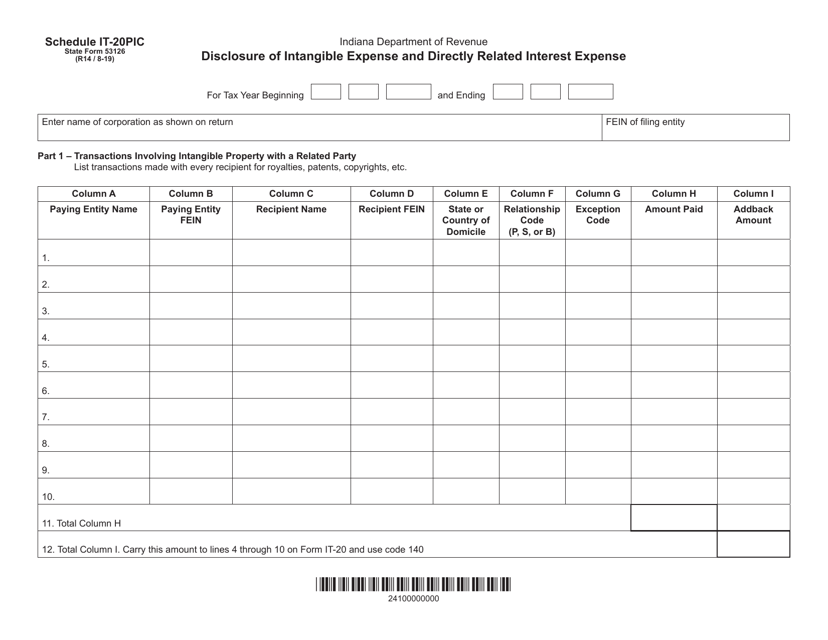

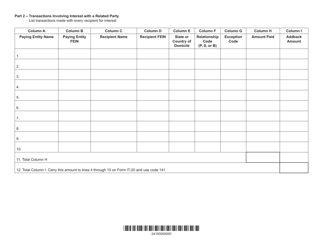

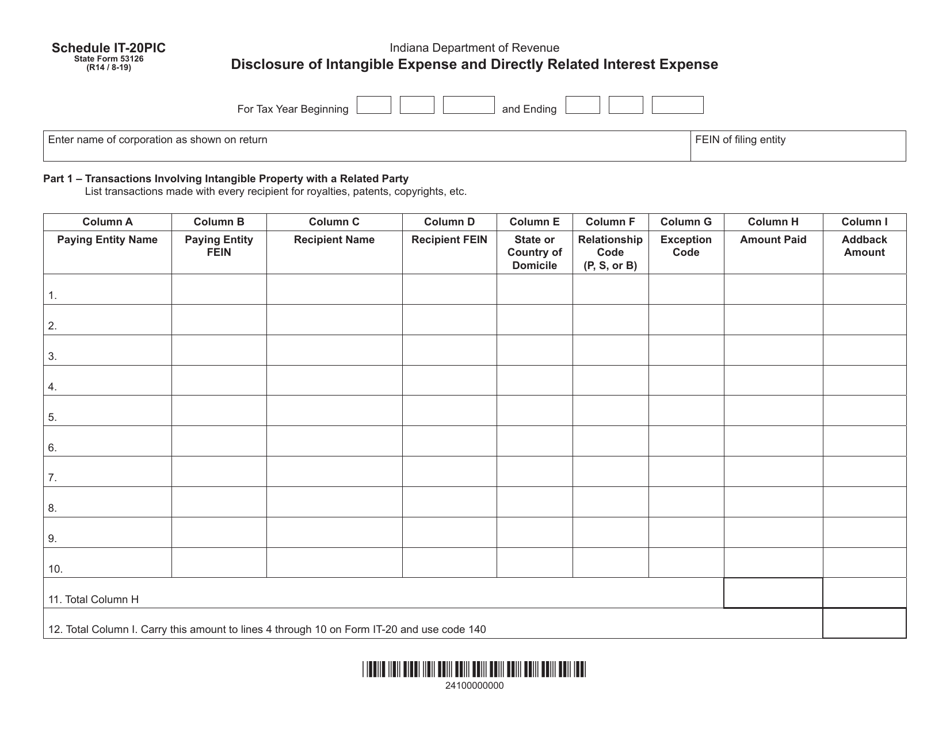

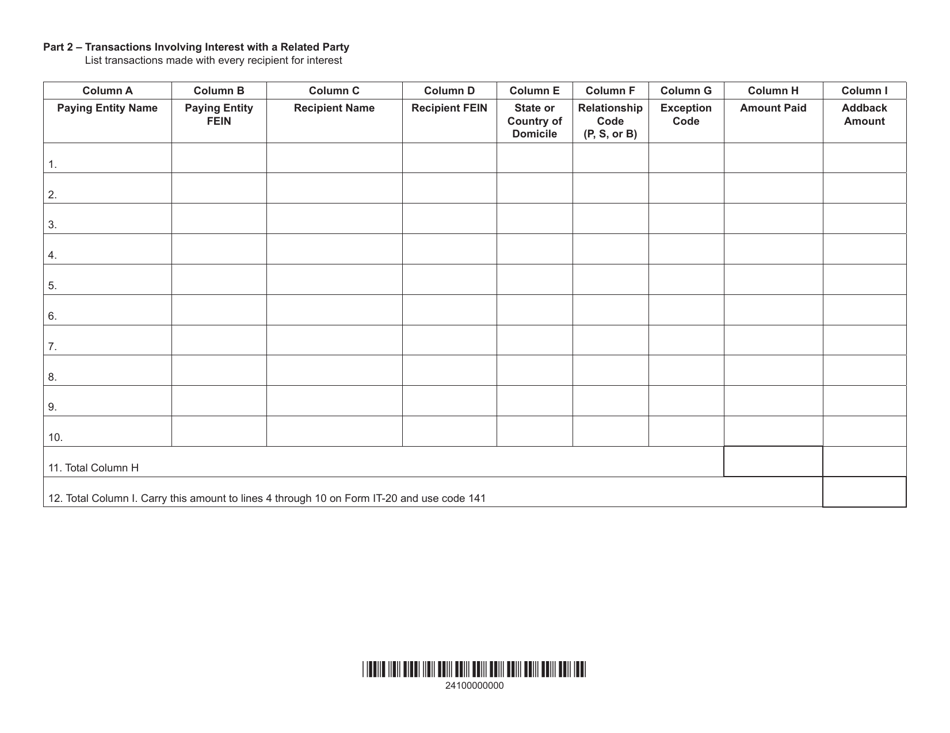

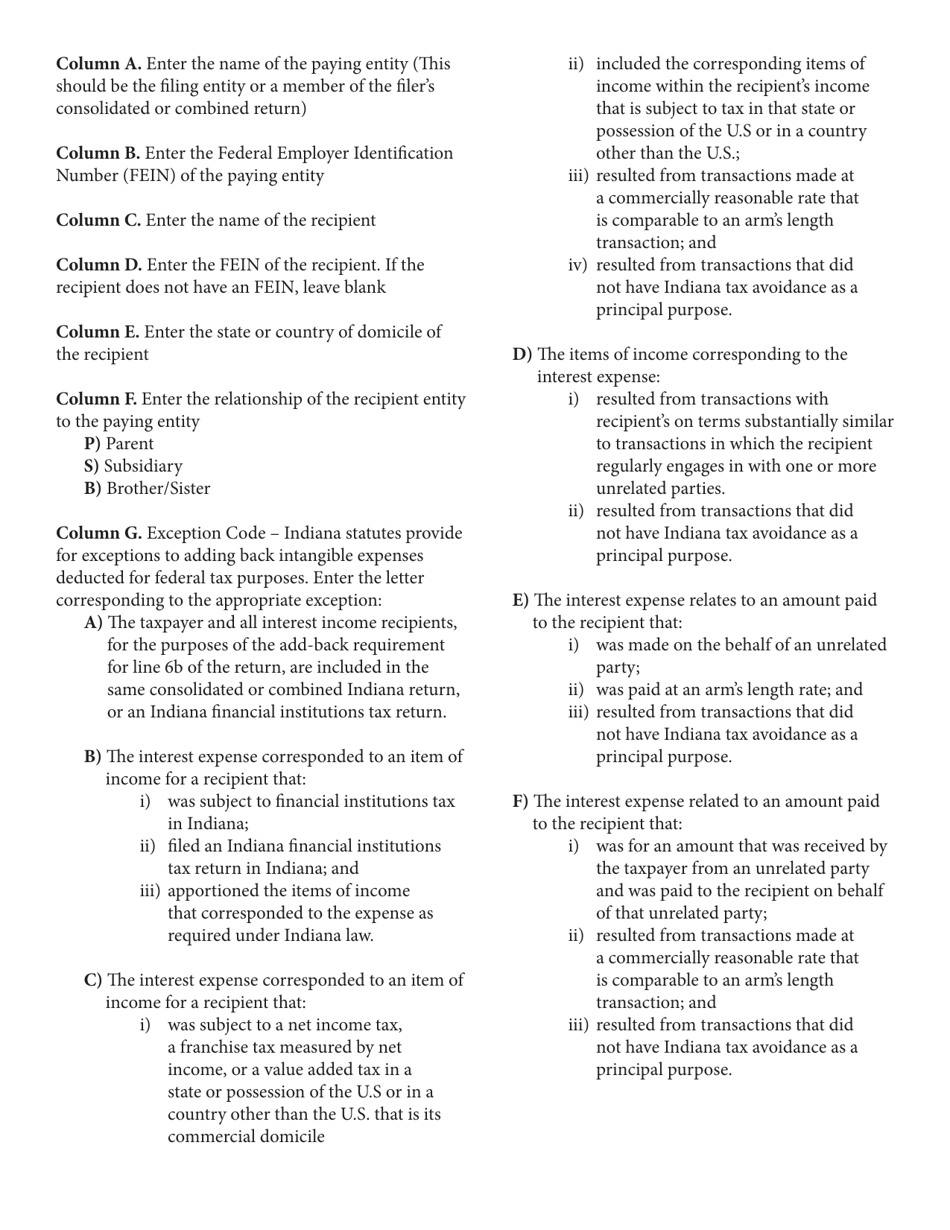

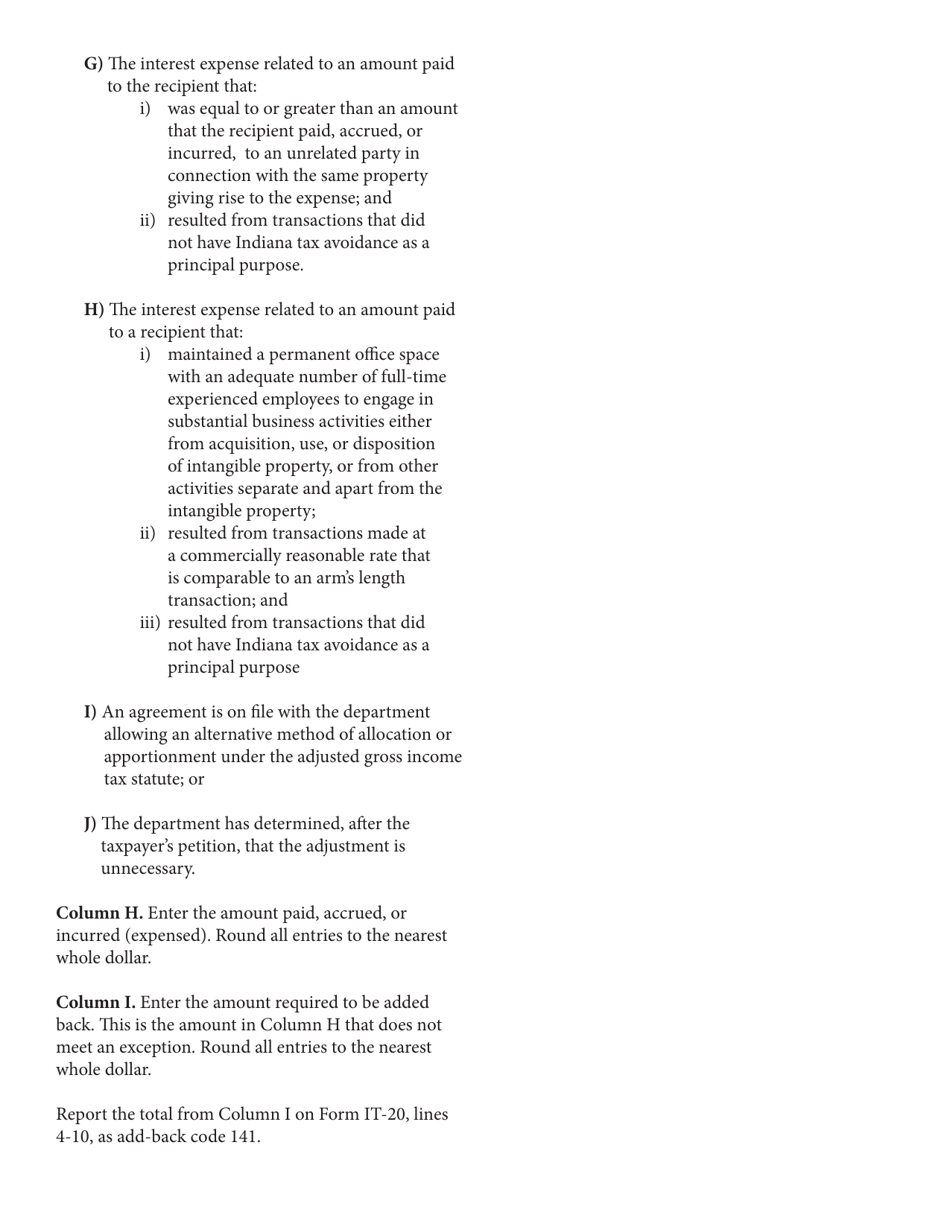

State Form 53126 Schedule IT-20PIC Disclosure of Intangible Expense and Directly Related Interest Expense - Indiana

What Is State Form 53126 Schedule IT-20PIC?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 53126?

A: State Form 53126 is a form used in Indiana to disclose intangible expense and directly related interest expense.

Q: What is Schedule IT-20PIC?

A: Schedule IT-20PIC is the specific section on the Indiana tax form where the disclosure of intangible expense and directly related interest expense is made.

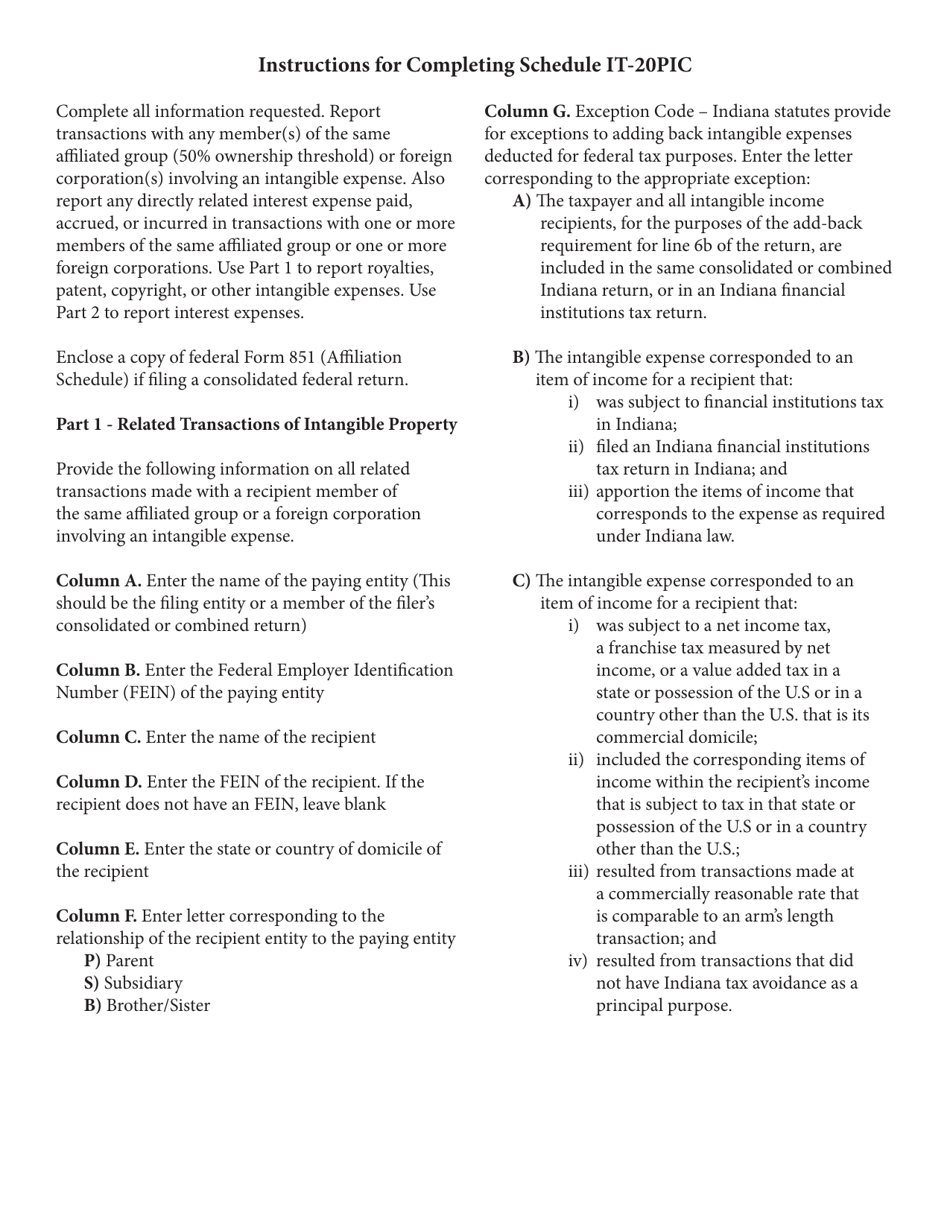

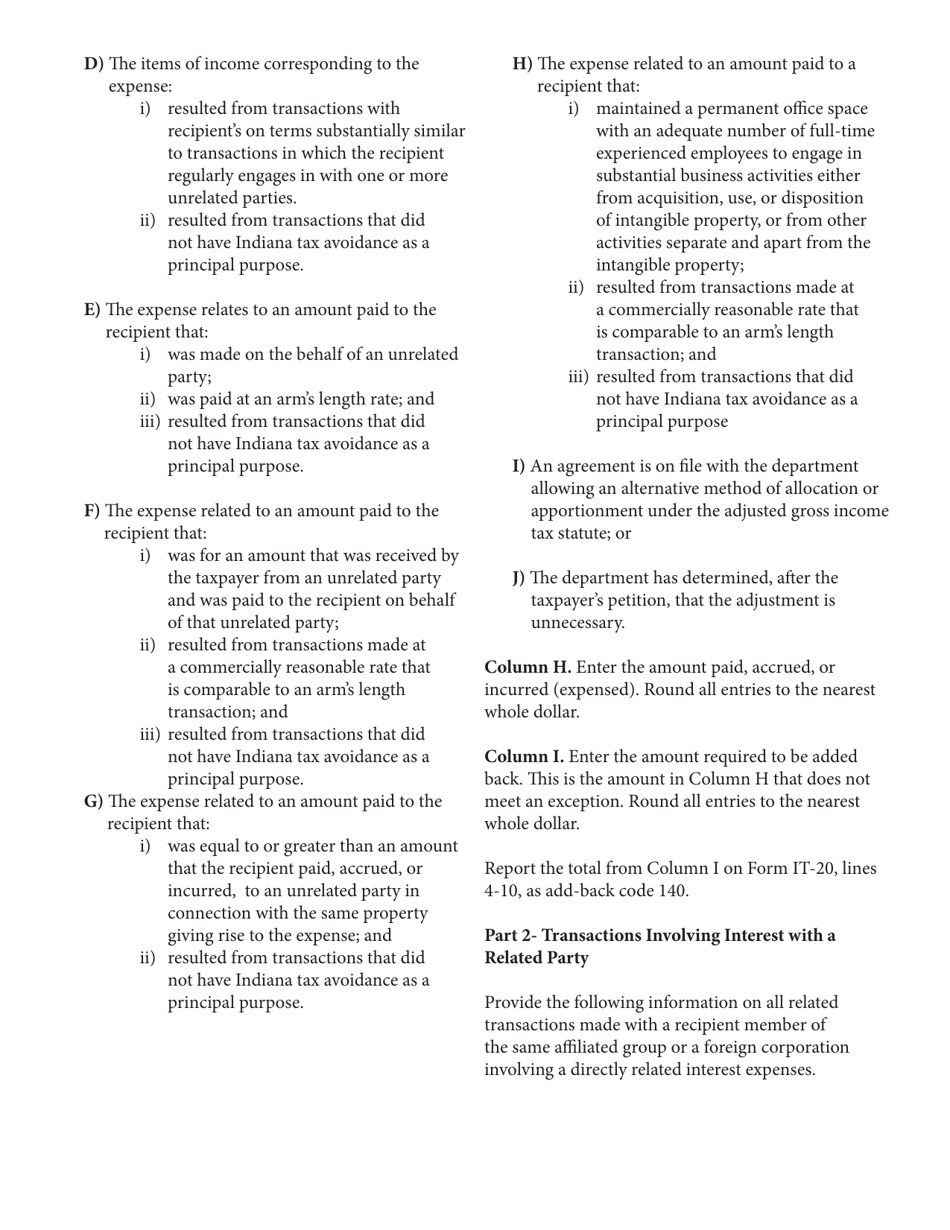

Q: What is intangible expense?

A: Intangible expense refers to expenses related to intangible assets, such as patents, copyrights, and trademarks.

Q: What is directly related interest expense?

A: Directly related interest expense refers to interest expenses that are directly associated with the acquisition or production of intangible assets.

Q: Why is it important to disclose intangible expense and directly related interest expense?

A: It is important to disclose these expenses for tax purposes and to ensure compliance with Indiana tax laws.

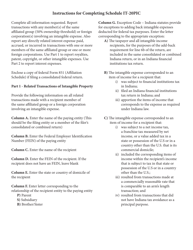

Q: Are there any specific requirements for filling out State Form 53126?

A: Yes, there may be specific instructions or requirements provided with the form. It is important to review these instructions carefully when filling out the form.

Q: Who needs to file Schedule IT-20PIC?

A: Taxpayers in Indiana who have intangible expenses and directly related interest expenses are required to file Schedule IT-20PIC.

Q: Are there any penalties for not disclosing intangible expense and directly related interest expense?

A: Failure to disclose these expenses may result in penalties and potential audits by the Indiana Department of Revenue. It is important to comply with the tax laws and regulations.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 53126 Schedule IT-20PIC by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.