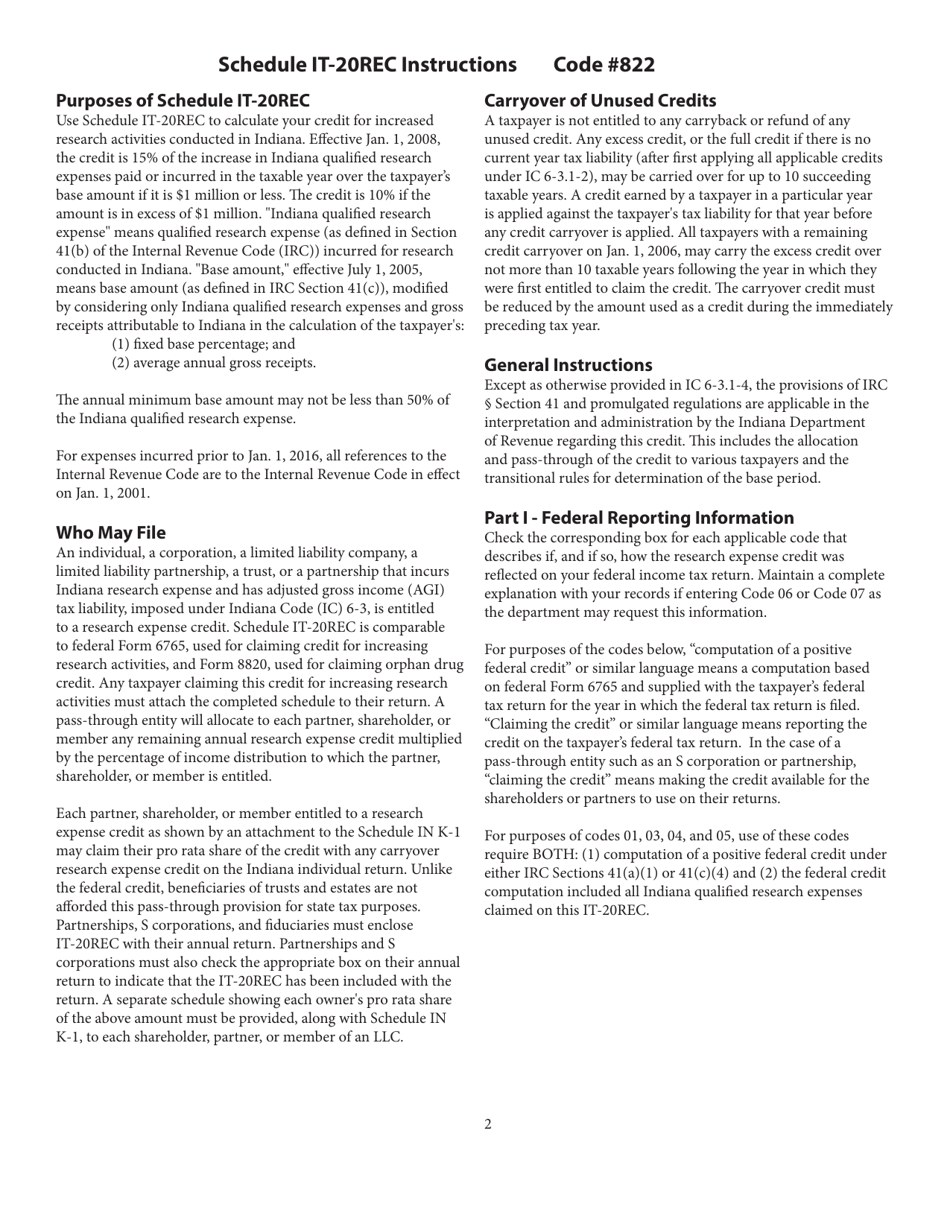

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the State Form 49184 Schedule IT-20REC?

A: The State Form 49184 Schedule IT-20REC is a form used in Indiana to claim the Research Expense Tax Credit.

Q: What is the Indiana Research Expense Tax Credit (#822)?

A: The Indiana Research Expense Tax Credit (#822) is a tax credit available in Indiana for qualifying research expenses.

Q: How do I claim the Indiana Research Expense Tax Credit?

A: To claim the Indiana Research Expense Tax Credit, you need to fill out the State Form 49184 Schedule IT-20REC and include it with your Indiana tax return.

Q: What expenses qualify for the Indiana Research Expense Tax Credit?

A: Qualifying expenses for the Indiana Research Expense Tax Credit include research and development expenditures incurred in Indiana.

Q: Is the Indiana Research Expense Tax Credit refundable?

A: Yes, the Indiana Research Expense Tax Credit is refundable, meaning that you can receive a refund even if you don't owe any tax.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 49184 Schedule IT-20REC by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.