This version of the form is not currently in use and is provided for reference only. Download this version of

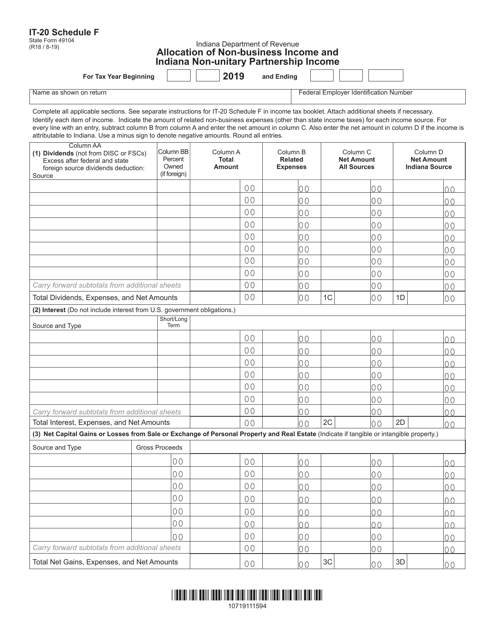

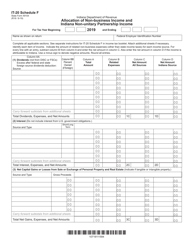

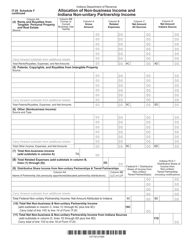

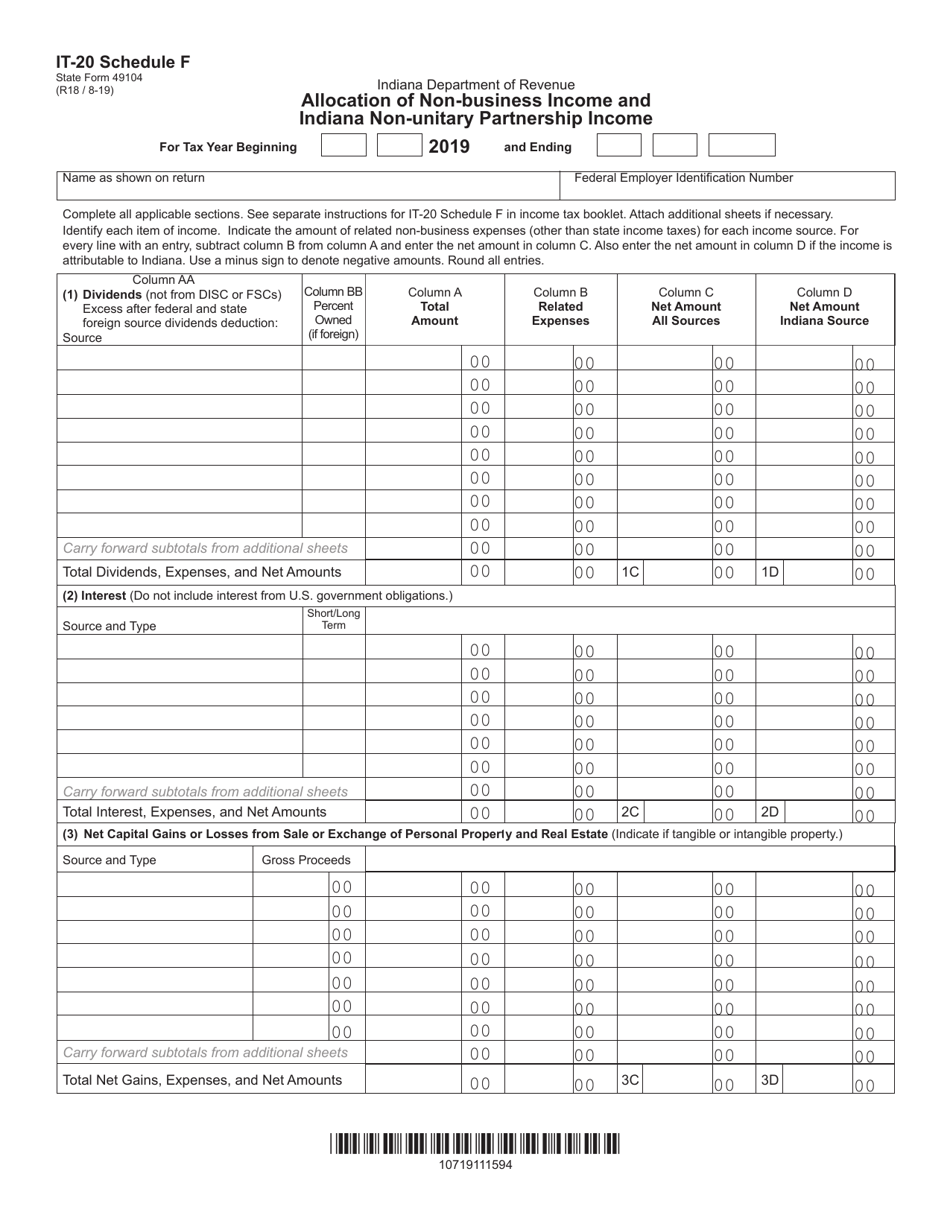

Form IT-20 (State Form 49104) Schedule F

for the current year.

Form IT-20 (State Form 49104) Schedule F Allocation of Non-business Income and Indiana Non-unitary Partnership Income - Indiana

What Is Form IT-20 (State Form 49104) Schedule F?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana.The document is a supplement to Form IT-20, Indiana Corporate Adjusted Gross Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-20?

A: Form IT-20 is a tax form used in Indiana to report corporate income tax.

Q: What is State Form 49104?

A: State Form 49104 is the specific form number for Schedule F, which is used to allocate non-business income and Indiana non-unitary partnership income.

Q: What is Schedule F?

A: Schedule F is a part of Form IT-20 that is used to allocate non-business income and Indiana non-unitary partnership income.

Q: What is non-business income?

A: Non-business income refers to income that is not generated from the regular operations of a business.

Q: What is Indiana non-unitary partnership income?

A: Indiana non-unitary partnership income refers to the income earned by a partnership that is not part of a unitary business group in Indiana.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-20 (State Form 49104) Schedule F by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.