This version of the form is not currently in use and is provided for reference only. Download this version of

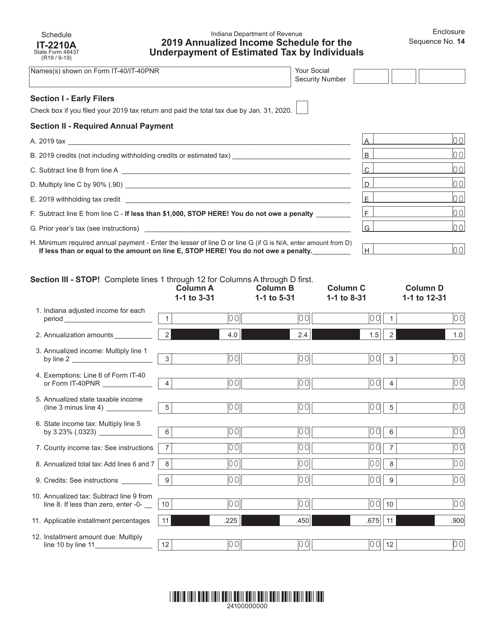

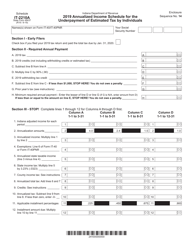

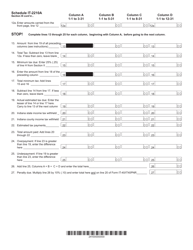

State Form 48437 Schedule IT-2210A

for the current year.

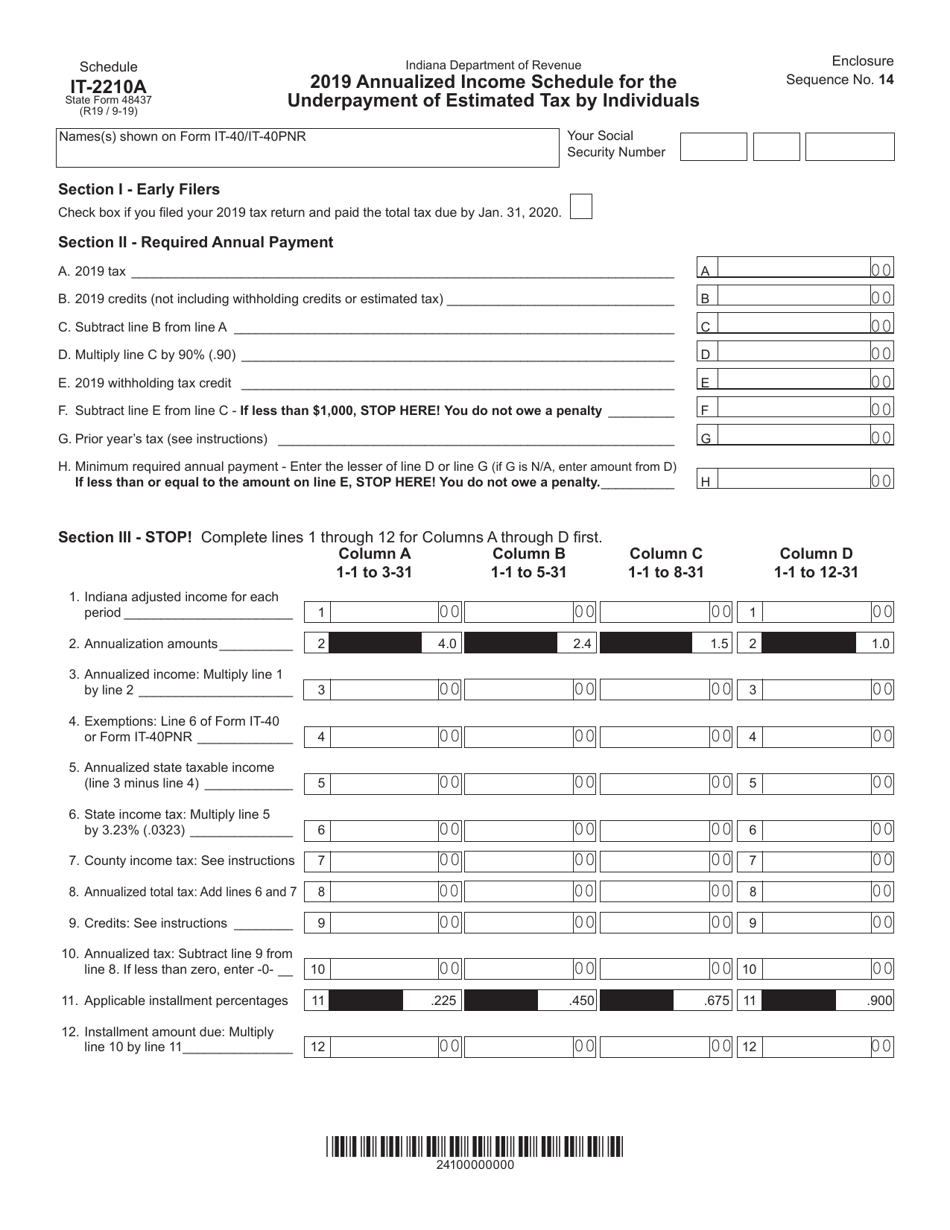

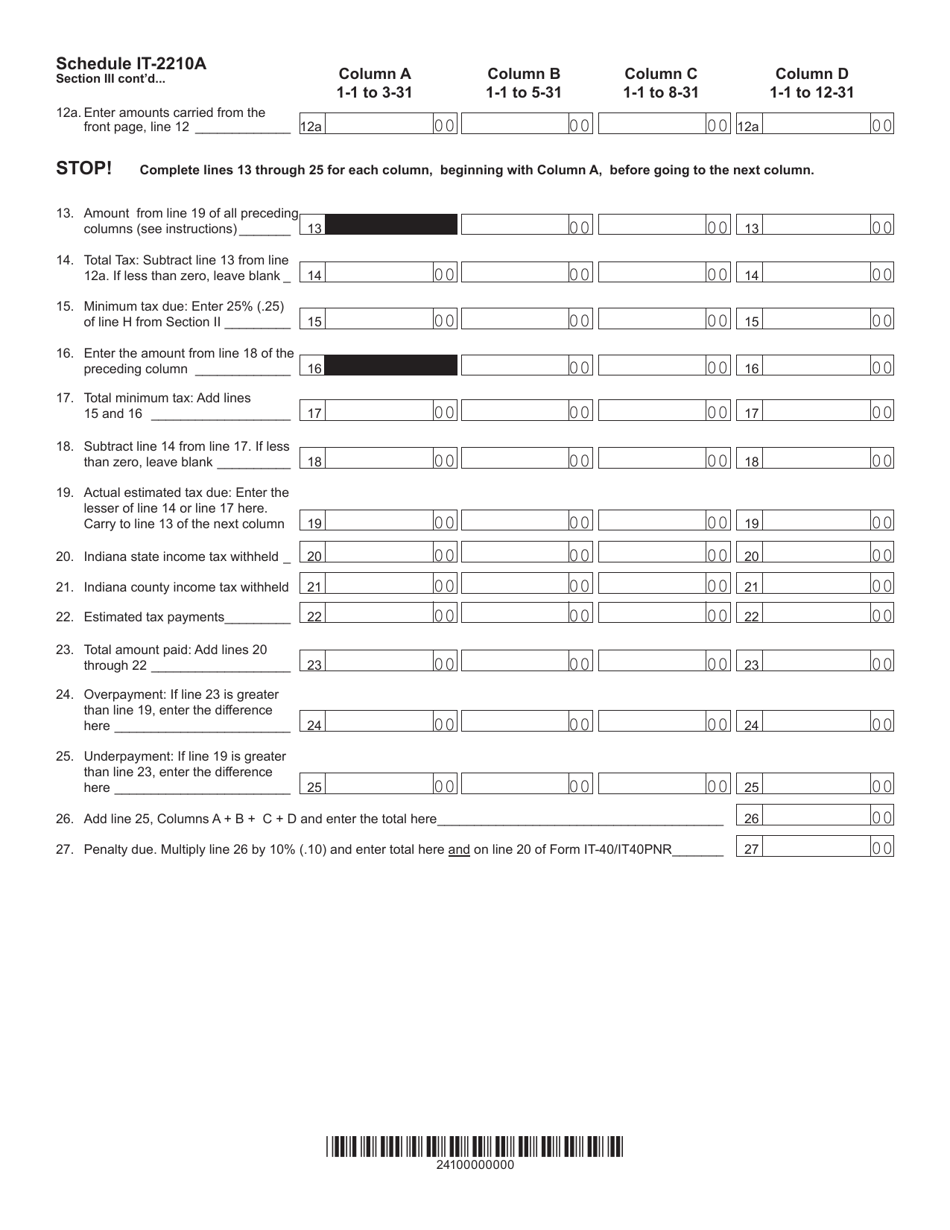

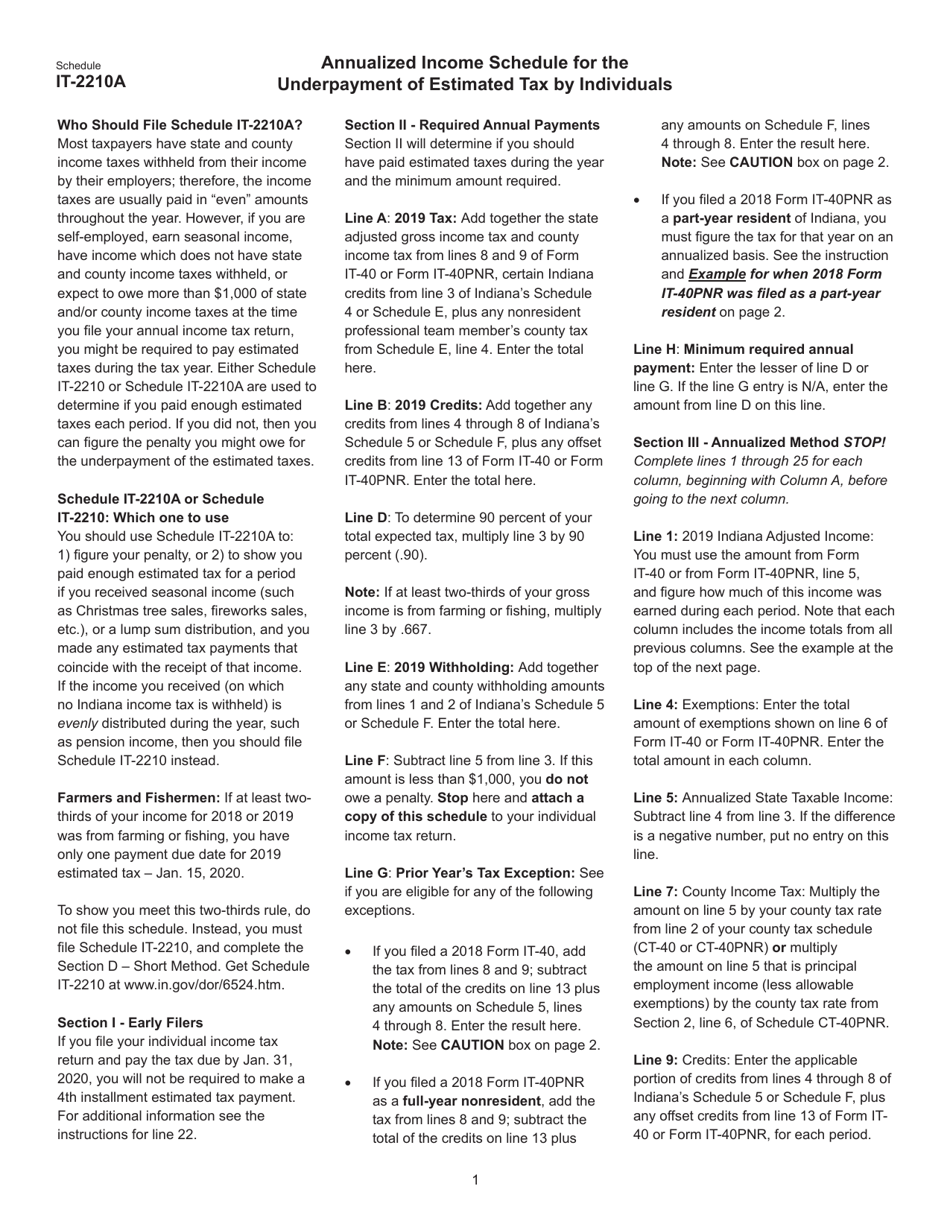

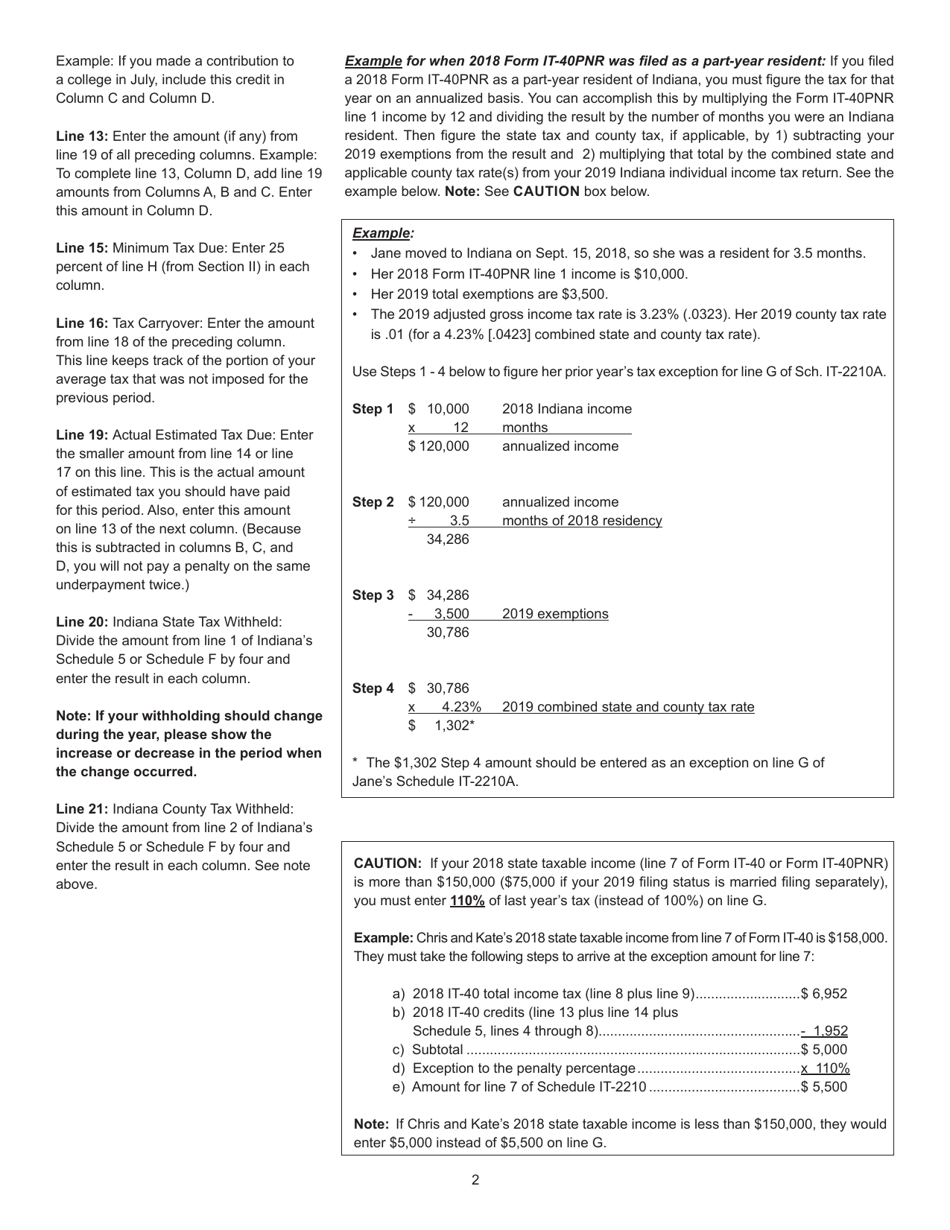

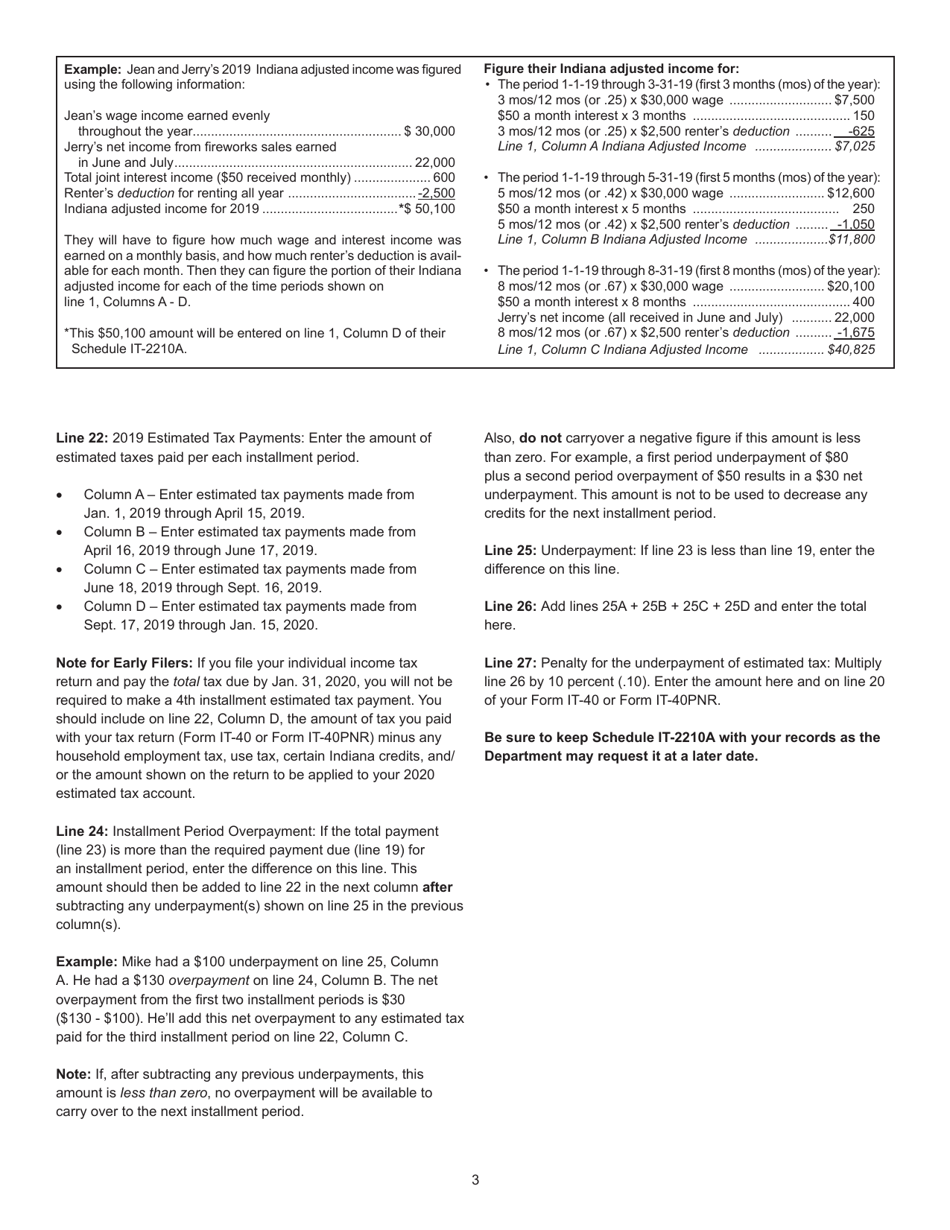

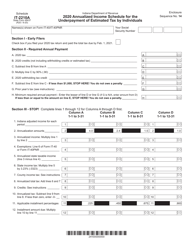

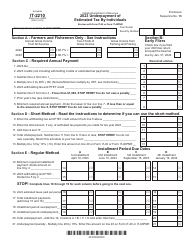

State Form 48437 Schedule IT-2210A Annualized Income Schedule for the Underpayment of Estimated Tax by Individuals - Indiana

What Is State Form 48437 Schedule IT-2210A?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 48437 Schedule IT-2210A?

A: Form 48437 Schedule IT-2210A is the Annualized Income Schedule for the Underpayment of Estimated Tax by Individuals in Indiana.

Q: Who needs to file Form 48437 Schedule IT-2210A?

A: Individuals in Indiana who underpaid their estimated taxes may need to file Form 48437 Schedule IT-2210A.

Q: What is the purpose of Form 48437 Schedule IT-2210A?

A: The purpose of Form 48437 Schedule IT-2210A is to calculate and report the annualized income for the underpayment of estimated tax in Indiana.

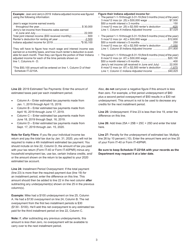

Q: How do I fill out Form 48437 Schedule IT-2210A?

A: You can fill out Form 48437 Schedule IT-2210A by following the instructions provided by the Indiana Department of Revenue.

Q: Is Form 48437 Schedule IT-2210A the same as my regular tax return?

A: No, Form 48437 Schedule IT-2210A is not the same as your regular tax return. It is a separate schedule used to report underpayment of estimated tax.

Q: When is Form 48437 Schedule IT-2210A due?

A: The due date for filing Form 48437 Schedule IT-2210A may vary. It is advised to check with the Indiana Department of Revenue for the specific deadline.

Q: Is there a penalty for not filing Form 48437 Schedule IT-2210A?

A: If you are required to file Form 48437 Schedule IT-2210A and fail to do so, you may be subject to penalties or interest charges.

Q: Can I electronically file Form 48437 Schedule IT-2210A?

A: Yes, the Indiana Department of Revenue allows for electronic filing of Form 48437 Schedule IT-2210A.

Q: Can I get an extension to file Form 48437 Schedule IT-2210A?

A: You may be able to request an extension to file Form 48437 Schedule IT-2210A. Contact the Indiana Department of Revenue for more information.

Form Details:

- Released on September 1, 2019;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 48437 Schedule IT-2210A by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.