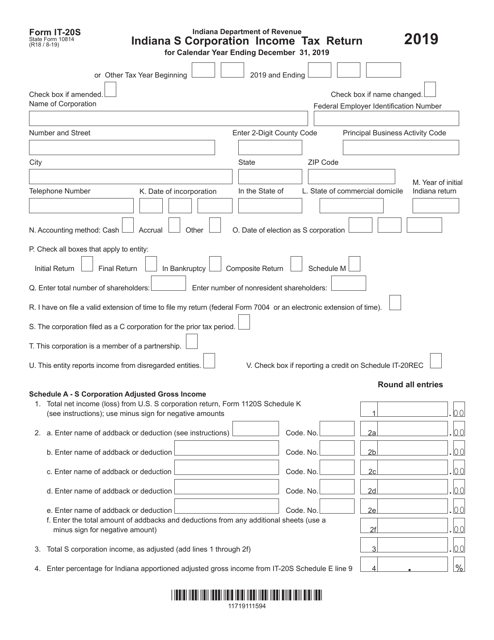

This version of the form is not currently in use and is provided for reference only. Download this version of

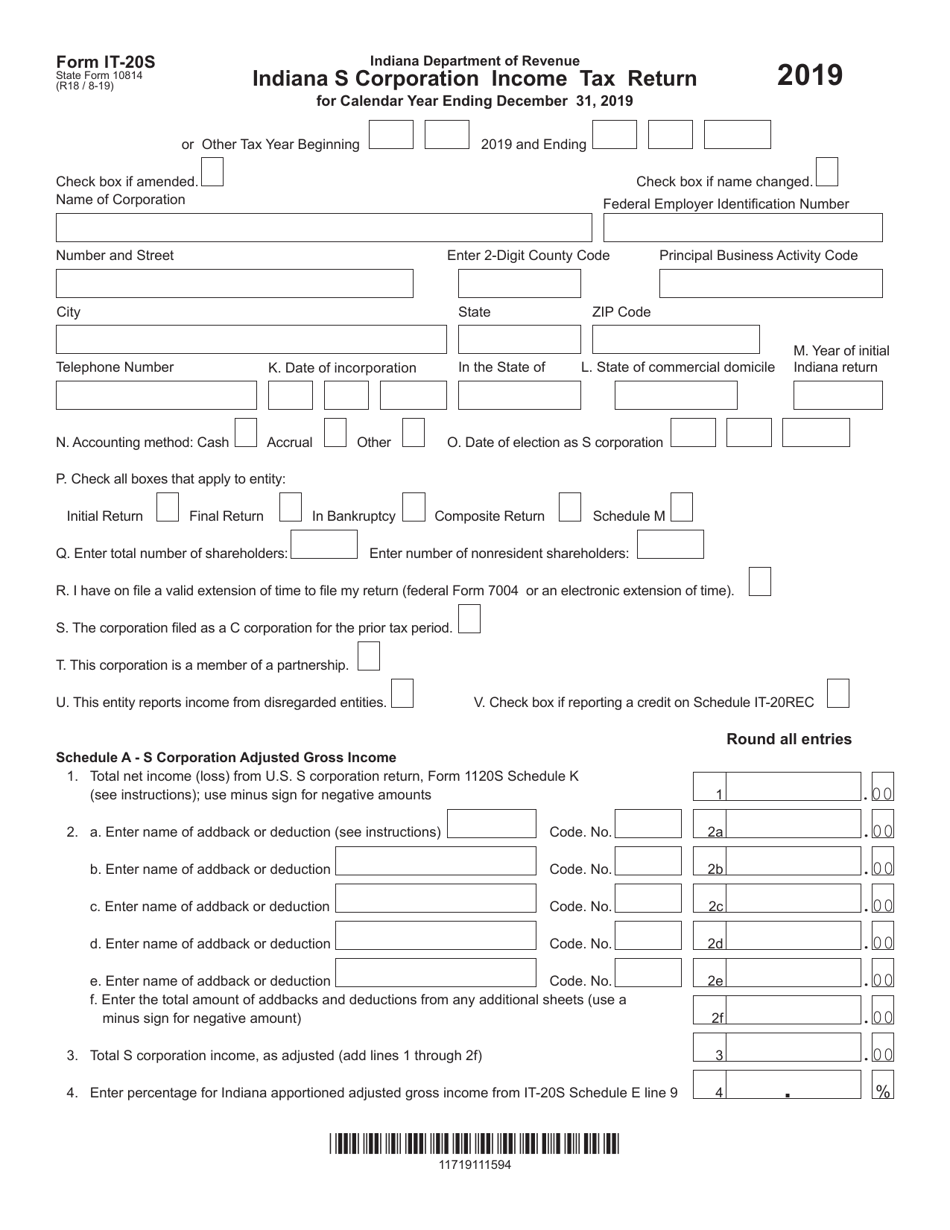

Form IT-20S (State Form 10814)

for the current year.

Form IT-20S (State Form 10814) Indiana S Corporation Income Tax Return - Indiana

What Is Form IT-20S (State Form 10814)?

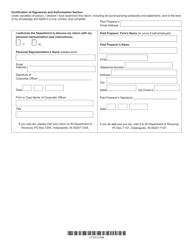

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-20S?

A: Form IT-20S is the Indiana S Corporation Income Tax Return for Indiana.

Q: Who needs to file Form IT-20S?

A: Indiana S corporations are required to file Form IT-20S.

Q: What is the purpose of Form IT-20S?

A: The purpose of Form IT-20S is to report the income, deductions, credits, and tax liability of an Indiana S corporation.

Q: When is the deadline to file Form IT-20S?

A: Form IT-20S is due on or before the 15th day of the 4th month following the end of the tax year.

Q: Are there any filing extensions available for Form IT-20S?

A: Yes, Indiana S corporations can request a filing extension using Form IT-9.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-20S (State Form 10814) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.