This version of the form is not currently in use and is provided for reference only. Download this version of

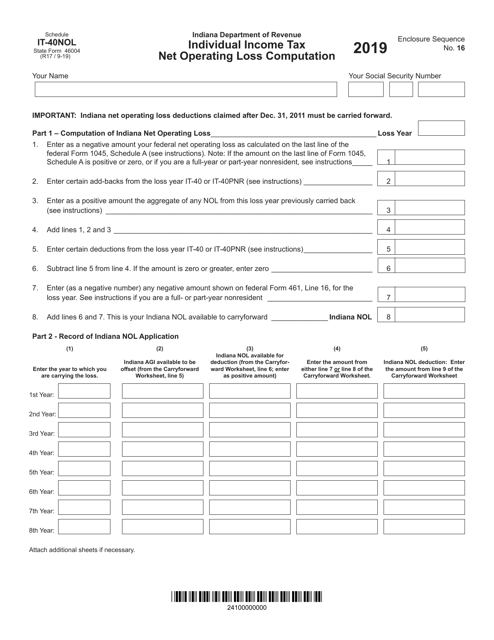

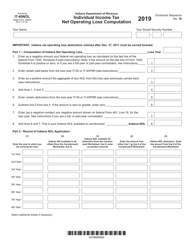

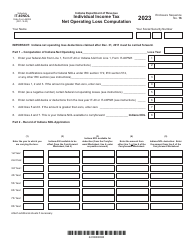

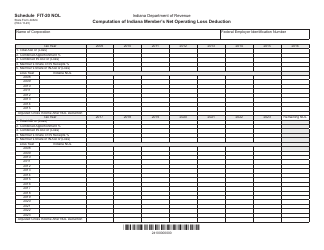

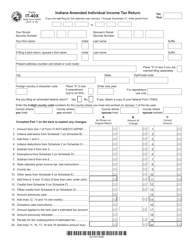

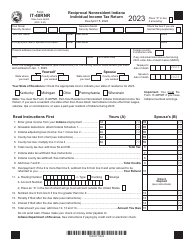

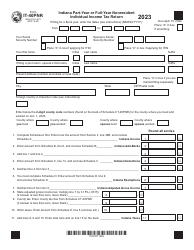

State Form 46004 Schedule IT-40NOL

for the current year.

State Form 46004 Schedule IT-40NOL Individual Income Tax Net Operating Loss Computation - Indiana

What Is State Form 46004 Schedule IT-40NOL?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 46004 Schedule IT-40NOL?

A: Form 46004 Schedule IT-40NOL is a tax form used to calculate the net operating loss for individual income tax in Indiana.

Q: Who needs to fill out Form 46004 Schedule IT-40NOL?

A: Individuals who have a net operating loss and are filing their income tax in Indiana need to fill out this form.

Q: What is a net operating loss?

A: A net operating loss occurs when a taxpayer's deductible expenses exceed their taxable income.

Q: What is the purpose of Form 46004 Schedule IT-40NOL?

A: The purpose of this form is to determine the amount of net operating loss for an individual in Indiana.

Q: What information do I need to fill out Form 46004 Schedule IT-40NOL?

A: You will need your income and expense information to calculate the net operating loss on this form.

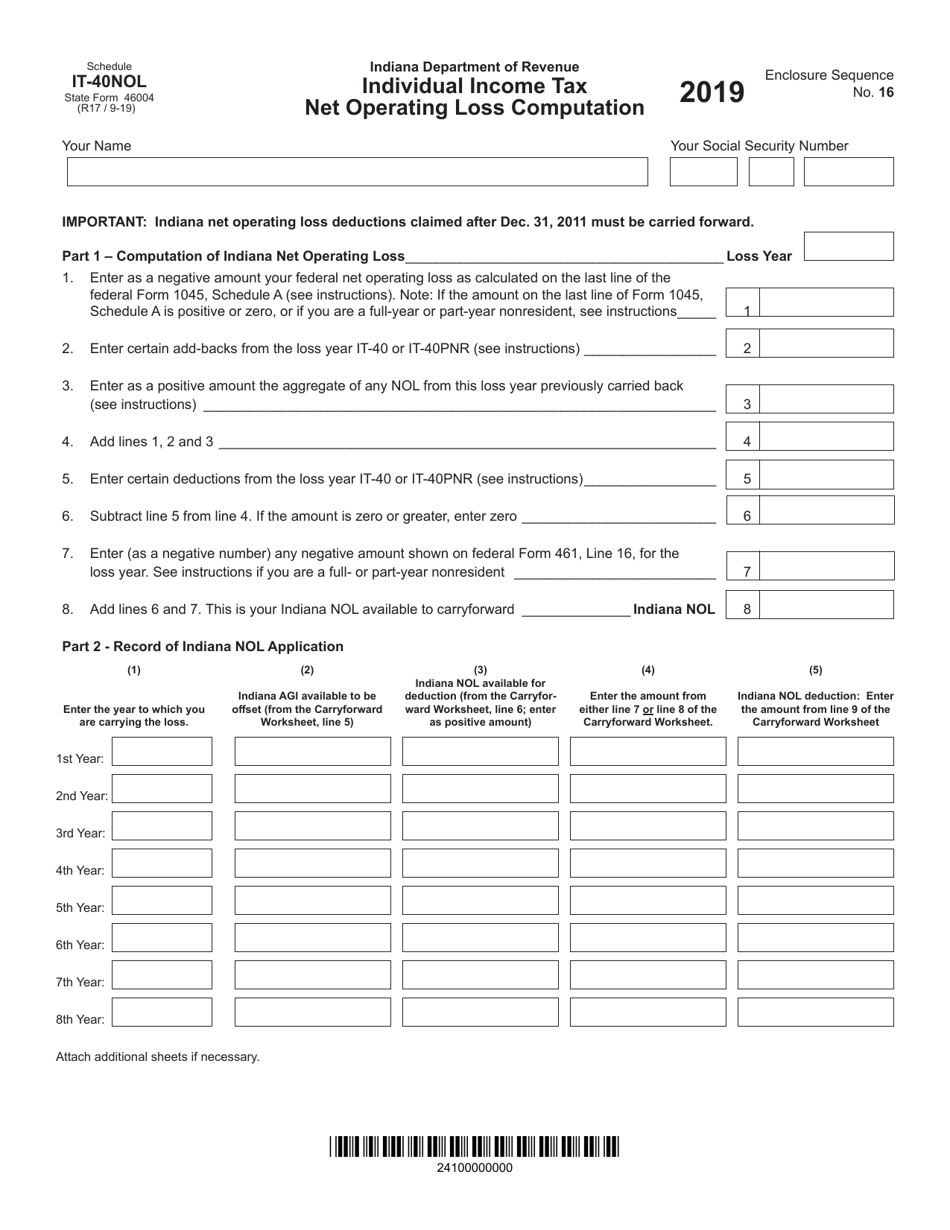

Q: Are there any specific instructions for filling out Form 46004 Schedule IT-40NOL?

A: Yes, you should refer to the instructions provided with the form to ensure accurate completion.

Q: When is the deadline for filing Form 46004 Schedule IT-40NOL?

A: The deadline for filing this form is typically the same as the deadline for filing your Indiana income tax return.

Q: Can I file Form 46004 Schedule IT-40NOL electronically?

A: Yes, you can file this form electronically if you are e-filing your Indiana income tax return.

Q: Do I need to include Form 46004 Schedule IT-40NOL with my federal income tax return?

A: No, this form is specific to Indiana income tax and does not need to be included with your federal tax return.

Form Details:

- Released on September 1, 2019;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 46004 Schedule IT-40NOL by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.