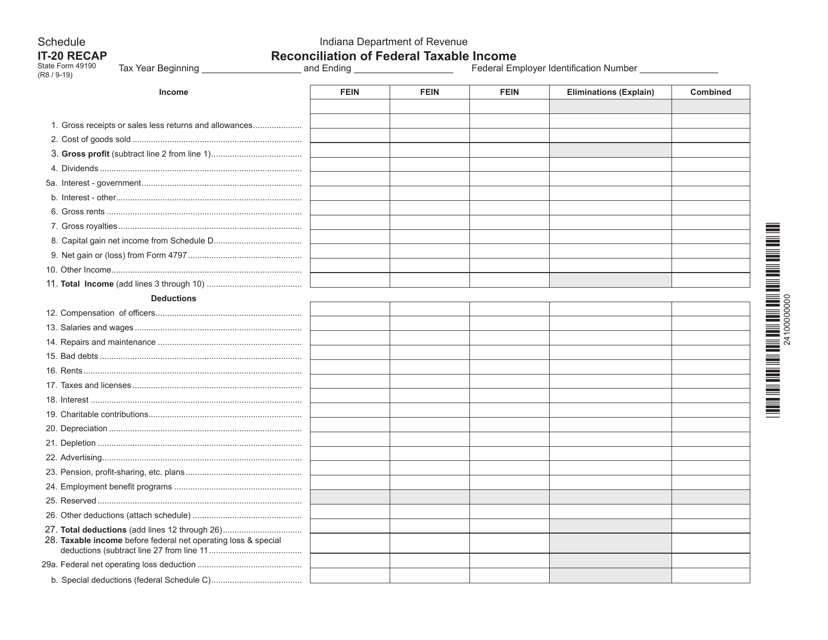

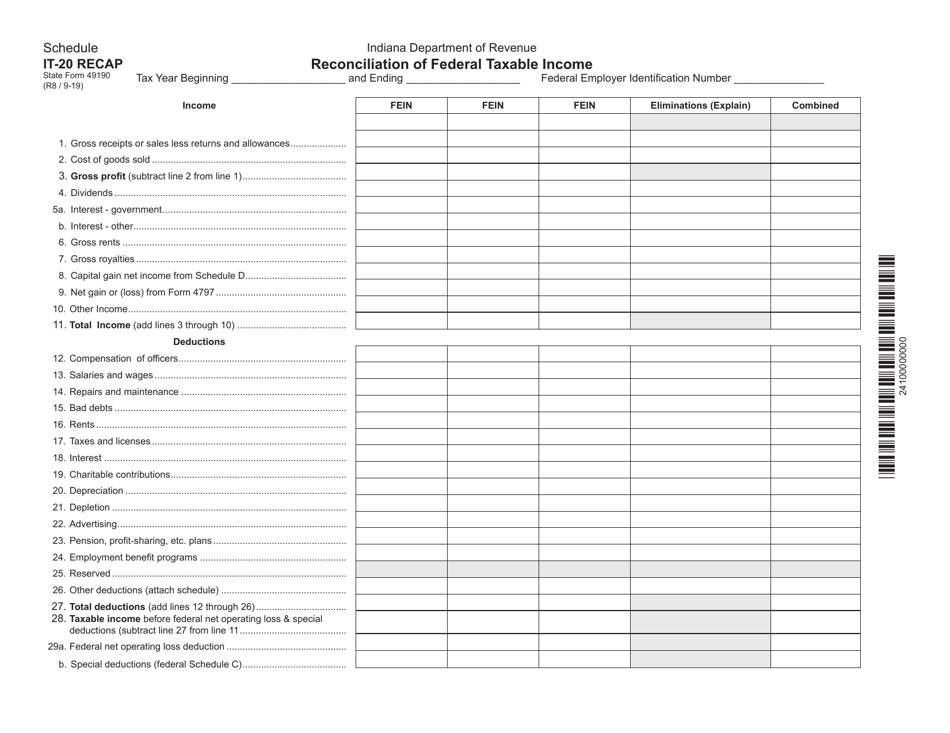

State Form 49190 Schedule IT-20 RECAP Reconciliation of Federal Taxable Income - Indiana

What Is State Form 49190 Schedule IT-20 RECAP?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 49190 Schedule IT-20 RECAP?

A: Form 49190 Schedule IT-20 RECAP is a document used in Indiana to reconcile federal taxable income.

Q: What is the purpose of Schedule IT-20 RECAP?

A: The purpose of Schedule IT-20 RECAP is to calculate the differences between federal taxable income and Indiana taxable income.

Q: How is Schedule IT-20 RECAP used?

A: Schedule IT-20 RECAP is used to report adjustments, deductions, or credits that affect Indiana taxable income but may not be considered at the federal level.

Q: Who needs to fill out Schedule IT-20 RECAP?

A: Individuals or businesses that have differences between federal and Indiana taxable income may need to fill out Schedule IT-20 RECAP.

Form Details:

- Released on September 1, 2019;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 49190 Schedule IT-20 RECAP by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.