This version of the form is not currently in use and is provided for reference only. Download this version of

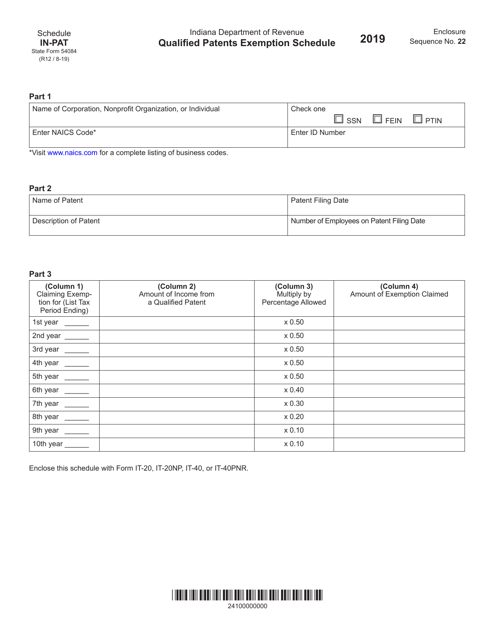

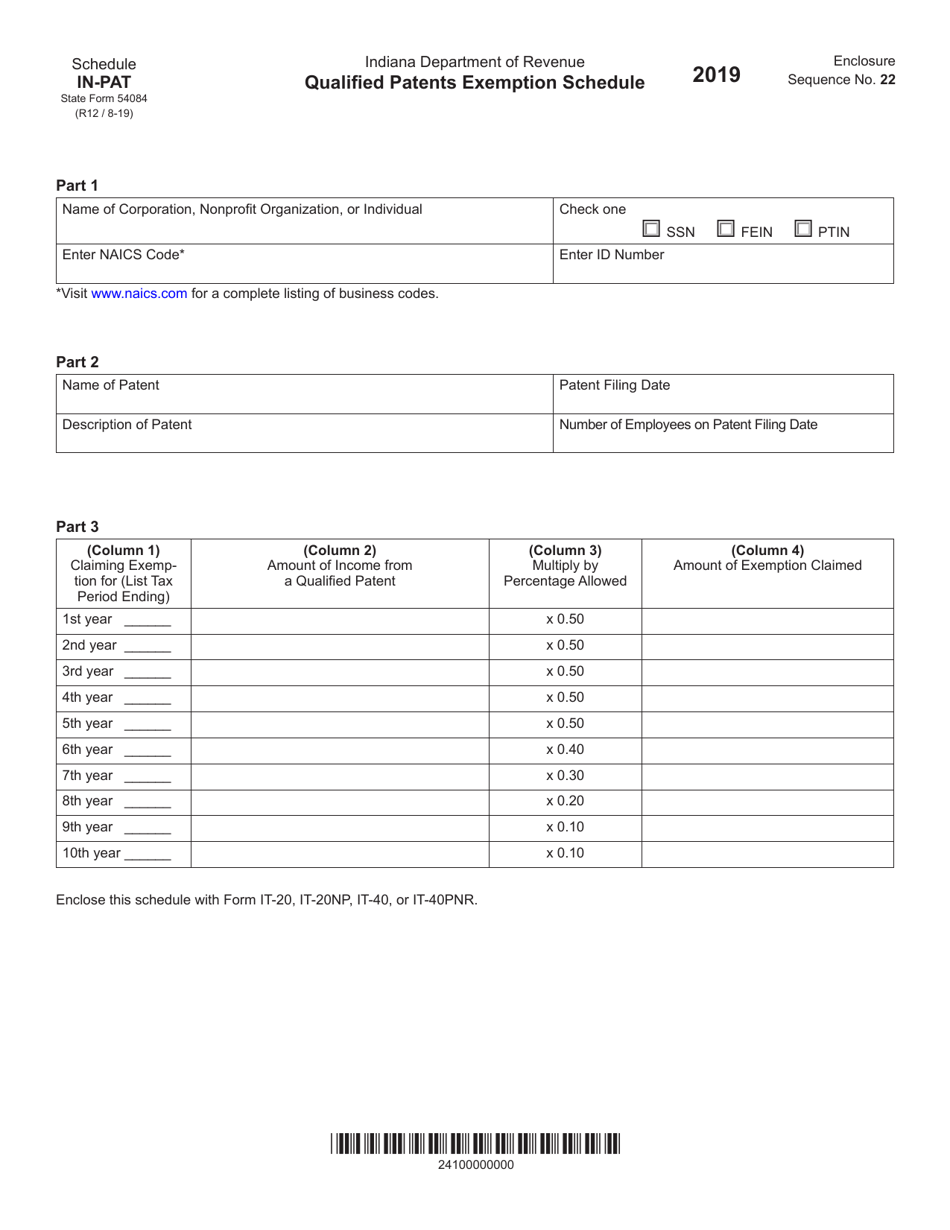

State Form 54084 Schedule IN-PAT

for the current year.

State Form 54084 Schedule IN-PAT Qualified Patents Exemption Schedule - Indiana

What Is State Form 54084 Schedule IN-PAT?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 54084 Schedule IN-PAT?

A: Form 54084 Schedule IN-PAT is a specific tax form used in the state of Indiana.

Q: What is the purpose of Schedule IN-PAT?

A: The purpose of Schedule IN-PAT is to claim a qualified patents exemption.

Q: Who needs to file Form 54084 Schedule IN-PAT?

A: Individuals or businesses in Indiana who want to claim the qualified patents exemption need to file this form.

Q: What is the qualified patents exemption?

A: The qualified patents exemption is a tax benefit that allows individuals or businesses to exclude certain patent-related income from their taxable income.

Q: Is there a specific deadline for filing Schedule IN-PAT?

A: Yes, the deadline for filing Schedule IN-PAT is typically the same as the deadline for filing the Indiana state tax return, which is usually April 15th.

Q: Is there any fee associated with filing this form?

A: No, there is no fee associated with filing Form 54084 Schedule IN-PAT.

Q: Can I file Schedule IN-PAT electronically?

A: Yes, Indiana allows electronic filing of Schedule IN-PAT.

Q: Can I claim the qualified patents exemption if I don't live in Indiana?

A: No, the qualified patents exemption is specific to Indiana residents or businesses.

Q: What documentation do I need to include when filing Schedule IN-PAT?

A: You may be required to include supporting documentation such as licensing agreements or patents when filing Schedule IN-PAT.

Q: Can I amend my Schedule IN-PAT if I made a mistake?

A: Yes, you can amend your Schedule IN-PAT if you made a mistake or need to make changes. Follow the instructions provided by the Indiana Department of Revenue.

Q: Is Schedule IN-PAT only for individuals, or can businesses also use it?

A: Both individuals and businesses can use Schedule IN-PAT if they meet the eligibility requirements.

Q: What if I don't have any qualified patents to claim?

A: If you don't have any qualified patents to claim, you do not need to file Schedule IN-PAT.

Q: Can I carry over any unused qualified patents exemption to future years?

A: The qualified patents exemption cannot be carried over to future years. It is only applicable for the tax year in which it is claimed.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 54084 Schedule IN-PAT by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.