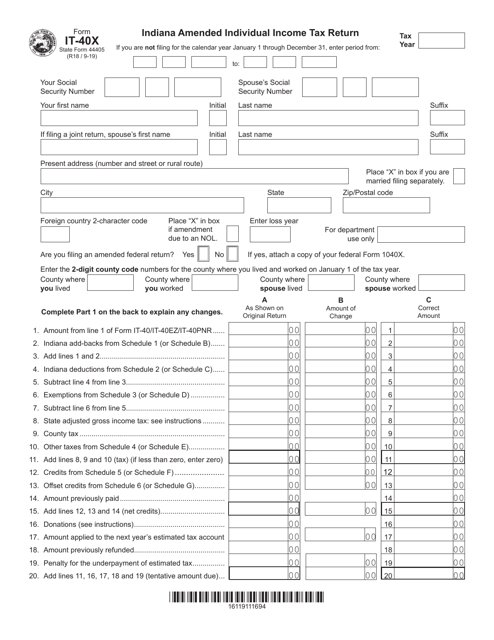

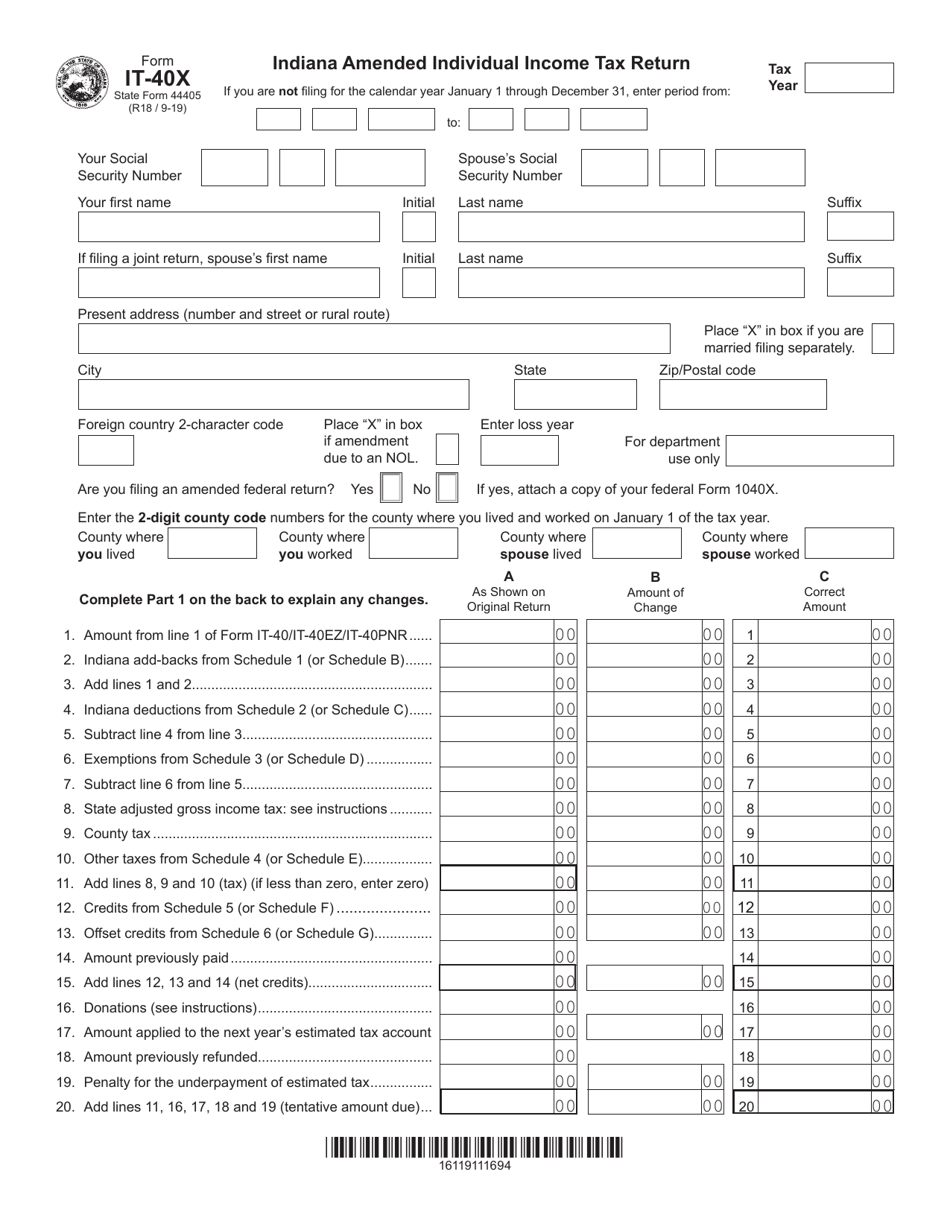

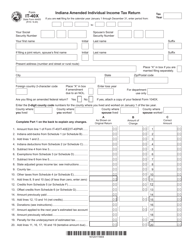

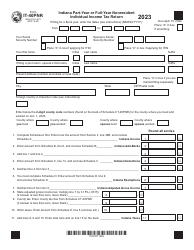

Form IT-40X (State Form 44405) Indiana Amended Individual Income Tax Return - Indiana

What Is Form IT-40X (State Form 44405)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-40X?

A: Form IT-40X is the Indiana Amended Individual Income Tax Return.

Q: What is the purpose of Form IT-40X?

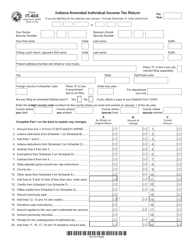

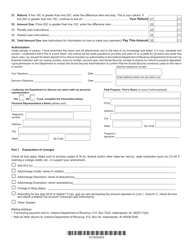

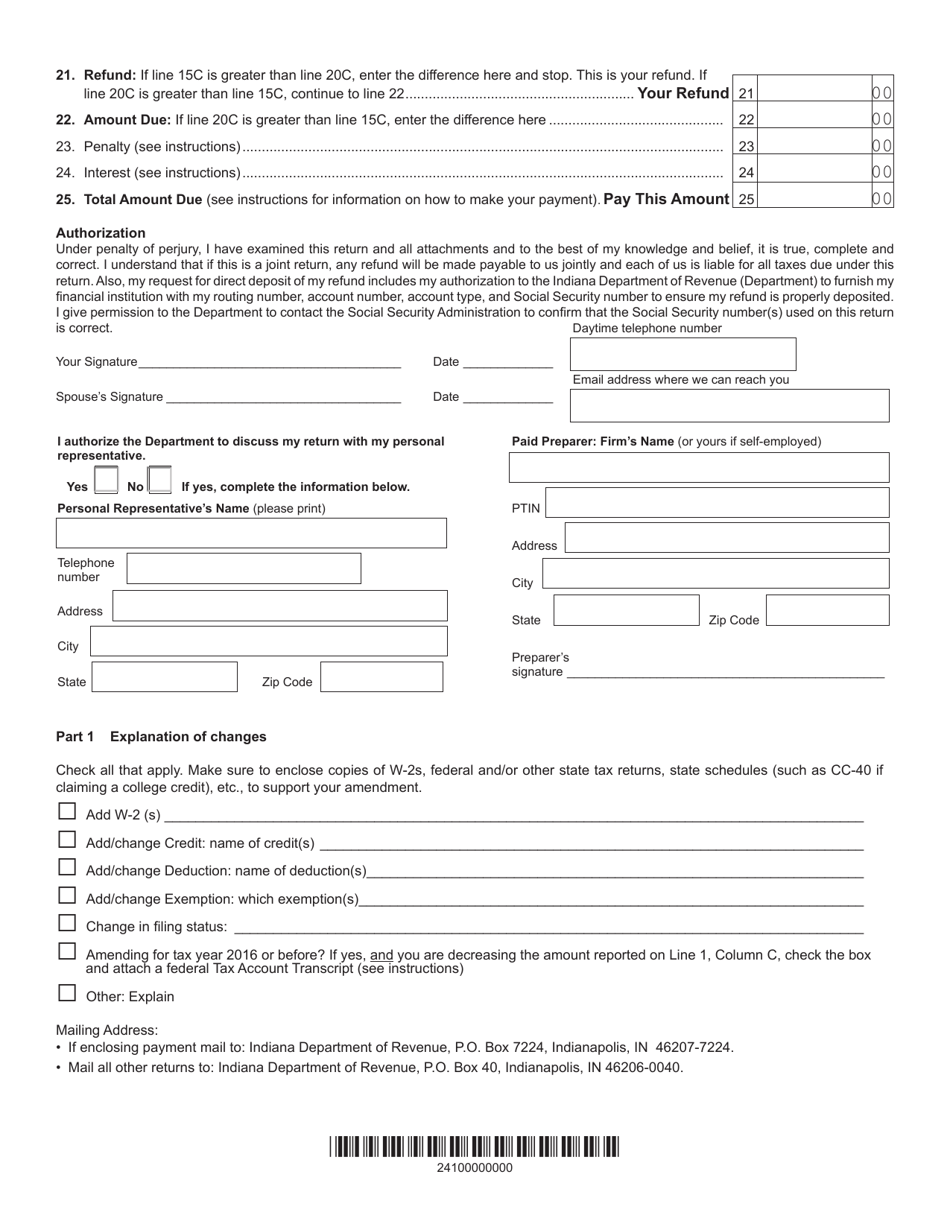

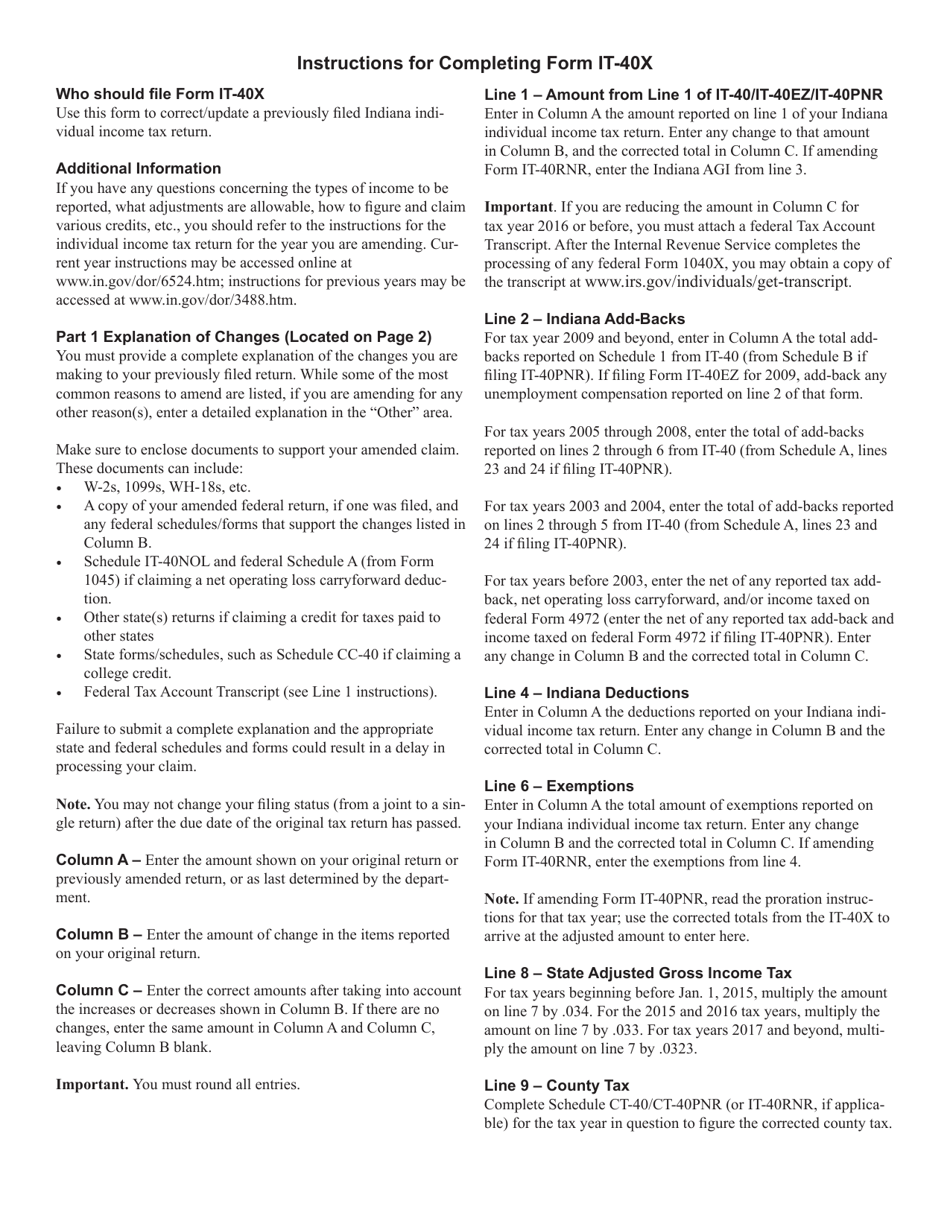

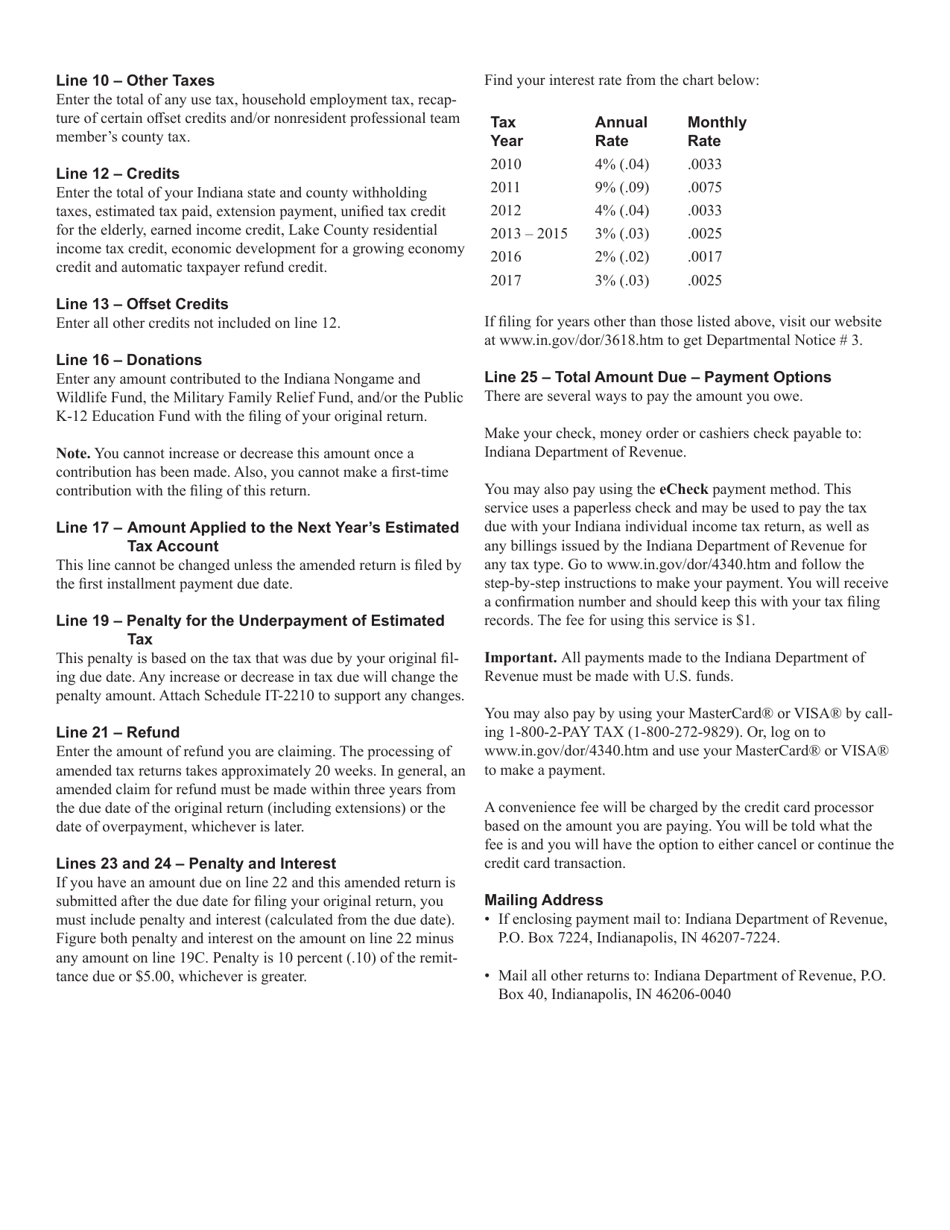

A: The purpose of Form IT-40X is to correct errors or make changes to a previously filed Indiana Individual Income Tax Return.

Q: Who should file Form IT-40X?

A: Any Indiana resident or non-resident who needs to amend their previously filed Indiana Individual Income Tax Return should file Form IT-40X.

Q: When should I file Form IT-40X?

A: Form IT-40X should be filed as soon as possible after you discover an error or need to make a change to your previously filed Indiana Individual Income Tax Return.

Form Details:

- Released on September 1, 2019;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-40X (State Form 44405) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.