This version of the form is not currently in use and is provided for reference only. Download this version of

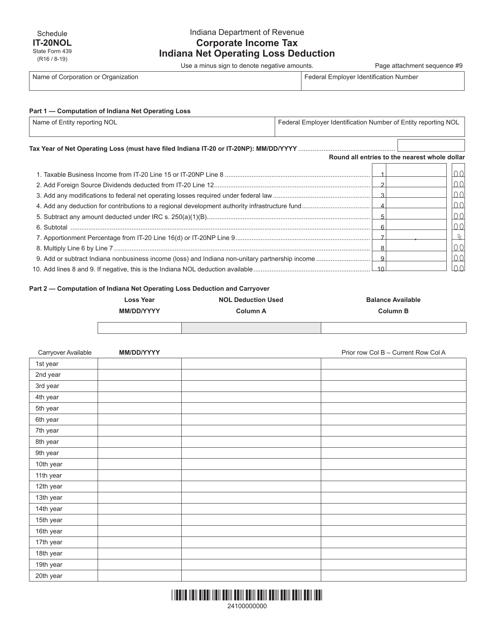

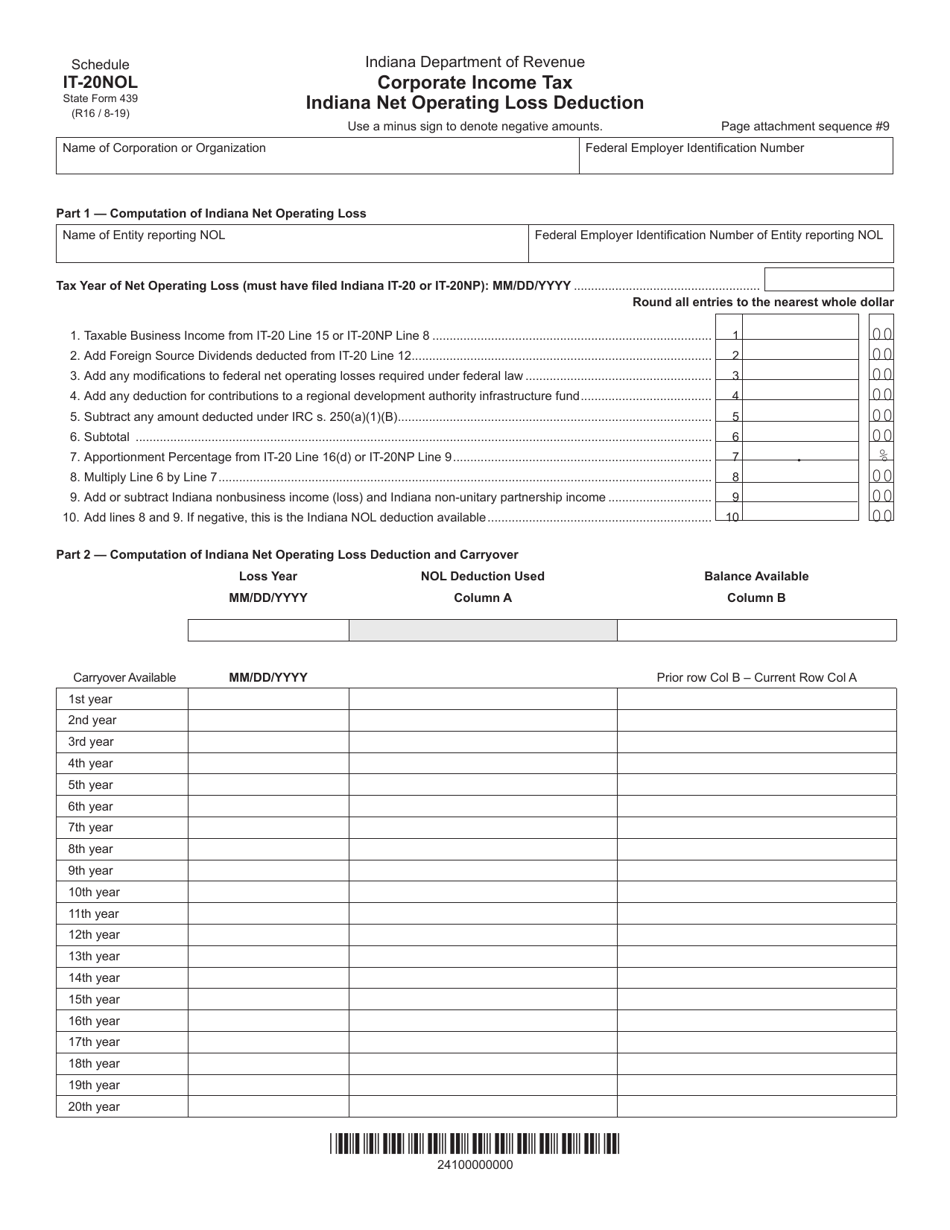

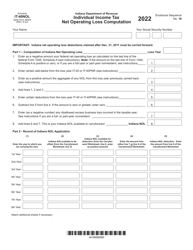

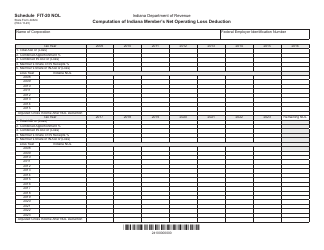

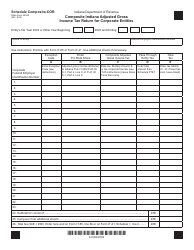

State Form 439 Schedule IT-20NOL

for the current year.

State Form 439 Schedule IT-20NOL Corporate Income Tax Indiana Net Operating Loss Deduction - Indiana

What Is State Form 439 Schedule IT-20NOL?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 439?

A: State Form 439 is a form used for Schedule IT-20NOL, which is related to the Indiana Net Operating Loss Deduction for Corporate Income Tax.

Q: What is Schedule IT-20NOL?

A: Schedule IT-20NOL is a schedule used to claim the Indiana Net Operating Loss Deduction for Corporate Income Tax in Indiana.

Q: What is the Indiana Net Operating Loss Deduction?

A: The Indiana Net Operating Loss Deduction is a deduction that allows corporations to offset their taxable income by the amount of their net operating losses in Indiana.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 439 Schedule IT-20NOL by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.