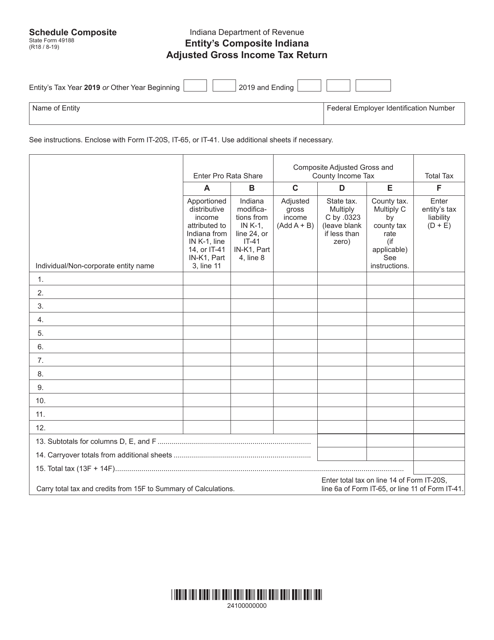

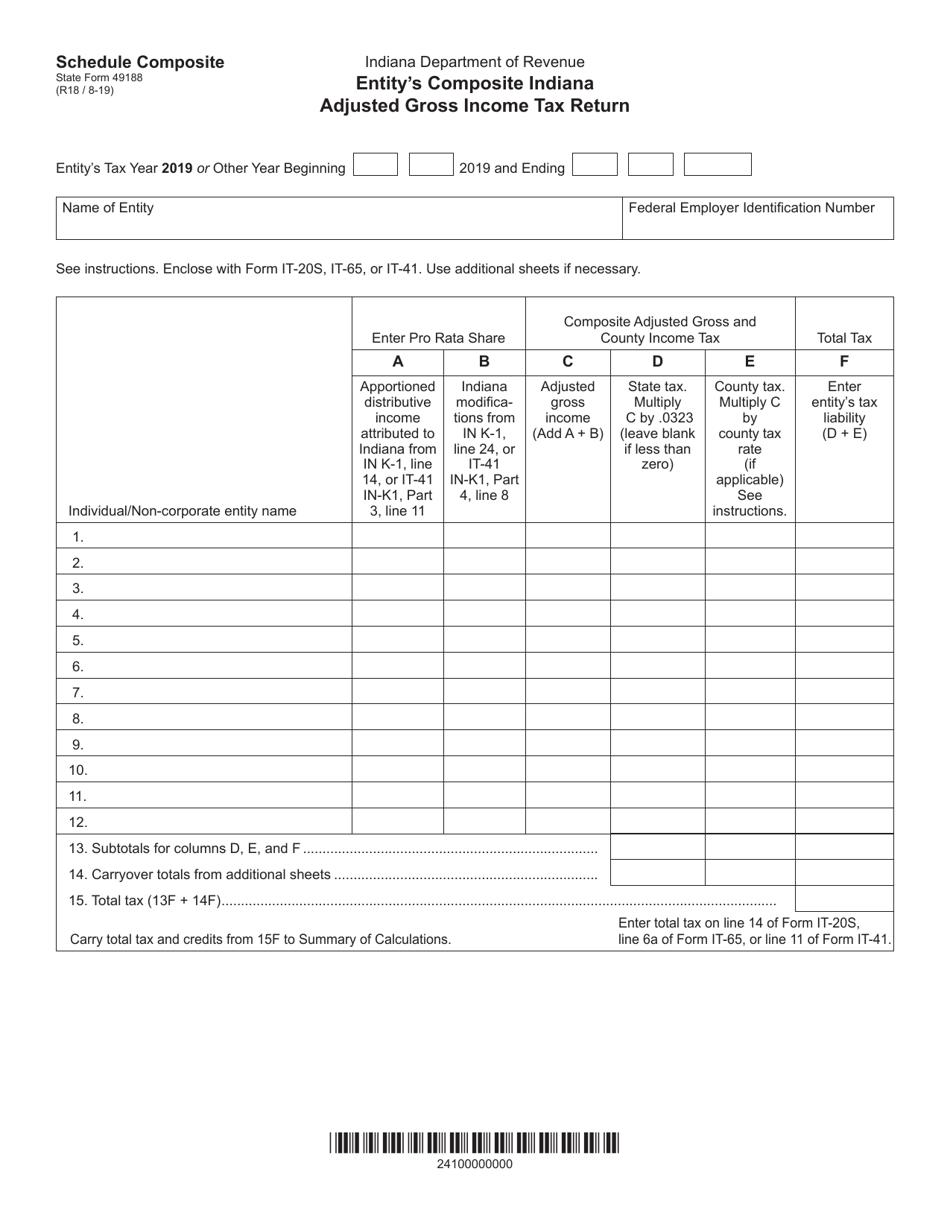

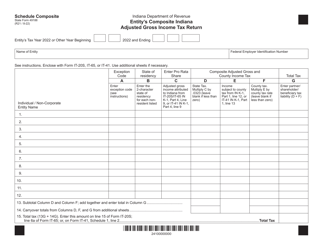

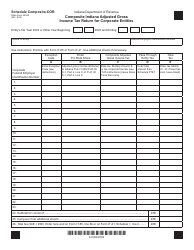

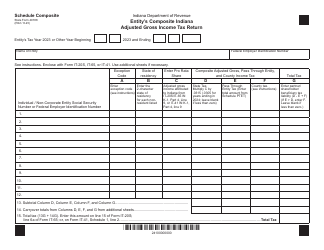

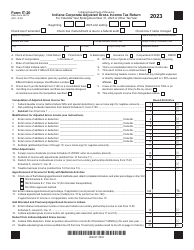

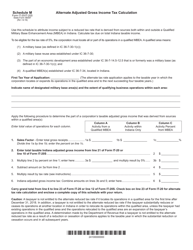

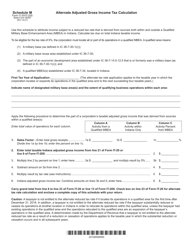

State Form 49188 Entity's Composite Indiana Adjusted Gross Income Tax Return - Indiana

What Is State Form 49188?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 49188?

A: State Form 49188 is the Entity's Composite Indiana Adjusted Gross Income Tax Return for residents of Indiana.

Q: Who needs to file State Form 49188?

A: Residents of Indiana who have composite income from an entity that is subject to Indiana adjusted gross income tax need to file State Form 49188.

Q: What is composite income?

A: Composite income is the income earned by an entity that is subject to Indiana adjusted gross income tax.

Q: What is Indiana adjusted gross income tax?

A: Indiana adjusted gross income tax is a tax levied on the income earned by residents of Indiana.

Q: Is State Form 49188 for individuals or businesses?

A: State Form 49188 is for individuals who have composite income from an entity.

Q: When is the deadline to file State Form 49188?

A: The deadline to file State Form 49188 is typically on or before April 15 of each year.

Q: Is there a penalty for late filing of State Form 49188?

A: Yes, there may be penalties for late filing or failure to file State Form 49188.

Q: What should I do if I need more information or assistance with State Form 49188?

A: If you need more information or assistance with State Form 49188, you should contact the Indiana Department of Revenue or seek guidance from a tax professional.

Q: Are there any exemptions or deductions available for State Form 49188?

A: There may be exemptions or deductions available for State Form 49188. It is recommended to consult the instructions provided with the form or seek guidance from a tax professional.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 49188 by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.